Filed Pursuant to Rule 424(b)(3)

Registration No. 333-251924

PROSPECTUS SUPPLEMENT No. 3

(To Prospectus Dated February 25, 2021)

ATIF HOLDINGS LIMITED

(incorporated in the British Virgin Islands with

limited liability)

4,739,130

Ordinary Shares

This prospectus supplement (this “Prospectus

Supplement”) updates and supplements the prospectus dated February 25, 2021 (the “Prospectus”), which forms a part of

our Registration Statement on Form F-1, as amended (Registration No. 333-251924). This Prospectus Supplement is being filed to update

and supplement the information in the Prospectus with the information contained in our Report on Form 6-K, furnished with the Securities

and Exchange Commission on August 9, 2021 (the “Form 6-K”). Accordingly, we have attached the Form 6-K to this Prospectus

Supplement.

The Prospectus and this Prospectus Supplement relates

to relates to the resale of an aggregate of 4,739,130 shares of our ordinary shares that are issuable upon the exercise of outstanding

warrants by the selling shareholders identified herein. These warrants were issued in connection with a private placement we completed

on November 5, 2020. We will not receive any of the proceeds from the sale by the selling shareholders of the ordinary shares. Upon any

exercise of the warrants by payment of cash, however, we will receive the exercise price of the warrants.

This Prospectus Supplement should be read in

conjunction with the Prospectus. If there is any inconsistency between the information in the Prospectus and this Prospectus Supplement,

you should rely on the information in this Prospectus Supplement.

Our ordinary shares are listed on the NASDAQ Capital

Market under the symbol “ATIF.” On August 6, 2021, the last reported sale price of our ordinary share was $0.8397 per share.

INVESTING IN OUR SECURITIES INVOLVES RISKS.

YOU SHOULD REVIEW CAREFULLY THE RISKS AND UNCERTAINTIES DESCRIBED UNDER THE HEADING “RISK FACTORS” CONTAINED ON PAGE 3 OF

THE PROSPECTUS AND IN OUR ANNUAL REPORT ON FORM 20-F FOR THE YEAR ENDED JULY 31, 2020, AS WELL AS OUR SUBSEQUENTLY FILED PERIODIC AND

CURRENT REPORTS, WHICH WE FILE WITH THE SECURITIES AND EXCHANGE COMMISSION AND ARE INCORPORATED BY REFERENCE INTO OR SUPPLEMENTED TO THIS

PROSPECTUS. YOU SHOULD READ THE ENTIRE PROSPECTUS ALONG WITH THE PROSPECTUS SUPPLEMENT CAREFULLY BEFORE YOU MAKE YOUR INVESTMENT DECISION.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR

ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED THESE SECURITIES OR DETERMINED IF THIS PROSPECTUS IS TRUTHFUL OR COMPLETE.

ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

The date of this Prospectus Supplement is August 9,

2021.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of August 2021

Commission File Number: 001-38876

ATIF HOLDINGS LIMITED

Room 2803,

Dachong Business Centre, Dachong 1st Road,

Nanshan District, Shenzhen, China

(Address of principal executive office)

Indicate by check mark whether the registrant files

or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F ☒

Form 40-F ☐

Indicate by check mark if the registrant

is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate by check mark if the registrant is submitting

the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

Departure of Directors or Certain Officers; Election

of Directors; Appointment of Certain Officers; Compensatory Arrangement of Certain Officers.

On August 4, 2021, the Board of

Directors (the “Board”) of ATIF Holdings Limited (the “Company”) received the resignations from the following

individuals, all effective as of August 9, 2021:

|

|

-

|

Mr. PiShan Chi as a director and chief executive officer of the Company;

|

|

|

-

|

Ms. Fang Cheng as chief financial officer of the Company; and

|

|

|

-

|

Mr. Longdley Zephirin as an independent director of the Company.

|

The employment agreement with

Mr. PiShan Chi and Ms. Fang Cheng were terminated on August 9, 2021. The resignations from Mr. Chi, Ms. Cheng and Mr. Zephirin do not

involve any disagreements with the Company.

On August 4, 2021, the Board appointed

Mr. Jun Liu, our current president, chairman, and director, as chief executive officer of the Company, effective as of August 9, 2021.

In connection with Mr. Liu’s change in appointment, the Company and Mr. Liu entered into an amendment to Mr. Liu’s employment

agreement dated June 9, 2019, to include his position as the chief executive officer. There is no change in Mr. Liu’s compensation

in connection with his appointment as president and chairman of the Board.

In addition, on August 4, 2021,

the Board appointed Ms. Yue Ming, as a director and the chief financial officer of the Company. In connection with her appointment as

the chief financial officer, Ms. Ming entered into an employment agreement, dated August 9, 2021, for a term of three (3) years, and provides

for an annual salary of US$25,200.00 (RMB 163,200.00) which is subject to annual review and adjustment by the Company or the compensation

committee of the Company’s Board. In addition, to the extent that the Company adopts and maintains a share incentive plan, Ms. Ming

will be eligible to participate in such plan. Ms. Ming is also eligible for participation in any standard employee benefit plan of the

Company that currently exists or may be adopted by the Company in the future

Ms. Yue Ming, age 34, has more

than 10 years of corporate finance and accounting experience. She has served as our accountant since August 1, 2018. Prior to joining

the Company, she was employed by Asia Equity Exchange Group, Inc. and acted as financial manager from December 1, 2014 to July 31, 2018.

From April 12, 2010 to November 30, 2014, she was employed by an international trading company, Shenzhen Yamuna Science and Technology

Co., Ltd., as its financial manager. Ms. Ming started her accounting career at Shenzhen Huitian Accounting Firm on July 1, 2009 after

she graduated from Central China Normal University where she majored in international trade.

Except as disclosed in this Report,

there are no arrangements or understandings with any other person pursuant to which Ms. Ming was appointed as a director and chief financial

officer of the Company. There are also no family relationships between Ms. Ming and any of the Company’s directors or executive

officers. Except as disclosed in this Report, Ms. Ming has no direct or indirect material interest in any transaction required to be disclosed

pursuant to Item 404(a) of Regulation S-K.

On August 4, 2021, the Board appointed

Ms. Lei Yang as a member of the Board to fill the vacancy following the resignation of Mr. Zephirin. In addition, Ms. Yang was appointed

as a member of the Company’s audit committee, nomination committee and compensation committee. Ms. Yang will serve as the chairperson

of the compensation committee.

Ms Lei Yang, age 41, has 17 years

working experience in several Fortune 500 companies, engaged in business analysis, internal audit, financial management, etc. She received

her first master’s degree in Information Management from Nanjing University in 2004, and her second master’s degree in Accounting

from Bentley University in 2010. Ms. Yang is an American Institute of Certified Public Accountants Certified and an economist.

The Board has determined that

Ms. Yang satisfies the definition of “independent director” under Rule 10A-3 promulgated under the Securities Exchange Act

of 1934, as amended, and as defined by NASDAQ Rule 5605(a)(2).

In connection with Ms. Yang’s

appointment, Ms. Yang will receive an annual director’s fee in the amount of $1,200.00 per month ($14,400.00 per year), plus reimbursement

of expenses.

Except as disclosed in this Report,

there are no arrangements or understandings with any other person pursuant to which Ms. Yang was appointed as director of the Company.

There are also no family relationships between Ms. Yang and any of the Company’s directors or executive officers. Except as disclosed

in this Report, Ms. Yang has no direct or indirect material interest in any transaction required to be disclosed pursuant to Item 404(a)

of Regulation S-K.

A copy of the form of Employment

Agreement for Ms. Ming is filed as Exhibit 10.3 to our F-1 registration statement filed with the Securities and Exchange Commission (“SEC”)

on December 11, 2018 and incorporated herein by reference.

This Form 6-K, including all exhibits

attached hereto, is hereby incorporated by reference into the Company’s Registration Statement on Form F-3, as amended, filed with

the Securities and Exchange Commission on June 12, 2020 (Registration file number 333-239131), to be a part thereof from the date on which

this report is submitted, to the extent not superseded by documents or reports subsequently filed or furnished.

SIGNATURES

Pursuant to the requirements of

the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto

duly authorized.

|

|

ATIF Holdings Limited

|

|

|

|

|

|

By:

|

/s/ Jun Liu

|

|

|

Name:

Title:

|

Jun Liu

Chief Executive Officer

|

|

Dated: August 9, 2021

|

|

|

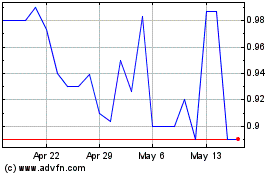

ATIF (NASDAQ:ATIF)

Historical Stock Chart

From Mar 2024 to Apr 2024

ATIF (NASDAQ:ATIF)

Historical Stock Chart

From Apr 2023 to Apr 2024