Republicans Near Agreement With Treasury Department on Puerto Rico Bill

May 18 2016 - 5:20PM

Dow Jones News

WASHINGTON—House Republicans are close to finalizing an

agreement with the Obama administration on legislation to provide

Puerto Rico a path to restructure its $70 billion debt load.

With nearly all other details ironed out, disagreements remained

over how to handle appointments to a seven-member board designed to

oversee the island's finances. There were also lingering

differences over how to respect constitutional priorities governing

bond and pension payments.

A successful legislative package would give the island its first

chance in years to ease a mounting debt burden that threatens to

prolong its decadelong recession. The bill would offer the island a

legal out similar to bankruptcy, and wouldn't commit any federal

money.

The bill follows weeks of delicate bipartisan negotiations

between the Treasury Department and conservative lawmakers leery of

interfering with bondholders' contracts. Democrats have called for

broader latitude in restructuring those debts.

Last month, House Republicans pulled an earlier iteration of the

legislation from committee consideration after objections surfaced

on both the left and right. Treasury officials called the details

of a proposed debt restructuring unworkable, while a muscular

advertising campaign from some bondholders characterized the

legislation as a bailout, making conservatives uneasy.

Those setbacks underscore the fluid state of play on legislation

that has enjoyed an unusually bipartisan process, and a bill isn't

likely to be introduced without assurances that the administration

won't oppose it.

House Natural Resources Committee Chairman Rob Bishop (R., Utah)

said last week that he expects that once Republicans reached

agreement with the Treasury Department on the legislation, it would

move "very quickly" through Congress. House Republicans said they

planned to introduce the latest version of the bill Wednesday.

Puerto Rico has defaulted on different classes of bonds,

including earlier this month when it missed most of a $422 million

payment, and faces payments totaling $2 billion on July 1.

Municipalities in many U.S. states can seek bankruptcy protection

in court, but Puerto Rico can't because territories are excluded

from the relevant part of the federal bankruptcy code.

Last week, Treasury Secretary Jacob Lew and Mr. Bishop

separately warned that failing to provide effective

debt-restructuring relief now would lead to louder calls later for

a bailout of the island and its bondholders. "If Puerto Rico spins

out into economic chaos, you may never have a chance of recovering

again," Mr. Bishop said last week.

The reintroduction of the legislation was repeatedly delayed

last week as aides to House Speaker Paul Ryan (R., Wis.) sought to

iron out differences with top officials in the Obama

administration.

Pensions emerged as a complicating factor because in addition to

Puerto Rico's $70 billion debt, the island has an unfunded pension

liability of some $40 billion. Puerto Rico has been in a recession

for most of the past decade, and it is steadily losing population

to the mainland, depleting its tax base.

Some bondholders have argued legislation should require pensions

to be reduced before their bonds are restructured, while some

Democrats have said pensions should be made senior to those bonds.

The bill does neither, and instead says the control board must

ensure pensions are adequately funded while respecting existing

law.

Write to Nick Timiraos at nick.timiraos@wsj.com

(END) Dow Jones Newswires

May 18, 2016 17:05 ET (21:05 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

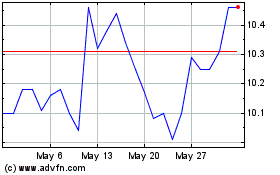

Pacific Current (ASX:PAC)

Historical Stock Chart

From Apr 2024 to May 2024

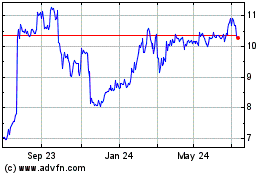

Pacific Current (ASX:PAC)

Historical Stock Chart

From May 2023 to May 2024