Australian Dollar Rises Amid Risk Appetite

April 28 2024 - 10:48PM

RTTF2

The Australian dollar strengthened against other major

currencies in the Asian session on Monday amid risk appetite, as

traders reacted to upbeat U.S. inflation data and a drop in

treasury yields, which may have helped mitigate any negative

response to the inflation data. They are also cautious and indulge

in some bargain hunting ahead of the U.S. Fed's monetary policy

announcement in two days.

Markets also anticipate that the Reserve Bank of Australia is

likely to implement three cash rate hikes throughout 2024.

Gains in technology and financial stocks also led to the upturn

of investor sentiment.

Crude oil prices edged higher on optimism about the outlook for

oil demand and concerns about supply. West Texas Intermediate Crude

oil futures for June ended higher by $0.28 or 0.34 percent at

$83.85 a barrel. WTI crude futures gained 0.85 percent in the

week.

In the Asian trading now, the Australian dollar rose to a

11-year high of 104.94 against the yen, nearly a 1-year high of

1.1014 against the NZ dollar and nearly a 4-month high of 1.6291

against the euro, from Friday's closing quotes of 103.41, 1.0997

and 1.6361, respectively. If the aussie extends its uptrend, it is

likely to find resistance around 105.00 against the yen, 1.11

against the kiwi and 1.61 against the euro.

Against the U.S. and the Canadian dollars, the aussie advanced

to near 3-week highs of 0.6587 and 0.8980 from last week's closing

quotes of 0.6533 and 0.8929, respectively. On the upside, 0.67

against the greenback and 0.90 against the loonie are seen as the

next resistance levels for the aussie.

Looking ahead, Eurozone business and consumer sentiment indices

for April are due to be released at 5:00 am ET in the European

session.

In the New York session, U.S. Dallas Fed Manufacturing business

Index for April is slated for release.

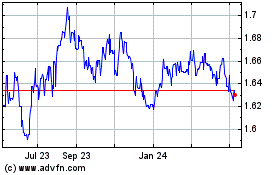

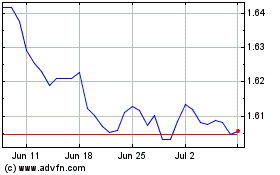

Euro vs AUD (FX:EURAUD)

Forex Chart

From Apr 2024 to May 2024

Euro vs AUD (FX:EURAUD)

Forex Chart

From May 2023 to May 2024