0001755237false00017552372023-07-122023-07-12

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): July 12, 2023

CYCLERION THERAPEUTICS, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

Massachusetts |

|

001-38787 |

|

83-1895370 |

(State or other jurisdiction of incorporation) |

|

(Commission File Number) |

|

(IRS Employer Identification Number) |

245 First Street, 18th Floor

Cambridge, Massachusetts 02142

(Address of principal executive offices, including Zip Code)

Registrant’s telephone number, including area code: (857) 327-8778

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

Common Stock, no par value |

|

CYCN |

|

The Nasdaq Capital Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). Emerging growth company☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 8.01. Other Events.

As previously disclosed, on May 11, 2023, Cyclerion Therapeutics, Inc., a Massachusetts corporation (the “Company”) entered into an Asset Purchase Agreement (the “Asset Purchase Agreement”) with JW Celtics Investment Corp., a Delaware corporation (“Buyer Parent”) and JW Cycle Inc., a Delaware corporation (“Buyer” and, together with Buyer Parent, “Buyers”), pursuant to which the Company agreed, subject to certain conditions, including the authorization and approval of the Asset Purchase Agreement by its shareholders, to sell to Buyer specified assets relating to the Company’s zagociguat (previously known as CY6463) and CY3018 programs (the “Purchased Programs” and, such assets, the “Purchased Assets”), and Buyer agreed to assume certain liabilities relating to the Purchased Programs, including, but not limited to, (i) liabilities, costs and expenses arising after the date of the Asset Purchase Agreement relating to the employment of certain individuals prior to the Employee Expenses End Date (as defined in the Asset Purchase Agreement) (“Employee Expenses”) and the conduct of certain preclinical and clinical trial activities prior to the closing of the transactions contemplated by the Asset Purchase Agreement (“R&D Expenses”), and (ii) liabilities relating to the Purchased Assets or the Purchased Programs to the extent relating to the period after the closing of the transaction, in each case, subject to the terms and conditions of the Asset Purchase Agreement (the “Asset Sale Transaction”). Cyclerion will retain the assets comprising the olinciguat, praliciguat and preclinical programs, which the Company intends to continue to develop and/or out-license following the closing of the Asset Sale Transaction.

As consideration for the Asset Sale Transaction, Buyers agreed to (a) pay the Company (i) $8,000,000 at the closing of the Asset Sale Transaction, plus (ii) the amount of any Employee Expenses and R&D Expenses for which Buyers are obligated to reimburse the Company pursuant to the Asset Purchase Agreement and which remain unpaid as of the closing of the Asset Sale Transaction; and (b) deliver to the Company a number of shares of common stock, par value $0.0001 per share, of Buyer Parent, such that following the issuance thereof, such shares comprise 10% of the issued and outstanding shares of Buyer Parent immediately following the closing of the Asset Sale Transaction, subject to certain protections against dilution up to a $100 million valuation of Buyer Parent on a fully diluted basis.

In connection with the proposed Asset Sale Transaction, the Company filed with the U.S. Securities and Exchange Commission (the “SEC”) a preliminary proxy statement on June 9, 2023, and a definitive proxy statement on June 20, 2023 (the “Proxy Statement”), which the Company first mailed to its stockholders on or about June 20, 2023.

Following the announcement of the Asset Purchase Agreement, as of the date of this Current Report on Form 8-K, one lawsuit challenging the Asset Sale Transaction has been filed (the “Lawsuit”). The Lawsuit, captioned Anthony Morgan v. Cyclerion Therapeutics, Inc., Errol De Souza, Peter Hecht, Steve Hyman, Ole Isacson, and Terrance McGuire (Case No. ), was filed in the United States District Court for the Southern District of New York. In addition, the Company received five demand letters from counsel representing individual stockholders of the Company (the “Demand Letters” and, together with the Lawsuit, the “Matters”). The Matters allege, among other things, that the defendants filed or caused to be filed a materially false and misleading proxy statement with the SEC relating to the Asset Sale Transaction, expressly or implicitly in violation of Section 14(a) and Section 20(a) of the U.S. Securities Exchange Act of 1934, as amended, and Rule 14a-9 promulgated thereunder.

The Company believes that the claims asserted in the Matters are without merit and supplemental disclosures are not required or necessary under applicable laws. However, in order to avoid the risk that the Matters delay or otherwise adversely affect the Asset Sale Transaction, and to minimize the costs, risks and uncertainties inherent in litigation, and without admitting any liability or wrongdoing, the Company has agreed to supplement the Proxy Statement as described in this Current Report on Form 8-K. The Company and the other named defendants deny that they have violated any laws or breached any duties to the Company’s stockholders. Nothing in this Current Report on Form 8-K shall be deemed an admission of the legal necessity or materiality under applicable laws of any of the disclosures set forth herein. On the contrary, the Company specifically denies all allegations in the Matters that any additional disclosure was or is required.

Supplemental Disclosures to Proxy Statement in Connection with the Matters

The additional disclosures (the “Supplemental Disclosures”) in this Current Report on Form 8-K supplement the disclosures contained in the Proxy Statement and should be read in conjunction with the disclosures contained in the Proxy Statement, which should be read in its entirety. To the extent that information set forth in the Supplemental Disclosures differs from or updates information otherwise contained in the Proxy Statement, the information in this Current Report on Form 8-K shall supersede or supplement that information otherwise contained in the Proxy Statement. All page references are to the Proxy Statement and terms used but not otherwise defined herein shall have the meanings ascribed to such terms in the proxy statement.

1.The following underlined language is added to the last sentence of the second full paragraph on page 23 of the Proxy Statement in the section entitled “Proposal 1: The Asset Sale Proposal – Background of the Asset Sale Transaction”:

2

During May 2022, following its engagement, Stifel, at the direction of the Board, began reaching out on behalf of Cyclerion and ultimately it contacted 65 potential counterparties for a strategic transaction, and management, at the instruction of the Board, contacted an additional 25 potential counterparties for such a transaction. At the same time, Cyclerion continued to explore capital raising opportunities and other potential strategic initiatives. By early September 2022, 30 potential counterparties had signed non-disclosure agreements with Cyclerion to begin considering such a transaction. Prior to the commencement of such outreach, Cyclerion had established a comprehensive data room, which data room was made available to parties that executed non-disclosure agreements. The Board held regular meetings during which it discussed with representatives of Stifel, management and counsel the status of such outreach and the due diligence review being conducted by various potential counterparties that may have been interested in a transaction with the Company. Although the non-disclosure agreements described above included standstill provisions, no such agreement contained any “don’t-ask-don’t-waive” provisions.

2.The following underlined language is added to the fourth bullet sentence of the first full paragraph on page 40 of the Proxy Statement in the section entitled “Proposal 1: The Asset Sale Proposal – Reasons for the Asset Sale Transaction”:

•that following the engagement of Stifel on May 1, 2022, to explore strategic alternatives, Stifel and management contacted 65 potential counterparties for a strategic transaction, management representatives contacted an additional 25 potential counterparties for such a transaction, 30 potential counterparties had signed non-disclosure agreements with respect to such a transaction, and ultimately the only potential transaction that remained was the proposed Asset Sale Transaction; although the non-disclosure agreements described above included standstill provisions, no such agreement contained any “don’t-ask-don’t-waive” provisions;

3.The following stricken language is deleted, and underlined language is added, to the two paragraphs beginning on page 37 and ending on page 38 of the Proxy Statement in the section entitled “Proposal 1: The Asset Sale Proposal – Opinion of the Company’s Financial Advisor”.

Stifel is acting as financial advisor to the Company in connection with the Asset Sale Transaction and will receive a fee for its services of approximately $1.3 million, substantially all of which is contingent upon the closing of the Asset Sale Transaction, except that Stifel received a one-time non-refundable retainer of $50,000 upon its original engagement in May 2022, which amount will be fully credited against the foregoing $1.3 million fee. Stifel also acted as financial advisor to the Independent Board. Stifel will not receive any other significant payment or compensation in connection with contingent upon the successful consummation of the Asset Sale Transaction. In addition, the Company has agreed to reimburse Stifel for its reasonable and documented out-of-pocket expenses incurred in connection with Stifel’s engagement, subject to a maximum aggregate amount of all such reimbursement of $50,000 and to indemnify Stifel and its affiliates and their respective officers, directors, employees and agents, and any persons controlling Stifel or any of its affiliates, against certain liabilities arising out of its engagement. Stifel may seek to provide investment banking services to the Company, Buyer, Buyer Parent or their respective affiliates in the future, for which Stifel would seek customary compensation. In the ordinary course of its business, Stifel, its affiliates and their respective clients may transact in the securities of the Company and may at any time hold a long or short position in such securities.

Other than as described herein, during the two years preceding the date of the Stifel Opinion, Stifel was not engaged by the Company or any other party to the Asset Sale Transaction in any engagement in which Stifel received any compensation or is intended to receive any compensation, other than the engagements and any amounts that were paid under the engagements described in this proxy statement.

4.The following stricken language is deleted, and underlined language is added, to the first paragraph under the sub-heading “Financial Analysis of the Purchased Assets” on page 37 of the Proxy Statement in the section entitled “Proposal 1: The Asset Sale Proposal – Opinion of the Company’s Financial Advisor”.

Stifel performed a discounted cash flow analysis with respect to the Purchased Assets to calculate the estimated present value of the stand-alone, unlevered, after-tax free cash flows that the Purchased Assets were projected to generate from June 30, 2023 through December 31, 2045, with such stand-alone, unlevered, after-tax free cash flows derived from the risk-adjusted projections for the Purchased Assets provided to Stifel by the Company management. Stifel estimated the terminal value of such unlevered, after-tax free cash flows generated by the Purchased Assets after calendar year 2045 by assuming a range of perpetuity decline rates of 25% to 75%. These cash flows and terminal value were then discounted to present values as of June 30, 2023 using a range an estimate of the Company’s weighted average cost of capital between of 21% and to 23%, estimated based on the capital asset pricing model and Stifel’s judgment and experience and considering the Company’s specific circumstances. In performing its discounted cash flow analysis, Stifel assumed that the Company could raise the funding necessary to pursue the development of the Purchased Assets on its own.

This analysis resulted in an implied value for the Purchased Assets of approximately ($14.0 million) to $4.4 million, as compared to the implied value for the Consideration to be received by the Company of approximately $12.5 million to $14.2 million.

3

5.The following bolded rows of financial information (beginning “zagociguat”, “CY3018” and “Gross Profit”) are added to the table under the sub-heading “Non-Risk-Adjusted Forecasts” on page 39 of the Proxy Statement in the section entitled “Proposal 1: The Asset Sale Proposal – Certain Prospective Financial Information”.

Non-Risk-Adjusted Forecasts

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

($ in mm) |

2H

2023 |

2024 |

2025 |

2026 |

2027 |

2028 |

2029 |

2030 |

2031 |

2032 |

2033 |

2034 |

2035 |

2036 |

2037 |

2038 |

2039 |

2040 |

2041 |

2042 |

2043 |

2044 |

2045 |

zagociguat |

|

|

|

|

|

|

|

$78 |

$92 |

$181 |

$258 |

$322 |

$330 |

$333 |

$336 |

$340 |

$343 |

$347 |

$350 |

$162 |

$81 |

$41 |

$20 |

CY3018 |

|

|

|

|

|

|

|

— |

$174 |

$261 |

$496 |

$721 |

$921 |

$965 |

$999 |

$1,033 |

$1,068 |

$1,105 |

$1,143 |

$1,182 |

$1,222 |

$1,264 |

$1,307 |

Total Revenue |

|

|

|

|

|

|

|

$78 |

$266 |

$442 |

$754 |

$1,043 |

$1,251 |

$1,299 |

$1,335 |

$1,373 |

$1,411 |

$1,451 |

$1,493 |

$1,344 |

$1,303 |

$1,304 |

$1,327 |

Gross Profit |

|

|

|

|

|

|

|

$76 |

$258 |

$420 |

$718 |

$994 |

$1,192 |

$1,238 |

$1,273 |

$1,309 |

$1,346 |

$1,384 |

$1,423 |

$1,281 |

$1,242 |

$1,244 |

$1,266 |

EBIT |

($15) |

($23) |

($34) |

($40) |

($56) |

($66) |

($81) |

($45) |

$85 |

$209 |

$499 |

$762 |

$963 |

$1,007 |

$1,039 |

$1,065 |

$1,092 |

$1,123 |

$1,250 |

$1,120 |

$1,085 |

$1,087 |

$1,107 |

Unlevered Free Cash Flow(1) |

($15) |

($23) |

($34) |

($40) |

($56) |

($66) |

($81) |

($45) |

$42 |

$162 |

$335 |

$496 |

$658 |

$723 |

$748 |

$767 |

$786 |

$808 |

$900 |

$844 |

$797 |

$790 |

$800 |

___________________

(1) Unlevered Free Cash Flow was estimated based on 27.3% tax rate, 20% net working capital requirement, and usage of future net operating losses

6.The following bolded rows of financial information (beginning “zagociguat”, “CY3018” and “Gross Profit”) are added to the table under the sub-heading “Risk-Adjusted Forecasts” on page 39 of the Proxy Statement in the section entitled “Proposal 1: The Asset Sale Proposal – Certain Prospective Financial Information”.

Risk-Adjusted Forecasts

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

($ in mm) |

2H

2023 |

2024 |

2025 |

2026 |

2027 |

2028 |

2029 |

2030 |

2031 |

2032 |

2033 |

2034 |

2035 |

2036 |

2037 |

2038 |

2039 |

2040 |

2041 |

2042 |

2043 |

2044 |

2045 |

zagociguat |

|

|

|

|

|

|

|

$18 |

$27 |

$54 |

$76 |

$95 |

$97 |

$98 |

$99 |

$100 |

$101 |

$102 |

$103 |

$49 |

$25 |

$12 |

$6 |

CY3018 |

|

|

|

|

|

|

|

— |

$16 |

$34 |

$65 |

$93 |

$119 |

$124 |

$128 |

$132 |

$137 |

$142 |

$146 |

$151 |

$157 |

$162 |

$168 |

Total Revenue |

|

|

|

|

|

|

|

$18 |

$44 |

$88 |

$141 |

$188 |

$215 |

$221 |

$227 |

$232 |

$237 |

$243 |

$249 |

$201 |

$181 |

$174 |

$174 |

Gross Profit |

|

|

|

|

|

|

|

$17 |

$42 |

$84 |

$134 |

$179 |

$205 |

$211 |

$216 |

$221 |

$226 |

$231 |

$237 |

$191 |

$173 |

$166 |

$165 |

EBIT |

|

($20) |

($21) |

($19) |

($25) |

($29) |

($24) |

($12) |

$3 |

$38 |

$89 |

$133 |

$159 |

$166 |

$171 |

$175 |

$178 |

$183 |

$201 |

$159 |

$143 |

$136 |

$136 |

Unlevered Free Cash Flow(1) |

($15) |

($20) |

($21) |

($19) |

($25) |

($29) |

($24) |

($12) |

($3) |

$27 |

$74 |

$104 |

$110 |

$119 |

$123 |

$126 |

$129 |

$132 |

$145 |

$125 |

$180 |

$101 |

$99 |

___________________

(1) Unlevered Free Cash Flow was estimated based on 27.3% tax rate, 20% net working capital requirement, and usage of future net operating losses

7.The following underlined language is added to the third bullet sentence of the first full paragraph on page 56 of the Proxy Statement in the section entitled “Proposal 1: The Asset Sale Proposal – Interests of Certain Persons in the Asset Sale Transaction”:

•Dr. Hecht will become the Chief Executive Officer and a member of the Board of Directors of Buyer Parent upon the closing of the Asset Sale Transaction and will receive equity securities in Buyer Parent as part of his compensation. Dr. Hecht will resign as the Company’s Chief Executive Officer but will remain a member of the Board upon the closing of the Asset Sale Transaction. Dr. Hecht did not engage in any discussions regarding his compensation for serving as Buyer Parent’s Chief Executive Officer or as a member of its Board of Directors prior to the execution of the Asset Purchase Agreement.

8.The following underlined language is added as a new fourth bullet sentence of the first full paragraph on page 56 of the Proxy Statement in the section entitled “Proposal 1: The Asset Sale Proposal – Interests of Certain Persons in the Asset Sale Transaction”:

•Following execution of the Asset Purchase Agreement, certain Cyclerion employees, including Mr. Hecht, received written offers of employment from Buyers, with such employment being effective as of and contingent on the occurrence of the Closing on terms and conditions set forth in the Asset Purchase Agreement.

4

9.The following entirely new paragraph is added in full immediately following the last paragraph on page 33 of the Proxy Statement in the section entitled “Proposal 1: The Asset Sale Proposal – Background of the Asset Sale Transaction”.

During the foregoing process, from time to time, certain parties to the Asset Sale Transaction discussed post-transaction employment by the Buyer Parent of Mr. Hecht and certain other Cyclerion employees as the Buyer Parent deemed necessary or appropriate to the development of the acquired assets. These discussions varied as the form and substance of the proposed transaction evolved as describe above (e.g., from a buyout to a licensing arrangement to an asset purchase). The parties, however, did not discuss Dr. Hecht’s or any other transferred employee’s potential compensation as officers or employees of Buyer Parent or its subsidiary prior to the execution of the Asset Purchase Agreement.

Additional Information and Where to Find It

This communication relates to the proposed transaction involving Cyclerion Therapeutics, Inc. (“Cyclerion”). In connection with the proposed transaction, Cyclerion has filed with the U.S. Securities and Exchange Commission (the “SEC”) a definitive proxy statement on Schedule 14A (the “Proxy Statement”). The Proxy Statement was first mailed to Cyclerion’s stockholders on or about June 20,2022. This communication is not a substitute for the Proxy Statement or for any other document that Cyclerion may file with the SEC and send to its stockholders in connection with the proposed transaction. The proposed transaction will be submitted to Cyclerion’s stockholders for their consideration. Before making any voting decision, Cyclerion’s stockholders are urged to read all relevant documents filed or to be filed with the SEC, including the Proxy Statement, as well as any amendments or supplements to those documents, when they become available because they will contain important information about the proposed transaction.

Cyclerion’s stockholders will be able to obtain a free copy of the Proxy Statement, as well as other filings containing information about Cyclerion, without charge, at the SEC’s website (www.sec.gov). Copies of the Proxy Statement and the filings with the SEC incorporated by reference therein can also be obtained, without charge, by directing a request to Cyclerion Therapeutics, Inc., 245 First Street, 18th Floor, Cambridge, Massachusetts 02142, Attention: Investor Relations, email: IR@cyclerion.com, or from Cyclerion’s website, www.cyclerion.com.

Participants in the Solicitation

Cyclerion and certain of its directors, executive officers and employees may be deemed to be participants in the solicitation of proxies in respect of the proposed transaction. Information regarding Cyclerion’s directors and executive officers is available in Cyclerion’s proxy statement on Schedule 14A for the 2023 special meeting of stockholders, which was filed with the SEC on June 20, 2023. Other information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, are contained in the Proxy Statement and other relevant materials to be filed with the SEC in connection with the proposed transaction when they become available. Free copies of the Proxy Statement and such other materials may be obtained as described in the preceding paragraph.

5

Forward-Looking Statements

This Current Report on Form 8-K and the attached exhibits contain “forward-looking statements” within the meaning of the federal securities laws. These forward-looking statements include statements concerning our outlook for the future, as well as other statements of beliefs, future plans and strategies or anticipated events, and similar expressions concerning matters that are not historical facts. These statements can be identified by the use of forward-looking terminology such as “predicts,” “believes,” “potential,” “continues,” “estimates,” “anticipates,” “expects,” “plans,” “intends,” “may,” “could,” “might,” “will,” “should,” “positive,” “projects,” “targets,” “optimistic,” aims,” or the negative thereof or other variations thereon or other comparable terminology. The forward-looking statements included in this Current Report on Form 8-K are based on management’s current expectations and assumptions about future events, which are inherently subject to uncertainties, risks and changes in circumstances that are difficult to predict and could cause actual results to differ materially from those expressed in, or implied by, the forward-looking statements. These risks and uncertainties include, but are not limited to, the following: our shareholders failing to approve the Asset Sale Transaction; the failure of one or more conditions to the closing of the Asset Sale Transaction to be satisfied or waived by the applicable party; an increase in the anticipated amount of costs, fees, expenses and other charges related to the Asset Purchase Agreement or Asset Sale Transaction, including the expenses of any claims or litigation seeking to challenge the transaction or disclosures in connection therewith or recover any damages alleged to arise therefrom; expenses associated with the potential exercise of appraisal rights and any related adjudication of the fair value of our common stock; the occurrence of any event, change or other circumstances that could give rise to the termination of the Asset Purchase Agreement; risks arising from the diversion of management’s attention from our ongoing business operations; risks associated with our ability to monetize the Retained Programs and/or to identify and realize business opportunities following the Asset Sale Transaction; fluctuations in demand for our technology; risks of losing key personnel, customers, distributors, or suppliers; protection of the Company’s intellectual property and government policies and regulations, including, but not limited to those affecting the Company’s industry; the impact of the Lawsuit and the Demand Letters; and the matters discussed under “Item 1A. Risk Factors” of the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2022, as amended and updated from time to time in the Company’s subsequent filings with the SEC. Readers are cautioned not to place undue reliance on forward-looking statements. Any forward-looking statement speaks only as of the date that it was made, and the Company undertakes no obligation to update any forward-looking statement, whether as the result of new information or otherwise.

6

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

Cyclerion Therapeutics, Inc. |

|

|

|

|

|

|

Dated: July 12, 2023 |

By: |

/s/ Anjeza Gjino |

|

|

Name: |

Anjeza Gjino |

|

|

Title: |

Chief Financial Officer |

7

v3.23.2

Document and Entity Information

|

Jul. 12, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Jul. 12, 2023

|

| Entity Registrant Name |

CYCLERION THERAPEUTICS, INC.

|

| Entity Central Index Key |

0001755237

|

| Entity Emerging Growth Company |

true

|

| Entity Ex Transition Period |

false

|

| Entity File Number |

001-38787

|

| Entity Incorporation, State or Country Code |

MA

|

| Entity Tax Identification Number |

83-1895370

|

| Entity Address, Address Line One |

245 First Street

|

| Entity Address, Address Line Two |

18th Floor

|

| Entity Address, City or Town |

Cambridge

|

| Entity Address, State or Province |

MA

|

| Entity Address, Postal Zip Code |

02142

|

| City Area Code |

857

|

| Local Phone Number |

327-8778

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, no par value

|

| Trading Symbol |

CYCN

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

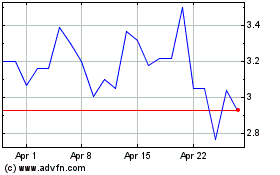

Cyclerion Therapeutics (NASDAQ:CYCN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Cyclerion Therapeutics (NASDAQ:CYCN)

Historical Stock Chart

From Apr 2023 to Apr 2024