Investors in search of a decent yield on their money have it

awfully rough these days. For over three years now, the Federal

Reserve has held its key interest rate between 0% and 0.25%.

And with the Fed recently reaffirming its pledge to

keep interest rates low until at least late 2014, short-term rates

like savings accounts and money market funds will continue paying

paltry returns for quite some time. Expect the long end of the

yield curve to remain compressed too.

To gain perspective on just how low interest rates

are, take a look at today's 10-year Treasury note compared with its

50-year average:

So what is an income investor to do in this

low-yield world? Consider these alternatives.

Blue Chip Stocks

"But stocks are too risky" you might say. In

the short-term, yes. But if you pay a reasonable price for a solid

business whose earnings are highly likely to be materially higher

5, 10 or 20 years from now, your returns have a good chance of

being higher over the long-run than with bonds.

And speaking of risk, don't you consider it risky

to lend money to an entity with over $115000000000000 (not a typo)

in unfunded liabilities and over $1000000000000 in annual deficits

for the foreseeable future?

What kind of rate would you require on your

investment? Would you lend that institution your money for 10-years

at a measly 2.0%? That return likely won't even keep up with

inflation.

Conversely, the earnings yield on the S&P 500

is currently 7.7 based on a forward price to earnings ratio of

13.0. Granted, returns over the last 10 years have not been great

for most stocks, even for many blue chips, but much of the reason

is that 10 years ago, those stocks were wildly overpriced. That

doesn't seem to be the case today.

Moreover, the average dividend yield of the 30 Dow

Jones Industrial Average components is a solid 2.8%. And there are

several blue-chip stocks with strong cash flows, stable businesses

and excellent credit ratings. Also, these companies often

raise their dividends annually, unlike bonds which typically

pay a fixed coupon.

Preferred Stocks

If you're still leery of investing in stocks, there

is a way to get the best of both worlds: preferred shares.

Preferred shares are hybrid securities that act like bonds in that

investors get a fixed payment, but still represent ownership in a

business like a stock (although they typically don't get voting

rights). Moreover, some preferred shares are convertible to common

stock if a company's share price takes off, providing unlimited

upside potential.

The dividends on preferred shares take priority

over their common stock cousins, but interest payments on debt take

the first priority. Nonetheless, if you're willing to shoulder a

little bit more risk, preferred shares can offer attractive total

returns.

Foreign Bonds

If you're willing to invest overseas, yields on

some foreign bonds, like Brazil and Australia, are very attractive

right now. And countries like Canada have much better balance

sheets than the U.S. (and AAA credit ratings from Standard &

Poors).

MLPs, REITs, BDCs

There's nothing like the threat of taxes on a

business to get them to shell out cash to their owners. Master

Limited Partnerships (MLPs), Real Estate Investment Trusts (REITs)

and Business Development Companies (BDCs) all have to pay out at

least 90% of their earnings to unitholders in the form of

distributions to avoid paying taxes on that money. This way that

money avoids double-taxation, which can lead to some juicy

yields.

Many of these entities are in highly volatile

industries, however, so their distributions often get cut during

recessions. But not all of them do. In fact, many MLPs, REITs and

BDCs actually raised their distributions during the Great

Recession.

Diversify

For income investors, I recommend a mixture of

these different income-generating investments. Here are 4 specific

ideas within each category above:

Blue Chip Stock Recommendation:

Chevron (CVX)

Dividend Yield: 3.3%

Earnings Yield: 12.7%

This oil giant recently announced its third

dividend increase in the last year and has raised it at a compound

annual rate of 8% since 1996.

The company generated nearly $15 billion in free

cash flow in 2011 and paid over $6 billion to shareholders in the

form of dividends, so it looks like it has room for additional

hikes down the road.

Seems a lot more attractive than Treasuries to

me.

Preferred Stock Recommendation:

PowerShares Preferred Stock ETF (PGX)

Dividend Yield: 6.5%

PGX is an ETF that tracks the BofA Merrill Lynch

Core Plus Fixed Rate Preferred Securities Index which is designed

to reflect the total return performance of the U.S.

dollar-denominated preferred securities market. Additionally, that

yield is the composite of 123 holdings, so investors get the

benefit of diversification.

Foreign Bond Recommendation:

PIMCO Australia Bond Index Fund ETF (AUD)

Yield: 6.5% (average as of March 31, 2012)

The Australia Bond Index Fund aims to provide

exposure to the Australian dollar-denominated, investment grade

bond market.

Australia is a land rich in natural resources, but

it is much more than just a mining and agriculture economy. The

services sector actually accounts for nearly 75% of GDP, including

a very stable financial services industry.

The country of 22 million people has experienced 21

consecutive years of economic growth, even in spite of the global

financial crisis.

Bond yields are high because the Reserve Bank of

Australia currently has its cash rate set at 3.75%. And unlike the

U.S., Australia has a AAA credit rating from Standard &

Poor's.

MLP Recommendation:

Holly Energy Partners LP (HEP)

Distribution Yield: 6.0%

Holly Energy Partners is a master limited

partnership (MLP) that operates petroleum product and crude oil

pipelines, storage tanks, distribution terminals, and loading rack

facilities. It is headquartered in Dallas, Texas and has a market

cap of $1.6 billion.

The partnership has consistently paid, and raised,

its distribution every quarter since going public in 2004.

That marks a remarkable 30 consecutive quarterly increases, even

during the Great Recession.

The Bottom Line

With interest rates expected to stay depressed for

quite some time, income investors need to explore other options. If

you're willing to stomach a little more risk over the short-run,

these 4 investments offer very attractive returns.

Todd Bunton is the Growth & Income Stock

Strategist for Zacks Investment Research and Editor of the Income

Plus Investor service.

CHEVRON CORP (CVX): Free Stock Analysis Report

CHEVRON CORP (CVX): Free Stock Analysis Report

CHEVRON CORP (CVX): Free Stock Analysis Report

HOLLY EGY PTNRS (HEP): Free Stock Analysis Report

HOLLY EGY PTNRS (HEP): Free Stock Analysis Report

HOLLY EGY PTNRS (HEP): Free Stock Analysis Report

To read this article on Zacks.com click here.

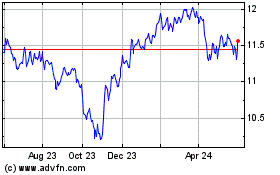

Invesco Preferred ETF (AMEX:PGX)

Historical Stock Chart

From Apr 2024 to May 2024

Invesco Preferred ETF (AMEX:PGX)

Historical Stock Chart

From May 2023 to May 2024