Australian, NZ Dollars Climb Amid Rising Risk Appetite

February 24 2022 - 10:01PM

RTTF2

The Australian and NZ dollars advanced against their major

counterparts in the Asian session on Friday, amid rising risk

appetite as investors digested the latest set of sanctions on

Russia by the U.S. and the European Union for its invasion of

Ukraine.

Although U.S. President Joe Biden imposed harsh sanctions

against Russia, he did not target oil exports or banned it from the

SWIFT international payments system.

Biden expressed unwillingness to deploy troops to fight Russian

forces in Ukraine, to help avoid a conflict between the U.S. and

Russia.

Risk sentiment improved after China injected liquidity into the

banking system to maintain stability.

The PBOC pumped a net 290 billion yuan through seven-day reverse

repurchase agreements to keep liquidity stable towards the end of

the month.

The aussie edged up to 0.7204 against the greenback and 83.01

against the yen, following its prior lows of 0.7139 and 82.43,

respectively. The aussie is poised to find resistance around 0.74

against the greenback and 85.00 against the yen.

Reversing from its early lows of 1.0675 against the kiwi and

0.9147 against the loonie, the aussie moved up to 1.0724 and

0.9212, respectively. Next key resistance for the aussie is seen

around 1.09 against the kiwi and 0.94 against the loonie.

The aussie firmed to 1.5553 against the euro, its strongest

level since November 25, 2021. If the aussie rises further, it may

find resistance around the 1.53 level.

The kiwi climbed to 0.6723 against the greenback and 1.6676

against the euro, rising from its previous lows of 0.6684 and

1.6751, respectively. The kiwi is seen finding resistance around

0.69 against the greenback and 1.64 against the euro.

The kiwi rebounded to 77.51 against the yen, from a low of 77.10

seen earlier in the session. The kiwi is likely to challenge

resistance around the 80 level.

Looking ahead, Eurozone economic confidence index for February

is due in the European session.

University of Michigan's final consumer sentiment index for

February, U.S. durable goods orders, pending home sales and

personal income and spending data, all for January, will be out in

the New York session.

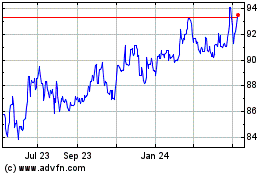

NZD vs Yen (FX:NZDJPY)

Forex Chart

From Mar 2024 to Apr 2024

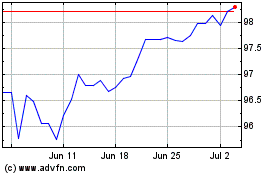

NZD vs Yen (FX:NZDJPY)

Forex Chart

From Apr 2023 to Apr 2024