- Consolidated sales of €100.2 million, +14.0% at constant

exchange rates

- Increase in EBITDA to €26.1 million (+18.7%), EBITDA margin of

26.1%

- Recurring operating profit of €10.3 million

- Cash position of €37.2 million at end-June 2023

Regulatory News:

Amplitude Surgical (ISIN: FR0012789667, Ticker: AMPLI, eligible

for PEA-PME plans) (Paris:AMPLI), a leading French player on the

surgical technology market for lower-limb orthopedics, announces

its 2022-23 annual results.

Olivier Jallabert, Amplitude Surgical’s CEO, commented:

“Group sales for the 2022-23 financial year were up by 14.0% on the

previous year at constant exchange rates. Activity notably improved

thanks to revenue growth of 15.8% in France, which benefited from a

favorable sales dynamic. This growth in activity and good control

over operating costs led to an 18.7% increase in EBITDA to €26.1

million. The recurring operating profit rose to €10.3 million. The

disposal of Novastep’s activities enabled the Group to reduce its

debt and strengthen its financial structure, which will allow it to

continue its sales development momentum and its investments in

technological projects”.

Financial summary – actual exchange rates:

In June 2022, the Board of Directors issued a recommendation

that a strategic review of the Group’s foot and ankle activities be

launched. On June 29, 2023, the Group announced the completion of

the sale of Novastep SAS and Novastep Inc. Therefore, for both

financial years, the Group has applied IFRS 5 “Non-current assets

held for sale and discontinued activities”. The contribution of

Novastep’s activities to the Group’s net profit for 2023 and the

proceeds of the divestment are thus presented on a single line as

Profit/loss from discontinued activities.

€ millions – IFRS

2022-23

2021-2022

Δ

Sales

100.2

87.6

14.4%

Gross margin

70.9

62.7

13.0%

as a % of sales

70.7%

71.6%

-89 bps

Sales & Marketing costs

29,7

27,3

8.5%

General & Administrative costs

13.3

11.5

15.4%

Research & Development costs

1.8

1.8

-3.3%

EBITDA

26.1

22.0

18.7%

as a % of sales

26.1%

25.1%

+95 bps

Recurring operating profit/loss

10.3

6.8

Non-recurring operating income and

expenses

-2.3

-1.8

Operating profit/loss

8.0

4.9

Financial profit/loss

-14.0

-6.6

Current and deferred tax

-0.8

-1.2

Profit/loss from discontinued

activities, after tax

45.3

-2.0

Net profit/loss - Group share

39.2

-4.4

Net financial debt

69.3

118.0

Net cash position at end of

period

37.2

21.0

EBITDA up by 18.7% with an EBITDA margin of 26.1%

During its 2022-23 financial year, Amplitude Surgical recorded

sales of €100.2 million, up 14.4% in actual terms and 14.0% at

constant exchange rates. The Group benefited from a favorable sales

dynamic in France throughout the year and from the growth of its

international activities.

Amplitude Surgical generated a gross margin of 70.7%, down 89

bps, primarily impacted by an increase in the cost prices of its

products.

The Group’s operating expenses totaled €44.7 million, an

increase of 9.9% on the previous year, given the growth in

sales.

Sales & Marketing spending was up 8.5%, due to the growth in

activity leading to a higher level of commissions, notably in

France.

General & Administrative spending rose by 15.4% to €13.3

million, with an increase in personnel costs and in expenses

notably for quality control and regulatory activities.

R&D costs booked as expenses represented 1.8% of sales,

compared with 2.1% the previous year. However, including

capitalized R&D spending, the Group’s global investment in

R&D increased, rising from €4.0 million in 2021-2022 to €4.9

million in the year to June 30, 2023.

Amplitude Surgical had a workforce of 426 staff at end-June 2023

compared with 389 at end-June 2022, an increase of 9.5%. Personnel

costs were up by 12.2% on the previous year.

EBITDA was thus €26.1 million, up 18.7%, giving an EBITDA margin

of 26.1% in 2022-23, an improvement of 95 bp compared with

2021-22.

The Recurring Operating Profit was €10.3 million, versus €6.8

million the previous year, driven by the positive sales trend and

the limited increase in operating costs.

The Operating Profit was €8.0 million in 2022-23 versus €4.9

million in 2021-22.

The financial result was -€14.0 million and consisted primarily

in an interest expense of €11.1 million and the booking of a net

currency loss of €3.6 million.

The profit from discontinued activities was €45.3 million at

June 30, 2023, and corresponds to the net impact of the divestment

of Novastep’s activities.

The Net Result (Group share) was a profit of €39.2 million,

versus a loss of €4.4 million the previous year.

Financial structure: cash position of €37.2 million at

end-June 2023

Net cash flow generated by operating activity totaled €8.1

million, versus €8.0 million in 2021-22.

Investments (excluding the impacts of the Novastep divestment)

totaled €19.4 million in 2022-23 compared with €12.1 million a year

earlier.

The proceeds of the sale of Novastep’s activities generated

approximately €68 million for the Group.

At the end of June 2023, the Group thus had cash and cash

equivalents of €37.2 million.

Net Financial Debt was €69.3 million, giving gearing (Net

Financial Debt over Shareholders’ Equity) of 0.72, compared with

2.24 at the end of June last year.

Key 2022-23 events

- On June 29, 2023, the Amplitude Group announced the completion

of the divestment of its Novastep subsidiaries to Enovis

Corporation. The proceeds of this sale received by the Group

totaled €68 million including €39.2 million of capital gains on the

sale received by Amplitude SAS.

- Partial redemption of the bond issue

- Amplitude Surgical undertook the partial redemption of its

bond issue for a nominal amount of €110 million, to the tune of €40

million, including €37.5 million corresponding to the principal and

€2.5 million to capitalized interest. The remaining bond debt at

June 30, 2023, before deduction of the costs of the issue and the

fair value of the hedging instruments, was €72.5m.

- URSSAF audits on tax on the promotion of medical

devices

- In a decision dated July 11, 2023, the Court of Valence

dismissed Amplitude SAS's claim for cancellation of the

reassessment in the fourth dispute concerning the medical device

promotion tax for the period from July 1, 2017 to June 30, 2020.

The court confirmed the reassessment and ordered the company to pay

URSSAF Rhône Alpes €5.9 million, including €5.5 million in

principal and €0.4 million in late payment surcharges. Amplitude

SAS has appealed this decision.

- Dispute with Zimmer Biomet

- In May 2023, the Court of Cassation rejected the appeal lodged

by Zimmer Biomet against Amplitude SAS, thus ending the dispute

over alleged unfair competition.

Outlook

For the 2023-24 financial year, the Group anticipates sales

growth of around 10%, with a stable EBITDA margin of around

26%.

Next press release:

Q1 2023-24 sales, on Thursday November 23, 2023, after

market.

About Amplitude Surgical

Founded in 1997 in Valence, France, Amplitude Surgical is a

leading French player on the global surgical technology market for

lower-limb orthopedics. Amplitude Surgical develops and markets

high-end products for orthopedic surgery covering the main

disorders affecting the hip and knee. Amplitude Surgical develops,

in close collaboration with surgeons, numerous high value-added

innovations in order to best meet the needs of patients, surgeons

and healthcare facilities. A leading player in France, Amplitude

Surgical is developing abroad through its subsidiaries and a

network of exclusive distributors and agents distributing its

products in more than 30 countries. As of June 30, 2023, Amplitude

Surgical employed 426 people and generated sales of nearly 100.2

million euros.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20231018060704/en/

Amplitude Surgical CFO Dimitri Borchtch

finances@amplitude-surgical.com +33 (0)4 75 41 87 41

NewCap Investor Relations Thomas Grojean

amplitude@newcap.eu +33 (0)1 44 71 94 94

NewCap Media Relations Nicolas Merigeau

amplitude@newcap.eu +33 (0)1 44 71 94 98

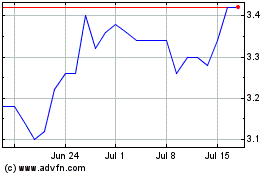

Amplitude Surgical (EU:AMPLI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Amplitude Surgical (EU:AMPLI)

Historical Stock Chart

From Apr 2023 to Apr 2024