TIDMLMS

RNS Number : 4473J

LMS Capital PLC

27 April 2022

27 April 2022

LMS CAPITAL PLC

First Quarter 2022 Update

LMS Capital plc (the " Company"), a listed Investment Company,

provides the following update covering the three months ended 31

March 2022.

Financial Highlights

-- Unaudited Net Asset Value ("NAV") at 31 March 2022 was

GBP50.3 million (62.3p per share). This compares to GBP49.1 million

(60.8p per share) at 31 December 2021;

-- Unrealised portfolio gains of GBP1.3 million, including

foreign exchange gains, and accrued interest income of GBP0.3

million from the Dacian Petroleum investment; and

-- Cash at 31 March 2022 was GBP19.5 million compared to GBP20.1 million at 31 December 2021.

Unaudited Net Asset Value at 31 March 2022

The GBP1.2 million increase in NAV during the first quarter is

comprise d of the following:

-- Unrealised gains of GBP0.6 million on the mature investment portfolio;

-- Accrued interest income of GBP0.3 million on the Dacian Petroleum investment;

-- GBP0.7 million of portfolio and GBP0.1 million of

non-portfolio foreign exchange gains from the strengthening of the

U.S. Dollar against sterling; and

-- GBP0.4 million of running costs and GBP0.1 million of investment related costs.

The 31 March 2022 NAV is summarised below:

Unaudited Audited

31 March 31 December

2022 2021

---------- ------------

GBP 000s

------------------------

Mature Investment Portfolio

---------- ------------

Quoted Investments 297 383

---------- ------------

Unquoted Investments 9,078 8,668

---------- ------------

Funds 14,755 13,929

---------- ------------

24,130 22,980

---------- ------------

New Investment Portfolio

---------- ------------

Quoted Investments - -

---------- ------------

Unquoted Investments 8,470 7,958

---------- ------------

Funds - -

---------- ------------

8,470 7,958

---------- ------------

Total Investments 32,600 30,938

---------- ------------

Cash 19,458 20,113

---------- ------------

Other Net Assets/Liabilities (1,746) (1,942)

---------- ------------

Net Asset Value 50,312 49,109

---------- ------------

The NAV at the end of March is based on the valuation of the

Company ' s investments as at 31 December 2021, adjusted for

transactions in the three months ended 31 March 2022, price

movements on quoted securities, movements in foreign currency

exchange rates, cash calls and distributions from funds, and the

latest information available from third party fund managers.

Portfolio Unrealised Net Gains

The portfolio net unrealised gains of GBP0.6 million and GBP0.3

million of accrued interest income, excluding foreign exchange

movements, are summarised below:

Quoted Investments

The Company ' s quoted investment valuations decreased by a net

GBP0.1 million during the first quarter of 2022, reflecting

underlying market price decreases.

Unquoted Investments

The Company ' s unquoted investments include our direct holdings

in Dacian Petroleum, Medhost and Elateral, assets managed by San

Francisco Equity Partners (ICU Eyewear and YesTo), and a

convertible debt instrument with IDE Group Holdings.

Total unquoted investment unrealised gains were nil during the

first quarter as a GBP0.1 million gain in Medhost was offset by a

GBP0.1 million loss in Elateral.

Dacian Petroleum had GBP0.3 million in investment accrued

interest income during the first quarter.

Funds

The Company ' s fund investments include its holding in Brockton

Capital Fund I, Opus Capital Venture Partners, Weber Capital

Partners and five other smaller fund interests.

Fund unrealised net gains were GBP0.7 million. The principal

movements were:

-- Opus Capital Venture Partners - Unrealised gain of GBP1.1

million, driven by a significant uplift in the fund manager's

valuation of one of the Fund's two principal remaining

investments;

-- Brockton Capital Fund 1 - Unrealised gain of GBP0.4 million,

reflecting the unwinding of the discount rate as the investment is

valued on a discounted cash flow basis;

-- Eden - Unrealised loss of GBP0.4 million;

-- Weber Capital Partners - unrealised loss of GBP0.3 million

due to the performance in the U.S. microcap equities held in the

fund; and

-- Other unrealised losses on funds of GBP0.1 million.

The carrying value of the funds is based on the latest available

information from the respective fund managers, generally the 31

December 2021 fund valuation reports except for Weber Capital

Partners , which is based on 31 March 2022 valuations.

Portfolio Realisations

There were fund distributions of GBP0.1 million during the first

quarter.

Liquidity and Outlook

The Company continues to maintain significant cash balances,

GBP19.5 million at 31 March 2022. The Board is reviewing a number

of opportunities with its real estate team, as well as further

investment opportunities, but continues to take a c autious stance

in the way the company's resources are deployed.

For further information please contact:

LMS Capital PLC

Nick Friedlos, Managing Director

0207 935 3555

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

QRFIFMLTMTTTBTT

(END) Dow Jones Newswires

April 27, 2022 02:01 ET (06:01 GMT)

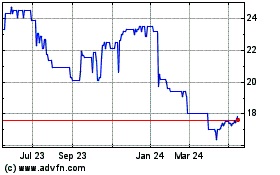

LMS Capital (AQSE:LMS.GB)

Historical Stock Chart

From Apr 2024 to May 2024

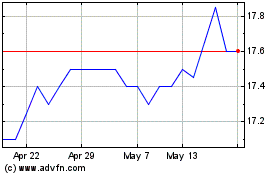

LMS Capital (AQSE:LMS.GB)

Historical Stock Chart

From May 2023 to May 2024