UPDATE: OZ Minerals Receives Fresh Proposal From Minmetals

March 30 2009 - 10:49PM

Dow Jones News

OZ Minerals Ltd. (OZL.AU) said Tuesday it received a fresh

proposal from China Minmetals Nonferrous Metals Co. that would see

the Chinese group acquire most of the embattled miner's assets but

not Prominent Hill.

The Australian government last week blocked Minmetals' A$2.6

billion takeover offer for OZ on the grounds that Prominent Hill is

in a military zone in South Australia state.

"OZ Minerals has received an alternative incomplete proposal

from Minmetals which, when completed, will result in Minmetals

acquiring all of OZ Minerals' assets except for Prominent Hill,

Martabe and the company's portfolio of listed assets," OZ said in a

statement.

A new Minmetals offer excluding Prominent Hill will be a fresh

test of the Australian government's attitude to a surge of

investment by Chinese government-backed entities in the nation's

key mining sector, most notably Aluminum Corp. of China's US$19.5

billion investment in Rio Tinto Ltd. (RTP).

OZ has A$1.1 billion in debt due Tuesday and said it expects

negotiations with lenders on an extension "will be completed

satisfactorily having regard to the proposal".

The Melbourne-based miner said it will make a definitive

announcement on refinancing negotiations before the commencement of

trading Wednesday and will try to make a definitive announcement on

the new Minmetals proposal within the same timeframe.

The new proposal from Minmetals involves the purchase of assets

rather than a takeover offer and OZ Executive General Manager

Business Support Bruce Loveday said it would see the miner continue

to trade as a listed entity.

"We think if this transaction completes there is very

definitively a very vibrant existence in the future for a somewhat

smaller OZ Minerals," he said.

Loveday said the Minmetals deal would provide a "complete

solution" to OZ's refinancing issues and the miner would have some

cash left over.

"Some of the proceeds would be used to deal with OZ Minerals'

debt situation and the residual amount would be cash available to

the company," he said.

"The value of OZ minerals in reduced form going forward

therefore would be based on Prominent Hill, Martabe, the listed

assets and the net cash position."

Minmetals confirmed it has made an incomplete offer to OZ that

excludes Prominent Hill, Martabe and OZ's investments in listed

entities.

"Minmetals believes it will bring stability to the operations

which it wants to buy and brings greater certainty to OZ Minerals

employees," the Chinese group said in a statement.

Parallel to the Minmetals offer, OZ has been carrying out a

sales process for its Martabe and Golden Grove assets.

Loveday said Martabe had been left out of the revised proposal

in part because it was of little interest to Minmetals and in part

because of advanced negotiations over the sale of the mine to a

third party.

"The sale process is fairly well advanced and it was essentially

carved out to enable that to complete in the event that for

whatever reason this transaction ran into some obstacles," he

said.

OZ Minerals had been seeking an extension from its lenders to

Sep. 15, but this related to the closing date of the previous

Minmetals offer, and the miner isn't saying what date it is now

seeking an extension until.

Loveday also declined to comment on whether OZ has received any

expressions of interest in Prominent Hill since the government

rejected the Minmetals proposal, with BHP Billiton Ltd. (BHP.AU)

seen by some analysts as a potential buyer of the mine.

-By Alex Wilson, Dow Jones Newswires; 61-3-9292 2094;

alex.wilson@dowjones.com

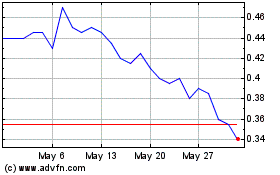

Toro Energy (ASX:TOE)

Historical Stock Chart

From Apr 2024 to May 2024

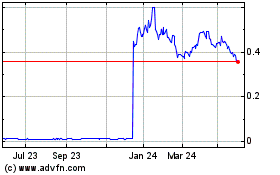

Toro Energy (ASX:TOE)

Historical Stock Chart

From May 2023 to May 2024