Current Report Filing (8-k)

March 25 2020 - 7:14AM

Edgar (US Regulatory)

CRACKER BARREL OLD COUNTRY STORE, INC false 0001067294 0001067294 2020-03-20 2020-03-20

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (date of earliest event reported): March 25, 2020 (March 20, 2020)

CRACKER BARREL OLD COUNTRY STORE, INC.

(Exact Name of Registrant as Specified in its Charter)

|

|

|

|

|

|

|

Tennessee

|

|

001-25225

|

|

62-0812904

|

|

(State or Other Jurisdiction

of Incorporation)

|

|

(Commission File Number)

|

|

(IRS Employer

Identification No.)

|

305 Hartmann Drive, Lebanon, Tennessee 37087

(Address of Principal Executive Offices) (Zip code)

(615) 444-5533

(Registrant’s Telephone Number, Including Area Code)

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s)

|

|

Name of each exchange

on which registered

|

|

Common Stock (Par Value $0.01)

Rights to Purchase Series A Junior Participating

Preferred Stock (Par Value $0.01)

|

|

CBRL

|

|

The Nasdaq Stock Market LLC

(Nasdaq Global Select Market)

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.06 Material Impairments.

The information set forth under Item 7.01 relating to the expected impairment charge relating to the investment by Cracker Barrel Old Country Store, Inc. (the “Company”) in PBS Holdco, LLC (“PBS Holdco”) is incorporated into this Item 2.06 by reference.

Item 7.01 Regulation FD Disclosure.

In response to the unprecedented circumstances and rapidly changing market conditions caused by the coronavirus disease (COVID-19) pandemic and related significant disruptions to the restaurant industry in the United States and the Company’s business, the Board of Directors (the “Board”) of the Company has determined to focus all available Company resources and implement conservative cash management strategies to ensure the viability of Cracker Barrel Old Country Store and Maple Street Biscuit Company locations, preserve and, if appropriate, increase, the Company’s available liquidity and maximize the Company’s financial flexibility until the crisis abates and market conditions stabilize.

General Update

As of March 24, 2020, the Company operates 664 Cracker Barrel restaurants and 28 Maple Street Biscuit Company locations across 45 states. The significant majority of Cracker Barrel and Maple Street Biscuit Company restaurants have been operating, and by March 25, 2020, virtually all of them will be operating, pick-up and delivery only with no dine-in service. To date, the Company has not closed any of its locations outright, but this is subject to change as circumstances warrant.

Management intends to take all appropriate actions during these uncertain times to protect the Company’s employees and customers and to protect the ongoing operations of the business, which include significant reductions in operating expenses to reflect reduced operations and sales levels as well as eliminating non-essential spending, among other measures. The Company expects to make additional announcements about the effects of the COVID-19 pandemic on its business in connection with the Company’s next quarterly earnings release and conference call.

Incremental Borrowings under Revolving Credit Facility

As previously disclosed, at January 31, 2020, the Company had $460 million of outstanding borrowings under the Company’s five-year $950 million revolving credit facility (the “Revolving Credit Facility”). In mid-March 2020 and as a precautionary measure, the Company provided notice to its lenders to borrow the remaining available amount under the Revolving Credit Facility so that a total of approximately $947 million of the revolving credit facility (including $6.7 million of standby letters of credit) is currently outstanding. The current weighted average interest rate for the Company’s borrowings under the Revolving Credit Facility is 2.81%. The proceeds from the incremental Revolving Credit Facility borrowings are currently being held on the Company’s balance sheet, resulting in total cash and cash equivalents of approximately $400 million as of March 24, 2020, which will be available for working capital, ongoing operating needs and general corporate purposes.

Impairment Charge Relating to Investment in PBS Holdco

As previously disclosed, effective July 18, 2019, the Company purchased approximately 58.6% of the economic ownership interest in PBS Holdco, which together with its subsidiaries owns and operates food, beverage and entertainment establishments under the name “Punch Bowl Social”. At January 31, 2020, the Company valued its equity investment in PBS Holdco at approximately $79.5 million. Additionally, in connection with its equity investment, the Company agreed to assume certain unsecured indebtedness of PBS Holdco at closing and to fund additional capital to PBS Holdco thereafter in return for additional unsecured indebtedness. As of March 24, 2020, the Company held unsecured indebtedness of PBS Holdco with a total principal value of $50.4 million.

As a result of the COVID-19 pandemic, PBS Holdco’s wholly-owned operating subsidiary, PBS BrandCo, LLC (“Brandco”), suspended all operations at each of its 19 locations and laid off substantially all restaurant and corporate employees. On March 20, 2020, the primary lender under Brandco’s secured credit facility provided notice to PBS Holdco and to the Company declaring a default under Brandco’s secured credit facility and stating the lender’s intention to foreclose on its collateral interest in the equity of Brandco and substantially all of Brandco’s assets unless the Company would repay or unconditionally guarantee Brandco’s indebtedness.

In keeping with the Company’s strategy to concentrate its resources on its core business during the pandemic, and in light of the substantial uncertainties surrounding the Punch Bowl Social business coming out of the pandemic, the Company has decided not to invest further resources to prevent the foreclosure or otherwise provide additional capital to PBS Holdco. The Company expects to record, in the financial results for its third quarter ending May 1, 2020, a non-cash impairment charge of approximately $133.0 million, representing the approximate total value of its equity investment in PBS Holdco and the principal and accumulated interest under the outstanding unsecured indebtedness of PBS Holdco held by the Company. This impairment is limited solely to the Company’s investment in the Punch Bowl Social business.

Deferral of Declared Dividend and Suspension of Regular Dividend Program

To preserve available cash during the pandemic and in light of the uncertainties as to its duration and economic impact, the Board has determined that it is appropriate for the Company to defer payment of the dividend that was declared on March 3, 2020. Payment of such dividend, which was scheduled for May 5, 2020 to shareholders of record on April 17, 2020, will be deferred until September 2, 2020, to shareholders of record on August 14, 2020. The Board has also determined to suspend all further dividend payments under the Company’s historical dividend program until further notice.

Suspension of Share Repurchases

As previously announced, on March 7, 2020 the Board authorized the Company to repurchase up to $25.0 million of the Company’s common stock, and the Company spent approximately $5.0 million of this authorization to purchase 42,739 shares of its common stock shortly thereafter. In response to the COVID-19 pandemic, however, the Company has temporarily suspended all further share repurchases.

The information furnished under Item 7.01 in this Current Report on Form 8-K shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section and shall not be deemed incorporated by reference in any filing made by the Company under the Securities Act of 1933, as amended (the “Securities Act”), or the Exchange Act, except as set forth by specific reference herein or in such filing.

Cautionary Note Regarding Forward-Looking Statements

Certain of the matters discussed in this Current Report on Form 8-K that are not purely historical are forward-looking statements within the meaning of Section 27A of the Securities Act, Section 21E of the Exchange Act and the Private Securities Litigation Reform Act of 1995. Such forward-looking statements only speak as of the date of this Current Report and the Company assumes no obligation to update the information included in this Current Report. Such forward-looking statements include statements relating to COVID-19 and the Company’s responses. Forward-looking statements generally can be identified by the use of forward-looking terminology such as “believe,” “expect,” “intend,” “plan” or similar expressions. These forward-looking statements are not historical facts, and are based on current expectations, estimates and projections about the

Company’s industry, management’s beliefs and certain assumptions made by management, many of which, by their nature, are inherently uncertain and beyond the Company’s control. Accordingly, readers are cautioned that any such forward-looking statements are not guarantees of future performance or occurrence of events and are subject to certain risks, uncertainties and assumptions that are difficult to predict. Actual results may vary materially from those contained in forward-looking statements based on a number of factors including, without limitation, conditions beyond our control such as weather, natural disasters, disease outbreaks, epidemics or pandemics impacting our customers or food supplies; food safety and food-borne illness concerns; and other factors disclosed from time to time in our filings with the Securities and Exchange Commission (the “SEC”). Although the Company believes that the expectations reflected in such forward-looking statements are reasonable as of the date made, expectations may prove to have been materially different from the results expressed or implied by such forward-looking statements. More information about potential risks and uncertainties that could affect the Company’s business and results of operations is included in the “Risk Factors” and “Forward-Looking Statements/Risk Factors” sections in the Annual Report on Form 10-K filed by the Company with the SEC on September 27, 2019 and in the “Risk Factors” section in the Quarterly Report on Form 10-Q filed by the Company with the SEC on February 25, 2020. The Company expressly disclaims any intent, obligation or undertaking to update or revise any forward-looking statements made herein to reflect any change in our expectations with regard thereto or any change in events, conditions or circumstances on which any such statements are based.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto duly authorized.

|

|

|

|

|

|

|

|

|

Date: March 25, 2020

|

|

|

|

CRACKER BARREL OLD COUNTRY STORE, INC.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

By:

|

|

/s/ Jill M. Golder

|

|

|

|

|

|

Name:

|

|

Jill M. Golder

|

|

|

|

|

|

Title:

|

|

Senior Vice President and Chief Financial Officer

|

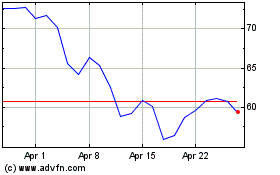

Cracker Barrel Old Count... (NASDAQ:CBRL)

Historical Stock Chart

From Mar 2024 to Apr 2024

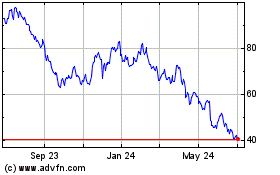

Cracker Barrel Old Count... (NASDAQ:CBRL)

Historical Stock Chart

From Apr 2023 to Apr 2024