EDF Plans To Buy Delmi Out Of Edison, No Price Set

October 24 2011 - 7:46AM

Dow Jones News

French state-controlled power group Electricite de France SA

(EDF.FR) Monday said it has offered to buy out investment vehicle

Delmi from Edison SpA (EDN.MI), although it came short of

elaborating on an exact price per share.

Edison is 61.3% held by Transalpina di Energia, itself 50% held

by EDF and 50% by Delmi, which in turn regroups Italian

shareholders led by A2A SpA (A2A.MI). EDF owns 19% in Delmi.

EDF said it proposed to commit to buy Delmi's Edison shares in

three years time, at a price based on the earnings before interest,

tax, depreciation and amortization, or Ebitda, multiple of a sample

of comparable listed companies.

"In this manner, the Italian partners which may wish to be able

to sell their shares could benefit from Edison's profitability

restructuring efforts," the group said.

EDF also offered A2A and Iren SpA (IRE.MI) to exchange their

respective 20% and 10% stakes in Edipower for 100% of the share

capital of Edens, a fully-owned subsidiary of Edison and the

fourth-largest Italian producer of electricity from renewable

sources. A2A and Iren would also be granted a call option to

acquire a hydro-generation facility at Mese at fair market value in

three years, EDF said.

"On the basis of this framework, EDF would ask [Italian

regulatory body] CONSOB for an exemption from any obligation to

launch a mandatory tender offer for Edison's remaining share

capital," the group also said.

-By Geraldine Amiel, Dow Jones Newswires; +33 1 40171767;

geraldine.amiel@dowjones.com

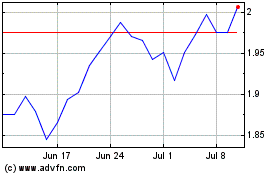

Iren (BIT:IRE)

Historical Stock Chart

From Mar 2024 to Apr 2024

Iren (BIT:IRE)

Historical Stock Chart

From Apr 2023 to Apr 2024