TIDMPOLR

RNS Number : 8992T

Polar Capital Holdings PLC

20 November 2023

Polar Capital Holdings plc ("Polar Capital" or "the Group")

Unaudited interim results for six months ended 30 September

2023

"Strong pipeline of interest in our diversified thematic

strategies, improving fund performance and balance sheet strength

support a maintained first interim dividend" Gavin Rochussen,

CEO

Highlights

-- Assets under Management ("AuM") at 30 September 2023

GBP19.1bn (31 March 2023: GBP19.2bn) and at 10 November 2023

GBP18.9bn.

-- Net outflows of GBP581m, a material decrease of GBP264m vs

the prior comparable period, aided by inflows into a number of

funds.

-- Core operating profit GBP22.5m (30 September 2022: GBP25.8m)

-- Profit before tax GBP21.1m (30 September 2022: GBP23.0m)

-- Basic earnings per share 16.2p (30 September 2022: 17.7p) and

adjusted diluted total earnings per share 17.2p (30 September 2022:

19.0p)

-- Interim dividend per ordinary share of 14.0p (January 2023:

14.0p) declared to be paid in January 2024. The dividend payment

date is 12 January 2024, with an ex-dividend date of 14 December

2023 and a record date of 15 December 2023.

T he non-GAAP alternative performance measures shown here are

described and reconciled to IFRS measures on the Alternative

Performance Measures (APM) page

This RNS does not constitute an offer or recommendation to

invest in any of the funds referenced within.

Gavin Rochussen, Chief Executive Officer, commented:

"The past six months have been a challenging period for equity

markets driven by a volatile macro environment. Like many of our

peers, Polar Capital has not been immune from these challenges, but

net outflows as a percentage of opening AuM have been relatively

modest, and in fact, have materially slowed vs the prior comparable

period. This was helped by net inflows into a number of funds,

namely our Polar Capital Emerging Market Stars Fund, Polar Capital

European ex-UK income Fund, Polar Capital Japan Value Fund and

Polar Capital Smart Energy Fund.

"Long-term performance remains positive across the UCITs fund

range with all funds bar one in the 1(st) or 2(nd) quartile of

their Lipper peer group since inception. More recently, 77% of

Polar Capital's total AuM is in the top two quartiles of the Lipper

peer group calendar year-to-date.

"As a result, and helped by a strong year for technology stocks,

assets under management ended the reporting period at GBP19.1bn,

representing a modest decrease from the year end.

"As an investment led, specialist boutique, the quality of our

product range remains central to our efforts to grow the business

and a number of our funds have seen renewed interest of late. For

example, the well documented breakthrough in artificial

intelligence has seen an increased interest in the Polar Capital

Artificial Intelligence Fund. It had its six-year anniversary in

October 2023 and is 3(rd) percentile against Lipper peers over one

year, 5(th) percentile over five years and 4(th) percentile since

inception.

"Similarly, the Polar Capital Global Insurance Fund has seen

renewed interest given its defensive characteristics. It recently

passed its 25-year anniversary and since launch it has delivered

strong and consistent annualised returns to investors of circa 10%

pa (Source: Polar Capital, 30 September 2023. R GBP Acc share class

with reinvestment of dividends and capital gain distributions, in

Pounds Sterling).

"In the six months, the largest beneficiary of net inflows was

our Emerging Market Stars fund range, which garnered a combined

total of GBP244m of net inflows, despite the tough backdrop and

muted investor demand for the asset class.

The Emerging Markets and Asia Stars team now collectively manage

GBP1.5bn and there has been continued progress in the US with US

domiciled fund vehicles surpassing GBP125m.

"The Smart funds managed by the Sustainable Thematic team have

now reached AuM of GBP280m.

"The Nordic region has continued to grow through additional

flows into the Polar Capital Emerging Market Stars Fund and there

is emerging interest in the Polar Capital Smart Energy and Smart

Mobility funds.

"Pleasingly, Polar Capital won the 2023 European Asset

Management Firm of the Year ( EUR20bn-EUR100bn) award at the Funds

Europe 2023 awards, which is testament to the quality of our

offering.

" We continue to invest in our digital marketing reach and have

intensified our client contact interactions to utilise our

significant remaining fund capacity. This, given our differentiated

range of sector, thematic and regional fund strategies, gives us

confidence that we will perform for our clients and shareholders

over the long term."

For further information please contact:

Polar Capital +44 (0)20 7227 2700

Gavin Rochussen (Chief Executive)

Samir Ayub (Finance Director)

Numis Securities- Nomad and Joint Broker +44 (0)20 7260 1000

Giles Rolls

Charles Farquhar

Stephen Westgate

Peel Hunt - Joint Broker +44 (0)20 3597 8680

Andrew Buchanan

John Welch

Sam Milford

Camarco +44 (0)20 3757 4995

Ed Gascoigne-Pees

Jennifer Renwick

Phoebe Pugh

Assets Under Management

AuM split by type

30 September 31 March 2023

2023

--------------------- --------------- -------------------- ----------------

GBPbn % GBPbn %

--------------------- -------- ----- -------------------- --------- -----

Open ended funds 14.1 74% Open ended funds 14.3 75%

Investment trusts 4.1 21% Investment trusts 3.9 20%

Segregated mandates 0.9 5% Segregated mandates 1.0 5%

--------------------- -------- ----- -------------------- --------- -----

Total 19.1 Total 19.2

--------------------- -------- ----- -------------------- --------- -----

AuM split by strategy

Ordered according to launch date

30 September 31 March 2023

2023

------------------------ --------------- ----------------------- ----------------

GBPbn % GBPbn %

------------------------ -------- ----- ----------------------- -------- ------

Technology 7.5 39% Technology 7.2 38%

European Long/Short 0.1 0.5% European Long/Short 0.1 0.5%

Healthcare 3.6 19% Healthcare 3.8 20%

Global Insurance 2.0 10% Global Insurance 2.1 11%

Financials 0.6 3% Financials 0.5 2%

Convertibles 0.5 2.5% Convertibles 0.7 4%

North America 0.6 3% North America 0.6 3%

Japan Value 0.2 1% Japan Value 0.2 1%

European Income 0.3 2% European Income 0.2 1%

UK Value 1.1 6% UK Value 1.2 6%

Emerging Markets and Emerging Markets and

Asia 1.5 8% Asia 1.3 7%

European Opportunities 0.8 4% European Opportunities 1.0 5%

European Absolute European Absolute

Return* - - Return* 0.1 0.5%

Sustainable Thematic Sustainable Thematic

Equities 0.3 2% Equities 0.2 1%

------------------------ -------- ----- ----------------------- -------- ------

Total 19.1 100% Total 19.2 100%

------------------------ -------- ----- ----------------------- -------- ------

* The Melchior European Absolute Return Fund was closed down in

May 2023.

Chief Executive's Report

Market Overview

The first half of Polar Capital's financial year ended on a weak

note in global bond and equity markets, with a sell-off during the

month of September 2023. Up to that point, bonds and equities had

been moving in opposite directions, with bonds weakening while

equity markets, and the US market in particular, made progress.

Bond markets are experiencing another difficult year. Central

banks remain in inflation-fighting mode, which has meant that

official rates have remained higher. Longer term US bond yields

have also moved up, driven by an increase in real interest rates,

and by a deterioration in the supply-demand balance as issuance

continues while the pace of central bank bond buying declines.

The positive tone in equity markets has surprised many investors

this year. Higher interest rates have not yet led to the widely

predicted recession, so corporate earnings have in aggregate

remained reasonably strong. At the same time, innovation has led to

positive outcomes in the technology and healthcare sectors. In

technology, the rapid development and commercialisation of machine

learning algorithms and large language models has led to strong

profit growth and, in turn, high expectations. In healthcare, the

positive clinical results and wide-ranging potential of the GLP-1,

class of diabetes drugs, have been similarly well received by

investors.

In both areas, the gains have accrued to a small number of

companies. The side effect of success in these particular areas is

that the big have become bigger, and equity market indices have

become more top heavy. Over the long term, the market will

naturally challenge established oligopolies, and any valuation

excesses will be unwound if underlying cash flow growth does not

match expectations.

These areas of success also led to outperformance in the first

half of 2023 in growth styles versus value, which is atypical in

periods of rising interest rates. More recently, this pattern has

started to reverse.

Fund Performance

In equity markets, the US market and the tech sector in

particular, have been the standout positive performers. At the

other end of the spectrum, Emerging Markets currently sit close to

a 20-year performance low point relative to the US. Slowing growth

in China, and the de-rating of the Chinese equity market, plays a

role here.

A further side effect of the success of tech companies which are

Artificial Intelligence beneficiaries, and of healthcare stocks

which stand to gain from GLP-1 medications, is that larger

companies have tended to outperform smaller ones. This has been a

headwind for Polar Capital. Many of our investment teams have

derived long term success from investing outside the larger,

better-known areas of their respective markets, and many clients

have supported this approach, as they often own the larger

companies directly.

So far this year, the dominance of the largest companies

accounts for the underperformance of the Polar Capital Global

Technology Fund and the Polar Capital Technology Trust, the Polar

Capital Healthcare Opportunities Fund, as well as the

underperformance of the Melchior European Opportunities Fund. These

strategies have good long term track records, but the recent past

has been more challenging.

As the dominance of growth styles has started to wane, we have

seen a recovery in the relative performance of the Group's more

value-driven strategies such as the Polar Capital European ex-UK

Income Fund, which is 277 bps ahead of benchmark in the six months

to end September 2023, the Polar Capital Japan Value Fund, which is

171 bps ahead, and the Polar Capital North American Fund, which is

107 bps ahead. The Polar Capital Global Insurance Fund is also

ahead of its benchmark over this period.

The Polar Capital Global Insurance Fund has celebrated its

25-year anniversary. Since launch it has delivered strong and

consistent annualised returns to investors of circa 10% pa, by

investing for the long-term in a concentrated portfolio of

best-in-class non-life insurers. Insurance sector performance is

typically counter cyclical, offering investors genuine

diversification with unique drivers. This Fund is ranked in the

2(nd) quartile in the Lipper peer group over three years, 1(st)

quartile over five years and is ranked at the 4(th) percentile

since inception.

The last three months have seen falling share prices across the

alternative energy sector as political commitments to

decarbonization have wavered, and as high interest rates have

undermined valuation. Polar Capital's Smart Energy strategies have

held their own versus benchmark so far, this financial year. The

rotation away from anything connected to the renewable energy or

electric vehicle supply chain has, however, been a short-term

headwind for Polar Capital's Emerging Market strategies, leading to

underperformance in the first six months of the financial year.

With the long-term need for alternative sources of energy as

pressing as ever, we believe that this will be an important

investment theme in the years to come.

Across the Polar Capital UCITS fund range, performance against

the Lipper peer group funds remains strong over all time periods,

albeit less strong over three years. The Polar Capital Global

Technology Fund had a challenging year in 2021 but has improved

relative to peers subsequently. Calendar year-to-date, against the

Lipper peer group, the Polar Capital Technology Fund is 14(th)

percentile and at the 22(nd) percentile since inception.

The Polar Capital Artificial Intelligence Fund which had its

six-year anniversary in October 2023 is 3(rd) percentile against

Lipper peers over one year, 5(th) percentile over five years and

4(th) percentile since inception.

Calendar year-to-date, 77% of Polar Capital's total AuM is in

the top two quartiles of the Lipper peer group, 73% over one year,

48% over three years, 84% over five years and 93% since inception

of respective funds.

Relative to respective benchmarks, 41% of AuM is on or ahead of

benchmark calendar year-to-date and 64% of AuM is on or ahead of

benchmark since inception.

AuM and Fund Flows

The latest Broadridge Fund Data indicate that in the period

April to August 2023 across Europe and the UK, equity funds have

been in outflow and in August bonds were also in outflow. This has

been a challenging environment for the industry.

In the six months to 30 September 2023, AuM declined from

GBP19.2bn to GBP19.1bn, a decrease of less than 1.0% over the

period. The GBP85m decline in AuM comprised net redemptions of

GBP581m, plus outflows from fund closures of GBP50m, which were

offset by an increase of GBP546m related to market movement and

fund performance.

In the six months, the largest beneficiary of net inflows was

our Emerging Market Stars fund range, which garnered a combined

total of GBP244m of net inflows, despite the tough backdrop and

muted investor demand for the asset class.

On the back of continued strong fund performance, the Polar

Capital European ex-UK Income Fund had net inflows of GBP95m.

The Polar Capital Smart Energy and Smart Mobility Funds had

combined net inflows of GBP60m. They marked their second

anniversary on 30 September 2023 and investor interest in the

strategies continues to build.

Within the healthcare suite of funds, the large cap focused,

Polar Capital Healthcare Blue Chip Fund benefited from net inflows

of GBP50m.

The Polar Capital Japan Value Fund saw a return to net inflows,

reflecting strong market returns and improving investor sentiment,

as did the Artificial Intelligence Fund, as investor interest in

this rapidly evolving space ignited.

More broadly during the period, we saw the return of inflation

and rapid interest rate rises around the world result in general

investor risk aversion, characterised by a flight to fixed income

and cash. Consequently, numerous of our funds experienced net

outflows during the period under review.

Marked negative investor sentiment towards UK and European

equities led to redemptions from the Melchior European

Opportunities Fund of GBP181m and from the Polar Capital UK Value

Opportunities Funds of GBP46m.

While the overall rate of outflows from our technology

strategies declined quarter on quarter, net outflows from the

open-ended Polar Capital Technology Fund were GBP181m and share buy

backs by the Polar Capital Technology Investment Trust amounted to

GBP65m over the period.

The Polar Capital Global Convertible Bond Fund experienced

outflows of GBP149m, as some income investors sought yield from

alternative, lower risk asset classes. The Polar Capital Global

Insurance Fund suffered net outflows of GBP152m, as two

long-standing shareholders decided to take profits following the

strong performance of the Fund in calendar year 2022.

Other funds experiencing outflows in the period included the

Polar Capital North American Fund, the Polar Capital Healthcare

Opportunities Fund, and to a lesser extent Polar Capital Global

Absolute Return, Biotechnology and Healthcare Discovery Funds.

Notwithstanding net outflows in October amounting to GBP390m,

which can mainly be attributed to redemptions by two clients from

Biotechnology and UK Value Opportunities funds, AuM at 10 November

was GBP18.9bn.

Financial Results

Average AuM over the six months to 30 September 2023 increased

by 2% from GBP19.1bn to GBP19.4bn. However, relative to the

comparable six-month period to 30 September 2022 average AuM

declined by 3% from GBP20.0bn to GBP 19.4bn. The decrease in

average AuM resulted in net management fees decreasing by 4% to

GBP76.5m from GBP80.0m in the comparable prior six-month period.

Management fee yield margin declined, as anticipated, by 1bp to

79bps over the period compared to the comparable prior half year

period.

Total operating costs were 1% lower at GBP55.0m compared to the

comparable prior half year.

Core operating profit was down 13% to GBP22.5m compared to the

comparable prior half year and up 2% from GBP22.1m in the

immediately preceding six-month period to 31 March 2023.

Profit before tax decreased by 8% to GBP21.1m compared to the

comparable prior half year. Basic EPS decreased by 8% compared to

the half year period to 30 September 2022. Adjusted diluted core

EPS of 17.3p is a 14% decrease over the comparable prior half year

period to 30 September 2022.

Six months Six months to Six months

to 31 March to

30 September 2023 30 September

2023 GBP'm 2022

GBP'm GBP'm

------------- -------------

Average AuM (GBP'bn) 19.4 19.1 20.0

Net management fees 76.5 74.8 80.0

Core operating profit 22.5 22.1 25.8

Performance fee profit - 1.7 -

Other income* (0.5) 3.6 (1.5)

Share-based payments on preference

shares (0.3) (0.2) (0.1)

Exceptional items (0.6) (5.0) (1.2)

------------- ------------- -------------------------

Profit before tax 21.1 22.2 23.0

------------- ------------- -------------------------

Basic EPS 16.2p 19.1p 17.7p

Adjusted diluted total earnings

per share 17.2p 25.3p 19.0p

Adjusted diluted core EPS 17.3p 19.6p 20.1p

----------------------------------- ------------- ------------- -------------------------

The non-GAAP alternative performance measures shown here are

described and reconciled in the APM section below.

* A reconciliation to reported results is given in the APM section below.

The Board has declared an interim dividend of 14.0p to be paid

in January 2024 (January 2023: 14.0p). Maintaining last year's

first interim dividend of 14.0p represents a covered dividend that

is 81% of first half adjusted diluted core EPS and reflects our

confidence in the business and the strength of our balance

sheet.

Strategic progress and thanks

We have continued to make steady progress in diversifying the

fund range and diversifying distribution both regionally and by

channel .

The Smart funds managed by the Sustainable Thematic team have

now reached AuM of GBP280m. The Emerging Markets and Asia Stars

team now collectively manage GBP1.5bn and there has been continued

progress in the US with US domiciled fund vehicles surpassing

GBP125m.

Further progress has been made in developing distribution

channels in Asia and the Nordic regions and following the opening

of offices in Singapore last year, an office was opened in

Stockholm during the period. The Nordic region has continued to

grow through additional flows into the Polar Capital Emerging

Market Stars funds and there is emerging interest in the Polar

Capital Smart Energy and Smart Mobility funds.

Polar Capital and its funds continued to be nominated for a

number of awards. The Convertible Bond Absolute Return Fund was

'highly commended' in the Absolute Return Category of the

Investment Week Awards. Polar Capital Technology Trust won the Best

Report & Accounts at the AIC Awards. Polar Capital Technology

Trust won the 'Best Technology/Biotech - Active' category in the A

J Bell Awards.

Polar Capital won the 2023 European Asset Management Firm of the

Year ( EUR20bn-EUR100bn) award at the Funds Europe 2023 awards and

is currently shortlisted for the following awards: ESG Investment

Leaders Awards 2023, Most Effective Brand Strategy - Small Company

at the Financial Services Forum Awards, Emerging Markets Manager of

the Year at the FN Fund Management Awards, ESG Investing Awards

2023 in both the Emerging Markets and Energy Transition categories.

The Emerging Markets Stars team is shortlisted for EM Manager of

the Year at the Wealth & Asset Management Awards. All three

Investment Trusts, Polar Capital Technology Trust, Polar Capital

Global Healthcare Trust and Polar Capital Financials Trust, have

been shortlisted at the Investment Week Investment Company of the

Year Awards.

We are immensely grateful for hard work and commitment from our

staff and partners over what has been a challenging period for

equity asset managers. We are also grateful for and appreciate the

ongoing support from our loyal and supportive clients and

shareholders.

Outlook

The last six months has continued to be challenging as the rate

of inflation, while peaking in some regions, remains stubbornly

high in others. A higher interest rate environment and increased

geopolitical tension not only in Ukraine, but also more recently in

the Middle East, has meant investors have taken a cautious 'risk

off' stance resulting in outflows across all asset classes.

Notwithstanding a challenging investment backdrop, our capacity

constrained funds have performed well over the long term. The total

capacity across all 13 of our teams is currently GBP63bn which

allows significant headroom for net inflows when market sentiment

improves.

We continue to invest in our digital marketing reach and have

intensified our client contact interactions to utilise our

significant remaining fund capacity. This, given our differentiated

range of sector, thematic and regional fund strategies, gives us

confidence that we will perform for our clients and shareholders

over the long term.

Gavin Rochussen

Chief Executive

17 November 2023

Alternate Performance Measures (APMs)

The Group uses the non-GAAP APMs listed below to provide users

of the Interim Report with supplemental financial information that

helps explain its results for the current accounting period.

APM Definition Reconciliation Reason for use

------------------- ------------------------ ------------------- ---------------------------------------

Core operating Profit before APM reconciliation To present a measure of the

profit performance Group's profitability excluding

fee profits, performance fee profits and

other income other components which may

and tax. be volatile, non-recurring

or non-cash in nature.

------------------- ------------------------ ------------------- ---------------------------------------

Performance fee Gross performance APM reconciliation To present a clear view of

profit fee revenue the net amount of performance

less performance fee earned by the Group after

fee interests accounting for staff remuneration

due to staff. payable that is directly attributable

to performance fee revenues

generated.

------------------- ------------------------ ------------------- ---------------------------------------

Core distributions Variable compensation APM reconciliation To present additional information

payable to investment thereby assisting users of

teams from management the accounts in understanding

fee revenue. key components of variable

costs paid out of management

fee revenue.

------------------- ------------------------ ------------------- ---------------------------------------

Performance Variable compensation APM reconciliation To present additional information

fee interests payable to investment thereby assisting users of

teams from performance the accounts in understanding

fee revenue. key components of variable

costs paid out of performance

fee revenue.

------------------- ------------------------ ------------------- ---------------------------------------

Adjusted diluted Profit after APM reconciliation The Group believes that (a)

total EPS tax but excluding as the preference share awards

(a) cost of have been designed to be earnings

share-based enhancing to shareholders

payments on adjusting for this non-cash

preference shares, item provides a useful supplemental

(b) the net understanding of the financial

cost of deferred performance of the Group,

staff remuneration (b) comparing staff remuneration

and (c) exceptional and profits generated in the

items which same time period (rather than

may either be deferring remuneration over

non-recurring a longer vesting period) allows

or non-cash users of the accounts to gain

in nature, and a useful supplemental understanding

in the case of the Group's results and

of adjusted their comparability period

diluted earnings on period and (c) removing

per share, divided acquisition related transition

by the weighted and termination costs as well

average number as the non-cash amortisation

of ordinary and any impairment, of intangible

shares. assets and goodwill provides

a useful supplemental understanding

of the Group's results.

------------------- ------------------------ ------------------- ---------------------------------------

Adjusted diluted Core operating APM reconciliation To present additional information

core EPS profit after that allows users of the accounts

tax excluding to measure the Group's earnings

the net cost excluding those from performance

of deferred fees and other components

core distributions which may be volatile, non-recurring

divided by the or non-cash in nature.

weighted average

number of ordinary

shares.

------------------- ------------------------ ------------------- ---------------------------------------

Core operating Core operating Chief Executive's To present additional information

profit margin profit divided report that allows users of the accounts

by to measure the core profitability

net management of the Group before performance

fees revenue. fee profits, and other components,

which can be volatile and

non-recurring.

------------------- ------------------------ ------------------- ---------------------------------------

Net management Gross management Chief Executive's To present a clear view of

fee fees revenue report the net amount of management

less commissions fees earned by the Group after

and fees payable. accounting for commissions

and fees payable.

------------------- ------------------------ ------------------- ---------------------------------------

Net Management Net management Chief Executive's To present additional information

fee yield fees revenue report that allows users of the accounts

divided by average to measure the fee margin

AuM. for the Group in relation

to its assets under management.

------------------- ------------------------ ------------------- ---------------------------------------

Summary of non-GAAP financial performance and reconciliation of

APMs to interim reported results

The summary below reconciles key APMs the Group measures to its

interim reported results for the current year and also reclassifies

the line-by-line impact on consolidation of seed investments to

provide a clearer understanding of the Group's core business

operation of fund management.

Any seed investments in newly launched or nascent funds, where

the Group is determined to have control, are consolidated. As a

consequence, the statement of profit or loss of the fund is

consolidated into that of the Group on a line-by-line basis. Any

seed investments that are not consolidated are fair valued through

a single line item (other income) on the Group consolidated

statement of profit or loss.

2023 Reclassification 2023 2022

Interim on consolidation Interim Interim

Reported of seed Reclassification Non-GAAP Non-GAAP

Results investments of costs results results APMs

GBP'm GBP'm GBP'm GBP'm GBP'm

Investment

management

and research fees 86.9 - - 86.9 90.9

Commissions and

fees payable (10.4) - - (10.4) (10.9)

------------------- ---------- ----------------- ------------------ ---------- ---------- ------------------

Net management

76.5 - - 76.5 80.0 fees

Operating costs (55.0) 0.2 21.8 (33.0) (31.3)

Finance costs (0.1) - - (0.1) -

- - (20.9) (20.9) (22.9) Core distributions

------------------ ---------- ----------------- ------------------ ---------- ---------- ------------------

Core operating

21.4 0.2 0.9 22.5 25.8 profits

Investment - - - - -

performance

fees

- - - - - Performance

fee interests

------------------ ---------- ----------------- ------------------ ---------- ---------- ------------------

- - - - - Performance

fee profits

Other income (0.3) (0.2) - (0.5) (1.5)

Share-based

payments

on preference

shares - - (0.3) (0.3) (0.1)

Exceptional items - - (0.6) (0.6) (1.2)

------------------- ---------- ----------------- ------------------ ---------- ---------- ------------------

Profit before

tax for the period 21.1 - - 21.1 23.0

------------------- ---------- ----------------- ------------------ ---------- ---------- ------------------

The effect of the adjustments made in arriving at the adjusted

diluted total EPS and adjusted diluted core EPS figures of the

Group is as follows:

Earnings per share (Unaudited) (Unaudited)

30 September 30 September

2023 2022

Pence Pence

--------------------------------- --- ------------- -------------

Diluted earnings per share 16.0 17.4

Impact of share-based payments

- preference shares only 0.3 0.1

Impact of exceptional items 0.6 1.2

Impact of deferment, where IFRS

defers cost into future periods 0.3 0.3

-------------------------------------- ------------- -------------

Adjusted diluted total EPS 17.2 19.0

Add back other income (post-tax) 0.1 1.1

-------------------------------------- ------------- -------------

Adjusted diluted core EPS 17.3 20.1

-------------------------------------- ------------- -------------

Exceptional items

Exceptional items for the period to 30 September 2023 include

amortisation of the acquired intangible asset as part of Dalton

acquisition (2022: Exceptional items include non-recurring

termination and reorganisation costs related to the closure of

Phaeacian mutual funds which were closed down in May 2022).

A breakdown of exceptional items is as follows:

Exceptional items (Unaudited) (Unaudited)

30 September 30 September

2023 2022

GBP'm GBP'm

------------------------------------------ ------------- -------------

Recorded in operating costs

Termination and reorganisation costs - 0.6

Amortisation of intangible asset 0.6 0.6

Net exceptional items recorded in the

consolidated statement of profit or loss 0.6 1.2

------------------------------------------ ------------- -------------

Interim Consolidated Statement of Profit or Loss

For the six months to 30 September 2023

(Unaudited) (Unaudited)

Six months Six months

to 30 September to 30 September

2023 2022

GBP'000 GBP'000

----------------------------------------------- ---------------- ----------------

Revenue 86,891 90,936

Other income (271) (1,221)

----------------------------------------------- ---------------- ----------------

Gross income 86,620 89,715

Commissions and fees payable (10,435) (10,955)

----------------------------------------------- ---------------- ----------------

Net income 76,185 78,760

Operating costs (55,020) (55,758)

Finance costs (108) -

Profit for the period before tax 21,057 23,002

Taxation (5,423) (5,914)

----------------------------------------------- ---------------- ----------------

Profit for the period attributable to ordinary

shareholders 15,634 17,088

----------------------------------------------- ---------------- ----------------

Earnings per share

Basic 16.2p 17.7p

Diluted 16.0p 17.4p

Adjusted basic (Non-GAAP measure) 17.4p 19.3p

Adjusted diluted (Non-GAAP measure) 17.2p 19.0p

----------------------------------------------- ---------------- ----------------

Interim Consolidated Statement of Other Comprehensive Income

For the six months to 30 September 2023

(Unaudited) (Unaudited)

Six months Six months

to 30 September to 30 September

2023 2022

GBP'000 GBP'000

--------------------------------------------------- ---------------- ----------------

Profit for the period attributable to ordinary

shareholders 15,634 17,088

Other comprehensive income - items that will

be reclassified to profit or loss in subsequent

periods:

Exchange differences on translation of foreign

operations (163) 2,267

--------------------------------------------------- ---------------- ----------------

Other comprehensive (loss)/income for the

period (163) 2,267

--------------------------------------------------- ---------------- ----------------

Total comprehensive income for the period,

net of tax, attributable to ordinary shareholders 15,471 19,355

--------------------------------------------------- ---------------- ----------------

All of the items in the above statements are derived from

continuing operations.

Interim Consolidated Balance Sheet

As at 30 September 2023

(Audited)

(Unaudited) 31 March

30 September

2023 2023

GBP'000 GBP'000

-------------------------------------------- -------------- ---------

Non-current assets

Goodwill and intangible assets 15,356 15,937

Property and equipment 9,451 10,534

Deferred tax assets 1,009 106

-------------------------------------------- -------------- ---------

25,816 26,577

-------------------------------------------- -------------- ---------

Current assets

Assets at fair value through profit or loss 70,471 83,048

Trade and other receivables 22,700 19,523

Other financial assets 4,667 5,237

Cash and cash equivalents 72,785 106,976

Current tax assets 610 319

171,233 215,103

-------------------------------------------- -------------- ---------

Total assets 197,049 241,680

-------------------------------------------- -------------- ---------

Non-current liabilities

Provisions and other liabilities 7,921 8,900

Liabilities at fair value through profit or

loss 286 462

Deferred tax liabilities - 518

-------------------------------------------- -------------- ---------

8,207 9,880

-------------------------------------------- -------------- ---------

Current liabilities

Liabilities at fair value through profit or

loss 8,163 16,369

Trade and other payables 55,266 68,651

Provisions 332 3,203

Other financial liabilities - 10

Current tax liabilities 2,004 712

65,765 88,945

-------------------------------------------- -------------- ---------

Total liabilities 73,972 98,825

-------------------------------------------- -------------- ---------

Net assets 123,077 142,855

-------------------------------------------- -------------- ---------

Capital and reserves

Issued share capital 2,530 2,520

Share premium 19,364 19,364

Investment in own shares (33,286) (31,623)

Capital and other reserves 12,188 12,299

Retained earnings 122,281 140,295

--------------------------------------------------- -------- --------

Total equity attributable to ordinary shareholders 123,077 142,855

--------------------------------------------------- -------- --------

Interim Consolidated Statement of Changes in Equity

For the six months to 30 September 2023

Issued Investment

share Share in own Capital Other Retained

capital premium shares reserves reserves earnings Total equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------------ --------- -------- ---------- --------- --------- --------- ------------

As at 1 April 2023

(audited) 2,520 19,364 (31,623) 695 11,604 140,295 142,855

Profit for the period - - - - - 15,634 15,634

Other comprehensive

income - - - - (163) - (163)

------------------------ --------- -------- ---------- --------- --------- --------- ------------

Total comprehensive

income - - - - (163) 15,634 15,471

Dividends paid to

shareholders - - - - - (30,865) (30,865)

Issue of shares 10 - - - - (10) -

Own shares acquired - - (7,588) - - - (7,588)

Release of own shares - - 5,925 - - (5,190) 735

Share-based payment - - - - - 2,417 2,417

Current tax in respect

of employee share

options - - - - 18 - 18

Deferred tax in respect

of employee share

options - - - - 34 - 34

------------------------ --------- -------- ---------- --------- --------- --------- ------------

As at 30 September

2023 (unaudited) 2,530 19,364 (33,286) 695 11,493 122,281 123,077

------------------------ --------- -------- ---------- --------- --------- --------- ------------

As at 1 April 2022

(audited) 2,506 19,364 (24,915) 695 11,722 146,875 156,247

Profit for the period - - - - - 17,088 17,088

Other comprehensive

income - - - - 2,267 - 2,267

------------------------ ----- ------ -------- --- ------ -------- --------

Total comprehensive

income - - - - 2,267 17,088 19,355

Dividends paid to

shareholders - - - - - (30,911) (30,911)

Issue of shares 14 - - - - (14) -

Own shares acquired - - (6,734) - - - (6,734)

Release of own shares - - 2,991 - - (1,736) 1,255

Share-based payment - - - - - 2,717 2,717

Current tax in respect

of employee share

options - - - - (3) - (3)

Deferred tax in respect

of employee share

options - - - - (606) - (606)

------------------------ ----- ------ -------- --- ------ -------- --------

As at 30 September

2022 (unaudited) 2,520 19,364 (28,658) 695 13,380 134,019 141,320

------------------------ ----- ------ -------- --- ------ -------- --------

Interim Consolidated Cash Flow Statement

For the six months to 30 September 2023

(Unaudited) (Unaudited)

Six months Six months

to 30 September to 30 September

2023 2022

GBP'000 GBP'000

--------------------------------------------- ---------------- ----------------

Operating activities

Cash flow generated from operations 7,449 10,405

Tax paid (5,853) (1,081)

Interest received 1,104 214

Interest on lease - (37)

--------------------------------------------- ---------------- ----------------

Net cash inflow from operating activities 2,700 9,501

--------------------------------------------- ---------------- ----------------

Investing activities

Investment income 350 502

Sale of assets at fair value through profit

or loss 28,971 17,850

Purchase of assets at fair value through

profit or loss (20,341) (33,733)

Net cashflow from deconsolidation of seed

investment - (6,080)

Purchase of property and equipment (149) (143)

Net cash inflow/(outflow) from investing

activities 8,831 (21,604)

--------------------------------------------- ---------------- ----------------

Financing activities

Dividends paid to shareholders (30,865) (30,911)

Lease payments (697) (653)

Interest on lease (108) -

Purchase of own shares (7,588) (6,734)

Third-party subscriptions into consolidated

funds 3,725 12,055

Third-party redemptions from consolidated

funds (10,163) (1,223)

Net cash outflow from financing activities (45,696) (27,466)

--------------------------------------------- ---------------- ----------------

Net decrease in cash and cash equivalents (34,165) (39,569)

Cash and cash equivalents at start of period 106,976 121,128

Effect of exchange rate changes on cash and

cash equivalents (26) 905

--------------------------------------------- ---------------- ----------------

Cash and cash equivalents at end of period 72,785 82,464

--------------------------------------------- ---------------- ----------------

Notes to the Unaudited Interim Consolidated Financial

Statements

For the six months to 30 September 2023

1. General Information, Basis of Preparation and Accounting Policies

1.1 Corporate information

Polar Capital Holdings plc (the 'Company') is a public limited

company incorporated and domiciled in England and Wales whose

shares are traded on the Alternative Investment Market ('AIM') of

the London Stock Exchange.

1.2 Basis of Preparation

The unaudited interim condensed consolidated financial

statements to 30 September 2023 have been prepared in accordance

with IAS 34: Interim Financial Reporting.

The unaudited interim condensed consolidated financial

statements do not include all the information and disclosures

required in annual financial statements and should be read in

conjunction with the Group's annual financial statements as at 31

March 2023, which have been prepared in accordance with UK-adopted

international accounting standards and in conformity with the

requirements of the Companies Act 2006.

The accounting policies adopted and the estimates and judgements

used in the preparation of the unaudited interim condensed

consolidated financial statements are consistent with the Group's

annual financial statements for the year ended 31 March 2023.

1.3 Group information

The Group is required to consolidate seed capital investments

where it is deemed to control them. The operating subsidiaries and

seed capital investments consolidated at 30 September 2023 are

consistent with the annual report at 31 March 2023 except for the

Polar Capital Emerging Market ex-China Stars Fund (a sub fund of

Polar Capital Fund plc) and Polar Capital Emerging Market ex-China

Stars Fund (a US 40-Act mutual fund), which have both been

consolidated effective 30 June 2023.

1.4 Going concern

The Directors have made an assessment of going concern taking

into account both the Group's current results as well as the impact

on the Group's outlook. As part of this assessment the Directors

have used a range of information available to the date of issue of

these interim financial statements and considered the Group budget,

longer term financial projections including stress testing

scenarios applied as part of the Group's ICARA, cash flow forecasts

and an analysis of the Group's forecasted liquid assets and its

regulatory capital position.

The Group continues to maintain a robust financial resources

position, access to cashflow from ongoing investment management

contracts and the Directors believe that the Group is well placed

to manage its business risks. The Directors also have a reasonable

expectation that the Group has adequate resources to continue

operating for a period of at least 12 months from the date of

approval of the interim consolidated financial statements.

Therefore, the Directors continue to adopt the going concern basis

of accounting in preparing the interim consolidated financial

statements.

2. Revenue

(Unaudited) (Unaudited)

Six months Six months

to 30 September to 30 September

2023 2022

GBP'000 GBP'000

---------------------------------------- ---------------- ----------------

Investment management and research fees 86,891 90,936

---------------------------------------- ---------------- ----------------

3. Components of other income and other comprehensive income

(a) Components of other income

(Unaudited) (Unaudited)

Six months Six months

to 30 September to 30 September

2023 2022

GBP'000 GBP'000

------------------------------------------------ ---------------- ----------------

Interest income on cash and cash equivalents 1,104 214

Net gain on other financial assets/ liabilities

- short positions 1,234 7,640

Net loss on other financial assets/ liabilities

- forward currency contracts (265) (5,607)

Net loss on financial assets and liabilities

at FVTPL (4,603) (6,460)

Investment income 350 502

Other loss - attributed to third party holdings 1,909 2,490

(271) (1,221)

------------------------------------------------ ---------------- ----------------

(b) Components of other comprehensive income

(Unaudited) (Unaudited)

Six months Six months

to 30 September to 30 September

2023 2022

GBP'000 GBP'000

------------------------------------------------- ---------------- ----------------

Exchange differences on translation of foreign

operations:

------------------------------------------------- ---------------- ----------------

(Losses)/gains arising during the period (163) 2,391

Reclassification adjustments for losses included

in the consolidated statement of profit or

loss - (124)

(163) 2,267

------------------------------------------------- ---------------- ----------------

4. Operating costs

a) Operating costs include the following items:

(Unaudited) (Unaudited)

Six months Six months

to 30 September to 30 September

2023 2022

GBP'000 GBP'000

----------------------------------------------------- ---------------- ----------------

Staff costs including partnership profit allocations 39,765 42,544

Depreciation 1,232 751

Amortisation of intangible assets 581 581

Auditors' remuneration 228 193

----------------------------------------------------- ---------------- ----------------

b) Auditors' remuneration:

Audit of Group financial statements 56 63

Local statutory audits of subsidiaries 105 76

Audit-related assurance services 4 3

Other assurance services - internal controls

review 63 51

228 193

--------------------------------------------- --- ---

5. Dividends

(Unaudited) (Unaudited)

Six months Six months

to 30 September to 30 September

2023 2022

GBP'000 GBP'000

-------------- ---------------- ----------------

Dividend paid 30,865 30,911

-------------- ---------------- ----------------

On 28 July 2023, the Group paid a second interim dividend for

2023 of 32p (2022: 32p) per ordinary share.

6. Share-based Payments

A summary of the charge to the consolidated statement of profit

or loss for each share-based payment arrangement is as follows:

(Unaudited) (Unaudited)

Six months Six months

to 30 September to 30 September

2023 2022

GBP'000 GBP'000

---------------------------------- ---------------- ----------------

Preference shares 370 138

LTIP share awards 860 1,514

Equity incentive shares 304 315

Deferred remuneration plan shares 883 750

---------------------------------- ---------------- ----------------

2,417 2,717

---------------------------------- ---------------- ----------------

Certain employees of the Group and partners of Polar Capital LLP

hold Manager Preference Shares or Manager Team Member Preference

Shares (together 'Preference Shares') in Polar Capital Partners

Limited, a group company.

The preference shares are designed to incentivise and retain the

Group's fund management teams. These shares provide each manager

with an economic interest in the funds that they run and ultimately

enable the manager, at their option and at a future date, to

convert their interest in the revenues generated from their funds

to a value that may (at the discretion of the parent undertaking,

Polar Capital Holdings plc) be satisfied by the issue of ordinary

shares in Polar Capital Holdings plc. Such conversion takes place

according to a pre-defined conversion formula that considers the

relative contribution of the manager to the Group as a whole. The

equity is awarded in return for the forfeiture of a manager's

current core economic interest and is issued over three years from

the date of conversion.

No conversion of preference shares into Polar Capital Holdings

plc equity has taken place during the period to 30 September 2023

(2022: No conversion).

At 30 September 2023, five sets of preference shares (2022: five

sets) have the right to call for conversion.

The following table illustrates the number of, and movements in,

the estimated number of ordinary shares to be issued.

Estimated number of ordinary shares to be issued against

preference shares with a right to call for conversion:

(Unaudited) (Unaudited)

30 September 30 September

2023 2022

Number of

shares Number of shares

--------------------------- -------------- -----------------

At 1 April 2,367,680 2,740,604

Conversion/crystallisation - -

Movement during the period (109,970) (404,308)

At 30 September 2,257,710 2,336,296

--------------------------- -------------- -----------------

Number of ordinary shares to be issued against converted

preference shares:

(Unaudited) (Unaudited)

30 September 30 September

2023 2022

Number of

shares Number of shares

---------------------------- -------------- -----------------

Outstanding at 1 April 810,310 1,352,128

Conversion/crystallisation - -

Issued during the period (405,154) (541,818)

Outstanding at 30 September 405,156 810,310

---------------------------- -------------- -----------------

7. Earnings Per Share

A reconciliation of the figures used in calculating the basic,

diluted and adjusted earnings per share (EPS) figures is as

follows:

(Unaudited) (Unaudited)

Six months Six months

to to

30 September 30 September

2023 2022

GBP'000 GBP'000

Earnings

Profit after tax for purpose of basic and

diluted EPS 15,634 17,088

Adjustments (post tax):

Add back cost of share-based payments on

preference shares 370 138

Add back exceptional items - termination/

acquisition related costs - 615

Add back exceptional items - amortisation

of intangible assets 581 581

Add net amount of deferred staff remuneration 225 250

-------------------------------------------------- ------------- -----------------

Profit after tax for purpose of adjusted

basic and adjusted diluted total EPS 16,810 18,672

-------------------------------------------------- ------------- -----------------

(Unaudited)

Six months (Unaudited)

to Six months

30 September to

2023 30 September

Number of 2022

shares Number of shares

-------------------------------------------------- ------------- -----------------

Weighted average number of shares

Weighted average number of ordinary shares,

excluding own shares for purposes of basic

and adjusted basic EPS 96,569,042 96,661,663

Effect of dilutive potential shares - LTIPs,

share options and preference shares crystallised

but not yet issued 1,274,957 1,372,703

Weighted average number of ordinary shares,

for purpose of diluted and adjusted diluted

total EPS 97,843,999 98,034,366

-------------------------------------------------- ------------- -----------------

(Unaudited) (Unaudited)

Six months Six months

to to

30 September 30 September

2023 2022

Pence Pence

------------------- ------------- --------------

Earnings per share

Basic 16.2 17.7

Diluted 16.0 17.4

Adjusted basic 17.4 19.3

Adjusted diluted 17.2 19.0

------------------- ------------- --------------

8. Goodwill and intangible assets

Goodwill relates to the acquisition of Dalton Capital (Holdings)

Limited, the parent company of Dalton Strategic Partnership LLP, a

UK based boutique asset manager acquired on 26 February 2021. The

goodwill is attributable to a single CGU.

Intangible assets at 30 September 2023 relate to investment

management contracts acquired as part of the business combination

with Dalton.

Investment

management

(Unaudited) Goodwill contracts Total

GBP'000 GBP'000 GBP'000

---------------------------------------- ---------- ----------- ---------

Cost

As at 1 April 2023 6,732 18,647 25,379

Revaluation/ Additions - - -

---------------------------------------- ---------- ----------- ---------

As at 30 September 2023 6,732 18,647 25,379

---------------------------------------- ---------- ----------- ---------

Accumulated amortisation and impairment

As at 1 April 2023 - 9,442 9,442

Amortisation for the period - 581 581

Impairment for the period - - -

---------------------------------------- ---------- ----------- ---------

As at 30 September 2023 - 10,023 10,023

---------------------------------------- ---------- ----------- ---------

Net book value as at 30 September

2023 6,732 8,624 15,356

---------------------------------------- ---------- ----------- ---------

Investment

management

Goodwill contracts Total

(Audited) GBP'000 GBP'000 GBP'000

---------------------------------------- ---------- ----------- ---------

Cost

As at 1 April 2022 6,732 18,647 25,379

As at 31 March 2023 6,732 18,647 25,379

---------------------------------------- ---------- ----------- ---------

Accumulated amortisation and impairment

As at 1 April 2022 - 8,279 8,279

Amortisation for the year - 1,163 1,163

Impairment for the year - - -

---------------------------------------- ---------- ----------- ---------

As at 31 March 2023 - 9,442 9,442

---------------------------------------- ---------- ----------- ---------

Net book value as at 31 March 2023 6,732 9,205 15,937

---------------------------------------- ---------- ----------- ---------

Amortisation and impairment of intangible assets are treated as

exceptional items.

Goodwill is tested for impairment at least on an annual basis or

more frequently when there are indications that goodwill may be

impaired.

The table below shows the carrying amount assigned to each

component of the intangible asset and the remaining amortisation

period.

(Unaudited) (Audited)

30 September 31 March

2023 2023

------------------------------ ----------------------------- ---------------------------

Remaining Remaining

Carrying amortisation Carrying amortisation

value period value period

GBP'000 GBP'000

------------------------------ ------------- -------------- ----------- --------------

Investment management contracts

acquired from Dalton Capital

(Holdings) Limited 8,624 7.4 years 9,205 7.9 years

8,624 9,205

------------------------------ ------------- -------------- ----------- --------------

The Group has reviewed the investment management contracts

related intangible assets as at 30 September 2023 and has concluded

that there are no indicators of impairment.

9. Property and equipment

Right-of-use Leasehold Computer Office

assets Improvements Equipment Furniture Total

(Unaudited) GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

---------------------- ------------- -------------- ----------- ----------- ----------

Cost

As at 1 April 2023 18,850 2,456 1,077 505 22,888

Additions - 68 52 29 149

As at 30 September

2023 18,850 2,524 1,129 534 23,037

---------------------- ------------- -------------- ----------- ----------- ----------

Accumulated Depreciation

As at 1 April 2023 9,531 1,476 877 470 12,354

Charge for the year 1,009 146 65 12 1,232

---------------------- ------------- -------------- ----------- ----------- ----------

As at 30 September

2023 10,540 1,622 942 482 13,586

---------------------- ------------- -------------- ----------- ----------- ----------

Net book value as at

30 September 2023 8,310 902 187 52 9,451

---------------------- ------------- -------------- ----------- ----------- ----------

Right-of-use Leasehold Computer Office

assets Improvements Equipment Furniture Total

(Audited) GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

---------------------- ------------- -------------- ----------- ----------- ----------

Cost

As at 1 April 2022 10,749 2,086 969 497 14,301

Additions 4,126 370 108 8 4,612

Modification 3,975 - - - 3,975

---------------------- ------------- -------------- ----------- ----------- ----------

As at 31 March 2023 18,850 2,456 1,077 505 22,888

---------------------- ------------- -------------- ----------- ----------- ----------

Accumulated Depreciation

As at 1 April 2022 7,763 1,256 743 426 10,188

Charge for the year 1,768 220 134 44 2,166

---------------------- ------------- -------------- ----------- ----------- ----------

As at 31 March 2023 9,531 1,476 877 470 12,354

---------------------- ------------- -------------- ----------- ----------- ----------

Net book value as at

31 March 2023 9,319 980 200 35 10,534

---------------------- ------------- -------------- ----------- ----------- ----------

10. Leases

A maturity analysis of the Group's lease liabilities is as

follows:

(Unaudited) (Audited)

30 September 31 March

2023 2023

Lease liabilities GBP'000 GBP'000

---------------------------------------------- -------------- ---------

Current 2,026 1,729

Non-current 6,544 7,526

------------------------------------

8,570 9,255

------------------------------------ ------------------------ ---------

The lease liabilities relate to the two leases in respect of the

Group's premises at 16 Palace Street in London, both expiring in

January 2028, and the Group's premises in Zurich, expiring in

November 2026. The movement in lease balances during the period was

GBP0.7m, of which GBP0.8m were lease payments and GBP0.1m was the

interest expense (31 March 2023: The movement in lease was GBP6.1m,

of which GBP1.6m were lease payments, GBP0.2m was the interest

expense, GBP3.5m related to initial recognition of new leases and

GBP4.0m related to lease modification of the existing lease).

The consolidated statement of profit or loss includes the

following amounts relating to leases recorded within operating

costs:

(Audited)

(Unaudited) 31 March

30 September

2023 2023

GBP'000 GBP'000

-------------------------------------------- -------------- -----------

Interest expense on lease liabilities 108 175

Depreciation on ROU assets 1,009 1,768

--------------------------------------------

1,117 1,943

-------------------------------------------- -------------- ---------

There are no lease expenses incurred in relation to low-value

assets or short-term leases.

11. Issued Share Capital

(Audited)

(Unaudited) 31 March

30 September

2023 2023

Allotted, called up and fully paid: GBP'000 GBP'000

--------------------------------------------- -------------- ---------

101,195,879 ordinary shares of 2.5p each

(31 March 2023: 100,790,725 ordinary shares

of 2.5p each) 2,530 2,520

--------------------------------------------- -------------- ---------

During the period, Polar Capital Holdings plc has issued 405,154

shares in connection with previously crystallised manager

preference shares.

12. Financial Instruments

The fair value of financial instruments that are traded in

active markets at each reporting date is determined by reference to

quoted market prices or dealer price quotation (bid price for long

positions and ask price for short positions), without any deduction

for transaction costs. For financial instruments not traded in an

active market, such as forward exchange contracts, the fair value

is determined using appropriate valuation techniques that take into

account the terms and conditions of the contracts and utilise

observable market data, such as spot and forward rates, as

inputs.

The Group uses the following hierarchy for determining and

disclosing the fair value of financial instruments by valuation

technique:

Level 1: quoted (unadjusted) prices in active markets for

identical assets or liabilities.

Level 2: other techniques for which all inputs which have a

significant effect on the recorded fair value are observable,

either directly or indirectly.

Level 3: techniques which use inputs which have a significant

effect on the recorded fair value that are not based on observable

market data.

(Unaudited) (Audited)

30 September 2023 31 March 2023

------------------------------------------ ------------------------------------------

Level Level Level Total Level Level Level Total

1 2 3 GBP'000 1 2 3 GBP'000

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

----------------------- --------- --------- --------- --------- --------- --------- --------- ---------

Financial assets

Assets at FVTPL 70,471 - - 70,471 83,048 - - 83,048

Other financial

assets 4,579 88 - 4,667 5,237 - - 5,237

----------------------- --------- --------- --------- --------- --------- --------- --------- ---------

75,050 88 - 75,138 88,285 - - 88,285

----------------------- --------- --------- --------- --------- --------- --------- --------- ---------

Financial liabilities

Liabilities at

FVTPL 8,107 - 342 8,449 16,285 - 546 16,831

Other financial

liabilities - - - - - 10 - 10

----------------------- --------- --------- --------- --------- --------- --------- --------- ---------

8,107 - 342 8,449 16,285 10 546 16,841

----------------------- --------- --------- --------- --------- --------- --------- --------- ---------

During the period there were no transfers between levels in fair

value measurements.

Movement in liabilities at FVTPL categorised as Level 3 during

the year were:

(Unaudited) (Audited)

30 September 31 March

2023 2023

GBP'000 GBP'000

----------------------------------------- -------------- ----------------------

At 1 April 546 855

Repayment (38) (226)

Net gains recognised in the statement of

profit or loss (166) (83)

----------------------------------------- -------------- ----------------------

At 30 September 342 546

----------------------------------------- -------------- ----------------------

13. Contingent liability

In the normal course of the Group's business, it may be subject

to legal and regulatory proceedings arising out of current and past

operations, which in some cases may result in contingent

liabilities.

There are no contingent liabilities to disclose at 30 September

2023 (31 March 2023: nil)

14. Notes to the Cash Flow Statement

Reconciliation of profit before taxation to cash generated from

operations

(Unaudited)

(Unaudited) Six months

Six months to

to 30 September 30 September

2023 2022

GBP'000 GBP'000

--------------------------------------------------- ---------------- ---------------------

Cash flows from operating activities

Profit on ordinary activities before tax 21,057 23,002

Adjustments for:

Interest receivable and similar income (1,104) (214)

Investment income (350) (502)

Interest on lease 108 37

Amortisation of intangible assets 581 581

Depreciation of non-current property and equipment 1,232 751

Decrease in fair value of assets at fair value

through profit or loss 4,768 6,552

Increase in other financial assets (553) (8,667)

(Increase)/decrease in receivables (3,176) 4,554

Decrease in trade and other payables including

other provisions (16,551) (18,861)

Share-based payments 2,416 2,717

Decrease in liabilities at fair value through

profit or loss(1) (1,945) (3,009)

Release of fund units held against deferred

remuneration 966 3,464

Cash flow generated from operations 7,449 10,405

--------------------------------------------------- ---------------- ---------------------

1. Movement includes those arising from acquiring and/or losing

control of consolidated seed funds.

2. Related Party Transactions

Transactions between the Company and its subsidiaries, which are

related parties of the Company, have been eliminated on

consolidation and are not included in this note. All related party

transactions during the period are consistent with those disclosed

in the Group's annual financial statements for the year ended 31

March 2023 and have taken place on an arm's length basis.

3. The Publication of Non-Statutory Accounts

The financial information contained in this unaudited interim

report for the period to 30 September 2023 does not constitute

statutory accounts as defined in s434 of the Companies Act 2006.

The financial information for the six months ended 30 September

2023 and 2022 has not been audited. The information for the year

ended 31 March 2023 has been extracted from the latest published

audited accounts, which have been filed with the Registrar of

Companies. The audited accounts filed with the Registrar of

Companies contain a report of the independent auditor dated 23 June

2023. The report of the independent auditor on those financial

statements contained no qualification or statement under s498 of

the Companies Act 2006.

Shareholder Information

Directors

David Lamb Non-executive Chairman

Gavin Rochussen Chief Executive Officer

Samir Ayub Finance Director

Alexa Coates Non-executive Director, Chair of Audit and Risk

Committee

Win Robbins Non-executive Director, Chair of Remuneration

Committee

Andrew Ross Non-executive Director

Laura Ahto Non-executive Director

Anand Aithal Non-executive Director

Company No.

Registered in England and Wales

4235369

Registered Office

16 Palace Street

London, SW1E 5JD

Tel: 020 7227 2700

Group Company Secretary

Neil Taylor

Dividend

A first interim dividend of 14.0p per share has been declared

for the year to 31 March 2024. This will be paid on 12 January 2024

to shareholders on the register on 15 December 2023. The shares

will trade ex-dividend from 14 December 2023.

Remuneration Code

Disclosure of the Group's Remuneration Code is made alongside

its MIFIDPRU public disclosure document and is available on the

Company's website.

Half Year Report

Copies of this announcement and of the Half Year report will be

available from the Secretary at the Registered Office, 16 Palace

Street, London SW1E 5JD and from the Company's website at

www.polarcapital.co.uk

Neither the contents of the Company's website nor the contents

of any website accessible from the hyperlinks on the Company's

website (or any other website) is incorporated into or forms part

of this announcement .

ENDS

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR GZMMMMNNGFZZ

(END) Dow Jones Newswires

November 20, 2023 02:00 ET (07:00 GMT)

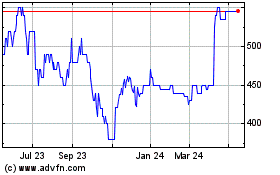

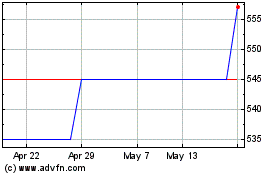

Polar Capital (AQSE:POLR.GB)

Historical Stock Chart

From Mar 2024 to Apr 2024

Polar Capital (AQSE:POLR.GB)

Historical Stock Chart

From Apr 2023 to Apr 2024