Filed pursuant to Rule 424(b)(5)

Registration Statement No. 333-230397

Prospectus Supplement

(To prospectus dated April 15, 2019)

SENMIAO TECHNOLOGY LIMITED

1,781,361 Shares of Common Stock

Series A Warrants to Purchase up to 1,336,021

Shares of Common Stock

Series B Warrants to Purchase up to 1,116,320

Shares of Common Stock

We are offering to

certain accredited investors (the “Investors”) 1,781,361 shares (the “Shares”) of our common stock,

par value $0.0001 per share (the “Common Stock”), for a purchase price equal to $3.38 per shares for gross proceeds

to us of approximately $6,000,000 before expenses payable by us. The sales will be made in accordance with the Securities Purchase

Agreement entered into between us and the Investors.

For no additional consideration,

we are also offering to the Investors Series A warrants (the “Series A Warrants”) to purchase up to an aggregate of

1,336,021 shares of Common Stock (the “Series A Warrant Shares”). The Series A Warrant are exercisable immediately

upon issuance, at an exercise price of $3.72 per share and will expire on the on the fourth (4

th

) anniversary of their

issuance.

For nominal consideration,

we are also offering to the Investors pre-funded Series B warrants (the “Series B Warrants,” and together with the

Series A Warrants, the “Warrants”) to purchase an aggregate amount of shares ranging from 0 shares of Common Stock

up to 1,116,320 shares (the “Series B Warrant Shares,” and together with the Series A Warrant Shares, the “Warrant

Shares”) of Common Stock. The amount of Series B Warrant Shares, if any, will be determined based upon a certain formula

set forth in the Series B Warrants on the fiftieth (50

th

) day after the closing of the offering. The Series B Warrants

are exercisable upon the fiftieth (50

th

) day after the closing of the offering, at an exercise price of $3.72 per share

and will expire on the on the first (1

st

) anniversary of their issuance.

The Warrants are not

and will not be listed for trading on any national securities exchange. For a description of our Common Stock and Warrants, see

the section entitled “

Description of Securities We Are Offering

” beginning on page S-20 of this prospectus

supplement.

We will pay all of

the expenses incident to the registration, offering and sale of the Shares and Warrants under this prospectus supplement and the

accompanying base prospectus.

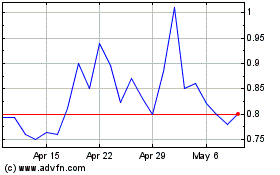

Our Common Stock is

listed on The NASDAQ Capital Market (NASDAQ) under the symbol “AIHS.” On June 19, 2019, the last reported sales price

of our Common Stock on NASDAQ was $2.62 per share.

As of June 19, 2019,

the aggregate market value of our outstanding Common Stock held by non-affiliates was approximately $67.98 million based on

25,945,255 outstanding shares of Common Stock, of which approximately 14,247,505 shares are held by non-affiliates,

and a per share price of $2.62, based upon the closing sale price of our Common Stock on June 19, 2019. During the 12 calendar

month period that ends on, and includes, the date of this prospectus supplement, we have not offered and sold any of our securities

pursuant to General Instruction I.B.6 of Form S-3.

You should read carefully

this prospectus supplement, the accompanying base prospectus and the documents incorporated by reference into this prospectus supplement

and the accompanying base prospectus before you invest. The Investors are deemed to be an “underwriter” for the offering

within the meaning of Section 2(a)(11) of the Securities Act of 1933, as amended.

Delivery of the Shares

and Warrants is expected to be made on or about June 20, 2019.

We have retained FT Global

Capital, Inc. to act as our exclusive placement agent in connection with this offering to use its best efforts to solicit offers

to purchase our Common Stock and warrants. The placement agent is not purchasing or selling any of our Common Stock or warrants

offered pursuant to this prospectus supplement or the accompanying prospectus. We have agreed to pay the placement agent a commission

of 8% and to reimburse the placement agent for certain expenses not to exceed $45,000. We will issue to the placement agent a

warrant to purchase 8% of the Shares issued in this offering at an exercise price of $3.38 per share on substantially the same

terms as the warrants sold in this offering, except that the placement agent warrants shall not be exercisable for a period of

180 days after the closing date of this offering. We have registered the placement agent warrant and the shares of Common Stock

underlying such warrant pursuant to this prospectus supplement. For additional information about the compensation paid to the

placement agent, see “Plan of Distribution” in this prospectus supplement.

Investing in our

securities involves a high degree of risk. You should read this prospectus supplement and the information incorporated herein

by reference carefully before you make your investment decision. See “

Risk Factors

” beginning on page S-9

of

this prospectus supplement.

Neither the Securities

and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the

accuracy or adequacy of this prospectus supplement. Any representation to the contrary is a criminal offense.

The date of this prospectus supplement is

June 20, 2019

TABLE OF CONTENTS

Prospectus Supplement

Prospectus

You should rely only

on the information we have provided or incorporated by reference in this prospectus supplement and the accompanying prospectus.

We have not authorized anyone to provide you with information different from that contained or incorporated by reference in this

prospectus supplement or the accompanying prospectus.

This prospectus supplement

and any later prospectus supplement is an offer to sell only the securities offered hereby, but only under circumstances and in

jurisdictions where it is lawful to do so.

You should assume that

the information contained in this prospectus supplement and in any other prospectus supplement is accurate only as of their respective

dates and that any information we have incorporated by reference is accurate only as of the date of the document incorporated by

reference, regardless of the time of delivery of this prospectus supplement or any other prospective supplement for any sale of

securities.

ABOUT THIS PROSPECTUS SUPPLEMENT

This document consists

of two parts. The first part is this prospectus supplement, which describes the specific terms of this offering. The second part,

the accompanying prospectus, gives more general information, some of which may not apply to this offering. Generally, when we refer

only to the “prospectus,” we are referring to both parts combined. This prospectus supplement may add to, update or

change information in the accompanying prospectus and the documents incorporated by reference into this prospectus supplement or

the accompanying prospectus.

If information in this

prospectus supplement is inconsistent with the accompanying prospectus, you should rely on this prospectus supplement. This prospectus

supplement, the accompanying prospectus, any related free-writing prospectus and the documents incorporated into each by reference

include important information about us, the shares being offered and other information you should know before investing in our

securities.

You should rely only on

this prospectus supplement, the accompanying prospectus, any related free-writing prospectus and the information incorporated or

deemed to be incorporated by reference in this prospectus supplement, the accompanying prospectus or in any free writing prospectuses

we have prepared. We have not authorized anyone to provide you with information that is in addition to, or different from, that

contained or incorporated by reference in this prospectus supplement, the accompanying prospectus or in any free writing prospectuses

we have prepared. If anyone provides you with different or inconsistent information, you should not rely on it. We are not offering

to sell securities in any jurisdiction where the offer or sale is not permitted. You should not assume that the information contained

or incorporated by reference in this prospectus supplement, the accompanying prospectus or any free-writing prospectus is accurate

as of any date other than as of the date of this prospectus supplement, the accompanying prospectus or any related free-writing

prospectus, as the case may be, or in the case of the documents incorporated by reference, the date of such documents regardless

of the time of delivery of this prospectus supplement and the accompanying prospectus or any sale of our securities. Our business,

financial condition, liquidity, results of operations, and prospects may have changed since those dates.

Unless otherwise stated,

all references to “us,” “our,” “AIHS,” “we,” the “Company” and similar

designations refer to Senmiao Technology Limited. Our logo, trademarks and service marks are the property of Senmiao Technology

Limited. Other trademarks or service marks appearing in this prospectus supplement are the property of their respective holders.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING

STATEMENTS

This prospectus supplement

and the documents incorporated by reference herein may contain forward looking statements that involve risks and uncertainties.

All statements other than statements of historical fact contained in this prospectus supplement and the documents incorporated

by reference herein, including statements regarding future events, our future financial performance, business strategy, and plans

and objectives of management for future operations, are forward-looking statements. We have attempted to identify forward-looking

statements by terminology including “anticipates,” “believes,” “can,” “continue,”

“could,” “estimates,” “expects,” “intends,” “may,” “plans,”

“potential,” “predicts,” “should,” or “will” or the negative of these terms or

other comparable terminology. Although we do not make forward looking statements unless we believe we have a reasonable basis for

doing so, we cannot guarantee their accuracy. These statements are only predictions and involve known and unknown risks, uncertainties

and other factors, including the risks outlined under “Risk Factors” or elsewhere in this prospectus supplement and

the documents incorporated by reference herein, which may cause our or our industry’s actual results, levels of activity,

performance or achievements expressed or implied by these forward-looking statements. Moreover, we operate in a highly regulated,

very competitive, and rapidly changing environment. New risks emerge from time to time and it is not possible for us to predict

all risk factors, nor can we address the impact of all factors on our business or the extent to which any factor, or combination

of factors, may cause our actual results to differ materially from those contained in any forward-looking statements.

We have based these forward-looking

statements largely on our current expectations and projections about future events and financial trends that we believe may affect

our financial condition, results of operations, business strategy, short term and long term business operations, and financial

needs. These forward-looking statements are subject to certain risks and uncertainties that could cause our actual results to differ

materially from those reflected in the forward looking statements. Factors that could cause or contribute to such differences include,

but are not limited to, those discussed (i) in our Annual Report on Form 10-K for the fiscal year ended March 31, 2018, (ii) in

our Quarterly Reports on Form 10-Q for the periods ended June 30, 2018, September 30, 2018 and December 31, 2018, (iii) in this

prospectus supplement, and in particular, the risks discussed below and under the heading “Risk Factors” and (iv) those

discussed in other documents we file with the Securities and Exchange Commission (“SEC”). The following discussion

should be read in conjunction with the consolidated financial statements for the fiscal years ended March 31, 2018 and 2017 and

notes incorporated by reference herein. We undertake no obligation to revise or publicly release the results of any revision to

these forward-looking statements, except as required by law. In light of these risks, uncertainties and assumptions, the forward-looking

events and circumstances discussed in this prospectus may not occur and actual results could differ materially and adversely from

those anticipated or implied in the forward-looking statement.

You should not place undue

reliance on any forward-looking statement, each of which applies only as of the date of this prospectus supplement. You are advised

to consult any further disclosures we make on related subjects in our reports on Forms 10-Q, 8-K and 10-K filed with the SEC.

PROSPECTUS SUPPLEMENT SUMMARY

This summary highlights

selected information contained elsewhere in this prospectus supplement. This summary does not contain all the information

that you should consider before investing in our Company. You should carefully read the entire prospectus supplement,

including all documents incorporated by reference herein. In particular, attention should be directed to our “Risk Factors,”

“Information With Respect to the Company,” “Management’s Discussion and Analysis of Financial Condition

and Results of Operations” and the financial statements and related notes thereto contained herein or otherwise incorporated

by reference hereto, before making an investment decision.

Overview

We are an automobile transaction

and financing service provider connecting auto dealers, financial institutions, and consumers, who are mostly existing and prospective

drivers affiliated with Didi Chuxing Technology Co., Ltd. (“Didi”), the largest ride-hailing service platform in China

(the “automobile transaction and financing service”). We also operate an online lending platform which facilitates

loan transactions between Chinese investors and individual and small-to-medium-sized enterprise (“SME”) borrowers (the

“online P2P lending”). Substantially all of our operations are conducted in the People’s Republic of China (“PRC”

or “China”).

Automobile Transaction and Financing Business

Our automobile transaction

and financing business is mainly comprised of (i) facilitation of automobile transaction and financing where we connect the prospective

ride-hailing drivers to financial institutions to buy, or get financing on the purchase of, cars to be used to provide ride-hailing

services (the “auto financing and transaction facilitation business”); (ii) automobile sales where we procure new

cars from dealerships and sell them to our customers in the automobile financing facilitation business (the “auto sales

business”); and (iii) automobile financing where we provide our customers with auto finance solutions through financing

leases (the “auto financing business”). We started our facilitation services in November 2018 and the sale of automobiles

in January 2019. As of March 31, 2019, we have facilitated financing for an aggregate of 311 automobiles with total value of approximately

$4.1 million and have sold an aggregate of 212 automobiles with total value of approximately $1.8 million. Our automobile financing

business did not commence until the end of March 2019 and has seen a slow growth to date. During the fiscal year ended March 31,

2019, our auto financing and transaction facilitation business and auto sales business accounted for 21.1% and 62.2% of our total

revenue, respectively.

Auto Financing and Transaction Facilitation

Leveraging the growing

popularity of ride-hailing services in China, we facilitate the auto financing transactions between the Didi drivers and financial

institutions. Our services simplify the transaction process for both the Didi drivers and the financial institutions. Specifically,

our facilitation services include purchase services and management and guarantee services.

Purchase services cover

a wide range of services provided to Didi drivers during the process of an automobile financing transaction, including but not

limited to, credit assessment, preparation of financing application materials, assistance with closing of financing transactions,

license and plate registration, payment of taxes and fees, purchase of insurance, installment of GPS devices, ride-hailing driver

qualification and other administrative procedures. Our service fees are based on the sales price of the automobiles and relevant

services provided. Our service fees for automobiles purchase services ranged from $500 to $4,000 per vehicle.

The management and guarantee

services are provided to Didi drivers after the delivery of the automobiles, covering (i) management services including, without

limitation, ride-hailing driver training, assisting with purchase of insurances, insurance claims and after-sale automobile services,

handling traffic violations and other consulting services; and (ii) guarantee services for the obligations of Didi drivers under

the financing arrangement. Our management and guarantee fees are based on the costs of our services and the results of our preliminary

credit assessment of the automobile purchasers. Our fees average approximately $1,100 per automobile for the affiliation period

and are paid by the affiliated drivers on a monthly basis during the affiliation period. As at March 31, 2019, the maximum contingent

liabilities we were exposed would be approximately $11.6 million if all the automobile purchasers defaulted.

Acquisition of Hunan Ruixi

Our auto financing and transaction facilitation business is conducted through Hunan Ruixi Financial Leasing

Co., Ltd. (“Hunan Ruixi”) and Sichuan Jinkailong Automobile Leasing Co., Ltd. (“Jinkailong”), our variable

interest entities. On November 21, 2018, we entered into an Investment

and Equity Transfer Agreement (the “Investment Agreement”) with Hunan Ruixi and all the shareholders of Hunan Ruixi

(“Hunan Ruixi Shareholders”), pursuant to which we acquired from the Hunan Ruixi Shareholders an aggregate of 60% of

the equity interest of Hunan Ruixi for no consideration. We closed the acquisition on November 22, 2018 and had made cash contribution

in the aggregate amount of $5,000,000 to Hunan Ruixi as of March 31, 2019 in accordance with the Investment Agreement.

Hunan Ruixi also controls

Jinkailong, an automobile transaction and financing services company

in China, through its 35% equity interest and a voting agreement with Sichuan Jinkailong's other shareholders, as amended (the

“Voting Agreement”). Pursuant to the Voting Agreement, all other Jinkailong’s shareholders have agreed, for a

period of 20 years, to vote along with Hunan Ruixi on all the fundamental corporate actions in the event of a disagreement. Though

not explicit in the share purchase agreements between Hunan Ruixi and Jinkailong, we may provide financial support to Jinkailong

to meet its capital requirements. Based on the Voting Agreement and our plan to provide financial support to Jinkailong, we determined

that we are the primary beneficiary of Jinkailong and therefore have consolidated Jinkailong’s financial statements into

our financial statements.

Transaction Process

The following chart

illustrates our typical process of auto financing facilitation.

Financing Partners

We

have established collaboration with a number of financial institutions, including commercial banks, financial leasing companies

as well as online peer-to-peer lending platforms, which finance the purchase of the automobiles by our automobile purchasers through

financing leasing agreements or loan agreements (the “Financing Agreements”). Under our arrangements with financing

partners, we will refer prospective drivers and are generally responsible for collecting information on such drivers, conducting

credit assessment of them, registration of the cars as collateral with government and providing guarantee on the payments of the

drivers. To secure the interests of the financing partners, each automobile is mortgaged in favor of the financing partner which

is registered with relevant local government agencies.

We

typically prepay the purchase price and expenses on behalf of the automobile purchasers when we provide purchase services

and collect all the advance payment and relevant services fees from the proceeds disbursed by the financial institutions upon

the closing of the financing and/or when the monthly installment payment made by automobile purchasers during the term of

the Financing Agreements. We are required under our arrangements with the financing partners to make payments on behalf of

the automobile purchasers in the event of default. As of March 31, 2019, the outstanding payments we made on behalf of

defaulted purchasers were approximately $0.15 million. After we make payments, we will request the defaulted purchasers to

pay us back. If we are unable to recover the payments within a certain period of time, we will start our collection process.

See “Overview – Automobile Transaction and Financing Business – Risk Management – Post-Financing

Services.”

During

the fiscal year ended March 31, 2019, our top two financing partners were Sichuan Jinding Fortune Information Technology Co., Ltd.

and Haitong Unitrust International Leasing Co., Ltd., which collectively financed an aggregate of 191 cars with a total value of

approximately $1.9 million, representing approximately 83.9% of the transaction value financed by our financing partners as of

March 31, 2019.

Partnership with

Didi

To

capitalize on the large and rapidly expanding fleet of Didi, we have established collaboration with Didi through both Hunan Ruixi

and Jinkailong. Under Jinkailong’s consulting service agreement with Didi, Jinkailong provides vehicle leasing and financing,

insurance facilitation, affiliated vehicle management, and other services for the fleet of Didi in Chengdu, Sichuan province. Hunan

Ruixi also entered into cooperation agreements with Didi in December 2018, pursuant to which Hunan Ruixi will source automobiles

for and provide automobile financing/leasing solutions to Didi drivers in Changsha city, Hunan province. Our relationship with

Didi is crucial to our business as it enables us to attract more automobile purchasers who are interested in working as Didi drivers

and becoming affiliated with us.

Partnership

with Feiniu

Jinkailong

also entered into a business cooperation agreement with Sichuan Feiniu Automobile Transportation Co., Ltd. (“Feiniu”),

a provider of intercity passenger transportation and freight logistics services and provider of consulting services to Didi’s

drivers on intercity carpool business. Pursuant to the business cooperation agreement, Jinkailong agreed to provide automobile

and driver sourcing services as Feiniu’s exclusive business partner for Feiniu’s intercity carpool business in Chengdu

city, Sichuan province for a period of three years. In return, Feiniu agreed to pay Jinkailong 30% of the consulting service fee

Feiniu receives under its agreement with Didi for the proportion of automobiles supplied by Jinkailong. In addition, Jinkailong

agreed to refer no less than 30% of its customers to subscribe for Feiniu’s automobile management services, including automobile

purchase, title registration, insurance purchase and financing.

Auto Transaction Facilitation Services

Through

Hunan Ruixi and Jinkailong, we also facilitate automobile purchase transactions between dealers, our cooperative third party sales

teams and the automobile purchasers, primarily Didi drivers. We provide sales venue and vehicle sourcing for the transactions.

We charge third party sales teams and automobile purchasers a facilitation fee based on the type of vehicle and negotiation

with each dealer, third party sales team and purchaser, generally no more than $2,200 per automobile from third party sales team

and $3,500 from the purchaser.

We

also provide a series of services for the purchasers throughout the automobile purchase transaction process, including registration

of license plates and permits from the relevant government authorities, insurance facilitation and assistance with applications

to financial institutions to finance the purchase. Our service fees are based on the total quoted price of the automobiles and

relevant services provided, our expenses to fulfill these services and other factors of the automobiles. Our service fees ranged

from approximately $500 to $4,000 per vehicle.

Automobile Sales

We are also engaged in

the sales of automobiles through Hunan Ruixi. As we are targeting to sell cars to drivers of Didi, Hunan Ruixi procures new cars

of model and specification acceptable to Didi. Hunan Ruixi typically sets up periodic procurement plans based on the estimated

transaction volume of Jinkailong and buy in bulk to obtain better pricing. Hunan Ruixi will then mark up the price and sell the

cars to the ride-hailing drivers who are typically customers in our auto financing facilitation services. All the new cars Ruixi

procured are parked in our warehouses in Chengdu.

Substantially all of the

cars are sold through a financing arrangement, under which we will receive a majority of the purchase price (ranging from approximately

69% to 100%) from the financing proceeds and the remainder from monthly installment payments of the Didi drivers.

Auto Financing

We began offering the

auto financing services in March 2019. In our self-operated financing, we act as a lessor and a customer (Didi driver) acts

as a lessee. We offer to the lessee a selection of automobiles that were purchased by us in advance. The lessee will choose

the desirable automobile to be purchased and enter into a financing lease with us. During the term of the financing lease,

the lessee will have use rights with respect to the automobile. We will obtain title to the automobile upfront and retain

such title during the term of the financing lease, as lessor. At the end of the lease term, the lessee will pay a minimal

price and obtain full title to the automobile after the financing lease is repaid in full. In connection with the financing

lease, the lessee will enter into a service agreement with us. Pursuant to this service agreement, the lessee will pay us a

service fee ranging from approximately $1,250 to approximately $3,500 for our services, which covers, among others, payment

of purchase taxes and insurance, license and plate registration, and training of ride-hailing drivers.

As of the date of this

prospectus, we have financed the purchase of 53 automobiles with an average financing amount per customer of approximately $19,000

and lease terms ranging from 36 to 48 months. The interest rates of our auto financing are fixed and range from 5.5% to 11.4% per

annum. No down payment is required under our financing leases.

Risk Management

The assessment of prospective

Didi drivers is based on collective efforts and provides a comprehensive evaluation of the automobile buyers. In our auto financing

facilitation business, assessment on a prospective buyer typically involves three parties: financial institutions, Didi and us.

As financial institution makes the ultimate decision on the financing application and the financing terms and Didi determines the

outcome of the driver qualification process, we do not maintain a credit grading system. We believe our manual review and verification

process is sufficient for the requirements of our current operations.

We conduct an initial screening

when we receive an application from the prospective Didi drivers based on credit reports from People’s Bank of China and

third party credit rating companies, and personal information including residence, ethnicity group, driving history and involvement

in legal proceeding. An initially qualified candidate must meet certain minimum criteria:

|

|

·

|

reside in the mainland of China;

|

|

|

·

|

have a driving history of at least three years;

|

|

|

·

|

not be subject to on-going legal proceedings or enforcement; and

|

|

|

·

|

not be listed on a national delinquent debtor’s list.

|

|

|

·

|

have a real willing to purchase automobile; if buy on behalf of someone else, need further materials

and guarantee;

|

|

|

·

|

the value of purchased automobile matches the income of the candidate.

|

Additionally, we arrange

a simple in-person interview with the applicant where we gather information on marital/family status, income, assets, borrowing

history and default history, if any. This interview is typically conducted by our risk management staff who will verify the accuracy

of information on the prospective driver by cross-checking information provided by the applicant with other sources. We will also

assess the prospective driver’s potential repayment ability.

Applicants with any of

the follow attributes will be rejected:

|

|

·

|

engaging in illegal or criminal activities;

|

|

|

·

|

involved in pornography, gambling, drug dealing and gangster activities and experiences;

|

|

|

·

|

engaging in usury lending; or

|

|

|

·

|

providing fraudulent information.

|

Once we have completed

our risk assessments on the applicant, we recommend qualified applicants to the financial institution who proactively reviews and

makes final credit decisions on the applications we recommend. Specifically, the financial institution is ultimately responsible

for, reviewing applications and verifying applicants’ personal information collected by us through various procedures.

We also share the driver’s

personal information with Didi, who requires all the drivers to be qualified under their own standard and conduct a background

check on each driver applicant. A qualified driver must meet certain minimum criteria:

|

|

·

|

be 22 to 60 years old (male); 22 to 55 years old (female);

|

|

|

·

|

have a driving history of at least three years with driving license of C2 or above

|

|

|

·

|

must not commit the a hit-and-run;

|

|

|

·

|

have no record of dangerous driving, drug use, driving under alcoholic influence, and violence

crime;

|

|

|

·

|

have no traffic violation of 12 demerit points or more in any year of the past three years;

|

|

|

·

|

have not had their tax driver’s license revoked in Chengdu within the past five years; and

|

|

|

·

|

have not been investigated or disciplined for unlawfully engaging in taxi services or other passenger

transportation operations in Chengdu within the past five years.

|

Our assessment of prospective lessees in our

auto financing business is substantially similar.

Post-Financing Services

Our post financing management

department is in charge of monitoring and managing monthly payments by the drivers. We send text messages and make phone calls

as reminders three business days prior to the due date. If a driver fails to pay on the due day, we will pay the financial institution

on behalf of the defaulted driver but continue to contact the driver and request for payments. If the delinquency continues for

more than 15 days, we then seek to repossess the car. Every car purchased through us has a GPS device installed, which helps us

locate the car. After a car is repossessed, we store it in a warehouse and later dispose of the automobile in accordance with law

and relevant financing documents. If we are unable to repossess collateral from a delinquent driver, we may commence a lawsuit

against the driver.

Customers

Over 95% of our customers

are Didi drivers. Due to the complexity and difficulty of obtaining registration of various licenses required for driving a ride-hailing

car, our customers choose to become affiliated with us who offer them a simplified and smooth process to become qualified. Our

automobile purchasers, who are mostly Didi drivers, typically become affiliated with us through affiliation agreements pursuant

to which we, as a qualified management company, provide them post-transaction management services during the affiliation period,

which is usually the same as the term of the Financing Agreements.

We acquire customers for

our automobile transaction and financing services through the network of third-party sales teams, referral from Didi and our own

efforts including online advertising and billboard advertising. We also send out flyers and participate in trade shows to advertise

our services. As of the date of this prospectus, we have serviced approximately 1,640 customers, including over 1,200 Didi drivers.

Seasonality

Due to our short operating

history, we have not observed trends or patterns in revenues in our automobile transaction and financing business.

Research and Development

With an aim to standardize

our transaction process and achieve higher operating efficiency, we are developing an integrated information system for our automobile

transaction and finance business. The system will comprise modules for procurement, qualification assessment, delivery and post-transaction

management which covers the whole transaction process. We have completed the development of certain functions such as information

entry and delivery which are being tested by us. We expect to complete and launch the system by the end of 2019.

Competition

The automotive finance

industry in China is large and evolving. According to Didi, there were approximately 300 automobile financing and leasing companies

that have established business relationships with Didi within Chengdu, Sichuan, China as of June 2019. We face significant competition

primarily from companies that operate in Chengdu, such as Chengdu Jingtengjian Business Consulting Co., Ltd., FAW Huidi Automotive

Technology Co., Ltd. and Guobang (Chengdu) Financing and Leasing Co., Ltd. We may also in the future face competition from new

entrants. We anticipate that more established companies, including technology companies that possess large, existing user bases,

substantial financial resources and sophisticated technological capabilities may also enter the market in the future.

Employees

As of the date of this

prospectus, we had a total of 110 full-time employees in our automobile transaction and financing business. The following table

sets forth the breakdown of our employees by function:

|

Function

|

|

Number of Employees

|

|

Management

|

|

3

|

|

Risk Management

|

|

4

|

|

Operations

|

|

5

|

|

Marketing

|

|

52

|

|

Drivers & Automobile Management

|

|

24

|

|

Post Financing Management

|

|

5

|

|

Human Resources & Administration

|

|

9

|

|

Finance and Accounting

|

|

8

|

|

Total

|

|

110

|

All of our employees are

based in Chengdu and Changsha, where our operations of automobile transaction and financing business are located.

We believe we offer our

employees competitive compensation packages and a work environment that encourages initiative and is based on merit, and as a result,

we have generally been able to attract and retain qualified personnel and maintain a stable core management team. We plan to hire

additional employees as we expand our business.

As required by PRC regulations,

we participate in various government statutory employee benefit plans, including social insurance funds, namely a pension contribution

plan, a medical insurance plan, an unemployment insurance plan, a work-related injury insurance plan and a maternity insurance

plan and a housing provident fund. We are required under PRC law to make contributions to employee benefit plans at specified percentages

of the salaries, bonuses and certain allowances of our employees, up to a maximum amount specified by the local government from

time to time. We have not made adequate employee benefit payments, and may be required to make up the contributions for these plans

as well as to pay late fees and fines.

We enter into standard

labor and confidentiality agreements with each of our employees. We believe that we maintain a good working relationship with our

employees, and we have not experienced any major labor disputes.

Facilities

We currently maintain two

offices for our automobile transaction and financing business. One office is located in Chengdu, comprising an aggregate of 1,803

square meters. We lease this office for a total monthly rent of approximately $10,735 under two lease agreements that expire in

2019 and 2021. The other office is located in Changsha city, Hunan province, comprising an aggregate of 625 square meters. We lease

this office for a monthly rent of approximately $3,505 under a lease expiring in 2023.

We also lease three warehouses

to park automobiles in Chengdu and Changsha. The monthly rent for these warehouses is approximately $1,800 in the aggregate.

Online P2P Lending Business

Through our platform,

we offer quick and easy access to credit for borrowers and attractive investment returns for investors. In September 2016, we acquired

our online lending platform which had been in operation for two years prior to the acquisition. Since the acquisition through March

31, 2019, we have facilitated loan transactions in an aggregate amount of over approximately $109 million. As of March 31, 2019,

we had an aggregate of 42,903 registered users and a total of 3,247 investors and 2,695 borrowers had participated in loan transactions

through our platform. We currently conduct our business operations exclusively in China, and all of our investors and borrowers

are located in China.

Our online platform enables

us to efficiently match borrowers with investors and execute loan transactions. We seek to address an unmet investor and borrower

demand in China. While presently our borrowers are mainly from referrals from customers and business partners, our investors come

from a variety of channels, including internet and our mobile applications, promotion and marketing events, as well as referrals

from our business partners.

Our revenues from online

lending services are primarily generated from fees charged for our services in matching investors with borrowers. We charge borrowers

transaction fees for the work we perform through our platform and charge our investors service fees on their actual investment

returns. The interest rates of the loans facilitated through our platform range from 7.68% to 10.80% per annum. The interest rates,

transaction fees, service fees and other charges are all disclosed to the users of our platform.

Recent Regulatory Developments for Online

Lending Platforms

In August 2018, the Office

of the Leading Group for the Rectification and Inspection Acceptance of Risk of Peer-to-Peer Online Lending Intermediaries (the

“Leading Group”) issued the Notice on Launching Compliance Inspection on Peer-to-Peer Online Lending Information Intermediaries

(the “Inspection Notice”), and the Compliance Checklist for Online Lending Information Intermediaries as specified

in the Inspection Notice (the “Checklist”). The Inspection Notice requires each online lending information intermediary

to complete the following compliance inspections by the end of December 2018: self-inspection, inspection conducted by local and

national internet finance association and verification conducted by the rectification office in charge of online lending.

We submitted our self-inspection

report pursuant to the Inspection Notice on October 15, 2018. We had two on-site inspection from the Financial Office of the High

and New Tech District of Chengdu on November 19, 2018 and from the Financial Bureaus of Chengdu City and Sichuan Province on December

13, 2018, respectively. These inspections were satisfactory to the relevant authorities and we did not receive any official regulatory

letter requiring rectification of our business. However, we may be required to make rectifications throughout the subsequent inspection

process. There can be no assurance that our company ultimately will be successful in passing the inspections by the competent authority.

Furthermore, we cannot assure you when we will be able to submit our filing application, and once submitted, whether such application

will be accepted by the local financial regulatory authorities or any other competent regulatory authorities as relevant laws and

regulations continue to develop and evolve. The delay in completing such record filing has had, and may continue to have, adverse

impacts on our business growth. If we fail to complete such compliance inspections or record-filing, we will not be able to obtain

the relevant telecommunication service license, in which event we may be forced to terminate our online lending information intermediary

business.

In January 2019, relevant PRC governmental authorities issued Circular on the Classification and Disposal

of Risks of Online Lending Institutions and Risk Prevention (“Circular 175”). According to Circular 175, except for

large-scale peer-to-peer direct lending marketplaces that are strictly in compliance with all relevant laws and regulations and

have not demonstrated any high-risk characteristics, which are generally referred to as Normal Marketplaces, other marketplaces,

including shell companies with no substantive operation, small-scale marketplaces, marketplaces with high risks and marketplaces

that are unable to repay investors or otherwise unable to operate their businesses, shall exit the peer-to-peer lending industry

or cease operation. Normal Marketplaces shall cease operating those businesses that are not in compliance with laws and regulations.

Circular 175 also encourages certain Normal Marketplaces to convert into other types of online financing institutions such as

online small loan companies or loan facilitation platforms. Circular 175 provides that “small-scale marketplace” shall

be determined by each province taking into consideration a marketplace’s outstanding loan balance, number of lenders and

other factors. There is no guidance on the definition of “small-scale marketplaces” in Sichuan province as of the

date of this prospectus . If we are considered a small-scale marketplace under Circular 175 as determined by Sichuan province,

we may have to cease our online lending services or convert into other types of online financing institutions.

Corporate Information

Our principal executive

offices are located 16F, Shihao Square, Middle Jiannan Blvd, High-Tech Zone, Chengdu, Sichuan, China, our telephone number is

+86 28 61554399, and our Internet website address is

http://www.senmiaotech.com

. The information on our website

is not a part of, or incorporated in, this prospectus supplement.

THE OFFERING

The following summary

contains basic information about the offering and is not intended to be complete. It does not contain all the information that

may be important to you. For a more complete understanding of the securities we are offering, you should read the section entitled

“Description of Securities We Are Offering.”

|

Common stock we are offering

|

|

1,781,361 shares.

|

|

|

|

|

|

Offering price of common stock

|

|

$3.38 per share (the “Share Purchase Price”).

|

|

|

|

|

|

Series A Warrants being offered by us

|

|

We are also offering for no additional consideration, Series A warrants (the “Series A Warrants”)

to purchase up to an aggregate of 1,336,021 shares of Common Stock (the “Series A Warrant Shares”). The

Series A Warrants are exercisable immediately upon issuance, at an exercise price of $3.72 per share (the “Series A Exercise Price”) and will expire on the on the fourth (4

th

) anniversary of their issuance. On the six (6)-month anniversary of the issuance date of the Series A Warrants, if the average Volume Weighted Average Price (“VWAP”) during the ten (10) trading days prior to such anniversary (“New Exercise Price”) is less than the Series A Exercise Price, then the Series A Exercise Price shall have one-time price adjustment equal to the New Exercise Price; provided, however, in no event, shall the New Exercise Price be less than $1.50 per share.

|

|

|

|

|

|

Series B Warrants being offered by us

|

|

We are also offering for nominal consideration,

pre-funded Series B warrants (the “Series B Warrants,” and together with the Series A Warrants, the “Warrants”)

to purchase an aggregate amount of shares ranging from 0 shares of Common Stock up to 1,116,320 shares (the “Series B Warrant

Shares,” and together with the Series A Warrant Shares, the “Warrant Shares”) of Common Stock. The

amount of Series B Warrant Shares, if any, are determined based upon a certain formula set forth in the Series B Warrants on the

fiftieth (50

th

) day after the closing of the offering. The Series B Warrants are exercisable upon the fiftieth

(50

th

) day after the closing of the offering, at an exercise price of $3.72 per share and will expire on the on the

first (1

st

) anniversary of their issuance.

|

|

|

|

|

|

Common stock to be outstanding immediately

after this offering (including the maximum amount of Warrant Shares)

|

|

30,178,957 shares of Common Stock (assuming

the maximum number of Warrant Shares are issued).

|

|

|

|

|

|

Use of proceeds

|

|

The Company intends to use the proceeds for general corporate purposes, including automobile purchases, the costs of providing leasing and other automobile transaction services, including financial leasing, costs of developing other types of financing businesses, investments in other entities, costs of technology development, costs of new hires, capital expenditures, working capital and the costs of operating as a public company. Notwithstanding the foregoing, the Company shall deposit or cause the Investors to deposit at least $500,000 of the proceeds into an account at a bank in the United States, which proceeds (x) may solely be used to satisfy any reasonable legal, audit, accounting and other professional fees and expenses of the Company and (y) shall not be transferred or used for any other purposes without the prior written consent of certain Investors. See “Use of Proceeds”.

|

|

Risk factors

|

|

Your investment in our securities involves substantial risks. You should consider the “Risk Factors” and the “Note Regarding Forward-Looking Statements” included and incorporated by reference in this prospectus supplement and the accompanying prospectus, including the risk factors incorporated by reference from our filings with the SEC

|

|

|

|

|

|

NASDAQ ticker symbol

|

|

Our Common Stock is listed on The NASDAQ Capital Market under the symbol “AIHS.” The Warrants will not be listed for trading on any national securities exchange.

|

|

|

|

|

The number of shares of

Common Stock shown above to be outstanding after this offering is based on the 25,945,255 shares outstanding as of June 19, 2019

and excludes as of such date:

|

|

•

|

272,085 shares of our Common Stock issuable

upon exercise of outstanding warrants at a weighted average exercise price of $4.80 per share.

|

RISK FACTORS

Investing in our securities

involves a high degree of risk. Before deciding whether to invest in our securities, you should carefully consider the risk factors

we describe in this prospectus supplement and in any related free writing prospectus that we may authorize to be provided to you

or in any report incorporated by reference into this prospectus supplement, including our Annual Report on Form 10-K for the year

ended March 31, 2018, or any Annual Report on Form 10-K or Quarterly Report on Form 10-Q that is incorporated by reference

into this prospectus supplement after the date of this prospectus supplement. Although we discuss key risks in those risk

factor descriptions, additional risks not currently known to us or that we currently deem immaterial also may impair our business. Our

subsequent filings with the SEC may contain amended and updated discussions of significant risks. We cannot predict future

risks or estimate the extent to which they may affect our financial performance.

Risks Related to This Offering

Management will have broad discretion

as to the use of the net proceeds from this offering, and we may not use these proceeds effectively.

We intend to use the net

proceeds from this offering for general corporate purposes, including automobile purchases, the costs of providing leasing and

other automobile transaction services, including financial leasing, costs of developing other types of financing businesses, investments

in other entities, costs of technology development, costs of new hires, capital expenditures, working capital and the costs of

operating as a public company. Notwithstanding the foregoing, the Company shall deposit or cause the investors to deposit

at least $500,000 of the proceeds into an account at a bank in the United States, which proceeds (x) may solely be used to satisfy

any reasonable legal, audit, accounting and other professional fees and expenses of the Company and (y) shall not be transferred

or used for any other purposes without the prior written consent of certain Investors.

Our management will have

broad discretion in the application of the net proceeds from this offering and could spend the proceeds in ways that do not improve

our results of operations or enhance the value of our common stock. Accordingly, you will be relying on the judgment of our management

with regard to the use of these net proceeds, and you will not have the opportunity, as part of your investment decision, to assess

whether the proceeds are being used appropriately. Our failure to apply these funds effectively could have a material adverse effect

on our business, delay the development of our product candidates and cause the price of our common stock to decline.

We do not anticipate declaring any cash

dividends on our common stock which may adversely impact the market price of our stock.

During the last four years,

we have not declared or paid cash dividends on our common stock and do not plan to pay any cash dividends in the near future. Investors

must look solely to the potential for appreciation in the market price of the shares of our common stock to obtain a return on

their investment.

Sales of a significant number of shares

of our common stock in the public markets, or the perception that such sales could occur, could depress the market price of our

common stock.

Sales of a significant

number of shares of our common stock in the public markets, or the perception that such sales could occur could depress the market

price of our common stock and impair our ability to raise capital through the sale of additional equity securities. We cannot predict

the effect that future sales of our common stock or the market perception that we are permitted to sell a significant number of

our securities would have on the market price of our common stock.

The exercise of outstanding warrants to acquire shares

of our common stock would cause additional dilution, which could cause the price of our common stock to decline.

In the past, we have

issued options and warrants to acquire shares of our common stock. As of the date hereof, there were 272,085 shares of common

stock issuable upon exercise of outstanding warrants at a weighted average exercise price of $4.80 per share, and we may

issue additional options, warrants and other types of equity in the future as part of stock-based compensation, capital raising

transactions or other strategic transactions. To the extent these options and warrants are ultimately exercised, existing holders

of our common stock would experience dilution which may cause the price of our common stock to decline.

Holders of the

pre-funded Series B Warrants purchased in this offering will have no rights as holders of common stock until such holders exercise

their pre-funded Series B Warrants and acquire our common stock, except as set forth in the pre-funded Series B Warrants.

Until

holders of pre-funded Series B Warrants acquire shares of our common stock upon exercise of the pre-funded Series B Warrants, holders

of pre-funded Series B Warrants will have no rights with respect to the shares of our common stock underlying such pre-funded warrants,

except as set forth in the pre-funded Series B Warrants. Upon exercise of the pre-funded warrants, the holders will be entitled

to exercise the rights of a holder of common stock only as to matters for which the record date occurs after the exercise date.

There is no public market for the pre-funded

Series B Warrants being offered in this offering.

There

is no established public trading market for the pre-funded warrants being offered in this offering, and we do not expect a market

to develop. In addition, we do not intend to apply to list the pre-funded Series B warrants on any securities exchange or nationally

recognized trading system, including NASDAQ. Without an active market, the liquidity of the pre-funded Series B Warrants will be

limited.

Risks Related to

Our Automobile Transaction and Financing Services

The business, financial

condition and operating results of our automobile transaction and financing business can be affected by a number of factors, whether

currently known or unknown, including but not limited to those described below, any one or more of which could, directly or indirectly,

cause our actual financial condition and operating results to vary materially from past, or from anticipated future, financial

condition and operating results. Any of these factors, in whole or in part, could materially and adversely affect our business,

financial condition, operating results and stock price.

We face intense

competition, which may lead to loss of market share, reduced service fees and revenue, increased expenses, departures of qualified

employees, and disputes with competitors.

We

face intense competition in the automobile transaction and financing industry. Our competitors may have significantly more resources

than we do, including financial, technological, marketing and others and may be able to devote greater resources to the development

and promotion of their services. As a result, they may have deeper relationships with automobile dealers, automobile financing

partners and other third-party service providers than we do. This could allow them to develop new services, adapt more quickly

to changes in technology and to undertake more extensive marketing campaigns, which may render our services less attractive to

consumers and cause us to lose market share. Moreover, intense competition in the markets we operate in may reduce our service

fees and revenue, increase our operating expenses and capital expenditures, and lead to departures of our qualified employees.

We may also be harmed by negative publicity instigated by our competitors, regardless of its validity. We may in the future continue

to encounter disputes with our competitors, including lawsuits involving claims asserted under unfair competition laws and defamation

which may adversely affect our business and reputation. Failure to compete with current and potential competitors could materially

harm our business, financial condition and our results of operations.

Our relationship

with Didi, a leading Chinese ride-hailing service platform, third party sales teams and financing partners is crucial to our ability

to grow our business, results of operations and financial condition.

Our

strategic relationship with Didi, a leading ride-hailing service platform in China, is crucial to our business as most of the cars

we provide services to are used as ride-hailing vehicles for Didi. Our cooperative arrangement with Didi is on a non-exclusive

basis, and Didi may have cooperative arrangements with our competitors. If our collaboration with Didi was terminated, we may not

be able to maintain our existing customers or attract new customers who are and will be Didi drivers, which could materially and

adversely affect our business and impede our ability to continue our operations.

We

also cooperate with third party sales teams, automobile dealers and financial institutions and others to provide automobile transaction

and financing services. Our ability to acquire consumers depends on our own marketing efforts through online advertising and billboard

advertising, as well as the network of different third party sales teams. Our ability to attract and maintain customers also depends

on whether our financing partners provide timely and sufficient funding to automobile purchase. We intend to strengthen relationships

with existing financing partners and develop new relationships for our automobile transaction and financing business. If we are

not able to attract or retain cooperative third party sales teams or financing partners as new business partners on acceptable

terms, our business growth will be hindered and our results of operations and financial condition will suffer.

We rely on a

limited number of third-party financing partners to fund automobile purchases, and our inability to maintain sufficient access

to funding would materially and adversely affect our liquidity, business, results of operations and financial condition.

We

partner with financing institutions and refer our customers to finance their purchase of automobiles. From our acquisition of Hunan

Ruixi to March 31, 2019, the amount of automobile purchase we facilitated was approximately $4.2 million, approximately 62% of

which has been funded by third-party financial institutions. As of March 31, 2019, two financing partners collectively financed

purchases of approximately $1.9 million in the aggregate, representing approximately 84.5% of the transaction value financed by

all financing partners.

Because

we rely on a limited number of financing partners and there is no commitment on the amount of automobile purchase our financing

partners will fund through us, as the demand for financing for automobile purchase increases, there can be no assurance that our

current third-party financing partners can meet the funding needs of the automobile sales we facilitated, or we can find additional

financing partners, or our cooperation with new financing partners will meet our expectations. The availability of funding from

financial institutions depends on many factors, some of which are out of our control. We have, in the past, terminated our collaboration

with certain third-party financing partners and may in the future take similar measures. If we terminate our collaboration with

the financing partners, we may be unable to find substitutes on commercially reasonable terms, or at all. As a result, we would

experience a material adverse effect on our business and results of operations. We and our financing partners may not be able to

arrange alternative funding source in time and our capital and liquidity would be strained, which would be materially and adversely

affect our business, results of operations and financial condition.

Our success

depends on our ability to attract prospective automobile purchasers.

The

growth of our automobile transaction and financing services business depends on our ability to attract prospective automobile purchasers.

In order to expand our base of automobile purchasers, we must continue to invest significant resources in the development of new

solutions and services and build our relationships with financial institutions, dealers and other participants. Our ability to

successfully launch, operate and expand our solutions and services and to improve user experience to attract prospective automobile

purchasers depends on many factors, including our ability to anticipate and effectively respond to changing interests and preferences

of automobile purchasers, anticipate and respond to changes in the competitive landscape, and develop and offer solutions and services

that address the needs of automobile purchasers. If our efforts in these regards are unsuccessful, our base of automobile purchasers,

and the amount of financing and other transactions we facilitate to them, may not increase at the rate we anticipate, and it may

even decrease. As a result, our business, prospects, financial condition and results of operations may be materially and adversely

affected.

In

addition, in order to attract prospective automobile purchasers, we must also devote significant resources to enhancing the experience

of automobile purchasers, in particular the ride-hailing drivers, on an ongoing basis. We must continually enhance our speed for

processing the automobile purchase and financing transactions. If we fail to provide superior customer service or address complaints

of automobile purchasers in a timely manner, we may fail to attract prospective automobile purchasers as to our solutions and services,

the number of transactions we facilitate may decline.

In

the meantime, we also seek to maintain our relationships with existing automobile purchasers and cross-sell new solutions and services.

However, there can be no assurance that we will be able to maintain or deepen such relationships.

Our limited

operating history in certain of our services and the rapid evolution of our business model make it difficult for investors to evaluate

our business and prospects.

The

ride-hailing and automobile financing markets, in the PRC are relatively new and at an early stage of development. While they have

undergone significant growth in the past few years, there is no assurance that it can continue to grow as rapidly. As part of our

business, we offer automobile facilitation and purchase services, management, guarantee and other services over the affiliation

period to automobile purchasers and third party sales teams. Jinkailong, began its automobile transaction and financing operations

in January 2018, and we only acquired this business segment in November 2018; thus, we have a limited operating history and may

have insufficient experience to address the risks to which companies operating in new or rapidly evolving markets may be exposed.

We may also launch new products and services from time to time. Our limited operating history in some of our services and the rapid

evolution of our business model mean that the early growth we have experienced in our automobile transaction and financing operations

segment is not necessarily indicative of our future performance. We cannot assure you that our new service offerings will achieve

the expected results or we will be able to achieve similar results or grow at the same rate as we did in the past. As our business

and the automobile leasing and financing industry in China continue to develop, we may adjust our service offerings or modify our

business model.

Our customers’

failure to fully comply with PRC taxi-related laws may expose us to potential penalties and negatively affect our operations.

According

to the guidelines issued by the Municipal Communications Commission of Chengdu in November 2016, online reservation taxi operating

license, automobile certificate and online reservation taxi driver’s license are required to operate the online ride-hailing

business. Approximately 10% of the automobiles used for online ride-hailing which we provide management services to do not have

the automobile certificates and approximately 79% of our ride-hailing drivers have not obtained the online reservation taxi driver’s

licenses. We are in the process of assisting the drivers to obtain the required certificate and license. However, there is no guarantee

that all of the drivers affiliated without us would be able to obtain all the certificate and license. Our ability and method to

provide the automobile transaction related services might be affected or restricted. Our business and results of operations will

be materially affected if our affiliated drivers are suspended from providing ride-hailing services or imposed substantial fines.

We advance payments

for over 90% of the automobile purchases for our customers and we can provide no assurances that our current financial resources

will be adequate to support this operation.

We

prepay all the purchase price and expenses on behalf of the automobile purchasers when we provide purchase services and collect

all the advance payment and relevant services fees from the proceeds disbursed by the financial institutions upon the closing of

the financing and/or when the monthly installment payment made by automobile purchasers during the lease term. As of March 31,

2019, we had advanced payments of approximately $2.6 million (RMB17.2 million) for the automobile purchases. We fund those advance

payments by proceeds of our initial public offering and loans from financial institutions.

Our

liquidity may be negatively impacted as a result of the increases of advance payments for automobile purchases in addition to general

economic and industry factors. We anticipate that, to the extent that we require additional liquidity, it will be funded through

the incurrence of other indebtedness, additional equity financings or a combination of these potential sources of liquidity. If

we raise additional funds by issuing equity securities or convertible debt, our shareholders will experience dilution. Debt financing,

if available, would result in increased fixed payment obligations and may involve agreements that include covenants limiting or

restricting our ability to take specific actions, such as incurring additional debt, making capital expenditures or declaring dividends.

The covenants under future credit facilities may limit our ability to obtain additional debt financing. We cannot be certain that

additional funding will be available on acceptable terms, or at all. Any failure to raise capital in the future could have a negative

impact on our financial condition and our ability to pursue our business strategies.

Our

failure to raise additional capital and in sufficient amounts may significantly impact our ability to maintain and expand our business.

We may need

additional capital to pursue business objectives and respond to business opportunities, challenges or unforeseen circumstances,

and financing may not be available on terms acceptable to us, or at all.

Since

inception, Jinkailong has borrowed from third parties and related parties to support the growth of its business. As we intend to

continue to make investments to support the growth of our automobile business, we may require additional capital to pursue our

business objectives and respond to business opportunities, challenges or unforeseen circumstances, including developing new solutions

and services, increasing the amount of financing transactions we facilitate, further enhance our risk management capabilities,

increasing our sales and marketing expenditures to improve brand awareness and engage automobile purchasers through expanded online

channels, enhancing our operating infrastructure and acquiring complementary businesses and technologies. We plan to expand our

automobile transaction and financing services, and we may need to make additional capital contribution as a result. Accordingly,

we may need to engage in equity or debt financings to secure additional funds. However, additional funds may not be available when

we need them, on terms that are acceptable to us, or at all. Repayment of the debts may divert a substantial portion of cash flow

to repay principal and service interest on such debt, which would reduce the funds available for expenses, capital expenditures,

acquisitions and other general corporate purposes; and we may suffer default and foreclosure on our assets if our operating cash

flow is insufficient to service debt obligations, which could in turn result in acceleration of obligations to repay the indebtedness

and limit our sources of financing.

Volatility

in the credit markets may also have an adverse effect on our ability to obtain debt financing. If we raise additional funds through

further issuances of equity or convertible debt securities, our existing shareholders could suffer significant dilution, and any

new equity securities we issue could have rights, preferences and privileges superior to those of holders of our common stock.

If we are unable to obtain adequate financing or financing on terms satisfactory to us when we require it, our ability to continue

to pursue our business objectives and to respond to business opportunities, challenges or unforeseen circumstances could be significantly

limited, and our business, financial condition, results of operations and prospects could be adversely affected.

Our automobile

financing facilitation services may subject us to regulatory and reputational risks, each of which may have a material adverse

effect on our business, results of operations and financial condition.

We

provide automobile financing facilitation services to finance consumers’ car purchases. The PRC laws and regulations concerning

financial services are evolving and the PRC government authorities may promulgate new laws and regulations in the future. We cannot

assure you that our practices would not be deemed to violate any PRC laws or regulations either now or in the future. The financing

products of our financial partners referred by us may be deemed to exceed the stipulated cap on the financing amount relative to

the car purchase price, in which case we may be required to make adjustments to our cooperation arrangements or cease to cooperate

with these financing partners. If we are required to make adjustments to our automobile financing facilitation referral business

model or withdraw, discontinue or change some of our automobile financing facilitation referral services, our business, financial

condition and results of operations would be materially and adversely affected. In addition, if the financing products referred

by us and our cooperation with financing partners were to be deemed as in violation of applicable PRC laws or regulations, our

reputation would suffer.

Moreover,

developments in the financial service industry may lead to changes in PRC laws, regulations and policies or in the interpretation

and application of existing laws, regulations and policies, which may limit or restrict consumer financing or related facilitation

services like those we offer. We may, from time to time, be required to adjust our arrangement with third-party financing partners,

which could materially and adversely affect our business, results of operations and financial condition. Furthermore, we cannot

rule out the possibility that the PRC government will institute a new licensing regime covering services we provide in the future.

If such a licensing regime were introduced, we cannot assure you that we would be able to obtain any newly required license in

a timely manner, or at all, which could materially and adversely affect our business and impede our ability to continue our operations.

We are exposed

to credit risk in our auto financing and transaction facilitation and auto financing businesses. Our current risk management system

may not be able to accurately assess and mitigate all risks to which we are exposed, including credit risk.

We

are exposed to credit risk as we provide automobile financing to automobile purchasers and are required to provide guarantees to

certain our financing partners on the financing for automobile purchases facilitated by us. As at March 31, 2019, the maximum contingent

liabilities the Company exposed to would be approximately $11.5 million if all the automobile purchasers defaulted. Customers may

default on their lease/loan payments for a number of reasons including those outside of their or our control. The credit risk may

be exacerbated in automobile financing due to the relatively limited credit history and other available information of many consumers

in China.

If we are unable

to repossess the car collateral for delinquent financing payments of the automobile purchasers referred by us or do so in a cost-effective

manner or if our ability to collect delinquent financing payments is impaired, our business and results of operations would be

materially and adversely affected. We may also be subject to risks relating to third-party debt collection service providers who

we engage for the recovery and collection of loans.

Under

most of the financial leases/loan agreements between the automobile purchasers and third-party financing partners, we guarantee

the lease/loan payments including principal and the accrued and unpaid interest for the automobile purchase funded by these financing

partners. Therefore, failure to collect lease/loan payments or to repossess the collateral may have a material adverse effect on

our business operations and financial positions. Although the lease/loan payments are secured by the cars, we may not be able to

repossess the car collateral when our customers default. Our measures to track the cars include installing GPS trackers on cars.

We cannot assure you that we will be able to successfully locate and recover the car collateral. We have in the past failed to

repossess one car as the GPS trackers failed to function properly or had been disabled, and we cannot assure you that this incident

will not happen again the future. We also cannot assure you that there will not be regulatory changes that prohibit the installation

of GPS trackers, or the realized value of the repossessed cars will be sufficient to cover our customers' payment obligations.

If we cannot repossess some of these cars or the residual values of the repossessed cars are lower than we expected and not sufficient

to cover the automobile purchaser' payment obligation, our business, results of operations and financial condition may be materially

and adversely affected.

Moreover,

the current regulatory regime for debt collection in the PRC remains unclear. We aim to ensure our collection efforts carried out

by our asset management department comply with the relevant laws and regulations in the PRC. However, if our collection methods

are viewed by the automobile purchasers or regulatory authorities as harassments, threats or other illegal means, we may be subject