Noventiq Holdings PLC (“Noventiq”), a global digital

transformation and cybersecurity solutions and services provider,

and Corner Growth Acquisition Corp. (Nasdaq: COOL) (“Corner

Growth”), a special purpose acquisition company led by veteran

technology investors (“Sponsors”), today filed with the U.S.

Securities and Exchange Commission (the “SEC”) a Registration

Statement on Form F-4/A (the “F-4/A”) in connection with the

previously announced proposed Business Combination (as defined

below).

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20240313935971/en/

Recent Key Business Developments

- Noventiq delivered strong results with revenue for the first

six months FY24 of $219.8 million, an increase of 36.4%

year-over-year on a reported currency basis and 41.4% in constant

currency. Gross profit was $93.8 million, an increase of 25.3% on a

reported currency basis, and 32.6% in constant currency. Adjusted

EBITDA (excluding share based compensation) was $14.0 million, an

increase of 178.4% on a reported currency basis. Adjusted EBITDA

(excluding share based compensation) margin on revenue was

6.4%.

- Noventiq recently completed an audit in compliance with Public

Company Accounting Oversight Board (“PCAOB“) requirements on its

financial statements for FY22 and FY23, and a review by its

auditors on the first six months of H1 FY24.

- Noventiq has also published its updated investor presentation

which includes highlights of its strategy, positioning and

financial results, which can be found at [Noventiq IR]

Hervé Tessler, CEO of Noventiq, said:

“I am very pleased with the strong growth and continued momentum

in our business as we position Noventiq for a Nasdaq listing. In

addition to the strength of our operational performance, we

continue to drive our transformational agenda across our global

client base as we invest at scale in our business and our people,

and in new and enhanced technologies and capabilities. I am excited

about the opportunities ahead as we make significant progress

towards delivering more value for all our stakeholders.”

Marvin Tien, Co-Chairman & CEO of Corner Growth,

said:

“Noventiq continues to drive significant top line and EBITDA

growth through its strong and special partnerships with Microsoft

and Amazon and secular tailwinds for growing IT spend in India and

other core emerging markets. With deep expertise in digital

transformation, cybersecurity and artificial intelligence

solutions, and a track record of successfully scaling in

high-growth emerging markets, we believe Noventiq is truly a

transformative company with a substantial opportunity ahead. We are

very excited for the future, and pleased to be a key partner and

supporter of Noventiq as they pursue this transaction.”

Continued Momentum for the six months to 30 September 2023

(H1, FY24)

- Revenue for the six months FY24 of $219.8 million, an increase

of 36.4% year-over-year on a reported currency basis and 41.4% in

constant currency.

- Noventiq reported broad based strength with double-digit growth

across all three business segments. Services revenue of $95.7

million grew 37.3% year-over-year, Hardware revenue of $60.4

million grew 54.7% year-over-year, and Software & Cloud revenue

of $63.6 million grew 21.6% year-over-year. From a geographic

perspective, APAC and EMEA were particularly strong with revenue

growth of 96.2%, and 44.6%, respectively.

- Recurring revenue was $43.1 million representing an increase of

23.1% year-over-year.

- Gross profit was $93.8 million, an increase of 25.3%

year-over-year on a reported currency basis, and 32.6% in constant

currency. Gross profit in Services was $41.8 million with growth of

30.9% year-over-year. Gross profit in Software & Cloud was

$42.2 million with growth of 22.1% year-over-year. Gross profit in

Hardware was $9.8 million with growth of 16.8% year-over-year.

- Adjusted EBITDA (excluding share based compensation) was $14.0

million, an increase of 178.4% year-over-year on a reported

currency basis. Adjusted EBITDA (excluding share based

compensation) margin on revenue was 6.4%.

Refer to exhibits to this press release for reconciliations of

Non-IFRS financial measures to IFRS financial measures.

Business Outlook

While the company expects continued strong demand from its

customers for digital transformation, it remains mindful of the

continued broader economic and geopolitical uncertainty.

For FY24 (fiscal year ended March 31, 2024), Noventiq is now

targeting revenue of at least $495 million, representing at least

23% growth on a reported currency basis. Noventiq aims to deliver

Adjusted EBITDA (excluding share based compensation) of

approximately $38 million, representing growth of approximately

25%.

For FY25 (fiscal year ended March 31, 2025), Noventiq is

targeting revenue of at least $550 million, and approximately $46

million of Adjusted EBITDA (excluding share based compensation),

representing approximately 21% growth over FY24.

Investor Presentation The investor presentation can be

found here: [Noventiq IR]

Non-IFRS measures

This communication includes certain non-IFRS financial measures,

such as Adjusted EBITDA excluding share based compensation,

recurring revenue, and growth in constant currency which are

defined in the F-4/A. These non-IFRS financial measures may not be

comparable to similarly titled measures presented by other

companies, nor should they be construed as an alternative to other

financial measures determined in accordance with IFRS. We believe

these additional metrics are meaningful indicators of financial and

operational performance.

No Offer or Solicitation

This communication relates to the proposed Business Combination

between Noventiq and Corner Growth. This document does not

constitute an offer to sell or exchange, or the solicitation of an

offer to buy or exchange, any securities, nor shall there be any

sale of securities in any jurisdiction in which such offer, sale or

exchange would be unlawful prior to registration or qualification

under the securities laws of any such jurisdiction. No offer of

securities shall be made except by means of a prospectus meeting

the requirements of Section 10 of the Securities Act.

Additional Information and Where to Find It

In connection with the Business Combination, Noventiq Holding

Company has filed with the SEC a Registration Statement on Form F-4

(as may be amended from time to time, the "Registration

Statement"), which includes a preliminary prospectus and

preliminary proxy statement. Corner Growth will mail a definitive

proxy statement, definitive prospectus and other relevant documents

to its shareholders when the Registration Statement is declared

effective. This communication is not a substitute for the

Registration Statement, the definitive proxy statement, the

definitive prospectus or any other document that Corner Growth will

send to its shareholders in connection with the Business

Combination. Investors and security holders of Corner Growth are

advised to read, when available, the proxy statement in connection

with Corner Growth's solicitation of proxies for its special

meeting of shareholders to be held to approve the Business

Combination (and related matters) because the proxy statement will

contain important information about the Business Combination and

the parties to the Business Combination. The definitive proxy

statement will be mailed to shareholders of Corner Growth as of a

record date to be established for voting on the Business

Combination. Shareholders will also be able to obtain copies of the

proxy statement, without charge, once available, at the SEC's

website www.sec.gov or by directing a request to:

ryan.flanagan@icrinc.com.

Participants in the Solicitation

Corner Growth, Noventiq and their respective directors,

executive officers, other members of management, and employees,

under SEC rules, may be deemed to be participants in the

solicitation of proxies of Corner Growth's shareholders in

connection with the Business Combination. Investors and security

holders may obtain more detailed information regarding the names

and interests in the Business Combination of Corner Growth's

directors and officers in Corner Growth's filings with the SEC

including the Registration Statement which will include the proxy

statement of Corner Growth for the Business Combination, and such

information and names of Noventiq's directors and executive

officers will also be in the Registration Statement which will

include the proxy statement of Corner Growth for the Business

Combination.

About Noventiq

Noventiq (Noventiq Holdings PLC) is a leading global solutions

and services provider in digital transformation and cybersecurity,

headquartered in London. The company enables, facilitates, and

accelerates digital transformation for its customers’ businesses,

connecting organizations across a comprehensive range of industries

with best-in-class IT vendors, alongside its own services and

proprietary solutions.

The company’s rapid growth is underpinned by its

three-dimensional strategy to expand its market penetration,

product portfolio, and sales channels. This is supported by an

active approach to M&A, positioning Noventiq to capitalize on

the industry’s ongoing consolidation. With around 6,400 employees

globally, Noventiq operates in approximately 60 countries with

significant growth potential in multiple regions including Latin

America, EMEA, and APAC – with a notable presence in India.

About Corner Growth Acquisition Corp.

Corner Growth Acquisition Corp. (Nasdaq: COOL) is a special

purpose acquisition company (SPAC) focused on partnering with a

high growth technology company. Corner Growth’s mission is to

deliver value to its investors by providing a compelling

alternative to a traditional public offering. Corner Growth is

uniquely positioned to deliver on its value-add approach given its

management team’s history, experience, relationships, leadership

and track record in identifying and investing in disruptive

technology companies across all technology verticals.

Corner Growth also brings a group of highly respected investment

professionals, with strong track records and deep individual

experience in SPAC and de-SPAC processes, a rolodex of premier

public market investors, and a team of advisors who offer

experience and access to networks across a broad functional and

physical geography.

Forward Looking Statements

Certain statements made herein that are not historical facts are

forward-looking statements for purposes of the safe harbor

provisions under The Private Securities Litigation Reform Act of

1995. Forward-looking statements generally are accompanied by words

such as “believe,” “may,” “will,” “estimate,” “continue,”

“anticipate,” “intend,” “expect,” “target,” “aim,” “should,”

“would,” “plan,” “predict,” “potential,” “seem,” “seek,” “future,”

“outlook” and similar expressions that predict or indicate future

events or trends or that are not statements of historical matters.

These forward-looking statements include, but are not limited to,

statements regarding future events, the Business Combination

between Corner Growth and Noventiq, the estimated or anticipated

future results and benefits of the Combined Company following the

Business Combination, including the likelihood and ability of the

parties to successfully consummate the Business Combination, future

opportunities for the Combined Company, statements regarding

Noventiq's future financial position, and other statements that are

not historical facts. These statements are based on the current

expectations of Corner Growth’s management and/or Noventiq’s

management, as applicable, and are not predictions of actual

performance. These forward-looking statements are provided for

illustrative purposes only and are not intended to serve as, and

must not be relied on, by any investor as a guarantee, an

assurance, a prediction or a definitive statement of fact or

probability. Actual events and circumstances are difficult or

impossible to predict and will differ from assumptions. Many actual

events and circumstances are beyond the control of Corner Growth

and Noventiq. These statements are subject to a number of risks and

uncertainties regarding Noventiq’s business, Corner Growth’s

businesses and the Business Combination, and actual results may

differ materially. These risks and uncertainties include, but are

not limited to, general economic, political and business

conditions; the inability of the parties to consummate the Business

Combination or the occurrence of any event, change or other

circumstances that could give rise to the termination of the

Business Combination Agreement; the outcome of any legal

proceedings that may be instituted against the parties following

the announcement of the Business Combination; the receipt of an

unsolicited offer from another party for an alternative business

transaction that could interfere with the Business Combination; the

risk that the approval of the shareholders of Corner Growth or

Noventiq for the potential transaction is not obtained; failure to

realize the anticipated benefits of the Business Combination,

including as a result of a delay in consummating the potential

transaction or difficulty in integrating the businesses of Corner

Growth or Noventiq; the risk that the Business Combination disrupts

current plans and operations as a result of the announcement and

consummation of the Business Combination; the ability of the

Combined Company to grow and manage growth profitably and retain

its key employees; the amount of redemption requests made by Corner

Growth’s shareholders; the inability to obtain or maintain the

listing of the post-acquisition company’s securities on Nasdaq

following the Business Combination; costs related to the Business

Combination; the impact of competitive products and pricing on

Noventiq; Noventiq’s ability to offer the products and services of

its key vendors, particularly Microsoft, for sale to customers and

to earn incentives on such sales; demand for Noventiq’s services

and solutions; the ability of Noventiq to achieve operating

synergies from acquired businesses; the successful integration of

acquired businesses; breaches in cybersecurity or disruption to IT

systems; Noventiq’s ability to attract, hire, train and retain

experienced personnel; fluctuations in currency exchange rates; the

ability to comply with the laws and regulations across the markets

in which Noventiq operates and the effectiveness of its internal

controls, procedures, compliance systems and risk management

systems; other risks and uncertainties detailed in the F-4; and

those factors discussed in Corner Growth’s Annual Report on Form

10-K for the fiscal year ended December 31, 2020, filed with the

SEC on March 31, 2021, in Corner Growth’s Annual Report on Form

10-K for the fiscal year ended December 31, 2022, filed with the

SEC on March 31, 2023, and other filings with the SEC. If any of

these risks materialize or if assumptions prove incorrect, actual

results could differ materially from the results implied by these

forward-looking statements. There may be additional risks that

Corner Growth and/or Noventiq presently do not know or that Corner

Growth and/or Noventiq currently believe are immaterial that could

also cause actual results to differ from those contained in the

forward-looking statements. In addition, forward-looking statements

provide the expectations, plans or forecasts of future events and

views of Corner Growth and/or Noventiq as of the date of this

communication. Corner Growth and Noventiq anticipate that

subsequent events and developments will cause their assessments to

change. However, while Corner Growth and/or Noventiq may elect to

update these forward-looking statements at some point in the

future, Corner Growth and Noventiq specifically disclaim any

obligation to do so. These forward-looking statements should not be

relied upon as representing Corner Growth’s and/or Noventiq’s

assessments as of any date subsequent to the date of this

communication. Accordingly, undue reliance should not be placed

upon the forward-looking statements.

Disclaimer

The financial information included in this communication

comprises financial information for the years ended March 31, 2023

and 2022 derived from the audited financial statements of Noventiq,

and the unaudited financial statements for the six months ended

September 30, 2023. This communication includes certain non-IFRS

financial measures, such as Adjusted EBITDA excluding share based

compensation, recurring revenue, and growth in constant currency

which are defined in the F-4/A. These non-IFRS financial measures

may not be comparable to similarly titled measures presented by

other companies, nor should they be construed as an alternative to

other financial measures determined in accordance with IFRS.

Certain figures contained in this communication, including

financial information, have been subject to rounding adjustments

(and, in certain circumstances, may not conform exactly to the

total figure given).

Exhibit 1 - Reconciliation of Non-IFRS financial measures to

IFRS financial measures.

(in thousands of U.S. dollars, unless

otherwise indicated)

Six months ended September

30,

2023

2022

Revenue

219,757

161,105

Add/(Less):

Indian rupee impact

-1,412

1,582

Egyptian pound impact

1,608

534

Euro impact

-722

2,217

Argentine peso impact

1,804

641

Turkish lira impact

988

1,728

Belarusian ruble impact

5,260

931

Kazakh tenge impact

-220

807

Other

664

1,204

Revenue, CCY

227,727

170,749

Revenue growth, CCY

41.4%

—

(in thousands of U.S. dollars, unless

otherwise indicated)

Six months ended September

30,

2023

2022

Gross profit

93,810

74,887

Add/(Less):

Egyptian pound impact

1,405

455

Indian rupee impact

-558

927

Argentine peso impact

1,511

432

Euro impact

-339

861

Turkish lira impact

604

790

Belarusian ruble impact

2,340

442

Other

535

1,046

Gross profit, CCY

99,308

79,840

Gross profit growth, CCY

32.6%

—

Six months ended September

30,

2023

2022

(in millions of U.S. dollars)

Loss for the year from continuing

operations

-28.2

-22.9

Added back:

Income tax expense

3.8

0.5

Depreciation and amortization

10.9

6.9

Foreign exchange (gain) / loss

5.9

6.0

Net financial income and expenses

8.9

6.3

Property and equipment write-off

0.0

0.1

Employee termination payments

0.3

0.1

Impairment losses

6.0

6.3

One-off items (penalties and acquisition

related expenses)

6.4

1.7

Adjusted EBITDA (excluding share based

compensation)

14.0

5.0

Six months ended September

30,

2023

2022

(in thousands of U.S.

dollars)

Software subscription

9,742

7,706

Third-party cloud resale products

31,112

24,776

Own cloud solutions

2,225

2,502

Recurring revenue

43,079

34,984

Software and licenses

22,799

19,852

Services

93,472

67,214

Hardware

60,407

39,055

Non-recurring revenue

176,678

126,121

Total revenue

219,757

161,105

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240313935971/en/

Noventiq Contacts

Investors: Steven Salter VP Corporate Affairs

IR@noventiq.com

Media: Rocio Herraiz Global Head of Communications

pr@noventiq.com

Corner Growth Contacts

Investors: Ryan Flanagan, ICR

ryan.flanagan@icrinc.com

Media: Brian Ruby, ICR Brian.ruby@icrinc.com

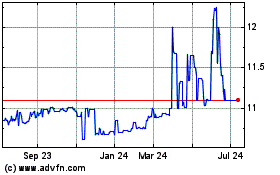

Corner Growth Acquisition (NASDAQ:COOL)

Historical Stock Chart

From Mar 2024 to Apr 2024

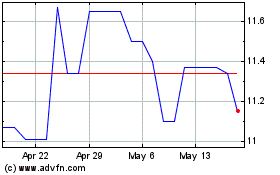

Corner Growth Acquisition (NASDAQ:COOL)

Historical Stock Chart

From Apr 2023 to Apr 2024