Delta, American to Trim Capacity, Southwest CEO to Take Pay Cut--3rd Update

March 10 2020 - 11:42AM

Dow Jones News

By Alison Sider

Airlines on Tuesday detailed the growing impact of the

coronavirus by cutting more flights in domestic and international

markets, parking planes, freezing hiring and reducing executive

pay.

American Airlines Group Inc. and Delta Air Lines Inc. both said

they planned to reduce the number of flights across their networks.

United Airlines Holdings Inc. CEO Oscar Munoz and President Scott

Kirby said they would forgo their base salaries until at least June

30, and Southwest Airlines Co. CEO Gary Kelly told employees he

will take a 10% pay cut as the airlines face the most severe

downturn in decades because of the spread of the coronavirus.

The moves come as bookings have dropped off amid growing

passenger fears about traveling. Airlines are now preparing for the

prospect that recovery could take months, rather than the quick

bounceback many had initially anticipated when the virus started to

affect travel early this year. The virus's rapid impact on demand

has sent airlines reeling: American, Delta and United have all

withdrawn their financial guidance for the year and suspended share

buyback programs, among other measures.

American said it plans to cut domestic flying by 7.5% by

decreasing frequencies in markets where it operates many flights.

It will reduce international flying by 10% for the summer peak

travel season.

Delta said Tuesday that it will park some planes and reduce

capacity across its network, cutting international capacity as much

as 25%, and domestic capacity as much as 15%. Delta also said it

would freeze hiring and offer voluntary leave options, in addition

to deferring $500 million in capital expenditures and said it would

consider retiring some planes early.

"This is a fear event," Delta CEO Ed Bastian said, speaking at

an industry conference that was webcast, rather than being held

live, on Tuesday. Mr. Bastian said he expects demand will continue

to erode in the near term.

Overseas, the European Commission is close to approving a

suspension of airport-slot rules that would allow airlines to cut

back capacity without risking the loss of lucrative takeoff and

landing rights, according to people familiar with the matter.

The move, which could be signed off as early as Tuesday

afternoon, would provide significant relief for domestic and

international carriers operating in Europe. Some have been

operating near-empty flights in and out of congested hubs, like

London's Heathrow, to retain the slots.

Under the "use-it-or-lose-it" airport slot rules, airlines must

use a takeoff or landing slot at a level of at least 80% to keep

the flying rights for the next season.

United said it now expected to incur a first-quarter loss,

rather than the profits it had anticipated. The airline said it

raised $2 billion from a group of banks, which will bring its total

liquidity to $8 billion. The airline is also slashing capital

spending by $2.5 billion.

Southwest's Mr. Kelly told employees that the virus has created

a challenge more serious than any the industry has faced since

9/11, "and it may be worse."

"The velocity and the severity of the decline is breathtaking,"

Mr. Kelly said in a video message Monday that was viewed by The

Wall Street Journal. "There is no question this is a severe

recession for our industry and for us, and it's a financial

crisis." Southwest had previously said the reduced bookings could

result in as much as $300 million in lost revenue in March

alone.

The virus is testing airlines' ability to weather the kind of

economic crisis they have promised investors they could withstand

following a decadelong run of industry profits. While a sharp drop

in fuel prices is likely to relieve some pressure, carriers are

facing a global-demand shock that looks to be more severe than

anything they have encountered since 9/11.

American CEO Doug Parker said corporate travelers have shown the

steepest declines in demand, as companies have told employees to

stay put. The airline saw a "large increase" in bookings when it

opened up more seats at cheaper prices, he said.

American's reduction in domestic flights will include

cancellation of routes where customers can be easily rerouted. Some

domestic routes will get a boost, though, with bigger planes that

would have been used for international flying.

Internationally, the airline will hold off on flying to mainland

China until late October, and will extend cancellations to Hong

Kong and Singapore for months. It is temporarily suspending or

cutting back on service to European destinations including

Barcelona, Madrid, Rome and Paris. Latin America, which had been

the one relative haven for U.S. airlines' international operations,

will also see cuts, including American's flights to Chile, Uruguay,

and Brazil.

United said Tuesday that it expects the schedule reductions it

has already announced will be rolled forward.

All three airlines said fuel savings could be a silver lining

due to the oil-price rout. American pegged the cost reduction at as

much as $3 billion in a presentation prepared for Tuesday's

conference.

European carriers stepped up their own cancellations after Italy

shut down travel in and out of the country. Ryanair Holdings PLC

revised down its traffic plans for this year by three million

passengers to 151 million, while Norwegian Air Shuttle ASA said it

would cut 3,000 flights from its schedule.

--Benjamin Katz and Doug Cameron contributed to this

article.

Write to Alison Sider at alison.sider@wsj.com

(END) Dow Jones Newswires

March 10, 2020 11:27 ET (15:27 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

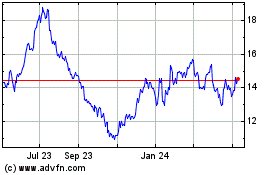

American Airlines (NASDAQ:AAL)

Historical Stock Chart

From Mar 2024 to Apr 2024

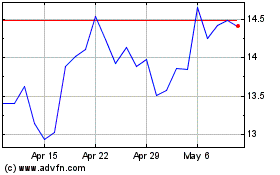

American Airlines (NASDAQ:AAL)

Historical Stock Chart

From Apr 2023 to Apr 2024