UPDATE: EDF Makes Offers To Gain Total Control Of Edison

October 24 2011 - 8:51AM

Dow Jones News

French state-controlled power giant Electricite de France SA

(EDF.FR) Monday offered to buy its Italian partners out of Italian

power company Edison SpA (EDN.MI), in a move aimed at gaining full

control of the utility after nearly two years of haggling over its

strategy and management.

EDF, which is 85%-owned by the French state, said it offered to

buy out investment vehicle Delmi from Edison, although it came

short of elaborating on an exact price per share.

Last week, a person familiar with the matter told Dow Jones

Newswires that EDF turned down a request from Delmi to be bought

out of Edison for EUR1.55 a share. Sunday, Italian business daily

Il Sole 24 Ore reported that EDF was ready to offer EUR1.15 and

EUR1.30 a share.

Edison is 61.3% held by Transalpina di Energia, itself 50% held

by EDF and 50% by Delmi, which in turn regroups Italian

shareholders led by A2A SpA (A2A.MI) and including Iren SpA

(IRE.MI). EDF owns 19% in Delmi.

No-one at Delmi, A2A nor Iren was immediately available to

comment.

EDF proposed to buy Delmi's Edison shares in three years time,

at a price based on the earnings before interest, tax, depreciation

and amortization, or Ebitda, multiple of a sample of comparable

listed companies.

"In this manner, the Italian partners which may wish to be able

to sell their shares could benefit from Edison's profitability

restructuring efforts," the group said.

Also Monday, EDF offered A2A and Iren SpA (IRE.MI) to exchange

their respective 20% and 10% stakes in Edipower for 100% of the

share capital of Edens, a fully-owned subsidiary of Edison and the

fourth-largest Italian producer of electricity from renewable

sources. A2A and Iren would also be granted a call option to

acquire a hydro-generation facility at Mese at fair market value in

three years, EDF said.

"On the basis of this framework, EDF would ask [Italian

regulatory body] CONSOB for an exemption from any obligation to

launch a mandatory tender offer for Edison's remaining share

capital," the group also said.

EDF and Edison's Italian shareholders have been entangled in

long talks over the utility's fate, trying to reach a deal that

would give clear control of the Italian utility. The most recent

deadline for an agreement is Oct. 31.

Earlier this year EDF reached a preliminary agreement with A2A

that would have allowed the French utility to take control of

Edison and let A2A acquire some hydroelectric assets. However, the

agreement was botched by the Italian government, forcing them to

renew talks to find another solution.

At 1150 GMT, shares in EDF were trading up 0.6% at EUR22.67,

while the CAC-40 benchmark index was down 0.1%. Shares in Edison,

after having been briefly suspended during the session, resumed

trading and were down 5.4% to EUR0.89.

-By Geraldine Amiel, Dow Jones Newswires; +33 1 40171767;

geraldine.amiel@dowjones.com

(Oscar Bodini from MF-DJ in Milan contributed to this story)

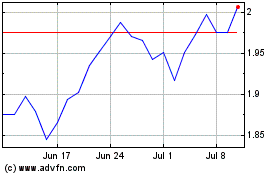

Iren (BIT:IRE)

Historical Stock Chart

From Mar 2024 to Apr 2024

Iren (BIT:IRE)

Historical Stock Chart

From Apr 2023 to Apr 2024