Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

October 04 2023 - 12:05PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of October, 2023

Commission File Number: 0001-34184

NEW PACIFIC METALS CORP.

(Translation of registrant’s name into English)

Suite 1750 - 1066 W. Hastings Street

Vancouver BC, Canada, V6E 3X1

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

[ ] Form 20-F [ X ] Form 40-F

EXHIBIT INDEX

EXHIBIT 99.1 INCLUDED WITH THIS REPORT IS HEREBY INCORPORATED BY REFERENCE AS AN EXHIBIT TO THE REGISTRANT'S REGISTRATION STATEMENT ON FORM F-10 (FILE NO. 333-273541), AS AMENDED AND SUPPLEMENTED, AND TO BE A PART THEREOF FROM THE DATE ON WHICH THIS REPORT IS SUBMITTED, TO THE EXTENT NOT SUPERSEDED BY DOCUMENTS OR REPORTS SUBSEQUENTLY FILED OR FURNISHED.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

|

| |

NEW PACIFIC METALS CORP. |

|

|

|

| Dated: October 4, 2023 |

By: |

/s/ Jalen Yuan |

| |

|

Jalen Yuan |

| |

|

Chief Accounting Officer |

Exhibit 99.1

Form 51-102F3

Material Change Report

|

|

| 1. |

Name and Address of Company |

New Pacific Metals Corp. (the "Company") Suite 1750, 1066 West Hastings Street Vancouver, BC V6E 3X1

|

|

| 2. |

Date of Material Change |

September 29, 2023

News releases with respect to the material change were provided to GlobeNewswire for dissemination on September 25, 2023 and September 29, 2023 and were subsequently filed on SEDAR+.

|

|

| 4. |

Summary of Material Change |

On September 25, 2023, the Company entered into an agreement (the "Engagement Agreement") with Raymond James Ltd., on behalf of a syndicate of underwriters co-lead by Raymond James Ltd. and Eight Capital (together, the "Co-Lead Underwriters", and collectively with the other underwriters in the syndicate, the "Underwriters"), pursuant to which the Underwriters agreed to purchase, on a bought deal basis, 13,208,000 common shares of the Company (the "Offered Shares") at a price of C$2.65 per Offered Share, for total gross proceeds of approximately C$35 million (the "Offering").

On September 29, 2023, the Company closed the Offering.

|

|

| 5. |

Full Description of Material Change |

On September 25, 2023, the Company entered into the Engagement Agreement with respect to the Offering.

On September 29, 2023, the Company closed the Offering (the "Closing"). The Offering was co-led by the Co-Lead Underwriters, on behalf of the Underwriters, pursuant to the terms of an underwriting agreement (the "Underwriting Agreement") between the Company and the Underwriters dated September 26, 2023.

Silvercorp Metals Inc. ("Silvercorp") participated in the Offering by subscribing for 2,541,890 Offered Shares, representing approximately US$5 million (approximately C$6.7 million) in gross proceeds. As of the Closing, Silvercorp owns, directly and indirectly, approximately 27.4% of the outstanding common shares of the Company (the "Common Shares"). Silvercorp is a related party of the Company for the purposes of Multilateral Instrument 61-101 – Protection of Minority Security Holders in Special Transactions ("MI 61-101") and the acquisition by Silvercorp of Offered Shares pursuant to the Offering was a related party transaction. The acquisition by Silvercorp of Offered Shares pursuant to the Offering was exempt from the valuation and minority approval requirements of MI 61-101 pursuant to the exemptions in Sections 5.5(a) and 5.7(1)(a) of MI 61-101.

2

Pan American Silver Corp. ("Pan American") participated in the Offering by subscribing for 5,083,780 Offered Shares, representing approximately US$10 million (approximately C$13.5 million) in gross proceeds. As of the Closing, Pan American owns, directly and indirectly, approximately 11.6% of the outstanding Common Shares.

The Offering was completed by way of a prospectus supplement (the "Prospectus Supplement") dated September 26, 2023 to the Company’s short form base shelf prospectus dated August 16, 2023.

The full text of each of the Underwriting Agreement and the Prospectus Supplement is available under the Company’s profile on SEDAR+ at www.sedarplus.ca.

|

|

| 6. |

Disclosure for Restructuring Transactions |

Not applicable.

|

|

| 7. |

Reliance on subsection 7.1(2) of National Instrument 51-102 |

This report is not being filed on a confidential basis.

No information has been omitted in respect of the material change.

Andrew Williams, Chief Executive Officer

Phone: 604-633-1368 Ext. 236

October 3, 2023

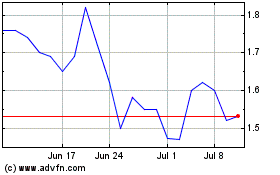

New Pacific Metals (AMEX:NEWP)

Historical Stock Chart

From Mar 2024 to Apr 2024

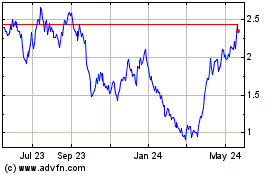

New Pacific Metals (AMEX:NEWP)

Historical Stock Chart

From Apr 2023 to Apr 2024