STX Offshore Sale Halted

November 25 2016 - 4:10AM

Dow Jones News

SEOUL—The sale of South Korea's STX Offshore & Shipbuilding

Co. has been halted after a Seoul bankruptcy court handling the

case disqualified a bidder that hoped to buy all of the company's

assets as a package.

A U.K. investment fund, which earlier this month submitted a

letter of intent to buy all of STX Offshore's assets, including

shipyards in Korea and abroad, dropped out of the race because it

couldn't demonstrate how it could raise needed money, a judge and

spokesman for the Seoul Central District Court said Friday.

"We'll have to restart the sale process for STX sometime next

year by inviting bids again," he said.

But the judge said the sale of STX France—STX Offshore's

profitable French unit, which makes cruise ships—will proceed as

scheduled.

Earlier this month, the court said that it received four bids

and hoped to see a deal concluded by the end of year.

Bidders had the choice of purchasing STX Offshore, the French

unit and another South Korea-based shipyard separately or as a

package.

The three other bidders—Italian shipbuilding giant Fincantieri

SpA, Dutch counterpart Damen Shipyards Group and French

state-controlled naval shipbuilder DCNS—showed interest only in

STX's French unit, the sole profitable asset of the Korean

shipbuilder. STX France has a full order book for the next seven

years.

The three parties are required to submit their binding takeover

proposals by Dec. 27.

The sale of STX France is a key part of the restructuring plan

by STX—Korea's fourth largest shipbuilder— which filed for

receivership in May and owns two-thirds of the French unit.

Creditors have pumped in billions of dollars to bail out STX

Offshore, but it still ran up a 314 billion won ($265.6 million)

operating loss last year, following a 1.5 trillion won loss in

2014. The company owes financial institutions nearly six trillion

won.

Korea is home to the world's three largest shipyards: Hyundai

Heavy Industries Co., Daewoo Shipbuilding & Marine Engineering

Co. and Samsung Heavy Industries Co. All three are undergoing

corporate overhauls that include layoffs and the sale of noncore

assets, after being buffeted by shrinking orders amid weak freight

rates and competition from lower-cost Chinese rivals.

Write to In-Soo Nam at In-Soo.Nam@wsj.com

(END) Dow Jones Newswires

November 25, 2016 03:55 ET (08:55 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

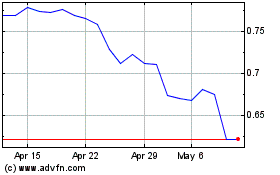

Fincantieri (BIT:FCT)

Historical Stock Chart

From Mar 2024 to Apr 2024

Fincantieri (BIT:FCT)

Historical Stock Chart

From Apr 2023 to Apr 2024