Bitcoin MVRV Ratio Approaches 1.5 Level, Will Break Happen?

March 30 2023 - 11:30AM

NEWSBTC

On-chain data shows the Bitcoin MVRV ratio is approaching a retest

of the 1.5 level, breaking above which may be bullish for the

asset’s price. Bitcoin MVRV Ratio Has Been Going Up In Recent Days

As explained by an analyst in a CryptoQuant post, the 1.5 level of

the metric has held significant importance in the past. The “MVRV

ratio” is an indicator that measures the ratio between the market

cap of Bitcoin and its realized cap. The “realized cap” here refers

to a capitalization model for BTC that assumes that each coin in

the circulating supply has its real value the same as the price at

which it was last moved or transferred on the blockchain. Since the

MVRV ratio compares the market cap (that is, the normal price of

BTC) with this fair-value model, the ratio’s value can provide

hints about whether BTC is currently aptly valued or not. When the

value of the indicator is higher than one, it means the asset’s

market cap is greater than its realized cap right now. Such a trend

can imply the cryptocurrency may be overvalued currently. On the

other hand, the metric having values below this threshold suggest

the fair value of BTC is above its current price, and hence, the

coin may be undervalued at the moment. Now, here is a chart that

shows the trend in the Bitcoin MVRV ratio over the last few years:

Looks like the value of the metric has observed a rapid rise

recently | Source: CryptoQuant As you can see in the above graph,

the quant has highlighted the relevant portions of the trend for

the Bitcoin MVRV ratio. The region below 1, as mentioned earlier,

is the undervalued zone where bottoms have historically formed for

the coin. Cyclical tops, however, haven’t generally formed in the

zone above 1, but rather at much higher values like 3 or more.

Following the COVID crash back in 2020, the MVRV bounced out of the

underpriced region and showed some constant upwards momentum, until

it reached higher than 3.75, and the top of the bull run in the

first half of 2021 was formed. Related Reading: Bitcoin Net Taker

Volume Nears In On Bullish Crossover After that, in the May-July

2021 mini-bear period, the indicator took a plunge and hit a value

of around 1.5. The level, however, provided support to the metric

and helped it make a sharp recovery, which ultimately culminated in

the November 2021 Bitcoin all-time high price. When the transition

towards the bear market started to take place, the MVRV ratio

plummeted to the 1.5 level again, but the line once again helped

the indicator hold on. This time, however, after sideways movement

around the level, the indicator eventually plunged below it as the

market crash due to the LUNA collapse occurred. The decline also

continued later with the Three Arrows Capital (3AC) collapse, and

the metric found itself inside the undervalued region again. The

ratio spent a while in this zone until the latest rally came and

finally pulled it out of there. This escape above the region may

suggest that at least the worst of the bear market may be over for

now. With the sharp rise in BTC recently, the MVRV ratio has also

naturally continued to go up and is now approaching the 1.5 level

which it had multiple encounters within the last few years. Related

Reading: Here Are The Altcoins That Are Outperforming Bitcoin It’s

possible that the coin could find resistance here and be rejected

back downwards. The quant believes, however, that if a breach does

happen here, then Bitcoin might be able to sustain its bullish

momentum. BTC Price At the time of writing, Bitcoin is trading

around $28,600, up 4% in the last week. BTC has sharply gone up

over the last two days | Source: BTCUSD on TradingView Featured

image from Dmitry Demidko on Unsplash.com, charts from

TradingView.com, CryptoQuant.com

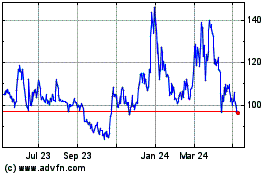

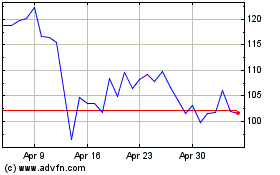

Quant (COIN:QNTUSD)

Historical Stock Chart

From Apr 2024 to May 2024

Quant (COIN:QNTUSD)

Historical Stock Chart

From May 2023 to May 2024