Internet Computer (ICP) Dips, Will Bearish Momentum Persist?

May 18 2023 - 12:00PM

NEWSBTC

The price of Internet Computer (ICP) experienced a downward

movement dropping by 41.98% to a low of $5.05 on April 26, 2023.

This was after a significant surge from April 10 to April 19, when

it started the downtrend. This price decline affected the

market sentiment of Investors and traders. Since the beginning of

this month, ICP has exhibited range-bound behavior. ICP price has

fluctuated between $6 – $5, resulting in a sideway price movement.

The question is whether the bearish momentum will continue or if

there’s a chance for a reversal soon. Bears To Hold Current Trend,

Or Will The Bulls Rebuild Momentum? According to data, ICP

experienced a slight price increase, reaching $5.34, representing a

2.7% increase within the last 24-hour trading period. This increase

suggests that demand has surpassed supply in the market. This might

attract more buyers and also increase the overall market

confidence. Related Reading: PEPE Unlikely To Be As Big As DOGE

& SHIB, Says Santiment The total market cap of ICP is also up

today by 2.58%, representing a value of over $2 million. The growth

in market cap was potentially driven by an increase in demand or

positive market sentiment. The 24-hour trading volume surged by

21.81% overnight, rising to about $19 million. The Internet

Computer Fear & Greed Index is 50 based on investor sentiment

and market psychology. A value of 50 suggests that neither fear nor

greed is dominant among traders and investors. Based on the recent

increase in the overall ICP’s price movement, the bulls are

gradually taking control of the market. If this momentum persists,

ICP might rise significantly in the next few weeks. ICP Technical

Outlook Using Indicators The asset is trading above its 200-Day

Simple Moving Average (SMA). This indicates a long-term bullish

trend and presents a potential buy opportunity for traders and

investors. While ICP’s long-term prospects are bullish, there may

be potential short-term uncertainties that need to be considered by

traders. For instance, the Relative Strength Index is showing

47.46. This shows that there’s market indecision between buyers and

sellers. Also, the pressure currently in the market is

neutral. Also, the Moving Average Convergence/Divergence

(MACD) indicates a potential bearish trend as the MACD is trading

below its signal line. Related Reading: Historical Crossover

Suggests Ethereum (ETH) Top Is In Moreover, ICP is below its 50-Day

Simple Moving Average (SMA), a bearish indication based on the

short-term price movement. The current price trend, as indicated by

the ICP chart, suggests a possibility of further decline in the

short term. But it remains uncertain if this trend will continue or

if the bulls will regain dominance as more developments on the

network could spike adoption and usage. Internet Computer now

trades between its direct support and resistance levels of

$4.923 and $6.860. The next significant support level is $3.302,

while the resistance level is $8.251. If the bulls maintain this

growing momentum, ICP might break the primary resistance level of

$6.860 before heading toward the next resistance level. Featured

image from Pixabay and chart from Tradingview

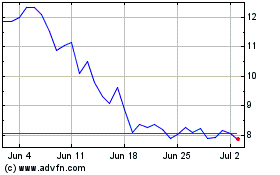

Internet Computer (COIN:ICPUSD)

Historical Stock Chart

From Mar 2024 to Apr 2024

Internet Computer (COIN:ICPUSD)

Historical Stock Chart

From Apr 2023 to Apr 2024