false

0001438231

0001438231

2024-02-27

2024-02-27

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 27, 2024

DIGIMARC CORPORATION

(Exact name of registrant as specified in its charter)

|

Oregon

|

001-34108

|

26-2828185

|

|

(State or other jurisdiction

of incorporation)

|

(Commission

File No.)

|

(IRS Employer

Identification No.)

|

8500 SW Creekside Place, Beaverton Oregon 97008

(Address of principal executive offices) (Zip Code)

(503) 469-4800

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of Each Class

|

|

Trading Symbol

|

|

Name of Each Exchange on Which Registered

|

|

Common Stock, $0.001 Par Value Per Share

|

|

DMRC

|

|

The NASDAQ Stock Market LLC

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act (17 CFR 230.405) or Rule 12b-2 of the Exchange Act of 1934 (17 CFR 240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

Item 1.02.

|

Termination of a Material Definitive Agreement |

Equity Distribution Agreement

On May 16, 2019, Digimarc Corporation (the “Company”) entered into an Equity Distribution Agreement (the “Agreement”) with Wells Fargo Securities, LLC (the “Sales Agent”). Pursuant to the terms of the Agreement, the Company may sell from time to time through the Sales Agent the Company’s common stock having an aggregate offering price of up to $30,000,000.

On February 27, 2024, Digimarc provided notice to the Sales Agent of our intention to terminate the Agreement, effective March 1, 2024.

|

Item 2.02.

|

Results of Operations and Financial Condition

|

On February 28, 2024, Digimarc Corporation issued a press release announcing its financial results for the quarter-ended and year-ended December 31, 2023. The full text of the press release is attached hereto as Exhibit 99.1.

Attached hereto as Exhibit 99.2 is the script from the Company’s conference call on February 28, 2024 announcing its financial results for the quarter-ended and year-ended December 31, 2023, as posted on the Company’s website at https://www.digimarc.com/investors/quarterly-earnings.

|

Item 9.01.

|

Financial Statements and Exhibits

|

(d) Exhibits

|

ExhibitNo.

|

|

Description

|

| |

|

|

|

99.1

|

|

|

|

99.2

|

|

|

|

104

|

|

Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: February 28, 2024

| |

|

By:

|

|

/s/ Charles Beck

|

| |

|

|

|

Charles Beck

|

| |

|

|

|

Chief Financial Officer and Treasurer

|

Exhibit 99.1

Digimarc Reports Fourth Quarter and Fiscal Year 2023 Financial Results

Annual Recurring Revenue(1) Increases 71%

Subscription Gross Profit Margin(2) Expands to 87%

Beaverton, Ore. – February 28, 2024 – Digimarc Corporation (NASDAQ: DMRC) reported financial results for the fourth quarter and fiscal year ended December 31, 2023.

“Q4 was another strong quarter for Digimarc. On a year-over-year basis, we accelerated our ARR growth to 71%, accelerated our subscription revenue growth to 37%, and expanded our subscription Gross Profit Margins more than 1,000 basis points to 87%,” said Digimarc CEO Riley McCormack. “These results were made possible by the team’s execution on multiple important initiatives we have been pursuing since we began our transformation in the second quarter of 2021, and with an ethos of never settling for the status quo and always planting the seeds for future growth, we remain excited for what is ahead.”

Fourth Quarter 2023 Financial Results

Subscription revenue for the fourth quarter of 2023 increased to $5.6 million compared to $4.1 million for the fourth quarter of 2022, primarily due to higher subscription revenue from new and existing commercial contracts.

Service revenue for the fourth quarter of 2023 increased to $3.7 million compared to $3.1 million for the fourth quarter of 2022, primarily due to higher service revenue from a consortium of the world’s central banks (the “Central Banks”).

Total revenue for the fourth quarter of 2023 increased to $9.3 million compared to $7.2 million for the fourth quarter of 2022.

Gross profit margin for the fourth quarter of 2023 increased to 63% compared to 53% for the fourth quarter of 2022. Excluding amortization expense on acquired intangible assets, subscription gross profit margin for the fourth quarter of 2023 increased to 87% from 77% for the fourth quarter of 2022, while service gross profit margin was flat at 56%.

Non-GAAP gross profit margin for the fourth quarter of 2023 increased to 79% compared to 72% for the fourth quarter of 2022.

Operating expenses for the fourth quarter of 2023 decreased to $16.8 million compared to $17.1 million for the fourth quarter of 2022.

Non-GAAP operating expenses for the fourth quarter of 2023 decreased to $13.4 million compared to $14.3 million for the fourth quarter of 2022.

Net loss for the fourth quarter of 2023 was $10.6 million or ($0.52) per share compared to $12.4 million or ($0.62) per share for the fourth quarter of 2022.

Non-GAAP net loss for the fourth quarter of 2023 was $5.6 million or ($0.28) per share compared to $8.2 million or ($0.41) per share for the fourth quarter of 2022.

Fiscal Year 2023 Financial Results

Subscription revenue for fiscal year 2023 increased to $19.0 million compared to $15.2 million for fiscal year 2022, primarily due to $4.9 million of higher subscription revenue from new and existing commercial contracts, partially offset by $0.9 million of lower subscription revenue as a result of sunsetting our Piracy Intelligence product in 2022.

Service revenue for fiscal year 2023 increased to $15.9 million compared to $15.0 million for fiscal year 2022, primarily due to $1.9 million of higher service revenue from the Central Banks, reflecting a larger annual budget for program work, partially offset by $0.8 million of lower service revenue from the timing of HolyGrail 2.0 recycling projects.

Total revenue for fiscal year 2023 increased to $34.9 million compared to $30.2 million for fiscal year 2022.

Gross profit margin for fiscal year 2023 increased to 58% compared to 51% for fiscal year 2022. Excluding amortization expense on acquired intangible assets, subscription gross profit margin for fiscal year 2023 increased to 84% from 75% for fiscal year 2022, while service gross profit margin decreased from 56% for fiscal year 2022 to 54% for fiscal year 2023.

Non-GAAP gross profit margin for the fiscal year 2023 increased to 76% compared to 70% for fiscal year 2022.

Operating expenses for fiscal year 2023 decreased to $68.4 million compared to $77.1 million for fiscal year 2022, primarily due to $4.2 million of lower compensation costs due to lower headcount, partially offset by annual compensation adjustments, $1.5 million of lower contractor and consulting costs, $1.1 million of lower travel and training costs, $0.9 million of lower legal costs, $0.8 million of lower facility costs, and $0.7 million of lower lease impairment expense, partially offset by higher severance costs of $0.7 million incurred for organizational changes.

Non-GAAP operating expenses for fiscal year 2023 decreased to $55.0 million compared to $61.8 million for fiscal year 2022, primarily due to $4.1 million of lower cash compensation costs due to lower headcount, partially offset by annual compensation adjustments, $1.5 million of lower contractor and consulting costs, $1.1 million of lower travel and training costs, and $0.9 million of lower legal costs, partially offset by higher cash severance costs of $0.7 million incurred for organizational changes.

Net loss for fiscal year 2023 was $46.0 million or ($2.26) loss per common share compared to a net loss of $59.8 million or ($3.12) loss per common share for fiscal year 2022.

Non-GAAP net loss for fiscal year 2023 was $26.4 million or ($1.30) loss per common share compared to a net loss of $38.6 million or ($2.02) loss per common share for fiscal year 2022.

At December 31, 2023, cash, cash equivalents, and marketable securities totaled $27.2 million compared to $52.5 million at December 31, 2022.

(1) Annual Recurring Revenue (ARR) is a company performance metric calculated as the aggregation of annualized subscription fees from all of our commercial contracts as of the measurement date.

(2) Subscription Gross Profit Margin excludes amortization expense on acquired intangible assets.

Conference Call

Digimarc will hold a conference call today (Wednesday, February 28, 2024) to discuss these financial results and to provide a business update. CEO Riley McCormack, CFO Charles Beck and CLO Joel Meyer will host the call starting at 5:00 p.m. Eastern time (2:00 p.m. Pacific time). A question and answer session will follow management’s prepared remarks.

The conference call will be broadcast live and available for replay here and in the investor section of the company's website. The conference call script will also be posted to the company's website shortly before the call.

For those who wish to call in via telephone to ask a question, please dial the number below at least five minutes before the scheduled start time:

Toll-Free Number: 877-407-0832

International Number: 201-689-8433

Conference ID: 13740292

Company Contact:

Charles Beck

Chief Financial Officer

Charles.Beck@digimarc.com

+1 503-469-4721

###

About Digimarc

Digimarc Corporation (NASDAQ: DMRC) is the pioneer and global leader in digital watermarking technologies. For nearly 30 years, Digimarc innovations and intellectual property in digital watermarking have been deployed at massive scale for the identification and the authentication of physical and digital items. A notable example of this is our partnership with the Central Banks to deter counterfeiting of global currency. Digimarc is also instrumental in supporting global industry standards efforts spanning both the physical and digital worlds. In 2023, Digimarc was named to the Fortune 2023 Change the World list and honored as a 2023 Fast Company World Changing Ideas finalist. Learn more at Digimarc.com.

Forward-Looking Statements

Except for historical information contained in this release, the matters described in this release contain various “forward-looking statements.” These forward-looking statements include statements identified by terminology such as “will,” “should,” “expects,” “estimates,” “predicts” and “continue” or other derivations of these or other comparable terms. These forward-looking statements are statements of management's opinion and are subject to various assumptions, risks, uncertainties and changes in circumstances. Actual results may vary materially from those expressed or implied from the statements in this release as a result of changes in economic, business and regulatory factors. More detailed information about risk factors that may affect actual results are outlined in the company's Form 10-K for the year ended December 31, 2022, and in subsequent periodic reports filed with the SEC. Readers are cautioned not to place undue reliance on these forward-looking statements, which reflect management's opinions only as of the date of this release. Except as required by law, Digimarc undertakes no obligation to publicly update or revise any forward-looking statements to reflect events or circumstances that may arise after the date of this release.

Non-GAAP Financial Measures

This release contains the following non-GAAP financial measures: Non-GAAP gross profit, Non-GAAP gross profit margin, Non-GAAP operating expenses, Non-GAAP net loss, and Non-GAAP loss per share (diluted). See below for a reconciliation of each non-GAAP financial measure to the most directly comparable GAAP financial measure. These non-GAAP financial measures are an important measure of our operating performance because they allow management, investors and analysts to evaluate and assess our core operating results from period-to-period after removing non-cash and non-recurring activities that affect comparability. Our management uses these non-GAAP financial measures in evaluating its financial and operational decision making and as a means to evaluate period-to-period comparisons.

Digimarc believes that providing these non-GAAP financial measures, together with the reconciliation to GAAP, helps management and investors make comparisons between us and other companies. In making any comparisons to other companies, investors need to be aware that companies use different non-GAAP measures to evaluate their financial performance. Investors should pay close attention to the specific definition being used and to the reconciliation between such measures and the corresponding GAAP measures provided by each company under applicable SEC rules. These non-GAAP financial measures are not measurements of financial performance or liquidity under GAAP. In order to facilitate a clear understanding of its consolidated historical operating results, investors should examine Digimarc’s non-GAAP financial measures in conjunction with its historical GAAP financial information, and investors should not consider non-GAAP financial measures in isolation or as substitutes for performance measures calculated in accordance with GAAP. Non-GAAP financial measures should be viewed as supplemental to, and should not be considered as alternatives to, GAAP financial measures. Non-GAAP financial measures may not be indicative of the historical operating results of the Company nor are they intended to be predictive of potential future results.

Digimarc Corporation

Consolidated Income Statement Information

(in thousands, except per share amounts)

(Unaudited)

| |

|

Three Months Ended December 31,

|

|

|

Twelve Months Ended December 31,

|

|

| |

|

2023

|

|

|

2022

|

|

|

2023

|

|

|

2022

|

|

|

Revenue:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Subscription

|

|

$ |

5,599 |

|

|

$ |

4,098 |

|

|

$ |

18,973 |

|

|

$ |

15,219 |

|

|

Service

|

|

|

3,685 |

|

|

|

3,120 |

|

|

|

15,878 |

|

|

|

14,978 |

|

|

Total revenue

|

|

|

9,284 |

|

|

|

7,218 |

|

|

|

34,851 |

|

|

|

30,197 |

|

|

Cost of revenue:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Subscription (1)

|

|

|

711 |

|

|

|

944 |

|

|

|

2,975 |

|

|

|

3,878 |

|

|

Service (1)

|

|

|

1,631 |

|

|

|

1,380 |

|

|

|

7,252 |

|

|

|

6,557 |

|

|

Amortization expense on acquired intangible assets

|

|

|

1,113 |

|

|

|

1,077 |

|

|

|

4,459 |

|

|

|

4,439 |

|

|

Total cost of revenue

|

|

|

3,455 |

|

|

|

3,401 |

|

|

|

14,686 |

|

|

|

14,874 |

|

|

Gross profit

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Subscription (1)

|

|

|

4,888 |

|

|

|

3,154 |

|

|

|

15,998 |

|

|

|

11,341 |

|

|

Service (1)

|

|

|

2,054 |

|

|

|

1,740 |

|

|

|

8,626 |

|

|

|

8,421 |

|

|

Amortization expense on acquired intangible assets

|

|

|

(1,113 |

) |

|

|

(1,077 |

) |

|

|

(4,459 |

) |

|

|

(4,439 |

) |

|

Total gross profit

|

|

|

5,829 |

|

|

|

3,817 |

|

|

|

20,165 |

|

|

|

15,323 |

|

|

Gross profit margin:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Subscription (1)

|

|

|

87 |

% |

|

|

77 |

% |

|

|

84 |

% |

|

|

75 |

% |

|

Service (1)

|

|

|

56 |

% |

|

|

56 |

% |

|

|

54 |

% |

|

|

56 |

% |

|

Total

|

|

|

63 |

% |

|

|

53 |

% |

|

|

58 |

% |

|

|

51 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating expenses:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sales and marketing

|

|

|

5,639 |

|

|

|

6,016 |

|

|

|

22,409 |

|

|

|

29,718 |

|

|

Research, development and engineering

|

|

|

6,282 |

|

|

|

6,759 |

|

|

|

26,577 |

|

|

|

26,490 |

|

|

General and administrative

|

|

|

4,659 |

|

|

|

3,918 |

|

|

|

18,071 |

|

|

|

18,945 |

|

|

Amortization expense on acquired intangible assets

|

|

|

265 |

|

|

|

100 |

|

|

|

1,065 |

|

|

|

1,064 |

|

|

Impairment of lease right of use assets and leasehold improvements

|

|

|

— |

|

|

|

341 |

|

|

|

250 |

|

|

|

915 |

|

|

Total operating expenses

|

|

|

16,845 |

|

|

|

17,134 |

|

|

|

68,372 |

|

|

|

77,132 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating loss

|

|

|

(11,016 |

) |

|

|

(13,317 |

) |

|

|

(48,207 |

) |

|

|

(61,809 |

) |

|

Other income, net

|

|

|

582 |

|

|

|

894 |

|

|

|

2,452 |

|

|

|

2,108 |

|

|

Loss before income taxes

|

|

|

(10,434 |

) |

|

|

(12,423 |

) |

|

|

(45,755 |

) |

|

|

(59,701 |

) |

|

Provision for income taxes

|

|

|

(139 |

) |

|

|

(25 |

) |

|

|

(204 |

) |

|

|

(97 |

) |

|

Net loss

|

|

$ |

(10,573 |

) |

|

$ |

(12,448 |

) |

|

$ |

(45,959 |

) |

|

$ |

(59,798 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss per share:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss per share — basic

|

|

$ |

(0.52 |

) |

|

$ |

(0.62 |

) |

|

$ |

(2.26 |

) |

|

$ |

(3.12 |

) |

|

Loss per share — diluted

|

|

$ |

(0.52 |

) |

|

$ |

(0.62 |

) |

|

$ |

(2.26 |

) |

|

$ |

(3.12 |

) |

|

Weighted average shares outstanding — basic

|

|

|

20,369 |

|

|

|

19,921 |

|

|

|

20,322 |

|

|

|

19,140 |

|

|

Weighted average shares outstanding — diluted

|

|

|

20,369 |

|

|

|

19,921 |

|

|

|

20,322 |

|

|

|

19,140 |

|

(1) Cost of revenue, Gross profit and Gross profit margin for Subscription and Service excludes amortization expense on acquired intangible assets.

Digimarc Corporation

Reconciliation of GAAP to Non-GAAP Financial Measures

(in thousands, except per share amounts)

(Unaudited)

| |

|

Three Months Ended December 31,

|

|

|

Twelve Months Ended December 31,

|

|

| |

|

2023

|

|

|

2022

|

|

|

2023

|

|

|

2022

|

|

|

GAAP gross profit

|

|

$ |

5,829 |

|

|

$ |

3,817 |

|

|

$ |

20,165 |

|

|

$ |

15,323 |

|

|

Amortization of acquired intangible assets

|

|

|

1,113 |

|

|

|

1,077 |

|

|

|

4,459 |

|

|

|

4,439 |

|

|

Amortization and write-off of other intangible assets

|

|

|

140 |

|

|

|

146 |

|

|

|

573 |

|

|

|

576 |

|

|

Stock-based compensation

|

|

|

260 |

|

|

|

177 |

|

|

|

1,126 |

|

|

|

913 |

|

|

Non-GAAP gross profit

|

|

$ |

7,342 |

|

|

$ |

5,217 |

|

|

$ |

26,323 |

|

|

$ |

21,251 |

|

|

Non-GAAP gross profit margin

|

|

|

79 |

% |

|

|

72 |

% |

|

|

76 |

% |

|

|

70 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GAAP operating expenses

|

|

$ |

16,845 |

|

|

$ |

17,134 |

|

|

$ |

68,372 |

|

|

$ |

77,132 |

|

|

Depreciation and write-off of property and equipment

|

|

|

(210 |

) |

|

|

(336 |

) |

|

|

(1,121 |

) |

|

|

(1,372 |

) |

|

Amortization of acquired intangible assets

|

|

|

(265 |

) |

|

|

(100 |

) |

|

|

(1,065 |

) |

|

|

(1,064 |

) |

|

Amortization and write-off of other intangible assets

|

|

|

(117 |

) |

|

|

(100 |

) |

|

|

(393 |

) |

|

|

(163 |

) |

|

Amortization of lease right of use assets under operating leases

|

|

|

(91 |

) |

|

|

(197 |

) |

|

|

(517 |

) |

|

|

(965 |

) |

|

Stock-based compensation

|

|

|

(2,752 |

) |

|

|

(1,802 |

) |

|

|

(10,032 |

) |

|

|

(10,376 |

) |

|

Impairment of lease right of use assets and leasehold improvements

|

|

|

— |

|

|

|

(341 |

) |

|

|

(250 |

) |

|

|

(915 |

) |

|

Acquisition-related expenses

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(447 |

) |

|

Non-GAAP operating expenses

|

|

$ |

13,410 |

|

|

$ |

14,258 |

|

|

$ |

54,994 |

|

|

$ |

61,830 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GAAP net loss

|

|

$ |

(10,573 |

) |

|

$ |

(12,448 |

) |

|

$ |

(45,959 |

) |

|

$ |

(59,798 |

) |

|

Total adjustments to gross profit

|

|

|

1,513 |

|

|

|

1,400 |

|

|

|

6,158 |

|

|

|

5,928 |

|

|

Total adjustments to operating expenses

|

|

|

3,435 |

|

|

|

2,876 |

|

|

|

13,378 |

|

|

|

15,302 |

|

|

Non-GAAP net loss

|

|

$ |

(5,625 |

) |

|

$ |

(8,172 |

) |

|

$ |

(26,423 |

) |

|

$ |

(38,568 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GAAP loss per share (diluted)

|

|

$ |

(0.52 |

) |

|

$ |

(0.62 |

) |

|

$ |

(2.26 |

) |

|

$ |

(3.12 |

) |

|

Non-GAAP net loss

|

|

$ |

(5,625 |

) |

|

$ |

(8,172 |

) |

|

$ |

(26,423 |

) |

|

$ |

(38,568 |

) |

|

Non-GAAP loss per share (diluted)

|

|

$ |

(0.28 |

) |

|

$ |

(0.41 |

) |

|

$ |

(1.30 |

) |

|

$ |

(2.02 |

) |

Digimarc Corporation

Consolidated Balance Sheet Information

(in thousands)

(Unaudited)

| |

|

December 31,

|

|

|

December 31,

|

|

| |

|

2023

|

|

|

2022

|

|

|

ASSETS

|

|

|

|

|

|

|

|

|

|

Current assets:

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents (1)

|

|

$ |

21,456 |

|

|

$ |

33,598 |

|

|

Marketable securities (1)

|

|

|

5,726 |

|

|

|

18,944 |

|

|

Trade accounts receivable, net

|

|

|

5,813 |

|

|

|

5,427 |

|

|

Other current assets

|

|

|

4,085 |

|

|

|

6,172 |

|

|

Total current assets

|

|

|

37,080 |

|

|

|

64,141 |

|

|

Property and equipment, net

|

|

|

1,570 |

|

|

|

2,390 |

|

|

Intangibles, net

|

|

|

28,458 |

|

|

|

33,170 |

|

|

Goodwill

|

|

|

8,641 |

|

|

|

8,229 |

|

|

Lease right of use assets

|

|

|

4,017 |

|

|

|

4,720 |

|

|

Other assets

|

|

|

786 |

|

|

|

1,127 |

|

|

Total assets

|

|

$ |

80,552 |

|

|

$ |

113,777 |

|

| |

|

|

|

|

|

|

|

|

|

LIABILITIES AND SHAREHOLDERS’ EQUITY

|

|

|

|

|

|

|

|

|

|

Current liabilities:

|

|

|

|

|

|

|

|

|

|

Accounts payable and other accrued liabilities

|

|

$ |

6,672 |

|

|

$ |

5,989 |

|

|

Deferred revenue

|

|

|

5,853 |

|

|

|

4,145 |

|

|

Total current liabilities

|

|

|

12,525 |

|

|

|

10,134 |

|

|

Long-term lease liabilities

|

|

|

5,994 |

|

|

|

5,977 |

|

|

Other long-term liabilities

|

|

|

106 |

|

|

|

76 |

|

|

Total liabilities

|

|

|

18,625 |

|

|

|

16,187 |

|

| |

|

|

|

|

|

|

|

|

|

Shareholders’ equity:

|

|

|

|

|

|

|

|

|

|

Preferred stock

|

|

|

50 |

|

|

|

50 |

|

|

Common stock

|

|

|

20 |

|

|

|

20 |

|

|

Additional paid-in capital

|

|

|

376,189 |

|

|

|

367,692 |

|

|

Accumulated deficit

|

|

|

(311,768 |

) |

|

|

(265,809 |

) |

|

Accumulated other comprehensive loss

|

|

|

(2,564 |

) |

|

|

(4,363 |

) |

|

Total shareholders’ equity

|

|

|

61,927 |

|

|

|

97,590 |

|

|

Total liabilities and shareholders’ equity

|

|

$ |

80,552 |

|

|

$ |

113,777 |

|

(1) Aggregate cash, cash equivalents, and marketable securities was $27,182 and $52,542 at December 31, 2023 and 2022, respectively.

Digimarc Corporation

Consolidated Cash Flow Information

(in thousands)

(Unaudited)

| |

|

Twelve Months Ended December 31,

|

|

| |

|

2023

|

|

|

2022

|

|

|

Cash flows from operating activities:

|

|

|

|

|

|

|

|

|

|

Net loss

|

|

$ |

(45,959 |

) |

|

$ |

(59,798 |

) |

|

Adjustments to reconcile net loss to net cash used in operating activities:

|

|

|

|

|

|

|

|

|

|

Depreciation and write-off of property and equipment

|

|

|

1,121 |

|

|

|

1,372 |

|

|

Amortization of acquired intangible assets

|

|

|

5,524 |

|

|

|

5,503 |

|

|

Amortization and write-off of other intangible assets

|

|

|

966 |

|

|

|

739 |

|

|

Amortization of lease right of use assets under operating leases

|

|

|

517 |

|

|

|

965 |

|

|

Stock-based compensation

|

|

|

11,158 |

|

|

|

11,289 |

|

|

Impairment of lease right of use assets and leasehold improvements

|

|

|

250 |

|

|

|

915 |

|

|

Increase in allowance for doubtful accounts

|

|

|

20 |

|

|

|

89 |

|

|

Changes in operating assets and liabilities:

|

|

|

|

|

|

|

|

|

|

Trade accounts receivable

|

|

|

(335 |

) |

|

|

2,232 |

|

|

Other current assets

|

|

|

2,200 |

|

|

|

(1,933 |

) |

|

Other assets

|

|

|

299 |

|

|

|

(520 |

) |

|

Accounts payable and other accrued liabilities

|

|

|

660 |

|

|

|

(3,856 |

) |

|

Deferred revenue

|

|

|

1,627 |

|

|

|

(371 |

) |

|

Lease liability and other long-term liabilities

|

|

|

(43 |

) |

|

|

(1,034 |

) |

|

Net cash used in operating activities

|

|

|

(21,995 |

) |

|

|

(44,408 |

) |

| |

|

|

|

|

|

|

|

|

|

Cash flows from investing activities:

|

|

|

|

|

|

|

|

|

|

Net cash paid for acquisition

|

|

|

— |

|

|

|

(3,512 |

) |

|

Purchase of property and equipment

|

|

|

(314 |

) |

|

|

(934 |

) |

|

Capitalized patent costs

|

|

|

(426 |

) |

|

|

(533 |

) |

|

Proceeds from maturities of marketable securities

|

|

|

27,664 |

|

|

|

21,425 |

|

|

Purchases of marketable securities

|

|

|

(14,363 |

) |

|

|

(12,689 |

) |

|

Net cash provided by investing activities

|

|

|

12,561 |

|

|

|

3,757 |

|

| |

|

|

|

|

|

|

|

|

|

Cash flows from financing activities:

|

|

|

|

|

|

|

|

|

|

Issuance of common stock, net of issuance costs

|

|

|

— |

|

|

|

62,890 |

|

|

Purchase of common stock

|

|

|

(2,724 |

) |

|

|

(2,356 |

) |

|

Repayment of loans

|

|

|

(36 |

) |

|

|

(35 |

) |

|

Net cash (used in) provided by financing activities

|

|

|

(2,760 |

) |

|

|

60,499 |

|

|

Effect of exchange rate on cash

|

|

|

52 |

|

|

|

(39 |

) |

|

Net (decrease) increase in cash and cash equivalents (2)

|

|

$ |

(12,142 |

) |

|

$ |

19,809 |

|

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Cash, cash equivalents and marketable securities at beginning of period

|

|

|

52,542 |

|

|

|

41,618 |

|

|

Cash, cash equivalents and marketable securities at end of period

|

|

|

27,182 |

|

|

|

52,542 |

|

|

(2) Net (decrease) increase in cash, cash equivalents and marketable securities

|

|

$ |

(25,360 |

) |

|

$ |

10,924 |

|

###

Exhibit 99.2

Digimarc Corporation (DMRC) Conference Call

Fourth Quarter 2023 Financial Results

February 28, 2024

Joel Meyer – Chief Legal Officer

Welcome to our Q4 conference call. Riley McCormack, our CEO, and Charles Beck, our CFO, are with me on the call. On the call today, we will provide a business update and discuss Q4 2023 and fiscal year 2023 financial results. This will be followed by a question and answer forum. We have posted our prepared remarks in the investor relations section of our website and will archive this webcast there.

Safe Harbor Statement

Before we begin, let me remind everyone that today's discussion contains forward-looking statements that have risks and uncertainties. Please refer to our press release for more information on the specific risk factors that could cause actual results to differ materially.

Riley will now provide a business update.

Business Update

Thank you Joel, and hello everyone.

Q4 was another strong quarter for Digimarc. On a year-over-year basis, we accelerated our ARR growth to 71%, accelerated our subscription revenue growth to 37%, and expanded our subscription Gross Profit Margins more than 1,000 basis points to 87.3%.

This performance was the result of our continued execution against our transformation strategy, but it is important to note that our transformation strategy itself continues to evolve, as I hope it always will. While the rate of change is attenuating as we move from the “radical transformation” stage we entered in Q2 2021 to the “constant iteration and continuous improvement” stage in which we are now, the fact is we can always be better tomorrow, and thus that will always be our goal.

Constant iteration and continuous improvement can be confusing if not anchored by a consistent true north, and our true north is beautifully simple: Our goal is to support companies progressing in their digital transformation journey, and to achieve that we need to be easy to begin doing business with and excellent at guiding customers along their journey.

The initiatives we are pursuing in pursuit of our true north range in maturation from just-exiting-ideation to already-launched-and-in-execution, and the quality of both the initiatives as well as our execution of those initiatives will dictate the strength of our future performance. I want to use today’s call to talk about four initiatives in greater detail because I believe all four are likely to have outsized impacts on our quarterly results for years to come.

The first is the recent launch of the next-generation configuration of our digital watermark, an initiative we have been working on for over two years. Our next gen digital watermark is the culmination of a lot of incredible work by a lot of incredible people, and represents not just a step-change improvement in our digital watermarking technology, but also allows us to knock over a barrier that has historically added friction in our quest to digitize the world’s products.

Yes, the latest configuration of our digital watermark delivers dramatic improvement in important areas such as security, adaptability, imperceptibility, and performance, and all of these improvements are important because they all deliver a step-change increase in value to our customers.

But it is the addition of powerful new data access and detection controls that I believe will ultimately be what this new configuration is best known for, because these controls not only deliver value to our current offerings, they also enable something never before possible: the application of digital watermarking to products and packaging well ahead of adoption of any Digimarc offering. With these new controls, companies can now embed our digital watermarks well ahead of planned activation, future-proofing their products during planned packaging refreshes, regional roll outs, or ahead of future product digitization initiatives. This is not only a new capability of ours, it is something that no other data carrier can provide. It becomes yet another point of differentiation for us and our platform while simultaneously allowing Digimarc and our partners to rapidly plant seeds we can harvest for years to come.

The second initiative that I believe will have an outsized impact on future quarters is the evolution of our partner strategy to encompass and incentivize partners not yet ready to build their own products and services on top of Illuminate. This is another step towards our being easy to begin doing business with, in this case not only for our customers but also our partners.

Digimarc excels in supporting customers progressing in their digital transformation journey where the identification or the authentication of physical and digital assets is critical. This superpower is applicable to almost every single industry and brings us in contact with an incredible number of potential partners. These partners, in turn, possess existing customers, large pipelines of prospects, many salespeople, and incredible domain expertise. Our new Center of Expertise (CoE) Program allows us to build a mutually beneficial relationship by combining the strengths we both bring to bear while also allowing us both to benefit as we support our shared customers in progressing their digital transformation journey. The CoE Program is new but the early results have been promising.

Taking a step back, just like our products themselves, our initiatives should also be accretive, and in the case of the two just mentioned, they indeed are; while the interest in our CoE program was strong ahead of the announcement of our next generation configuration of our digital watermark, post that announcement the interest has notably increased. While all the improvements delivered by our latest digital watermark are resonating, it is the new data access and detection controls that have really spurred partner interest as they understand these controls not only help them ensure their customers’ products and packaging are future-proofed, but also allow them to share in our success when those customers activate those watermarks by subscribing to a Digimarc offering.

The third initiative I’d like to discuss was one we announced just a few days ago. In pursuit of being easy to begin doing business with, we have opened a fifth avenue to market for Digimarc Recycle. Under this new avenue to market, Digimarc will license Digimarc Recycle to qualified partners who would then lead the regional or country-wide rollout of our powerful offering to address the plastic packaging pollution crisis. To be clear, our other four avenues are still open; this is not a replacement but an augmentation to the options available. And like I imagine many of our successful initiatives will be, this new avenue to market was informed by conversations we had with multiple stakeholders who added their feedback to improve our final offering while sharing their excitement about its potential to open their markets. This new avenue excites us as well because it has the potential to not just speed time to revenue but also time to broad adoption. And when it comes to Digimarc Recycle, our interest in shortening time to adoption comes not just from the opportunity Digimarc Recycle presents us as a business, but also the opportunity that widespread adoption of Digimarc Recycle presents us all as a planet.

Finally, as discussed at an investor conference last month, we are putting the finishing touches on some major updates to Digimarc Engage. Being easy to begin doing business and excellent at guiding customers along the journey sometimes entails providing the market something they’ve never had the ability to do before, new capabilities that lead to a better end customer experience while also revealing data that has never before been available for the revealing. Our upgrade to Digimarc Engage will not only provide new functionality for physical products, it will also take the industry-leading capabilities of Digimarc Engage into the digital domain. Moreover, it will allow for a seamless experience between these two domains, something that is not possible with any other consumer engagement offering. We are excited to share more on this very, very soon.

The results of our initiatives don’t just show up in our quarterly results, they also allow our participation in important conversations focused on driving the world forward. As the pioneer and global leader in digital watermarking, we welcome the world’s understanding of the power of this technology and believe it is our responsibility to lend our almost 30 years of experience and expertise to conversations in which digital watermarking is a topic.

Throughout the fourth quarter, we participated in a series of meetings in Washington, D.C. with leaders from both the Executive and Legislative Branches on the critical topic of AI security. We were afforded this opportunity given our expertise and proven track record of protecting some of the world’s most recognized brands and critical assets.

In November, we were invited to participate in one of the Senate AI Insight forums hosted by Senate Majority Leader Chuck Schumer and Senators Todd Young, Martin Heinrich, and Mike Rounds. It was there that I testified to the need for trustworthy digital watermarks in the fight for online authenticity given the advent of artificial intelligence. We remain steadfast in our belief that among the many benefits GenAI will bring, perhaps the most powerful will be catalyzing the safer, fairer, and more transparent internet we all deserve.

In addition to our work inside the beltway, Digimarc was appointed co-chair of the C2PA working group on digital watermarking, once again establishing our credibility and leadership in the authenticity ecosystem – a position we look forward to maintaining. Whether it be individual events or ongoing engagements, two things are becoming clear to more and more stakeholders: digital watermarking is a technology of unlimited potential and Digimarc is the company best positioned to bring that technology to the world.

I will now turn the call over to Charles to discuss our financial results.

Financial Results

Thank you Riley, and good afternoon everyone.

Building on the positive financial trends we delivered in the third quarter, we saw continued progress in our financial performance during the fourth quarter in several key areas:

| • |

Ending ARR grew to $22.3 million, representing 71% year-over-year growth;

|

| • |

Subscription revenue increased 37% year-over-year;

|

| • |

Subscription gross profit margin reached 87.3%, a 1,000 basis point improvement;

|

| • |

Operating expenses decreased 2% from Q4 last year;

|

| • |

Non-GAAP net loss decreased $2.5 million or 31%; and

|

| • |

Free cash flow usage improved $2.2 million or 29%.

|

I highlight these areas as they are all critical drivers towards reaching positive free cash flow.

ARR increased 71% from $13.0 million at the end of 2022 to $22.3 million at the end of 2023. The increase in ARR largely reflects the impact of new customer contracts and to a lesser extent several important customer upsells during the year. As a reminder, we believe ARR is the best leading indicator for future commercial subscription revenue growth. Subscription revenue will lag ARR growth as subscription revenue is recognized ratably over a contract term versus ARR is recognized upfront upon entering into a contract.

Total revenue for the quarter was $9.3 million, an increase of $2.1 million or 29% from $7.2 million in Q4 last year, reflecting strong growth in both subscription and service revenue.

Subscription revenue, which accounted for 60% of total revenue for the quarter, grew 37% from $4.1 million to $5.6 million. The increase reflects subscription revenue recognized on new customer contracts as well as upsells on existing customer contracts. Commercial subscription revenue grew at an even higher rate at 40%.

Service revenue increased 18% from $3.1 million to $3.7 million. The increase primarily reflects a larger annual budget from the Central Banks for project work in 2023 than 2022.

Subscription gross profit margin improved from 77% in Q4 last year to over 87% in Q4 2023. The large increase year-over-year reflects a favorable mix in subscription revenue to our newer products, which have higher gross profit margins than our legacy products. This bodes well for continued expansion of our subscription gross profit margins as we both migrate existing customers to our newer products and we sign up new customers.

Service gross profit margin2 was flat at 56% in Q4 of both years. We continue to expect service gross profit margin to be in the mid-50’s on average going forward with some fluctuation quarter to quarter depending on labor mix.

Operating expenses for the quarter were $16.8 million compared to $17.1 million in Q4 last year, a decrease of 2%. Despite the impact of annual compensation adjustments for our employees, we were able to reduce our operating costs year-over-year as we continue to focus on ways to maximize our productivity and efficiency as an organization.

Non-GAAP operating expenses, which excludes non-cash and non-recurring items, were $13.4 million for the quarter, down 6%, compared to $14.3 million in Q4 last year.

Net loss per share for the quarter was 52 cents versus 62 cents in Q4 last year. Non-GAAP net loss per share was also considerably lower for the quarter at 28 cents versus 41 cents in Q4 last year.

We ended the year with $27.2 million in cash and investments.

Free cash flow usage was $5.6 million for the quarter, compared to $7.8 million used in Q4 last year. We used an additional $700 thousand of cash in Q4 for share repurchases. Our free cash flow usage was down considerably in the second half of 2023 as compared to the first half of the year, largely reflecting the impact of growing our ARR, and as promised free cash flow usage was noticeably less in the second half of 2023 as compared to Q2. Given cash flows can fluctuate quarter to quarter depending on the timing of cash inflows and outflows, we continue to believe that a good proxy for a normalized level of free cash flow is using non-GAAP loss and adding capital expenditures. While the trend in free cash flow has significantly improved over the past two quarters and we expect it to continue to improve, we do expect Q1 2024 to be higher than Q4 2023 due to year-end related expenses including annual incentive payments.

As I am sure you are all aware by now, we entered into a registered direct stock transaction over the weekend whereby we raised $32.5 million of gross cash proceeds by selling 929 thousand shares of our common stock at a price of $35.00. The price represented only a 2.5% discount to the last trade. This transaction not only topped off our balance sheet; it expanded our roster of both long-term and value-added shareholders. A special thank you to Rishi and the team at Altai Capital for the introduction to these new shareholders, their efforts in bringing this deal together, and their continued partnership.

After completing this transaction, we also decided to terminate our At-The-Market or ATM stock program that we had established back in 2019. The ATM program will be terminated effective March 1, 2024.

For the fiscal year, we made considerable progress in the underlying fundamentals of our business.

| • |

Subscription revenue increased 25% from last year and 33% if you exclude the impact of our retired Piracy Intelligence product; while commercial subscription revenue grew at an even higher rate at 38% excluding Piracy Intelligence;

|

| • |

Subscription gross profit margin averaged 84.3% for the year, a 1,000 basis point improvement over last year; and

|

| • |

Operating expenses decreased $8.8 million or 11% despite the headwinds from inflation.

|

As a result of accelerating our subscription revenue growth, expanding our subscription gross profit margins and lowering our operations expenses:

| • |

Non-GAAP loss decreased $12.1 million or 31% for the year; and |

| • |

Free cash flow usage was more than cut in half, decreasing from $45.9 million in 2022 to $22.7 million in 2023. |

We took a giant step in 2023 to move the company down the path to cash flow positive. We still have work to do but we will remain maniacally focused on continuing to grow ARR, expanding our gross profit margins and effectively managing our expenses to shorten that path.

For further discussion of our financial results, and risks and prospects for our business, please see our Form 10-K that will be filed with the SEC later this week.

I will now turn the call back over to Riley for final remarks.

Final Remarks

Thanks Charles.

Q4 was another strong quarter for Digimarc, made possible by the progress we have made on multiple important initiatives we have been pursuing since we began our transformation in Q2 2021. While we are through the most radical part of our transformation, we will always be focused on what’s next, guided by our simple mantra of being easy to begin doing business with and excellent at guiding customers along their journey.

I believe the four initiatives we shared today are likely to become inputs to future strong quarterly reports, and it is important to note, they are just a sampling of the things on which we are hard at work every day.

I share my teammates’ excitement about where we are going as well as their urgency to get there, urgency that comes from knowing there is a massive market waiting for us to unlock it, and that we are in a unique position to do just that.

Strong results are wonderful and as we’ve said consistently over the last two and a half years, we expect you to judge us on nothing but our results. But they are only made possible by never settling for the status quo and by always planting the seeds for future growth. The only constant, at least at Digimarc, is improvement, and I don’t expect that will ever change. The combination of This Team and This Tech is a scarily powerful mix, and as a Team we are excited by what the future holds.

Operator, we will now open up the call for questions.

1Annual Recurring Revenue (ARR) is a company performance metric calculated as the aggregation of annualized subscription fees from all of our commercial contracts as of the measurement date.

2Subscription gross profit margin excludes amortization expense on acquired intangible assets.

3Free cash flow includes cash used in operating activities, the purchase of property and equipment and capitalized patent costs.

v3.24.0.1

Document And Entity Information

|

Feb. 27, 2024 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

DIGIMARC CORPORATION

|

| Document, Type |

8-K

|

| Document, Period End Date |

Feb. 27, 2024

|

| Entity, Incorporation, State or Country Code |

OR

|

| Entity, File Number |

001-34108

|

| Entity, Tax Identification Number |

26-2828185

|

| Entity, Address, Address Line One |

8500 SW Creekside Place

|

| Entity, Address, City or Town |

Beaverton

|

| Entity, Address, State or Province |

OR

|

| Entity, Address, Postal Zip Code |

97008

|

| City Area Code |

503

|

| Local Phone Number |

469-4800

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock

|

| Trading Symbol |

DMRC

|

| Security Exchange Name |

NASDAQ

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0001438231

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

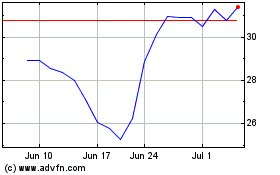

Digimarc (NASDAQ:DMRC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Digimarc (NASDAQ:DMRC)

Historical Stock Chart

From Apr 2023 to Apr 2024