Current Report Filing (8-k)

June 15 2017 - 5:27PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

Current Report Pursuant to Section 13

or 15(d)

of the Securities Exchange Act of 1934

Date of report (Date of earliest event reported):

June 9, 2017

Amyris, Inc.

(Exact name of registrant as specified in

its charter)

|

Delaware

|

001-34885

|

55-0856151

|

|

(State or other jurisdiction

of incorporation)

|

(Commission File Number)

|

(I.R.S. Employer

Identification No.)

|

|

|

5885 Hollis Street, Suite 100, Emeryville, CA

|

94608

|

|

|

|

(Address of principal executive offices)

|

(Zip Code)

|

|

|

|

(510) 450-0761

|

|

|

|

(Registrant’s telephone number, including area code)

|

|

|

|

|

|

|

|

(Former name or former address, if changed since last report.)

|

|

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligations of the registrant under any of the following provisions (see General Instruction

A.2 below):

|

o

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

o

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

o

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

o

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate by check mark whether the

registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of

the Securities Exchange Act of 1934 (17 CFR §240.12b-2). Emerging growth company ☐

If an emerging growth company, indicate

by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 4.01 Change in Registrant’s Certifying Accountant.

On June 9, 2017, PricewaterhouseCoopers

LLP (“

PwC

”) notified Amyris, Inc. (the “

Company

”) that it declined to stand

for re-election as the independent registered public accounting firm for the Company. The Audit Committee (the “

Audit

Committee

”) of the Board of Directors of the Company has been conducting a competitive process to determine the

Company’s independent registered public accounting firm for its 2017 fiscal year. The Audit Committee invited three national

accounting firms to participate in this process, and expects to complete the process and engage a new independent registered accounting

firm next week.

PwC’s audit reports on the Company’s

consolidated financial statements for the fiscal years ended December 31, 2016 and 2015 contained no adverse opinion or disclaimer

of opinion and were not qualified or modified as to uncertainty, audit scope, or accounting principles, except that PwC’s

reports for the fiscal years ended December 31, 2016, and December 31, 2015 included an explanatory paragraph indicating that there

was substantial doubt about the Company’s ability to continue as a going concern.

During the Company’s two most recent

fiscal years, which ended December 31, 2016 and December 31, 2015, and the subsequent interim period through June 9, 2017, (i)

there were no “disagreements” (within the meaning set forth in Item 304(a)(1)(iv) of Regulation S-K) with PwC on any

matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedure, which disagreements,

if not resolved to PwC’s satisfaction, would have caused PwC to make reference to the subject matter of the disagreements

in their reports on the Company’s consolidated financial statements for such years; and (ii) there were no “reportable

events” (within the meaning set forth in Item 304(a)(1)(v) of Regulation S-K).

In accordance with Item 304(a)(3) of Regulation

S-K, the Company has requested that PwC furnish it with a letter addressed to the United States Securities and Exchange Commission

stating whether or not PwC agrees with above statements of the Company in this Item 4.01. PwC furnished the requested letter, stating

its agreement with such statements, and a copy is filed as Exhibit 16.1.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

|

Exhibit Number

|

|

Description

|

|

|

|

|

|

16.1

|

|

Letter of PricewaterhouseCoopers LLP dated June

15, 2017

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act

of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

AMYRIS, INC.

|

|

|

|

|

|

|

|

|

|

|

|

|

Date: June 15, 2017

|

By:

|

/s/ Kathleen Valiasek

|

|

|

|

|

Kathleen Valiasek

|

|

|

|

|

Chief Financial Officer

|

Amyris (NASDAQ:AMRS)

Historical Stock Chart

From Mar 2024 to Apr 2024

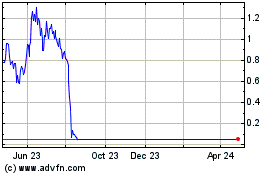

Amyris (NASDAQ:AMRS)

Historical Stock Chart

From Apr 2023 to Apr 2024