Strong revenue growth at 25% and

solid cash generation

Regulatory News:

Verallia (Paris:VRLA):

Highlights

- Revenue up +24.5% over nine months at €2,518 million

(+24.4% at constant exchange rates and scope)(1), compared

to the first nine months of 2021

- Revenue increase of +26.5% at €879 million in Q3 2022

(+27.5% at constant exchange rates and scope)(1), compared

to Q3 2021

- Adjusted EBITDA rose to €654 million over nine months,

compared to €528 million over 9M 2021 (+24.0%)

- Adjusted EBITDA margin at 26.0% over 9M 2022, vs. 26.1%

over 9M 2021

- Net debt ratio fell to 1.1x adjusted EBITDA for the last

12 months, compared to 1.8x at the end of September 2021 and 1.5x

at the end of June 2022

- Increase in the annual target for adjusted EBITDA to above

€820 million

(1) The revenue growth at constant exchange rates and scope,

excluding Argentina, was +21.5% over 9M 2022 compared to 9M 2021,

and +21.4% in Q3 2022 compared to Q3 2021.

“These excellent third quarter results follow on from a strong

first half. Revenue growth remained high despite the slight

expected decline in volumes due to less available capacity.

Adjusted EBITDA also continued to grow thanks to a positive

inflation spread over the period, the improved operational

efficiency that resulted from our Performance Action Plan, and

unprecedented momentum across Latin America. The lighting of a

second furnace in Jacutinga will take place as planned on November

9th. Higher visibility for the end of the year, coupled with

excellent third-quarter results, puts Verallia in a position to

increase its annual EBITDA targets.” said Patrice Lucas, CEO

of Verallia.

Revenue

In € million

9M 2022

9M 2021

Revenue

2,517.6

2,022.2

Reported growth

+24.5%

Organic growth

+24.4%

In € million

Q3 2022

Q3 2021

Revenue

878.7

694.5

Reported growth

+26.5%

Organic growth

+27.5%

(i) Revenue growth at constant exchange rates and scope. Revenue

at constant exchange rates is calculated by applying the average

exchange rates of the comparative period to revenue for the current

period of each Group entity, expressed in its reporting currency.

The revenue growth at constant exchange rates and scope, excluding

Argentina, was +21.5% over 9M 2022 compared to 9M 2021 and +21.4%

in Q3 2022 compared to Q3 2021.

Over the first nine months of the year, Verallia’s revenue stood

at €2,518 million, compared to €2,022 million over the same

period in 2021, representing a +24.5% increase on a reported

basis.

The impact of exchange rates was positive at +0.1% over

9M 2022 (+€2.1 million), largely due to the stronger Brazilian real

and Eastern European currencies.

At constant exchange rates and scope, revenue rose

sharply over the first nine months of the year, up +24.4%

(+21.5% excluding Argentina), despite volumes declining slightly in

the third quarter. As previously announced, five furnaces are being

renovated during the second half – four in Q3 alone – limiting

Verallia’s available production capacity. The sales price

increases, implemented in Europe in the first half to offset the

sharp rise in production costs, had a positive impact over the

period. Moreover, the strong momentum in terms of pricing policy

and mix in Latin America continued in view of the high inflation in

the region. Product mix also remained robust during the

quarter.

Revenue breakdown by region for the first nine months of the

year:

- In Southern and Western Europe,

sales were up over the first nine months of the year, despite a

slight decline in volumes in the third quarter due to the

simultaneous renovations of several furnaces.

- Northern and Eastern Europe posted

improved revenue for the first nine months of the year. Volumes

were, however, also down slightly during the third quarter.

Verallia’s situation in Ukraine remained similar to during the

first half of the year: one furnace was emptied and cooled in order

to keep it in good condition, while the second is now mainly

focused on producing food jars. As the situation in the country

remains volatile, Verallia’s priority is the safety of its teams

and the needs of its local customers.

- In Latin America, the excellent

momentum seen during the first half continued in the region, in

terms of both volumes and sales prices.

Adjusted EBITDA

In € million

9M 2022

9M 2021

Adjusted EBITDA (i)

654.2

527.6

Adjusted EBITDA margin

26.0%

26.1%

In € million

Q3 2022

Q3 2021

Adjusted EBITDA (i)

228.8

182.9

Adjusted EBITDA margin

26.0%

26.3%

(i) Adjusted EBITDA is calculated on the basis of operating

income adjusted for depreciation, amortisation and impairment,

restructuring costs, acquisition and M&A costs,

hyperinflationary effects, management share ownership plans,

subsidiary disposal‐related effects and contingencies, plant

closure costs and other items.

Adjusted EBITDA rose by +24.0% over the first nine months

of 2022 (and +24.3% at constant exchange rates and scope) to

€654 million. The exchange rates effect was slightly

negative at -€1.7 million.

Despite the continuing rise in production costs, Verallia

managed to generate a positive inflation spread1 of €46.6

million at Group level over the nine-month period, mainly thanks to

Latin America, whereas inflation spread remained slightly negative

in Europe.

The net reduction in production cash costs that resulted from

the PAP over the first nine months of 2022 represented 1.9% of

production cash costs (€22.3 million).

The adjusted EBITDA margin stood at 26.0% for the

first nine months of 2022, despite the mathematic dilutive effect

of the sales price increases seen since the start of the year.

Continued reduction in net

debt

During the first nine months of the year, Verallia continued to

reduce its net debt that amounts to €922 million at

the end of September 2022. This corresponded to a net debt ratio of

1.1x adjusted EBITDA for the last 12 months, down

significantly from 1.8x at the end of September 2021 and 1.5x at

the end of June 2022.

As of 30 September 2022, around 80% of Verallia’s long-term

debt was at a fixed rate (SLB and hedging on Term Loan A –

TLA).

The Group still had high liquidity2 of €1 223 million as

of 30 September 2022.

2022 outlook3

Annual reported revenue growth will reach around 25%.

The new furnace being built in Brazil (in Jacutinga) is expected

to start, as planned, on November 9th.

Thanks to higher year-end visibility, coupled with excellent

third quarter results, the Group has increased its adjusted

EBITDA target for 2022 to above €820 million (compared to

€750–800 million previously).

*************************

An analysts’ conference call will be held on Thursday, 20

October 2022 at 9.00 am (CET) via an audio webcast service (live

and replay) and the results presentation will be available on

www.verallia.com.

Financial calendar

- 17 January 2023: start of the

quiet period.

- 15 February 2023: financial

results for Q4 and 2022 financial year – Press release

after market close and

conference call/presentation the following morning at 9.00 am

CET.

- 29 March 2023: start of the quiet

period.

- 19 April 2023: financial results

for Q1 2023 – Press release after

market close and conference call/presentation the following

morning at 9.00 am CET.

- 25 April 2023: Annual General

Shareholders’ Meeting.

- 4 July 2023: start of the quiet

period.

- 25 July 2023: results for H1 2023

– Press release after market

close and conference call/presentation the following morning

at 9.00 am CET.

- 28 September 2023: start of the

quiet period.

- 19 October 2023: financial results

for Q3 2023 – Press release after

market close and conference call/presentation the following

morning at 9.00 am CET.

About Verallia At Verallia, our purpose is to re-imagine

glass for a sustainable future. We want to redefine how glass is

produced, reused and recycled, to make it the world’s most

sustainable packaging material. We are joining forces with our

customers, suppliers and other partners across the value chain to

develop beneficial and sustainable new solutions for all.

With around 10,000 employees and 32 glass production facilities

in 11 countries, we are the European leader and the world’s

third-largest producer of glass packaging for beverages and food

products. We offer innovative, customised and environmentally

friendly solutions to over 10,000 businesses worldwide.

In 2021, Verallia produced more than 16 billion glass bottles

and jars and recorded a revenue of €2.7 billion. Verallia is listed

on compartment A of the regulated market of Euronext Paris (Ticker:

VRLA – ISIN: FR0013447729) and is included in the following

indices: SBF 120, CAC Mid 60, CAC Mid & Small and CAC

All-Tradable.

Disclaimer

Certain information included in this press release are not

historical facts but are forward-looking statements. These

forward-looking statements are based on current beliefs,

expectations and assumptions, including, without limitation,

assumptions regarding Verallia’s present and future business

strategies and the economic environment in which Verallia operates.

They involve known and unknown risks, uncertainties and other

factors, which may cause actual performance and results to be

materially different from those expressed or implied by these

forward-looking statements. These risks and uncertainties include

those discussed and identified in Chapter 4 “Risk Factors” in the

Universal Registration Document approved by the AMF and available on the Company’s website

(www.verallia.com) and the AMF’s website (www.amf-france.org).

These forward-looking information and statements are no guarantee

of future performance.

This press release includes only summary information and does

not purport to be comprehensive.

Personal data protection

You can unsubscribe from our press release distribution list at

any time by sending your request to the following email address:

investors@verallia.com. Press releases will still be available to

access via the website https://www.verallia.com/en/investors/.

Verallia SA, as data controller, processes personal data for the

purpose of implementing and managing its internal and external

communication. This processing is based on legitimate interests.

The data collected (last name, first name, professional contact

details, profiles, relationship history) is essential for this

processing and is used by the relevant departments of the Verallia

Group and, where applicable, its subcontractors. Verallia SA

transfers personal data to its service providers located outside

the European Union, who are responsible for providing and managing

technical solutions related to the aforementioned processing.

Verallia SA ensures that the appropriate guarantees are obtained in

order to supervise these data transfers outside of the European

Union. Under the conditions defined by the applicable regulations

for the protection of personal data, you may access and obtain a

copy of the data concerning you, object to the processing of this

data and request for it to be rectified or erased. You also have a

right to restrict the processing of your data. To exercise one of

these rights, please contact the Group Financial Communication

Department at investors@verallia.com. If, after having contacted

us, you believe that your rights have not been respected or that

the processing does not comply with data protection regulations,

you may submit a complaint to CNIL (Commission nationale de

l’informatique et des libertés – French regulatory body).

APPENDICES

Key figures for the first nine months

of the year

In € million

9M 2022

9M 2021

Revenue

2,517.6

2,022.2

Reported growth

+24.5%

Organic growth

+24.4%

Adjusted EBITDA (i)

654.2

527.6

Group margin

26.0%

26.1%

Net debt at end of period

921.6

1,213.4

Last 12 months adjusted EBITDA

804.7

678.8

Net debt/last 12 months adjusted

EBITDA

1.1x

1.8x

(i) Adjusted EBITDA is calculated on the basis of operating

income adjusted for depreciation, amortisation and impairment,

restructuring costs, acquisition and M&A costs,

hyperinflationary effects, management share ownership plans,

subsidiary disposal‐related effects and contingencies, plant

closure costs and other items.

Key figures for the third

quarter

In € million

Q3 2022

Q3 2021

Revenue

878.7

694.5

Reported growth

+26.5%

Organic growth

+27.5%

Adjusted EBITDA (i)

228.8

182.9

Adjusted EBITDA margin

26.0%

26.3%

(i) Adjusted EBITDA is calculated on the basis of operating

income adjusted for depreciation, amortisation and impairment,

restructuring costs, acquisition and M&A costs,

hyperinflationary effects, management share ownership plans,

subsidiary disposal‐related effects and contingencies, plant

closure costs and other items.

Change in revenue by type in € million

during the first nine months

In € million

9M 2021 revenue

2,022.2

Volumes

+33.2

Price/Mix

+460.0

Exchange rates

+2.1

9M 2022 revenue

2,517.6

Change in adjusted EBITDA by type in €

million during the first nine months

In € million

9M 2021 Adjusted EBITDA (i)

527.6

Activity contribution

+61.9

Price-mix/costs spread

+46.6

Net productivity

+22.3

Exchange rates

(1.7)

Other

(2.6)

9M 2022 Adjusted EBITDA (i)

654.2

(i) Adjusted EBITDA is calculated on the basis of operating

income adjusted for depreciation, amortisation and impairment,

restructuring costs, acquisition and M&A costs,

hyperinflationary effects, management share ownership plans,

subsidiary disposal‐related effects and contingencies, plant

closure costs and other items.

Reconciliation of operating income to

adjusted EBITDA

In € million

9M 2022

9M 2021

Operating income

432.2

317.0

Depreciation, amortisation and impairment

(i)

215.6

207.4

Restructuring costs

0.4

(1.8)

IAS 29 Hyperinflation (Argentina) (ii)

(2.2)

(2.1)

Management share ownership plan and

associated costs

6.7

7.2

Other

1.4

(0.1)

Adjusted EBITDA

654.2

527.6

(i) Includes depreciation and amortisation of intangible assets

and property, plant and equipment, amortisation of intangible

assets acquired through business combinations and impairment of

property, plant and equipment, including those linked to the

transformation plan implemented in France. (ii) The Group has

applied IAS 29 (Hyperinflation) since 2018.

Financial structure

In € million

Nominal amount or max. amount

drawable

Nominal rate

Final maturity

30 Sept. 2022

Sustainability-Linked Bond – May 2021

(i)

500

1.625%

May 2028

500.5

Sustainability-Linked Bond – November 2021

(i)

500

1.875%

Nov. 2031

500.5

Term Loan A – TLA (i)

500

Euribor +1.25%

Oct. 2024

499.1

Revolving credit facility RCF 1

500

Euribor +0.85%

Oct. 2024

-

Negotiable debt securities (Neu CP)

(i)

400

130.4

Other borrowings (ii)

144.1

Total borrowings

1,774.7

Cash and cash equivalents

853.1

Net borrowings

921.6

(i) Including accrued interests. (ii) o/w IFRS16 leasing

(€45.8m), cash collateral (€50.0m), local debts (€43.5m), factoring

recourse and double cash (€19.9m).

IAS 29: Hyperinflation in

Argentina

Since 2018, the Group has applied IAS 29 in Argentina. The

adoption of this standard requires the restatement of non‐monetary

assets and liabilities and of the statement of income to reflect

changes in purchasing power in the local currency. These

restatements may lead to a gain or loss on the net monetary

position included in the finance costs.

Financial items for the Argentinian subsidiary are converted

into euro using the closing exchange rate for the relevant

period.

In the first nine months of 2022, the net impact on revenue was

+€8.0 million. The hyperinflation impact has been excluded

from Group adjusted EBITDA as shown in the table “Reconciliation of

operating income to adjusted EBITDA”.

GLOSSARY

Activity category: corresponds to

the sum of the change in volumes plus or minus the net change in

inventories.

Organic growth: corresponds to

revenue growth at constant exchange rates and scope. Revenue growth

at constant exchange rates is calculated by applying the average

exchange rates of the comparative period to revenue for the current

period of each Group entity, expressed in its reporting

currency.

Adjusted EBITDA: This is a non-IFRS

financial measure. It is an indicator for monitoring the underlying

performance of businesses adjusted for certain expenses and/or

income which are non-recurring or liable to distort the Company’s

performance. Adjusted EBITDA is calculated on the basis of

operating profit (loss) adjusted for depreciation, amortisation and

impairment, restructuring costs, acquisition and M&A costs,

hyperinflationary effects, management share ownership plans,

subsidiary disposal-related effects and contingencies, plant

closure costs and other items.

Capex: Short for “capital

expenditure”, this represents purchases of property, plant and

equipment and intangible assets necessary to maintain the value of

an asset and/or adapt to market demand or to environmental and

health and safety constraints, or to increase the Group’s capacity.

It excludes the purchase of securities.

Recurring investments: Recurring

Capex represents purchases of property, plant and equipment and

intangible assets necessary to maintain the value of an asset

and/or adapt to market demand and environmental, health and safety

constraints. It mainly includes furnace renovation and maintenance

of IS machines.

Strategic investments: Strategic

investments represent the acquisitions of strategic assets that

significantly enhance the Group’s capacity or its scope (for

example, the acquisition of plants or similar facilities,

greenfield or brownfield investments), including the building of

additional new furnaces. Since 2021, they have also included

investments related to the implementation of the plan to reduce CO2

emissions.

Cash conversion: refers to the

ratio between cash flow and adjusted EBITDA. Cash flow refers to

adjusted EBITDA less Capex.

Free Cash Flow: Defined as the

Operating cash flow – Other operating impact – Interest paid &

other financing costs – Taxes paid.

The Southern and Western Europe

segment comprises production sites located in France, Spain,

Portugal and Italy. It is also designated by its acronym “SWE”.

The Northern and Eastern Europe

segment comprises production sites located in Germany,

Russia, Ukraine and Poland. It is also designated by its acronym

“NEE”.

The Latin America segment comprises

production sites located in Brazil, Argentina and Chile.

Liquidity: calculated as the Cash +

Undrawn revolving credit facilities – Outstanding Neu Commercial

Papers.

Amortisation of intangible assets acquired

through business combinations: Corresponds to the

amortisation of customer relationships recognised upon the

acquisition of Saint-Gobain’s packaging business in 2015 (initial

gross value of €740 million over a useful life of 12 years).

1 Spread represents the difference between (i) the increase in

sales prices and mix applied by the Group after passing the

increase in its production costs on to these prices, if required,

and (ii) the increase in its production costs. The spread is

positive when the increase in sales prices applied by the Group is

greater than the increase in its production costs. The increase in

production costs is recorded by the Group at constant production

volumes and before production gap and the impact of the Performance

Action Plan (PAP). 2 Calculated as the Cash + Undrawn Revolving

Credit Facilities - Outstanding Neu Commercial Papers. 3 It should

be noted that the direct consequences of the conflict in Ukraine

could still change substantially, which is likely to affect

forecasts.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20221019005738/en/

Verallia Press Office Annabel Fuder & Rachel

Hounsinou verallia@wellcom.fr – +33 (0)1 46 34 60 60

Verallia Investor Relations contact Alexandra Baubigeat

Boucheron – alexandra.baubigeat-boucheron@verallia.com

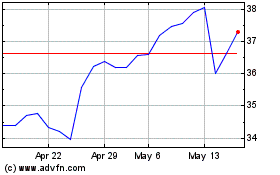

VERALLIA (EU:VRLA)

Historical Stock Chart

From Mar 2024 to Apr 2024

VERALLIA (EU:VRLA)

Historical Stock Chart

From Apr 2023 to Apr 2024