Finance Watch -- WSJ

August 04 2016 - 3:02AM

Dow Jones News

EARNINGS

French Banks Benefit From Visa Share Sale

French banks Crédit Agricole SA and Société Générale SA reported

bigger-than-expected jumps in second-quarter net profit, as the

sale of their Visa Europe shares helped offset pressure from

volatile markets and low interest rates.

Crédit Agricole's net profit rose 26% to EUR1.16 billion ($1.30

billion), while Société Générale's increased 8% to EUR1.46 billion.

Revenue rose 2% at both banks, to EUR4.74 billion at Crédit

Agricole and to EUR6.98 billion at Société Générale.

The Visa Europe stake sale gave Crédit Agricole a gain of EUR328

million and Société Générale EUR725 million.

--Noemie Bisserbe

M&A ACTION

SGX to Make Offer for Storied Exchange

Singapore Exchange Ltd. will make a formal offer for Baltic

Exchange Ltd. by the middle of this month in a move that could see

another historic London marketplace end up in foreign hands, people

involved in the matter said.

The 272-year-old Baltic Exchange is credited with helping expand

British trade during the country's imperial heyday.

SGX was a late entrant in the race. Other suitors included

Platts, a division of S&P Global Inc.; CME Group Inc., which

operates the Chicago Mercantile Exchange; and state-run

conglomerate China Merchants Group, the people said. SGX and Baltic

began exclusive talks May 25.

The transaction, if completed, would represent the second sale

in recent years of a storied London exchange to an Asian operator.

In 2012, Hong Kong Exchanges & Clearing Ltd. bought the London

Metal Exchange.

--Costas Paris

EXCHANGES

ICE Gets Boost From Recent Deals

Exchange operator Intercontinental Exchange Inc. logged

bigger-than-expected increases in profit and revenue for the second

quarter, as the company continues to reap the benefits of recent

acquisitions and as trading volume picked up.

In the latest quarter, Interactive Data Corp., which ICE bought

last year, continued to drive results. Revenue from data services

more than doubled from a year earlier to $497 million, thanks to

the addition of $265 million from IDC and London-based

Trayport.

ICE reported a profit of $357 million, or $2.98 a share, up from

$283 million, or $2.54 a share, a year earlier. Revenue increased

37% to $1.5 billion.

--Lisa Beilfuss, Bradley Hope

GAM HOLDING

Drop in Fees Causes Profit to Decline 46%

Swiss money manager GAM Holding AG said a slump in performance

fees led to a sharp fall in first-half profit, causing its shares

to drop 15% Wednesday.

GAM, which issued a profit warning in June, said performance

fees for the first half were 1.2 million Swiss francs ($1.24

million), compared with 44.1 million francs a year earlier. That

pushed underlying profit before taxes down 46% to 55 million

francs.

Clients pulled a net 5.6 billion francs from GAM's main unit.

Almost half of that came from absolute-return funds, which aim to

profit in all market conditions.

--Laurence Fletcher

(END) Dow Jones Newswires

August 04, 2016 02:47 ET (06:47 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

Rothschild (EU:ROTH)

Historical Stock Chart

From Apr 2024 to May 2024

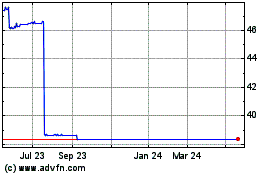

Rothschild (EU:ROTH)

Historical Stock Chart

From May 2023 to May 2024