Motopia Secures $15 Million Funding Facility with Dutchess Capital

May 02 2011 - 5:48AM

Business Wire

The Board of Motopia Limited (ASX:MOT) is pleased to announce

that it has signed an equity facility agreement with US based

Dutchess Capital to provide long-term funding for working capital

of up to $A15 million. The equity facility provides a solid base of

funding to Motopia over the next three years.

The funding allows Motopia to call on funds when needed, in

tranches of up to $300,000 per drawdown (or up to $500,000 if

agreed by the parties). At no time will Dutchess Capital hold more

than 19.99% of Motopia.

Dutchess Capital is an investment manager which provides

creative financing for public companies. Founded in 2000, Dutchess

has been a global leader in Equity Line Facilities (ELFs) for

almost a decade, and has transacted in excess of $1.8 billion in

such financings worldwide. The ELF is a flexible financing

structure by which publicly traded companies can raise capital

quickly, efficiently, and with less dilution than most traditional

offerings.

Executive Chairman of Motopia, Jitto Arulampalam stated “This

investment shows clearly the level of faith there is in Motopia,

the Board have worked tirelessly over the last 12 months, with many

hurdles to overcome to create a company with a solid foundation. To

develop the world standard solutions we pride ourselves on and for

the timely deliverables of these solutions, Dutchess Capital has

offered us the fuel we need to get there quickly. There’s nothing

stopping us now.”

Chief Executive Officer of Motopia, Matthew Gerard, said today

“The Board is delighted to have secured this investment

relationship with Dutchess Capital. This investment demonstrates

that Motopia is on the world stage and that our suite of full

service mobile marketing solutions is being noticed. We are

extremely excited about a number of projects we are currently

working on and this facility will allow us to accelerate the roll

out of these projects in the months ahead.”

Douglas Leighton of Dutchess Capital said today “We are very

pleased to be working with Motopia and look forward to providing

them with the capital to execute on their roll out of projects in

the upcoming months. “

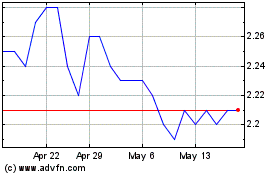

Metrics Income Opportuni... (ASX:MOT)

Historical Stock Chart

From Mar 2024 to Apr 2024

Metrics Income Opportuni... (ASX:MOT)

Historical Stock Chart

From Apr 2023 to Apr 2024