0001482981FALSE00014829812024-02-282024-02-28

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_____________________________

FORM 8-K

_____________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of report (Date of earliest event reported): February 28, 2024

_____________________________

The Vita Coco Company, Inc.

(Exact name of registrant as specified in its charter)

_____________________________

| | | | | | | | | | | | | | |

Delaware | | 001-40950 | | 11-3713156 |

(State or other jurisdiction of incorporation) | | (Commission File Number) | | (I.R.S. Employer Identification No.) |

250 Park Avenue South

Seventh Floor

New York, New York 10003

(Address of principal executive offices) (Zip Code)

(Registrant’s telephone number, include area code) (212) 206-0763

N/A

(Former Name or Former Address, if Changed Since Last Report)

_____________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

Title of each class |

| Trading Symbols |

| Name of each exchange on which registered |

Common Stock, $0.01 par value per share |

| COCO |

| The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On February 28, 2024, The Vita Coco Company, Inc. (the “Company”) issued a press release announcing financial results for the three months and year ended December 31, 2023 and other matters described in the press release. A copy of the Company’s press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K and incorporated herein by reference.

The information disclosed under this Item 2.02, including Exhibit 99.1 hereto, is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, nor shall it be incorporated by reference into any registration statement or other document pursuant to the Securities Act of 1933, as amended, except as expressly set forth in such filing.

Item 9.01 Financial Statements and Exhibits.

(d)Exhibits.

| | | | | |

Exhibit No. | Description |

| |

99.1 | |

| |

| |

104 | Cover Page Interactive Data File (embedded with Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| THE VITA COCO COMPANY, INC. |

|

|

|

Date: February 28, 2024 | By: | /s/ Corey Baker |

|

| Name: Corey Baker |

|

| Title: CFO |

Exhibit 99.1

The Vita Coco Company Reports Fourth Quarter and Full Year 2023 Financial Results

Full Year Net Sales Increased 15% to $494 million Driven by Vita Coco Coconut Water Growth of 14%

Full Year Net Income of $47 million and Full Year Non-GAAP Adjusted EBITDA1 of $68 million

For Fiscal Year 2024, Expect Net Revenue between $495-$505 million and Adjusted EBITDA2 between $74-$78 million

NEW YORK, NY – February 28, 2024 – The Vita Coco Company, Inc. (NASDAQ:COCO) (“Vita Coco” or “the Company”), a leading high-growth platform of better-for-you beverage brands, today announced financial results for the fourth quarter and full year ended December 31, 2023.

Fourth Quarter 2023 Highlights Compared to Prior Year

•Net sales grew 15% to $106 million, driven by strong 8% net sales growth and 3% volume growth of Vita Coco Coconut Water.

•Gross profit was $40 million, or 37% of net sales, an increase of $17 million, compared to 24% of net sales, with the improvement driven by lower year-over-year transportation costs, volume growth and higher Vita Coco Coconut Water pricing.

•Net income was $7 million, or $0.11 per diluted share, compared to a net loss of $(3) million, or $(0.05) per diluted share. Net income benefited from strong net sales growth and gross margin improvement resulting primarily from decreased transportation costs, partially offset by increased investments in selling, general and administrative ("SG&A") expenses.

•Non-GAAP Adjusted EBITDA1 was $8 million compared to $4 million, up $4 million due to improvements in gross profit partially offset by increased SG&A spending.

Full Year 2023 Highlights Compared to Prior Year

•Net sales grew 15% to $494 million, driven by strong 14% net sales growth and 11% volume growth of Vita Coco Coconut Water.

•Gross profit was $181 million, or 37% of net sales, compared to $103 million, or 24.2% of net sales, with the increase driven primarily by lower year-over-year transportation costs, volume growth and increased Vita Coco Coconut Water pricing.

•Net income was $47 million, or $0.79 per diluted share, compared to $8 million, or $0.14 per diluted share, with the increase driven by strong net sales growth and gross margin improvement resulting primarily from decreased transportation costs, partially offset by increased investments in SG&A, losses on foreign exchange, and increased tax expense.

•Non-GAAP Adjusted EBITDA1 was $68 million compared to $20 million due to improvements in gross profit partially offset by increased SG&A spending.

Michael Kirban, the Company's Co-Founder and Executive Chairman, stated, "I am very proud of our team and the record performance achieved in 2023. Our focus and investment to expand consumption occasions of coconut water contributed to strong volume performance for the category and for our flagship Vita Coco Coconut Water brand. The organization's ability to drive brand volume growth through strong retail execution and creative marketing programs, while continuing to improve profitability and cash generation at the same time is something that every member of the team should be proud of. As we enter our company's 20th year in business, we are committed to continuing to grow the coconut water category, and I could not be more excited for what is to come."

Martin Roper, the Company’s Chief Executive Officer, said, “We are extremely pleased with this year's results with 15% net sales growth, Net Income of $47 million, and Adjusted EBITDA1 of $68 million, which were all at the high end of our expectations. The coconut water category is healthy and our team continues to deliver strong results across our major markets as we gain branded share and benefit from our private label coconut water supply relationships. We expect our full year 2024 net sales to be between $495 and $505 million, driven by healthy coconut water volume growth, offset by the loss of some of our private label coconut oil business. While the macro environment remains very dynamic, we expect 2024 Adjusted EBITDA2 to be between $74 and $78 million. We remain focused on driving long term growth of the coconut water category and our brands."

Fourth Quarter 2023 Consolidated Results

Net sales increased $14 million, or 15%, to $106 million for the fourth quarter ended December 31, 2023, compared to $92 million for the fourth quarter ended December 31, 2022. The increase in net sales was driven by higher case equivalent ("CE") volumes of coconut water coupled with some benefits from net pricing actions on branded products partially offset by price/mix of private label products.

Improved gross margins and gross profit versus prior year resulted primarily from the reduction of transportation costs coupled with increased branded pricing and higher sales volumes. Gross profit was $40 million for the fourth quarter of 2023, compared to $22 million for the fourth quarter ended December 31, 2022. Gross margin of 37.5% in the fourth quarter of 2023, increased from 24.4% in the same period last year.

SG&A expenses in the fourth quarter of 2023 were $34 million, compared to $27 million in the same prior year period. The increase was largely due to investments in marketing expenses and higher personnel related expenses.

Net income was $7 million, or $0.11 per diluted share, for the fourth quarter of 2023, compared to a net loss of $(3) million, or $(0.05) per diluted share, in the fourth quarter of 2022. Net income benefited from strong gross profit, partially offset by increased SG&A investments.

Non-GAAP Adjusted EBITDA1 for the fourth quarter of 2023 was $8 million, compared to $4 million in the fourth quarter of 2022. The increase in Adjusted EBITDA1 was primarily driven by strong net sales growth and gross margin improvement resulting primarily from decreased transportation costs, increased volume, and improved branded pricing, partially offset by increased investments in SG&A.

Full Year 2023 Consolidated Results

Net sales increased $66 million, or 15%, to $494 million for the year ended December 31, 2023, compared to $428 million for the year ended December 31, 2022. The increase in net sales was driven by higher coconut water CE volumes across both the Americas and International segments, including Vita Coco Coconut Water volume growth of 11%.

Gross profit increased by $77 million, or 75%, to $181 million for the year ended December 31, 2023, from $103 million for the year ended December 31, 2022, driven by volume growth, transportation cost decreases and some benefit from improved Vita Coco Coconut Water pricing. Gross margin was 36.6% for the year ended December 31, 2023, as compared to 24.2% for the year ended December 31, 2022 primarily due to transportation cost decreases.

SG&A expenses increased by $24 million, or 24%, to $124 million for the year ended December 31, 2023, from $100 million for the year ended December 31, 2022. The increase was primarily driven by investments in sales and marketing expenses and a net increase in people costs.

Net income was $47 million, or $0.79 per diluted share for the year ended 2023, compared to $8 million, or $0.14 per diluted share in the prior year. The increase versus prior year was primarily driven by the increase in gross profit from decreased transportation costs and higher volumes, offset by investments in SG&A, partially offset by the less favorable impact of the non-cash mark-to-market gain in fair value on foreign currency hedges and increased tax expenses.

Adjusted EBITDA1 for the year ended 2023 was $68 million, compared to $20 million in 2022. The increase in Adjusted EBITDA1 was primarily driven by strong net sales growth and gross margin improvement resulting primarily from decreased transportation costs, volume growth and higher branded pricing, partially offset by increased investments in SG&A.

Balance Sheet

As of December 31, 2023, the Company had cash and cash equivalents of $133 million, compared to $20 million as of December 31, 2022. There was no debt as of December 31, 2023 and 2022. Inventories as of December 31, 2023 totaled $51 million. On December 31, 2023, there were 56,899,253 shares of common stock outstanding.

On October 30, 2023, the Company's Board of Directors approved a share repurchase program authorizing the Company to repurchase up to $40 million of the Company's common Stock. As of December 31, 2023, the Company had repurchased 30,000 shares for $773 thousand at an average price of $25.78 per share. As of February 28, 2024, the Company repurchased a total of 421,544 shares for an aggregate value of $10 million at an average share price of $23.72.

Fiscal Year 2024 Full Year Outlook

The Company is providing the following guidance:

•Expect 2024 net sales to be between $495 million and $505 million, with projected Vita Coco Coconut Water and private label coconut water volume growth, being offset by expected decreases in private label coconut oil business and price/mix effects.

•Full year gross margin expected to be between 36% and 38%, with some uncertainty related to transportation cost impacts from recent increases in ocean freight routes.

•SG&A expenses expected to be approximately flat to 2023.

•Forecasting Adjusted EBITDA in the range of $74 million to $78 million2.

Uncertainty and instability of the current operating environment, global economies, and geopolitical landscape could affect this outlook and our future results.

Footnotes:

(1)Adjusted EBITDA represents earnings before interest, taxes, depreciation, and amortization as adjusted for certain items as set forth in the reconciliation table of U.S. GAAP to non-GAAP information and is a measure calculated and presented on the basis of methodologies other than in accordance with GAAP. Please refer to the Non-GAAP Financial Measures herein for further discussion and reconciliation of this measure to GAAP measures.

(2)GAAP Net Income 2024 outlook is not provided due to the inherent difficulty in quantifying certain amounts due to a variety of factors including the unpredictability in the movement in foreign currency rates, as well as future charges or reversals outside of the normal course of business.

Conference Call and Webcast Details

The Vita Coco Company will host a conference call and webcast at 8:30 a.m. ET today to discuss these results. To participate in the live earnings call and question and answer session, please register at https://register.vevent.com/register/BIe6dcf1fadce5486fbe3f13b835deeed7 and dial-in information will be provided directly to you. A slide presentation to support the webcast, and the live audio webcast will be accessible in the “Events” section of the Company’s Investor Relations website at https://investors.thevitacococompany.com. An archived replay of the webcast will be available shortly after the live event has concluded.

About The Vita Coco Company

The Vita Coco Company was co-founded in 2004 by our Executive Chairman Michael Kirban and Ira Liran. Pioneers in the functional beverage category, The Vita Coco Company’s brands include the leading coconut water, Vita Coco; clean energy drink Runa; sustainable enhanced water, Ever & Ever; and protein-infused water, PWR LIFT. With its ability to harness the power of people and plants, while balancing purpose and profit, The Vita Coco Company has created a modern beverage platform built for current and future generations.

The company is incorporated as a Public Benefit Corporation in Delaware and is a Certified B Corporation™.

Contacts

Investor Relations:

ICR, Inc.

investors@thevitacococompany.com

Non-GAAP Financial Measures

In addition to disclosing results determined in accordance with U.S. GAAP, the Company also discloses certain non-GAAP results of operations, including, but not limited to, Adjusted EBITDA, that include certain adjustments or exclude certain charges and gains that are described in the reconciliation table of U.S. GAAP to non-GAAP information provided at the end of this release. These non-GAAP measures are a key metric used by management and our board of directors to assess our financial performance across reporting periods on a consistent basis by excluding items that we do not believe are indicative of our core operating performance and because we believe it is useful for investors to see the measures that management uses to evaluate the Company. In addition, we believe the presentation of these measures is useful to investors for period-to-period comparisons of results as the items described below in the reconciliation tables do not reflect ongoing operating performance.

These measures are not in accordance with, or an alternative to, U.S. GAAP, and may be different from non-GAAP measures used by other companies. In addition, other companies, including companies in our industry, may calculate such measures differently, which reduces its usefulness as a comparative measure. Investors should not rely on any single financial measure when evaluating our business. This information should be considered as supplemental in nature and is not meant as a substitute for our operating results in accordance with U.S. GAAP. We recommend investors review the U.S. GAAP financial measures included in this earnings release. When viewed in conjunction with our U.S. GAAP results and the accompanying reconciliations, we believe these non-GAAP measures provide greater transparency and a more complete understanding of factors affecting our business than U.S. GAAP measures alone.

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. All statements contained in this press release that do not relate to matters of historical fact should be considered forward-looking statements, including but not limited to, statements regarding our future financial and operating performance, including our GAAP and non-GAAP guidance, our strategy, projected costs, prospects, expectations, plans, objectives of management, supply chain predictions, customer and supplier relationships, and expected net sales and category share growth.

The forward-looking statements in this release are only predictions. We have based these forward-looking statements largely on our current expectations and projections about future events and financial trends that we believe may affect our business, financial condition and results of operations. Forward-looking statements involve known and unknown risks, uncertainties and other important factors that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Forward-looking statements involve a number of risks, uncertainties or other factors beyond the Company’s control. These factors include, but are not limited to, those discussed under the caption “Risk Factors” in our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q and our other filings with the U.S. Securities and Exchange Commission ("SEC") as such factors may be updated from time to time and which are accessible on the SEC’s website at www.sec.gov and the Investor Relations page of our website at https://investors.thevitacococompany.com. Any forward-looking statements contained in this press release speak only as of the date hereof and accordingly undue reliance should not be placed on such statements. We disclaim any obligation or undertaking to update or revise any forward-looking statements contained in this press release, whether as a result of new information, future events or otherwise, other than to the extent required by applicable law.

Website Disclosure

We intend to use our websites, vitacoco.com and investors.thevitacococompany.com, as a means for disclosing material non-public information and for complying with the SEC's Regulation FD and other disclosure obligations.

THE VITA COCO COMPANY, INC.

CONSOLIDATED BALANCE SHEETS

(Amounts in thousands, except share data)

| | | | | | | | | | | | | | | | | |

| December 31,

2023 | | December 31,

2022 | | | | | | |

Assets | | | | | | | | | |

Current assets: | | | | | | | | | |

| Cash and cash equivalents | $ | 132,537 | | | $ | 19,629 | | | | | | | |

| Accounts receivable, net of allowance of $2,486 at December 31, 2023, and $2,898 at December 31, 2022 | 50,086 | | | 43,350 | | | | | | | |

| Inventory | 50,757 | | | 84,115 | | | | | | | |

| Supplier advances, Current | 1,521 | | | 1,534 | | | | | | | |

| Derivative assets | 3,876 | | | 3,606 | | | | | | | |

| Asset held for sale | — | | | 503 | | | | | | | |

| Prepaid expenses and other current assets | 24,160 | | | 22,181 | | | | | | | |

Total current assets | 262,937 | | | 174,918 | | | | | | | |

| Property and equipment, net | 2,136 | | | 2,076 | | | | | | | |

| Goodwill | 7,791 | | | 7,791 | | | | | | | |

| | | | | | | | | |

| Supplier advances, long-term | 2,820 | | | 4,360 | | | | | | | |

| Deferred tax assets, net | 6,749 | | | 4,256 | | | | | | | |

| Right-of-use assets, net | 1,406 | | | 2,679 | | | | | | | |

| Other assets | 1,843 | | | 1,677 | | | | | | | |

Total assets | $ | 285,682 | | | $ | 197,757 | | | | | | | |

Liabilities and Stockholders’ Equity | | | | | | | | | |

| Current liabilities: | | | | | | | | | |

| Accounts payable | $ | 21,826 | | | $ | 15,910 | | | | | | | |

| Accrued expenses | 59,533 | | | 38,342 | | | | | | | |

| Notes payable, current | 13 | | | 23 | | | | | | | |

| Derivative liabilities | 1,213 | | | 71 | | | | | | | |

| Total current liabilities | 82,585 | | | 54,346 | | | | | | | |

| | | | | | | | | |

| Notes payable, long-term | 13 | | | 25 | | | | | | | |

| | | | | | | | | |

| Other long-term liabilities | 647 | | | 2,293 | | | | | | | |

Total liabilities | $ | 83,245 | | | $ | 56,664 | | | | | | | |

| | | | | | | | | |

Stockholders’ equity: | | | | | | | | | |

| Common stock, $0.01 par value; 500,000,000 shares authorized; 63,135,453 and 62,225,250 shares issued at December 31, 2023 and December 31, 2022, respectively; 56,899,253 and 56,019,050 Shares Outstanding at December 31, 2023 and December 31, 2022, respectively. | 631 | | | 622 | | | | | | | |

| Additional paid-in capital | 161,414 | | | 145,210 | | | | | | | |

| | | | | | | | | |

| Retained earnings | 100,742 | | | 55,183 | | | | | | | |

| Accumulated other comprehensive loss | (649) | | | (994) | | | | | | | |

| Treasury stock, 6,236,200 shares at cost as of December 31, 2023, and 6,206,000 as of December 31, 2022. | (59,701) | | | (58,928) | | | | | | | |

| Total stockholders’ equity attributable to The Vita Coco Company, Inc. | 202,437 | | | 141,093 | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Total liabilities and stockholders’ equity | $ | 285,682 | | | $ | 197,757 | | | | | | | |

THE VITA COCO COMPANY, INC.

CONSOLIDATED STATEMENTS OF OPERATIONS

(Amounts in thousands, except for share and per share data)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Twelve Months Ended December 31, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Net sales | $ | 106,144 | | | $ | 91,991 | | | $ | 493,612 | | | $ | 427,787 | |

| Cost of goods sold | 66,341 | | 69,558 | | 312,883 | | 324,426 |

| Gross profit | 39,803 | | 22,433 | | 180,729 | | 103,361 |

| Operating expenses | | | | | | | |

| Selling, general and administrative | 34,381 | | 27,288 | | 124,236 | | 100,306 |

| Total operating expenses | 34,381 | | 27,288 | | 124,236 | | 100,306 |

| Income from operations | 5,422 | | | (4,855) | | | 56,493 | | | 3,055 | |

| Other income (expense) | | | | | | | |

| Unrealized gain/(loss) on derivative instruments | 886 | | 190 | | (872) | | | 6,606 | |

| Foreign currency gain/(loss) | 179 | | 1,895 | | (251) | | | 1,387 | |

| | | | | | | |

| Interest income | 1,476 | | 21 | | 2,581 | | | 51 | |

| Interest expense | — | | (45) | | (31) | | | (258) | |

| Total other income (expense) | 2,541 | | 2,061 | | 1,427 | | | 7,786 | |

| Income before income taxes | 7,963 | | (2,794) | | 57,920 | | | 10,841 | |

| Income tax expense | (1,190) | | (16) | | (11,291) | | | (3,027) | |

| Net income | $ | 6,773 | | | $ | (2,810) | | | $ | 46,629 | | | $ | 7,814 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

Net income per common share | | | | | | | |

| Basic | $0.12 | | $(0.05) | | $0.83 | | $0.14 |

| Diluted | $0.11 | | $(0.05) | | $0.79 | | $0.14 |

| Weighted-average number of common shares outstanding | | | | | | | |

| Basic | 56,836,488 | | 55,951,237 | | 56,427,890 | | 55,732,619 |

| Diluted | 59,502,729 | | 56,405,035 | | 58,747,338 | | 56,123,661 |

THE VITA COCO COMPANY, INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

(Amounts in thousands)

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Twelve Months ended December 31, | | | | | | | | | | | | | | | | |

| 2023 | | 2022 | | | | | | | | | | | | | | | | |

Cash flows from operating activities: | | | | | | | | | | | | | | | | | | | |

Net income | $ | 46,629 | | | $ | 7,814 | | | | | | | | | | | | | | | | | |

Adjustments to reconcile net income to net cash provided by operating activities: | | | | | | | | | | | | | | | | | | | |

Depreciation and amortization | 660 | | | 1,901 | | | | | | | | | | | | | | | | | |

(Gain)/loss on disposal of equipment | 19 | | | 1 | | | | | | | | | | | | | | | | | |

Bad debt expense | 260 | | | 2,641 | | | | | | | | | | | | | | | | | |

Unrealized (gain)/loss on derivative instruments | 872 | | | (6,606) | | | | | | | | | | | | | | | | | |

Stock-based compensation | 9,128 | | | 7,384 | | | | | | | | | | | | | | | | | |

| Impairment loss on assets held for sale | 363 | | | 619 | | | | | | | | | | | | | | | | | |

Impairment of intangible assets | — | | | 6,714 | | | | | | | | | | | | | | | | | |

Deferred tax expense | (2,382) | | | (3,081) | | | | | | | | | | | | | | | | | |

| Noncash lease expense | 1,288 | | | 1,058 | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

Changes in operating assets and liabilities: | | | | | | | | | | | | | | | | | | | |

Accounts receivable | (7,088) | | | 321 | | | | | | | | | | | | | | | | | |

Inventory | 33,688 | | | (9,333) | | | | | | | | | | | | | | | | | |

| Prepaid expenses, net supplier advances, and other assets | (622) | | | (3,592) | | | | | | | | | | | | | | | | | |

Accounts payable, accrued expenses, and other liabilities | 24,340 | | | (16,776) | | | | | | | | | | | | | | | | | |

Net cash provided by (used in) operating activities | 107,155 | | | (10,935) | | | | | | | | | | | | | | | | | |

Cash flows from investing activities: | | | | | | | | | | | | | | | | | | | |

Cash paid for property and equipment | (599) | | | (982) | | | | | | | | | | | | | | | | | |

Proceeds from sale of property and equipment | 5 | | | — | | | | | | | | | | | | | | | | | |

Net cash used in investing activities | (594) | | | (982) | | | | | | | | | | | | | | | | | |

Cash flows from financing activities: | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

Proceeds from exercise of stock awards | 7,086 | | | 3,062 | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

Borrowings on credit facility | — | | | 22,000 | | | | | | | | | | | | | | | | | |

Repayments of borrowings on credit facility | — | | | (22,000) | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

Cash received (paid) on notes payable | (23) | | | (28) | | | | | | | | | | | | | | | | | |

Cash paid to acquire treasury stock | (773) | | | — | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

Net cash used in financing activities | 6,290 | | | 3,034 | | | | | | | | | | | | | | | | | |

Effects of exchange rate changes on cash and cash equivalents | 387 | | | (178) | | | | | | | | | | | | | | | | | |

Net (decrease) increase in cash and cash equivalents | 113,238 | | | (9,061) | | | | | | | | | | | | | | | | | |

Cash and cash equivalents at beginning of the period | 19,629 | | | 28,690 | | | | | | | | | | | | | | | | | |

Cash, cash equivalents, and restricted cash at end of the period 1 | $ | 132,867 | | | $ | 19,629 | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

1 Includes $330 and $0 of restricted cash as of December 31, 2023 and 2022, respectively, that were included in other current assets.

RECONCILIATION FROM GAAP NET INCOME TO NON-GAAP ADJUSTED EBITDA

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Year Ended December 31, |

| 2023 | | 2022 | | 2023 | | 2022 |

| (in thousands) | | (in thousands) |

| Net income | $ | 6,773 | | | $ | (2,810) | | | $ | 46,629 | | | $ | 7,814 | |

| Depreciation and amortization | 157 | | | 460 | | | 660 | | | 1,901 | |

| Interest income | (1,476) | | | (21) | | | (2,581) | | | (51) | |

| Interest expense | — | | | 45 | | | 31 | | | 258 | |

| Income tax expense | 1,190 | | | 16 | | | 11,291 | | | 3,027 | |

| EBITDA | 6,644 | | | (2,310) | | | 56,030 | | | 12,949 | |

| Stock-based compensation (a) | 2,002 | | | 1,727 | | | 9,128 | | | 7,384 | |

| Unrealized (gain)/loss on derivative instruments (b) | (886) | | | (190) | | | 872 | | | (6,606) | |

| Foreign currency (gain)/loss (b) | (179) | | | (1,895) | | | 251 | | | (1,387) | |

| | | | | | | |

| Secondary Offering Costs (c) | 669 | | | — | | | 1,525 | | | — | |

| Impairment of intangible assets (d) | — | | | 6,714 | | | — | | | 6,714 | |

| Other adjustments (e) | 34 | | | — | | | 363 | | | 1,240 | |

| Adjusted EBITDA | $ | 8,284 | | | $ | 4,046 | | | $ | 68,169 | | | $ | 20,294 | |

(a)Non-cash charges related to stock-based compensation, which vary from period to period depending on volume and vesting timing of awards and forfeitures. We adjusted for these charges to facilitate comparison from period to period.

(b)Unrealized gains or losses on derivative instruments and foreign currency gains or losses are not considered in our evaluation of our ongoing performance.

(c)Reflects other non-recurring expenses related to costs associated with two secondary offerings in which Verlinvest Beverages SA sold shares of the Company. The shares were sold in an underwritten public offering, which closed on May 26, 2023 and a block trade that was executed on November 9, 2023. The Company did not receive any proceeds from the sale of the shares.

(d)Non-cash intangible asset impairment charge related to the Runa trademarks and distributor relationships.

(e)Reflects other charges primarily related to the impairment loss related to assets held for sale in both periods and other non-recurring expenses.

SUPPLEMENTAL INFORMATION

| | | | | | | | | | | | | | | | | | | | | | | |

| NET SALES |

| Three Months Ended December 31, | | Year Ended December 31, |

(in thousands) | 2023 | | 2022 | | 2023 | | 2022 |

Americas segment | | | | | | | |

Vita Coco Coconut Water | $ | 63,396 | | | $ | 58,030 | | | $ | 317,221 | | $ | 275,964 |

Private Label | 25,800 | | 19,760 | | 103,166 | | 88,173 |

Other | 2,368 | | 1,932 | | 9,858 | | 9,485 |

Subtotal | $91,564 | | $79,722 | | $430,245 | | $ | 373,622 |

International segment | | | | | | | |

Vita Coco Coconut Water | $ | 8,201 | | $ | 8,460 | | $ | 41,829 | | $ | 38,570 |

Private Label | 5,573 | | 3,334 | | 18,713 | | 12,855 |

Other | 806 | | 475 | | 2,825 | | 2,740 |

Subtotal | $ | 14,580 | | $ | 12,268 | | $ | 63,367 | | $ | 54,165 |

Total net sales | $ | 106,144 | | $ | 91,990 | | $ | 493,612 | | $ | 427,787 |

| | | | | | | | | | | | | | | | | | | | | | | |

| COST OF GOODS SOLD & GROSS PROFIT |

| Three Months Ended December 31, | | Year Ended December 31, |

(in thousands) | 2023 | | 2022 | | 2023 | | 2022 |

Cost of goods sold | | | | | | | |

Americas segment | $ | 53,769 | | $ | 57,515 | | $ | 267,983 | | $ | 278,130 |

International segment | 12,572 | | 12,042 | | 44,900 | | 46,296 |

Total cost of goods sold | $ | 66,341 | | $ | 69,557 | | $ | 312,883 | | $ | 324,426 |

Gross profit | | | | | | | |

Americas segment | $ | 37,796 | | $ | 22,207 | | $ | 162,262 | | $ | 95,492 |

International segment | 2,007 | | 226 | | 18,467 | | 7,869 |

Total gross profit | $ | 39,803 | | $ | 22,433 | | $ | 180,729 | | $ | 103,361 |

Gross margin | | | | | | | |

Americas segment | 41.3 | % | | 27.9 | % | | 37.7 | % | | 25.6 | % |

International segment | 13.8 | % | | 1.8 | % | | 29.1 | % | | 14.5 | % |

Consolidated | 37.5 | % | | 24.4 | % | | 36.6 | % | | 24.2 | % |

| | | | | | | | | | | | | | | | | | | | | | | |

| VOLUME (CE) |

| Three Months Ended December 31, | | Year Ended December 31, |

| (in thousands) | 2023 | | 2022 | | 2023 | | 2022 |

| Americas segment | | | | | | | |

| Vita Coco Coconut Water | 6,510 | | | 6,189 | | | 33,021 | | 29,458 |

| Private Label | 2,844 | | 1,850 | | 11,298 | | 9,063 |

| Other | 209 | | 156 | | 923 | | 1,248 |

| Subtotal | 9,563 | | 8,195 | | 45,242 | | 39,769 |

| | | | | | | |

| International segment* | | | | | | | |

| Vita Coco Coconut Water | 1,118 | | | 1,216 | | | 5,783 | | 5,628 |

| Private Label | 715 | | 457 | | 2,481 | | 1,783 |

| Other | 16 | | 7 | | 62 | | 46 |

| Subtotal | 1,849 | | 1,680 | | 8,326 | | 7,457 |

| Total volume (CE) | 11,412 | | | 9,875 | | | 53,568 | | | 47,226 | |

Note: A CE is a standard volume measure used by management which is defined as a case of 12 bottles of 330ml liquid beverages or the same liter volume of oil.

*International Other excludes minor volume that is treated as zero CE

v3.24.0.1

Cover

|

Feb. 28, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Entity Registrant Name |

The Vita Coco Company, Inc.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-40950

|

| Entity Tax Identification Number |

11-3713156

|

| Entity Address, Address Line One |

250 Park Avenue South

|

| Entity Address, Address Line Two |

Seventh Floor

|

| Entity Address, City or Town |

New York

|

| Entity Address, State or Province |

NY

|

| Entity Address, Postal Zip Code |

10003

|

| City Area Code |

212

|

| Local Phone Number |

206-0763

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $0.01 par value per share

|

| Trading Symbol |

COCO

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001482981

|

| Amendment Flag |

false

|

| Document Period End Date |

Feb. 28, 2024

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

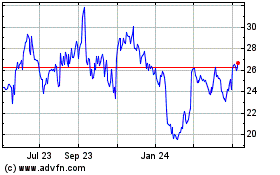

Vita Coco (NASDAQ:COCO)

Historical Stock Chart

From Mar 2024 to Apr 2024

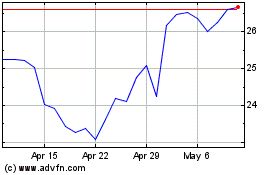

Vita Coco (NASDAQ:COCO)

Historical Stock Chart

From Apr 2023 to Apr 2024