MARKET COMMENT: S&P/ASX 200 +0.8% As Financials Lead Broad Recovery

March 14 2013 - 8:20PM

Dow Jones News

2350 GMT [Dow Jones] Australia's S&P/ASX 200 is up 0.8% at

5074.2 as financials lead a broad-based recovery after

lower-than-expected U.S. jobless claims data further bolstered the

improving U.S. economic outlook and pushed the S&P 500 up 0.6%

to a 5 1/2 year high. Major banks are up 0.9%-1.2%, with AMP

(AMP.AU), QBE (QBE.AU) and Macquarie (MQG.AU) up 1.1%-1.6% after

Thursday's falls. Materials stocks are lagging after spot iron ore

fell 4.4%, but BHP (BHP.AU) is outperforming its ADR's equivalent

close. "The selloff was overdone yesterday," says Macquarie Private

Wealth investment adviser James Rosenberg. "There is still a lot of

interest in stocks, but there's a lot of caution as well. People

are substantially more comfortable with risk and risk assets, but a

lot of people think it's run a bit hard." He says investors should

be encouraged by recent signs of domestic and U.S. economic

recovery, and the draft statement from European leaders that they

may give countries such as France, Spain and Portugal more time to

lower fiscal deficits. The 20-day moving average and former uptrend

line offer technical resistance at 5070/5080, and range support is

indicated at 4975.9. (david.rogers1@wsj.com)

Contact us in Singapore. 65 64154 140; MarketTalk@dowjones.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

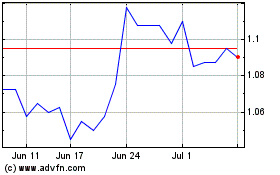

AMP (ASX:AMP)

Historical Stock Chart

From Apr 2024 to May 2024

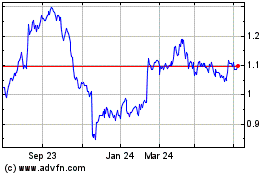

AMP (ASX:AMP)

Historical Stock Chart

From May 2023 to May 2024