DEXUS Property Group Announces Final Results of Cash Tender Offer for Notes & New Calculation of Total Consideration Using Re...

June 22 2012 - 9:49AM

Business Wire

DEXUS Property Group (ASX: DXS) (“DEXUS”) announced today the

final results of the previously announced cash tender offer (the

“Offer”) by DEXUS Funds Management Limited (ABN 24 060 920 783), in

its capacity as responsible entity of DEXUS Diversified Trust (the

“Company”), to purchase up to US$175,455,000 maximum aggregate

principal amount of the outstanding 7.125% Guaranteed Senior Notes

due 2014 (the “Notes”) of the Company and DEXUS Funds Management

Limited, in its capacity as responsible entity of DEXUS Office

Trust. The terms and conditions of the Offer are set forth in the

Company’s Offer to Purchase dated 15 May 2012 (as amended, the

“Offer to Purchase”) and the related Letter of Transmittal, as

previously amended by the DEXUS media releases dated 30 May 2012

and 11 June 2012.

The Offer expired at 9:00 a.m., New York City Time, on 22 June

2012 (the “Expiration Date”). As of the Expiration Date,

US$175,455,000 aggregate principal amount of Notes were validly

tendered and not validly withdrawn, according to information

received by Global Bondholder Services Corporation, the Information

Agent and Depositary for the Offer.

CUSIP Numbers Title of Security

Principal Amount Outstanding Prior to Payment Date

Principal Amount Tendered Principal Amount

Accepted Principal Amount to Remain Outstanding After

Payment Date 252391AA5 and Q3200PAA6 7.125% Guaranteed Senior

Notes due 2014 US$300,000,000 US$175,455,000 US$175,455,000

US$124,545,000

The Company has accepted for purchase all US$175,455,000 of

Notes validly tendered and not validly withdrawn pursuant to the

Offer. The Company will deliver the applicable consideration (as

described below) to the Depository Trust Company on the expected

payment date of 22 June 2012 (the “Payment Date”) for prompt

payment for all Notes accepted for purchase.

Holders of Notes who validly tendered and did not validly

withdraw their Notes on or before 5:00 p.m., New York City time, on

29 May 2012 (the “Early Tender Deadline”) will receive the Total

Consideration (as described below), which includes the early tender

payment of US$30 per US$1,000 principal amount of Notes accepted

for purchase (the “Early Tender Payment”).

The “Total Consideration” per each US$1,000 principal amount of

Notes validly tendered and accepted for payment pursuant to the

Offer was calculated by Deutsche Bank Securities Inc., the Dealer

Manager for the Offer, at 10:30 a.m., New York City time, on 30 May

2012, in the manner described in the Offer to Purchase by reference

to a fixed spread over the reference yield, each as specified in

the table below, and assuming that the Payment Date was to have

occurred on 13 June 2012, and recalculated by the Dealer Manager on

11 June 2012 using a revised assumed Payment Date of 25 June 2012.

The Company currently anticipates that the Payment Date will be

today, 22 June 2012. Using this new Payment Date, the Total

Consideration and Tender Offer Consideration (as defined in the

Offer to Purchase) have again been recalculated by the Dealer

Manager. Recalculated amounts appear in the table below. The Early

Tender Payment is included in the calculation of the Total

Consideration and is not in addition to the Total Consideration.

Tendering holders will also receive accrued and unpaid interest on

their Notes up to, but excluding, the Payment Date.

CUSIP Numbers Title of Security

Principal Amount Outstanding Reference U.S.

Treasury

Security

Reference Yield Fixed

Spread

(Basis

points)

Recalculated

Total Consideration per US$1,000

Principal Amount(1)

Recalculated

Tender Offer Consideration per US$1,000

Principal Amount

252391AA5 and Q3200PAA6 7.125% Guaranteed Senior Notes due 2014

US$300,000,000 0.25% U.S. Treasury Note due April 30, 2014 0.279%

180 US$1113.38 US$1083.38

_____________________________(1) Total Consideration per

US$1,000 principal amount of Notes accepted for purchase includes

the Early Tender Payment of US$30 per US$1,000 principal amount of

Notes accepted for purchase.

The Company’s obligations to accept any Notes tendered and to

pay the applicable consideration for them are set forth solely in

the Offer to Purchase and the related Letter of Transmittal. This

media release is neither an offer to purchase nor a solicitation of

an offer to sell any Notes. The Offer is made only by, and pursuant

to the terms of, the Offer to Purchase, and the information in this

media release is qualified by reference to the Offer to Purchase

and the related Letter of Transmittal.

Deutsche Bank Securities Inc. is the Dealer Manager for the

Offer. Persons with questions regarding the Offer should contact

Deutsche Bank Securities Inc. at 1-212-250-7527 (collect) or

1-855-287-1922 (toll-free) (Attention: Liability Management Group).

Requests for copies of the Offer to Purchase, the related Letter of

Transmittal and other related materials should be directed to

Global Bondholder Services Corporation, the Information Agent and

Depositary for the Offer, at (212) 430-3774 (for banks and brokers

only) or (866) 873-7700 (for all others and toll-free).

Certain statements contained in this media release include

"forward-looking statements" within the meaning of the Private

Securities Litigation Reform Act of 1995 and which are subject to

certain risks, trends and uncertainties. In particular, statements

made that are not historical facts may be forward-looking

statements. Words such as “should,” “may,” “will,” “anticipates,”

“expects,” “intends,” “plans,” “believes,” “seeks,” “estimates,”

and similar expressions identify forward-looking statements. Such

statements are not guarantees of future performance and are subject

to risks and uncertainties that could cause actual results to

differ materially from the results projected, expressed or implied

by these forward-looking statements. Factors that could cause or

contribute to such differences include those matters disclosed in

the Offer to Purchase. The Company does not undertake any

obligation to update any forward-looking statements.

About DEXUS

DEXUS is one of Australia’s leading property groups specialising

in world-class office, industrial and retail properties with total

assets under management of $13bn. In Australia, DEXUS is the market

leader in office and industrial and, on behalf of third party

clients, a leading manager and developer of shopping centres. DEXUS

is committed to being a market leader in Corporate Responsibility

and Sustainability. www.dexus.com (The information on the

Group’s website is not part of this release.)

DEXUS Funds Management Ltd ABN 24 060 920 783, AFSL 238163, as

Responsible Entity for DEXUS Property Group (ASX: DXS)

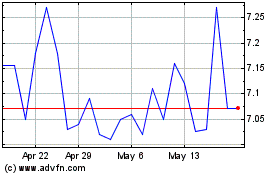

Dexus (ASX:DXS)

Historical Stock Chart

From Mar 2024 to Apr 2024

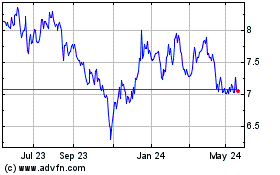

Dexus (ASX:DXS)

Historical Stock Chart

From Apr 2023 to Apr 2024