Italian Oil Giant Eni Forfeits $24.5 Million to Resolve Bribery Probe --Update

April 21 2020 - 12:46PM

Dow Jones News

By Dylan Tokar

Eni SpA has settled allegations in the U.S. that a subsidiary

used sham contracts with an intermediary to improperly win

contracts from an Algerian state-owned oil company.

The Italian oil-and-gas giant agreed to pay $24.5 million to

resolve alleged violations of the Foreign Corrupt Practices Act,

according to the U.S. Securities and Exchange Commission.

The company neither admitted nor denied wrongdoing in the

settlement reached Friday. A spokesperson for Eni confirmed the

settlement.

The contracts at the center of the SEC's bribery allegations

were arranged by subsidiary Saipem SpA, in which Eni then held a

43% controlling stake, between 2007 and 2010, according to the SEC.

The contracts were drawn up with the knowledge and participation of

Saipem's former chief financial officer who in 2008 was hired as

Eni's chief financial officer, the regulator said.

Alessandro Bernini served as Saipem's CFO from 1996 to 2008. He

later served as CFO of Eni until departing the company in 2012.

Reached by email for comment, Mr. Bernini -- who wasn't referred

to by name in the SEC order -- said an appeals court in Milan had

cleared him of wrongdoing after finding that no illegal payments

had been made.

After this article was published, Mr. Bernini said in an email

that he was not the decision maker at Saipem. "I was not

responsible for the commercial activities, I never had any

involvement in the Algerian operations," he said. He added that he

didn't promote the contract of any commercial agent.

The SEC doesn't typically name individuals or entities in

settlements whom it hasn't charged with wrongdoing.

Saipem and Mr. Bernini were found guilty of international

corruption charges in 2018, but a Milan appeals court in January

reversed the convictions. Italian prosecutors may ask the Supreme

Court of Italy to review the acquittals, the SEC said.

The U.S. Justice Department also investigated Eni's Algeria

activities, but federal prosecutors in October told the company

that they were closing the probe without bringing criminal

charges.

Saipem paid about EUR198 million ($215 million) to the unnamed

intermediary between 2007 and 2010, according to the SEC. The

intermediary directed at least a portion of that money, through

offshore shell entities, to Algerian officials, including the

country's minister of energy, the regulator alleged. The company

deducted the payments from its taxable income in Italy, the SEC

said.

The alleged scheme violated provisions of the FCPA that require

companies with shares listed on a U.S. stock exchange to keep

accurate books and records and maintain internal accounting

controls, according to the SEC.

Eni required Saipem to maintain its own internal controls and to

adopt Eni's directives on anti-corruption compliance. But Mr.

Bernini and others at Saipem bypassed its contracting and

procurement controls, including by falsifying and backdating

contracts, the SEC said.

Mr. Bernini allegedly communicated directly with the

intermediary, including its owner and associates, involved himself

in payments to the entity and worked to conceal the contracts from

Eni. The owner of the intermediary was a well-connected Algerian

whom the country's energy minister at the time considered like a

"son," the SEC said.

In his email to The Wall Street Journal, Mr. Bernini said his

involvement in the approval process of the contracts was limited to

the collection of certain documents, and that nothing was falsified

or backdated.

Mr. Bernini said he also had limited involvement with the

intermediary after transitioning from his role as Saipem's CFO. He

had received a few invoices from the intermediary by mistake, which

he simply forwarded to Saipem's new CFO, he said.

"I have represented those contracts in the financial statements

of the legal entities, as well as in the consolidated financial

statements, in the most proper way by using a specific account and

disclosing clearly the costs in the footnotes of the financial

report," Mr. Bernini said in an email following the initial

publication of this article.

"Internal and external auditors have scrutinized every year

those contracts in detail thanks to my transparent approach on the

subject and they never raised any comment or observation," he

added.

The Algerian state-owned oil company, Sonatrach, did not

immediately return a request for comment.

Eni in March said it had successfully completed a gas pipeline

in southeastern Algeria with Sonatrach.

Authorities in the U.S. and Italy have also scrutinized Eni's

acquisition in 2011 of rights to an offshore oil block in

Nigeria.

With Friday's settlement, the SEC informed Eni that it has now

closed its investigation into the company, including with respect

to the Nigeria allegations, the Eni spokesperson said.

Write to Dylan Tokar at dylan.tokar@wsj.com

(END) Dow Jones Newswires

April 21, 2020 12:31 ET (16:31 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

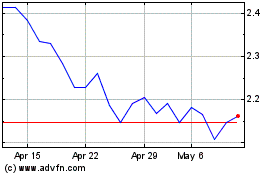

Saipem (BIT:SPM)

Historical Stock Chart

From Mar 2024 to Apr 2024

Saipem (BIT:SPM)

Historical Stock Chart

From Apr 2023 to Apr 2024