Expeditors International of Washington, Inc. (NASDAQ:EXPD) today

announced second quarter 2017 financial results including the

following highlights compared to the same quarter of 2016:

- Diluted Net Earnings Attributable to Shareholders per share

(EPS1) decreased 5% to $0.60

- Net Earnings Attributable to Shareholders decreased 6% to $109

million

- Operating Income decreased 6% to $168 million

- Revenues increased 13% to $1.7 billion

- Net Revenues2 increased 2% to $564 million

- Airfreight tonnage volume increased 9% and ocean container

volume increased 4%

“Volumes remain strong across all of our services and we believe

we continue to take profitable market share,” said Jeffrey S.

Musser, President and Chief Executive Officer. “Our order

management, warehousing and distribution, Transcon, and customs

brokerage businesses performed exceptionally well during the

quarter. While we experienced similar margin pressures that we have

seen in recent quarters in our air and ocean offerings, we recorded

some of the highest freight volumes in our company’s history. As

always, our people provided outstanding customer service and

performed extremely well in this environment.

“Global demand for air and ocean capacity continues to be

stronger than we have seen in the past few years, which has led to

a scarcity of favorable pricing. As the rate environment continues

to shift, we are being increasingly disciplined in how we work both

with our customers and with our carrier partners to secure access

to capacity. In June, we initiated rate increases in certain

high-volume lanes in response to the current market and expect to

see strong demand, tight capacity, and rate volatility to continue

throughout the remainder of the year.”

Bradley S. Powell, Senior Vice President and Chief Financial

Officer, added, “All regions have added people to process

additional shipment volumes in order to maintain our high level of

customer service. We are handling more shipments and are doing so

more efficiently than ever before. We continue to focus on

implementing process improvements and investing in our core

technologies that allow us to grow our business profitably. As the

industry continues to evolve and innovate at a more rapid pace, we

are also making additional investments to develop strategies,

including the use of technologies that allow us to maintain our

leadership position.”

Expeditors is a global logistics company headquartered in

Seattle, Washington. The company employs trained professionals in

177 district offices and numerous branch locations located on six

continents linked into a seamless worldwide network through an

integrated information management system. Services include the

consolidation or forwarding of air and ocean freight, customs

brokerage, vendor consolidation, cargo insurance, time-definite

transportation, order management, warehousing and distribution and

customized logistics solutions.

_______________________1Diluted earnings attributable to

shareholders per share.2Non-GAAP measure calculated as revenues

less directly related operating expenses attributable to the

Company's principal services. See reconciliation on the last page

of this release.NOTE: See Disclaimer on Forward-Looking

Statements on the following page of this release.

Expeditors International of Washington,

Inc.Second Quarter 2017 Earnings Release,

August 8, 2017Financial Highlights for the

Three and Six months ended June 30, 2017 and

2016 (Unaudited) (in 000's of US dollars except per share

data)

| |

Three months ended June

30, |

|

|

|

Six months ended June 30, |

|

|

| |

2017 |

|

2016 |

|

%Change |

|

2017 |

|

2016 |

|

%Change |

|

Revenues |

$ |

1,672,279 |

|

|

$ |

1,475,164 |

|

|

13 |

% |

|

$ |

3,217,411 |

|

|

$ |

2,893,636 |

|

|

11 |

% |

| Net

revenues1 |

$ |

563,633 |

|

|

$ |

553,117 |

|

|

2 |

% |

|

$ |

1,091,238 |

|

|

$ |

1,070,186 |

|

|

2 |

% |

| Operating

income2 |

$ |

168,240 |

|

|

$ |

178,864 |

|

|

(6 |

)% |

|

$ |

314,354 |

|

|

$ |

330,690 |

|

|

(5 |

)% |

| Net earnings

attributable to shareholders |

$ |

108,851 |

|

|

$ |

116,052 |

|

|

(6 |

)% |

|

$ |

202,115 |

|

|

$ |

212,636 |

|

|

(5 |

)% |

| Diluted

earnings attributable to shareholders per share

|

$ |

0.60 |

|

|

$ |

0.63 |

|

|

(5 |

)% |

|

$ |

1.11 |

|

|

$ |

1.16 |

|

|

(4 |

)% |

| Basic earnings

attributable to shareholders per share |

$ |

0.60 |

|

|

$ |

0.64 |

|

|

(6 |

)% |

|

$ |

1.12 |

|

|

$ |

1.17 |

|

|

(4 |

)% |

| Diluted

weighted average shares outstanding |

182,033 |

|

|

183,132 |

|

|

|

|

182,091 |

|

|

183,110 |

|

|

|

| Basic weighted

average shares outstanding |

180,012 |

|

|

181,753 |

|

|

|

|

180,037 |

|

|

181,882 |

|

|

|

_______________________1Non-GAAP measure calculated as revenues

less directly related operating expenses attributable to the

Company's principal services. See reconciliation on the last page

of this release.

2Includes recovery of certain legal and related fees totaling $8

million for both the quarter and year-to date periods ended

June 30, 2017 compared to $5 million in the same periods in

2016 and the favorable resolution of an indirect tax contingency of

$6 million in the second quarter of 2017. We do not expect further

recoveries in either matter.

During the three and six-month periods ended June 30, 2017,

we repurchased 1.5 million and 2.5 million shares of common stock

at an average price of $55.02 and $55.58 per share, respectively.

During the three and six-month periods ended June 30, 2016, the

Company repurchased 1.9 million and 3.4 million shares of common

stock at an average price of $49.47 and $48.75 per share,

respectively.

| |

Employee headcount as of June 30,

|

| |

2017 |

|

2016 |

| North

America |

6,002 |

|

|

5,732 |

|

|

Europe |

2,915 |

|

|

2,764 |

|

| North

Asia |

2,524 |

|

|

2,461 |

|

| Middle East,

Africa and India |

1,521 |

|

|

1,480 |

|

| South

Asia |

1,447 |

|

|

1,338 |

|

| Latin

America |

782 |

|

|

754 |

|

| Information

Systems |

892 |

|

|

795 |

|

|

Corporate |

366 |

|

|

341 |

|

|

Total |

16,449 |

|

|

15,665 |

|

| |

|

Year-over-year percentage increase

in: |

| |

|

Airfreight kilos |

|

Ocean freight FEU |

|

2017 |

|

|

|

|

|

April |

|

9 |

% |

|

2 |

% |

|

May |

|

11 |

% |

|

2 |

% |

|

June |

|

7 |

% |

|

7 |

% |

| Quarter

|

|

9 |

% |

|

4 |

% |

_______________________Investors may submit written questions

via e-mail to: investor@expeditors.com. Questions received by the

end of business on August 11, 2017 will be considered in

management's 8-K “Responses to Selected Questions” expected to be

filed on or about August 21, 2017.

Disclaimer on Forward-Looking

Statements:Certain portions of this release

contain forward-looking statements which are based on certain

assumptions and expectations of future events that are subject to

risks and uncertainties, including comments on continuing to take

profitable market share, the global demand for air and ocean

capacity, favorable pricing, the shifting rate environment, our

ability to secure access to capacity, our expectation that we will

see strong demand, tight capacity, and rate volatility throughout

the remainder of the year, our ability to maintain a high level of

customer service, our ability to handle more shipments more

efficiently than ever before, our ability to implement process

improvements and invest in core technologies that allow us to grow

our business profitably, and our ability to make investments to

develop strategies, including the use of additional technologies

that allow us to maintain our leadership position. Actual future

results and trends may differ materially from historical results or

those projected in any forward-looking statements depending on a

variety of factors including, but not limited to, the future

success of our business model, our ability to maintain consistent

and stable operating results, our ability to perpetuate profits,

changes in customer demand for Expeditors’ services caused by a

general economic slow-down, changes in global trade volumes,

customers’ inventory build-up, decreased consumer confidence,

volatility in equity markets, energy and fuel prices, geopolitical

changes, foreign exchange rates, regulatory actions or changes or

the unpredictable acts of competitors and other risks, risk factors

and uncertainties detailed in our Annual Report as updated by our

reports on Form 10-Q, filed with the Securities and Exchange

Commission.

| EXPEDITORS INTERNATIONAL OF WASHINGTON, INC.AND

SUBSIDIARIESCondensed Consolidated Balance Sheets(In thousands,

except per share data)(Unaudited) |

| |

| |

June 30,

2017 |

|

December 31,2016 |

|

Assets |

|

|

|

| Current

Assets: |

|

|

|

| Cash and

cash equivalents |

$ |

1,114,910 |

|

|

$ |

974,435 |

|

| Accounts

receivable, net |

1,215,278 |

|

|

1,190,130 |

|

| Other

current assets |

164,128 |

|

|

54,014 |

|

|

Total current assets |

2,494,316 |

|

|

2,218,579 |

|

| Property and equipment,

net |

490,776 |

|

|

536,572 |

|

| Goodwill |

7,927 |

|

|

7,927 |

|

| Other assets, net |

29,737 |

|

|

27,793 |

|

|

|

$ |

3,022,756 |

|

|

$ |

2,790,871 |

|

|

Liabilities and Equity |

|

|

|

| Current

Liabilities: |

|

|

|

| Accounts

payable |

$ |

774,941 |

|

|

$ |

726,571 |

|

| Accrued

expenses, primarily salaries and related costs |

211,376 |

|

|

185,502 |

|

| Federal,

state and foreign income taxes |

21,329 |

|

|

17,858 |

|

|

Total current liabilities |

1,007,646 |

|

|

929,931 |

|

| Deferred Federal and

state income taxes |

36,473 |

|

|

13,727 |

|

| |

|

|

|

| Commitments and

contingencies |

|

|

|

| |

|

|

|

| Shareholders’

Equity: |

|

|

|

| Preferred

stock; none issued |

— |

|

|

— |

|

| Common

stock, par value $0.01 per share. Issued and outstanding 179,637

shares at June 30,2017 and 179,857 shares at December 31,

2016 |

1,796 |

|

|

1,799 |

|

|

Additional paid-in capital |

11,152 |

|

|

2,642 |

|

| Retained

earnings |

2,049,403 |

|

|

1,944,789 |

|

|

Accumulated other comprehensive loss |

(86,507 |

) |

|

(104,592 |

) |

| Total

shareholders’ equity |

1,975,844 |

|

|

1,844,638 |

|

|

Noncontrolling interest |

2,793 |

|

|

2,575 |

|

| Total

equity |

1,978,637 |

|

|

1,847,213 |

|

|

|

$ |

3,022,756 |

|

|

$ |

2,790,871 |

|

| EXPEDITORS INTERNATIONAL OF WASHINGTON, INC.AND

SUBSIDIARIESCondensed Consolidated Statements of Earnings(In

thousands, except per share data)(Unaudited) |

|

|

| |

Three months ended |

|

Six months ended |

| |

June 30, |

|

June 30, |

| |

2017 |

|

2016 |

|

2017 |

|

2016 |

|

Revenues: |

|

|

|

|

|

|

|

| Airfreight

services |

$ |

671,868 |

|

|

$ |

582,093 |

|

|

$ |

1,287,413 |

|

|

$ |

1,142,946 |

|

| Ocean freight and ocean

services |

528,585 |

|

|

464,692 |

|

|

1,022,344 |

|

|

918,884 |

|

| Customs brokerage and

other services |

471,826 |

|

|

428,379 |

|

|

907,654 |

|

|

831,806 |

|

| Total

revenues |

1,672,279 |

|

|

1,475,164 |

|

|

3,217,411 |

|

|

2,893,636 |

|

| Operating

Expenses: |

|

|

|

|

|

|

|

| Airfreight

services |

499,418 |

|

|

403,419 |

|

|

942,822 |

|

|

792,196 |

|

| Ocean freight and ocean

services |

385,927 |

|

|

323,699 |

|

|

751,990 |

|

|

646,719 |

|

| Customs brokerage and

other services |

223,301 |

|

|

194,929 |

|

|

431,361 |

|

|

384,535 |

|

| Salaries and related

costs |

318,529 |

|

|

293,532 |

|

|

611,109 |

|

|

576,887 |

|

| Rent and occupancy

costs |

29,163 |

|

|

27,079 |

|

|

57,293 |

|

|

53,938 |

|

| Depreciation and

amortization |

12,042 |

|

|

11,642 |

|

|

23,969 |

|

|

22,971 |

|

| Selling and

promotion |

10,953 |

|

|

10,251 |

|

|

21,868 |

|

|

19,683 |

|

| Other |

24,706 |

|

|

31,749 |

|

|

62,645 |

|

|

66,017 |

|

| Total

operating expenses |

1,504,039 |

|

|

1,296,300 |

|

|

2,903,057 |

|

|

2,562,946 |

|

| Operating

income |

168,240 |

|

|

178,864 |

|

|

314,354 |

|

|

330,690 |

|

| Other Income

(Expense): |

|

|

|

|

|

|

|

| Interest income |

3,380 |

|

|

2,890 |

|

|

6,121 |

|

|

5,669 |

|

| Other, net |

2,190 |

|

|

1,603 |

|

|

2,488 |

|

|

2,482 |

|

| Other

income (expense), net |

5,570 |

|

|

4,493 |

|

|

8,609 |

|

|

8,151 |

|

| Earnings before income

taxes |

173,810 |

|

|

183,357 |

|

|

322,963 |

|

|

338,841 |

|

| Income tax expense |

65,055 |

|

|

66,918 |

|

|

120,641 |

|

|

125,355 |

|

| Net

earnings |

108,755 |

|

|

116,439 |

|

|

202,322 |

|

|

213,486 |

|

| Less net (loss)

earnings attributable to the noncontrolling interest |

(96 |

) |

|

387 |

|

|

207 |

|

|

850 |

|

| Net

earnings attributable to shareholders |

$ |

108,851 |

|

|

$ |

116,052 |

|

|

$ |

202,115 |

|

|

$ |

212,636 |

|

| Diluted earnings

attributable to shareholders per share |

$ |

0.60 |

|

|

$ |

0.63 |

|

|

$ |

1.11 |

|

|

$ |

1.16 |

|

| Basic earnings

attributable to shareholders per share |

$ |

0.60 |

|

|

$ |

0.64 |

|

|

$ |

1.12 |

|

|

$ |

1.17 |

|

| Dividends declared and

paid per common share |

$ |

0.42 |

|

|

$ |

0.40 |

|

|

$ |

0.42 |

|

|

$ |

0.40 |

|

| Weighted average

diluted shares outstanding |

182,033 |

|

|

183,132 |

|

|

182,091 |

|

|

183,110 |

|

| Weighted average basic

shares outstanding |

180,012 |

|

|

181,753 |

|

|

180,037 |

|

|

181,882 |

|

| EXPEDITORS INTERNATIONAL OF WASHINGTON, INC.AND

SUBSIDIARIESCondensed Consolidated Statements of Cash Flows(In

thousands)(Unaudited) |

|

|

| |

Three months ended |

|

Six months ended |

| |

June 30, |

|

June 30, |

| |

2017 |

|

2016 |

|

2017 |

|

2016 |

| Operating

Activities: |

|

|

|

|

|

|

|

| Net earnings |

$ |

108,755 |

|

|

$ |

116,439 |

|

|

$ |

202,322 |

|

|

$ |

213,486 |

|

| Adjustments to

reconcile net earnings to net cash from operating activities:

|

|

|

|

|

|

|

|

| Provision

for losses on accounts receivable |

515 |

|

|

562 |

|

|

1,446 |

|

|

1,140 |

|

| Deferred

income tax expense (benefit) |

7,261 |

|

|

(6,115 |

) |

|

12,854 |

|

|

3,781 |

|

| Stock

compensation expense |

17,203 |

|

|

12,957 |

|

|

27,826 |

|

|

23,788 |

|

|

Depreciation and amortization |

12,042 |

|

|

11,642 |

|

|

23,969 |

|

|

22,971 |

|

| Other,

net |

(174 |

) |

|

(6 |

) |

|

(525 |

) |

|

30 |

|

| Changes in operating

assets and liabilities: |

|

|

|

|

|

|

|

|

(Increase) decrease in accounts receivable |

(73,142 |

) |

|

(48,344 |

) |

|

2,312 |

|

|

64,366 |

|

| Increase

in accounts payable and accrued expenses |

52,623 |

|

|

51,422 |

|

|

34,299 |

|

|

36,078 |

|

| Decrease

in income taxes payable, net |

(47,159 |

) |

|

(34,734 |

) |

|

(27,335 |

) |

|

(23,809 |

) |

| Decrease

(increase) in other current assets |

3,290 |

|

|

1,361 |

|

|

(275 |

) |

|

(694 |

) |

| Net cash from operating

activities |

81,214 |

|

|

105,184 |

|

|

276,893 |

|

|

341,137 |

|

| Investing

Activities: |

|

|

|

|

|

|

|

| Purchase of property

and equipment |

(20,380 |

) |

|

(13,279 |

) |

|

(33,141 |

) |

|

(27,314 |

) |

| Other, net |

40 |

|

|

4,414 |

|

|

(631 |

) |

|

3,855 |

|

| Net cash from investing

activities |

(20,340 |

) |

|

(8,865 |

) |

|

(33,772 |

) |

|

(23,459 |

) |

| Financing

Activities: |

|

|

|

|

|

|

|

| Proceeds from issuance

of common stock |

51,501 |

|

|

48,488 |

|

|

96,866 |

|

|

90,123 |

|

| Repurchases of common

stock |

(84,052 |

) |

|

(96,115 |

) |

|

(137,960 |

) |

|

(166,407 |

) |

| Dividends paid |

(75,726 |

) |

|

(73,000 |

) |

|

(75,726 |

) |

|

(73,000 |

) |

| Net cash from financing

activities |

(108,277 |

) |

|

(120,627 |

) |

|

(116,820 |

) |

|

(149,284 |

) |

| Effect of exchange rate

changes on cash and cash equivalents |

6,270 |

|

|

(9,345 |

) |

|

14,174 |

|

|

4,074 |

|

| (Decrease) increase in

cash and cash equivalents |

(41,133 |

) |

|

(33,653 |

) |

|

140,475 |

|

|

172,468 |

|

| Cash and cash

equivalents at beginning of period |

1,156,043 |

|

|

1,013,917 |

|

|

974,435 |

|

|

807,796 |

|

| Cash and cash

equivalents at end of period |

$ |

1,114,910 |

|

|

$ |

980,264 |

|

|

$ |

1,114,910 |

|

|

$ |

980,264 |

|

| Taxes

paid: |

|

|

|

|

|

|

|

| Income taxes |

$ |

103,508 |

|

|

$ |

108,369 |

|

|

$ |

132,654 |

|

|

$ |

146,353 |

|

| EXPEDITORS INTERNATIONAL OF WASHINGTON, INC.AND

SUBSIDIARIESBusiness Segment Information(In

thousands)(Unaudited) |

|

|

| |

UNITEDSTATES |

|

OTHERNORTHAMERICA |

|

LATINAMERICA |

|

NORTHASIA |

|

SOUTHASIA |

|

EUROPE |

|

MIDDLEEAST,AFRICAAND

INDIA |

|

ELIMI-NATIONS |

|

CONSOLI-DATED |

| Three months

ended June30, 2017: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Revenues from

unaffiliatedcustomers |

$ |

452,217 |

|

|

62,554 |

|

|

23,463 |

|

|

620,050 |

|

|

157,698 |

|

|

259,533 |

|

|

96,764 |

|

|

— |

|

|

1,672,279 |

|

| Transfers

betweengeographic areas |

28,155 |

|

|

2,825 |

|

|

3,759 |

|

|

4,835 |

|

|

5,408 |

|

|

9,664 |

|

|

5,034 |

|

|

(59,680 |

) |

|

— |

|

| Total revenues |

$ |

480,372 |

|

|

65,379 |

|

|

27,222 |

|

|

624,885 |

|

|

163,106 |

|

|

269,197 |

|

|

101,798 |

|

|

(59,680 |

) |

|

1,672,279 |

|

| Net revenues |

$ |

250,027 |

|

|

28,173 |

|

|

14,008 |

|

|

120,959 |

|

|

38,228 |

|

|

80,896 |

|

|

30,286 |

|

|

1,056 |

|

|

563,633 |

|

| Operating income |

$ |

64,265 |

|

|

12,317 |

|

|

2,246 |

|

|

58,093 |

|

|

12,513 |

|

|

13,419 |

|

|

5,390 |

|

|

(3 |

) |

|

168,240 |

|

| Identifiable

assets |

$ |

1,487,582 |

|

|

129,830 |

|

|

48,064 |

|

|

576,655 |

|

|

129,002 |

|

|

437,628 |

|

|

207,191 |

|

|

6,804 |

|

|

3,022,756 |

|

| Capital

expenditures |

$ |

6,852 |

|

|

569 |

|

|

957 |

|

|

663 |

|

|

409 |

|

|

10,501 |

|

|

429 |

|

|

— |

|

|

20,380 |

|

| Depreciation and

amortization |

$ |

7,731 |

|

|

386 |

|

|

300 |

|

|

1,362 |

|

|

556 |

|

|

1,227 |

|

|

480 |

|

|

— |

|

|

12,042 |

|

| Equity |

$ |

1,147,962 |

|

|

61,957 |

|

|

24,320 |

|

|

402,211 |

|

|

117,077 |

|

|

135,726 |

|

|

124,628 |

|

|

(35,244 |

) |

|

1,978,637 |

|

| Three months

ended June30, 2016: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Revenues from

unaffiliatedcustomers |

$ |

417,735 |

|

|

56,674 |

|

|

21,169 |

|

|

517,489 |

|

|

151,890 |

|

|

229,882 |

|

|

80,325 |

|

|

— |

|

|

1,475,164 |

|

| Transfers

betweengeographic areas |

28,973 |

|

|

2,671 |

|

|

4,187 |

|

|

5,385 |

|

|

6,326 |

|

|

10,097 |

|

|

5,507 |

|

|

(63,146 |

) |

|

— |

|

| Total revenues |

$ |

446,708 |

|

|

59,345 |

|

|

25,356 |

|

|

522,874 |

|

|

158,216 |

|

|

239,979 |

|

|

85,832 |

|

|

(63,146 |

) |

|

1,475,164 |

|

| Net revenues |

$ |

232,860 |

|

|

30,815 |

|

|

14,468 |

|

|

122,117 |

|

|

46,257 |

|

|

77,639 |

|

|

28,975 |

|

|

(14 |

) |

|

553,117 |

|

| Operating income |

$ |

67,214 |

|

|

9,600 |

|

|

3,836 |

|

|

61,721 |

|

|

18,354 |

|

|

11,838 |

|

|

6,315 |

|

|

(14 |

) |

|

178,864 |

|

| Identifiable

assets |

$ |

1,343,669 |

|

|

84,358 |

|

|

58,570 |

|

|

471,832 |

|

|

118,352 |

|

|

378,859 |

|

|

225,877 |

|

|

5,938 |

|

|

2,687,455 |

|

| Capital

expenditures |

$ |

8,778 |

|

|

445 |

|

|

317 |

|

|

678 |

|

|

351 |

|

|

2,140 |

|

|

570 |

|

|

— |

|

|

13,279 |

|

| Depreciation and

amortization |

$ |

7,366 |

|

|

380 |

|

|

288 |

|

|

1,388 |

|

|

543 |

|

|

1,188 |

|

|

489 |

|

|

— |

|

|

11,642 |

|

| Equity |

$ |

1,069,876 |

|

|

38,638 |

|

|

39,482 |

|

|

309,557 |

|

|

78,668 |

|

|

133,387 |

|

|

141,315 |

|

|

(31,418 |

) |

|

1,779,505 |

|

|

(in thousands) |

UNITED STATES |

|

OTHER NORTH AMERICA |

|

LATIN AMERICA |

|

NORTHASIA |

|

SOUTHASIA |

|

EUROPE |

|

MIDDLEEAST,AFRICAAND INDIA |

|

ELIMI- NATIONS |

|

CONSOLI- DATED |

| Six months

ended June30, 2017: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Revenues from

unaffiliatedcustomers |

$ |

878,236 |

|

|

122,453 |

|

|

45,566 |

|

|

1,186,478 |

|

|

304,938 |

|

|

490,990 |

|

|

188,750 |

|

|

— |

|

|

3,217,411 |

|

| Transfers

betweengeographic areas |

52,468 |

|

|

5,464 |

|

|

7,394 |

|

|

9,886 |

|

|

10,839 |

|

|

18,986 |

|

|

9,998 |

|

|

(115,035 |

) |

|

— |

|

| Total revenues |

$ |

930,704 |

|

|

127,917 |

|

|

52,960 |

|

|

1,196,364 |

|

|

315,777 |

|

|

509,976 |

|

|

198,748 |

|

|

(115,035 |

) |

|

3,217,411 |

|

| Net revenues |

$ |

480,812 |

|

|

53,966 |

|

|

28,924 |

|

|

232,792 |

|

|

76,223 |

|

|

156,854 |

|

|

60,017 |

|

|

1,650 |

|

|

1,091,238 |

|

| Operating income |

$ |

116,611 |

|

|

17,368 |

|

|

5,697 |

|

|

111,445 |

|

|

25,737 |

|

|

25,065 |

|

|

12,433 |

|

|

(2 |

) |

|

314,354 |

|

| Identifiable assets at

period end |

$ |

1,487,582 |

|

|

129,830 |

|

|

48,064 |

|

|

576,655 |

|

|

129,002 |

|

|

437,628 |

|

|

207,191 |

|

|

6,804 |

|

|

3,022,756 |

|

| Capital

expenditures |

$ |

12,094 |

|

|

803 |

|

|

1,212 |

|

|

1,903 |

|

|

782 |

|

|

15,579 |

|

|

768 |

|

|

— |

|

|

33,141 |

|

| Depreciation and

amortization |

$ |

15,484 |

|

|

758 |

|

|

620 |

|

|

2,682 |

|

|

1,087 |

|

|

2,398 |

|

|

940 |

|

|

— |

|

|

23,969 |

|

| Equity |

$ |

1,147,962 |

|

|

61,957 |

|

|

24,320 |

|

|

402,211 |

|

|

117,077 |

|

|

135,726 |

|

|

124,628 |

|

|

(35,244 |

) |

|

1,978,637 |

|

| Six months

ended June30, 2016: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Revenues from

unaffiliatedcustomers |

$ |

825,561 |

|

|

108,780 |

|

|

41,233 |

|

|

1,014,721 |

|

|

288,308 |

|

|

451,779 |

|

|

163,254 |

|

|

— |

|

|

2,893,636 |

|

| Transfers

betweengeographic areas |

55,007 |

|

|

5,371 |

|

|

7,788 |

|

|

10,481 |

|

|

12,132 |

|

|

20,458 |

|

|

10,901 |

|

|

(122,138 |

) |

|

— |

|

| Total revenues |

$ |

880,568 |

|

|

114,151 |

|

|

49,021 |

|

|

1,025,202 |

|

|

300,440 |

|

|

472,237 |

|

|

174,155 |

|

|

(122,138 |

) |

|

2,893,636 |

|

| Net revenues |

$ |

453,558 |

|

|

58,193 |

|

|

28,201 |

|

|

232,908 |

|

|

85,775 |

|

|

152,180 |

|

|

59,382 |

|

|

(11 |

) |

|

1,070,186 |

|

| Operating income |

$ |

115,419 |

|

|

16,891 |

|

|

7,688 |

|

|

116,939 |

|

|

34,045 |

|

|

24,091 |

|

|

15,628 |

|

|

(11 |

) |

|

330,690 |

|

| Identifiable assets at

period end |

$ |

1,343,669 |

|

|

84,358 |

|

|

58,570 |

|

|

471,832 |

|

|

118,352 |

|

|

378,859 |

|

|

225,877 |

|

|

5,938 |

|

|

2,687,455 |

|

| Capital

expenditures |

$ |

16,915 |

|

|

756 |

|

|

802 |

|

|

1,763 |

|

|

1,006 |

|

|

4,259 |

|

|

1,813 |

|

|

— |

|

|

27,314 |

|

| Depreciation and

amortization |

$ |

14,698 |

|

|

744 |

|

|

541 |

|

|

2,707 |

|

|

1,055 |

|

|

2,286 |

|

|

940 |

|

|

— |

|

|

22,971 |

|

| Equity |

$ |

1,069,876 |

|

|

38,638 |

|

|

39,482 |

|

|

309,557 |

|

|

78,668 |

|

|

133,387 |

|

|

141,315 |

|

|

(31,418 |

) |

|

1,779,505 |

|

Net Revenues (Non-GAAP measure)

We commonly refer to the term “net revenues” when commenting

about our Company and the results of its operations. Net revenues

are a Non-GAAP measure calculated as revenues less directly related

operations expenses attributable to the Company's principal

services. We believe that net revenues are a better measure than

are total revenues when analyzing and discussing our effectiveness

in managing our principal services since total revenues earned as a

freight consolidator must consider the carriers' charges to us for

carrying the shipment, whereas revenues earned in other capacities

include primarily the commissions and fees earned by us. Net

revenue is one of our primary operational and financial measures

and demonstrates our ability to concentrate and leverage purchasing

power through effective consolidation of shipments from customers

utilizing a variety of transportation carriers and optimal

routings. Using net revenues also provides a commonality for

comparison among various services. The following table presents the

calculation of net revenues.

| |

Three months ended |

|

Six months ended |

| |

June 30, |

|

June 30, |

|

(in thousands) |

2017 |

|

2016 |

|

2017 |

|

2016 |

| Total revenues |

$ |

1,672,279 |

|

|

$ |

1,475,164 |

|

|

$ |

3,217,411 |

|

|

$ |

2,893,636 |

|

|

Expenses: |

|

|

|

|

|

|

|

| Airfreight

services |

499,418 |

|

|

403,419 |

|

|

942,822 |

|

|

792,196 |

|

| Ocean freight and ocean

services |

385,927 |

|

|

323,699 |

|

|

751,990 |

|

|

646,719 |

|

| Customs brokerage and

other services |

223,301 |

|

|

194,929 |

|

|

431,361 |

|

|

384,535 |

|

| Net

revenues |

$ |

563,633 |

|

|

$ |

553,117 |

|

|

$ |

1,091,238 |

|

|

$ |

1,070,186 |

|

CONTACTS:

Jeffrey S. Musser

President and Chief Executive Officer

(206) 674-3433

Bradley S. Powell

Senior Vice President and Chief Financial Officer

(206) 674-3412

Geoffrey Buscher

Director - Investor Relations

(206) 892-4510

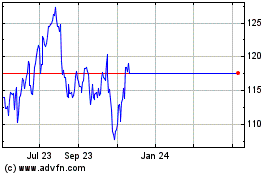

Expeditors International... (NASDAQ:EXPD)

Historical Stock Chart

From Mar 2024 to Apr 2024

Expeditors International... (NASDAQ:EXPD)

Historical Stock Chart

From Apr 2023 to Apr 2024