Italy Raises $3.8 Billion From Poste IPO

October 23 2015 - 7:40AM

Dow Jones News

MILAN—The Italian government completed the sale on Friday of a

minority stake in postal service Poste Italiane, the largest of a

string of privatizations Prime Minister Matteo Renzi is pressing

ahead with and a major test of his ability to convince foreign

investors Italy is on the road to recovery.

The offer, the first large sale of shares in government-owned

companies in 16 years, generated around €3.4 billion ($3.8 billion)

in much-needed cash for the government and was priced at €6.75 per

share—at the mid-point of the price range initially indicated,

valuing the business at roughly €8.8 billion.

"It was a great success," said Italy's Economy Minister Pier

Carlo Padoan. "It confirms the markets' confidence in our

country."

The sale of Poste was seen as a test case for Mr. Renzi's

government efforts to privatize state behemoths as it tries to

reduce the country's public debt, the second-largest of the euro

zone after Greece. The positive result of the sale could

reinvigorate these efforts, after the flop of shipmaker Fincantieri

SpA's initial public offering, where the shares offered were cut by

a third and priced at the bottom of its price range in June 2014.

That deal started the Renzi government's privatization effort off

on the wrong foot.

One of the main reasons behind the Fincantieri's problematic

sale, according to brokers, was the decision not to pay dividends

for the first three years. The government said at the time that

difficult market conditions undermined the outcome.

After Poste, the government plans to list a 49% stake in

air-traffic-control operator ENAV SpA in the first half of next

year and to partially privatize state railways Ferrovie dello Stato

Italiane Group. It said it is also considering selling a stake in

highway maintenance agency Anas in the future.

The planned transactions will help reduce the country's debt,

seen this year at 132.8% of gross domestic product, by 0.4% of the

country's GDP this year and 0.5% each of the following three years,

the government said in its budget law it approved last week. For

this year, it said the target appears to be within reach.

Privatizations are one of the main points of Mr. Renzi's

reformist agenda. The timing of the Poste IPO is also relatively

good, with the Italian economy expected to grow 0.9% this year,

exiting a three-year long recession—the longest since World War

II.

Yet, the recovery is too timid to shake off decades of

stagnation and Mr. Renzi still needs to prove to investors and

policymakers that he can reinvigorate the Italian economy.

The outcome of the â,¬12 billion privatization plan—which Mr.

Renzi inherited from the previous government—has been disappointing

so far. Last May, the International Monetary Fund warned Rome that

its progress in reducing debt remains insufficient and urged it to

take advantage of favorable market conditions to be more ambitious

in its privatization targets.

Despite only reducing slightly Italy's debt, the Poste's IPO

represents what Mr. Renzi's called "a change of direction" in his

push for the modernization of the country. The young prime minister

hopes it could help show that, thanks to his broad economic

overhauls, Italy is able to attract foreign capital again.

The government promised a hefty dividend payout for the next two

years to entice investors at a time of low interest rates. This

corresponds to around a 5% yield at the pricing of the IPO,

compared with 2% to 3% for large Italian banks and 0.2% for

two-year government bonds, making the investment quite appealing,

said Giacomo Tilotta, fund manager at AcomeA SGR.

Now, the government is facing a decision as to whether to list

the whole Ferrovie Group--which includes the railway network, a

train operating business and a vast real estate business made up by

the stations—or only part of it, but keeping control of the railway

grid.

Advocates for listing a stake in the entire holding company,

such as Ferrovie's Chief Executive Michele Elia, argue the company

now benefits from cross-synergies among the various businesses.

For instance, the train operating business can currently borrow

more easily because it can guarantee its debts with the vast

amounts of assets the holding owns, such as the railway grid, said

Paolo Beria, a professor in Transport economics at Milan's

Polytechnic.

Others, such as Transport Minister Graziano Delrio, say it would

be preferable to spin off the railway grid and maintain it into

public hands, as it represents a public good.

"There's an ongoing discussion within the government and with

the interested parties," said Fabrizio Pagani, head of the office

of the Economy Ministry.

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

October 23, 2015 07:25 ET (11:25 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

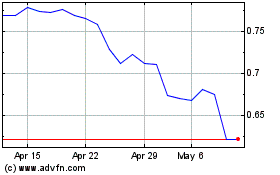

Fincantieri (BIT:FCT)

Historical Stock Chart

From Mar 2024 to Apr 2024

Fincantieri (BIT:FCT)

Historical Stock Chart

From Apr 2023 to Apr 2024