Reports Record Revenues and Reimbursement

Pipeline for the Fourth Quarter and Full Year

Myomo, Inc. (NYSE American: MYO) (“Myomo” or the “Company”), a

wearable medical robotics company that offers increased

functionality for those suffering from neurological disorders and

upper limb paralysis, today announced its financial results for the

fourth quarter and year ended December 31, 2018.

Recent Highlights and Accomplishments:

- Revenues for the fourth quarter 2018 of

$890,000 increased by 63% versus the comparable period of 2017. For

the full year 2018, total revenue increased 57% to $2,444,000.

Gross margins for the full year 2018 and 2017 were 70% and 68%,

respectively.

- The Company’s reimbursement pipeline

continued to grow, with 306 MyoPro units in the reimbursement

process as of December 31, 2018, after adding 139 units in the

fourth quarter. In 2018, the Company sold 92 units.

- The Company successfully completed a

follow-on public offering of its common stock in February 2019,

generating net proceeds of approximately $5,600,000.

“The record revenues for the quarter and the year are the result

of our increased investment in sales and marketing during 2018”,

said Paul R. Gudonis, Chairman and CEO of Myomo. “Our reimbursement

pipeline continues to grow, which is expected to result in

significant revenue growth in 2019.”

Financial Results

For the Three MonthsEnded

December 31,

Period-to-PeriodChange

For the Twelve MonthsEnded

December 31,

Period-to-PeriodChange

2018 2017 $ %

2018 2017 $ %

Revenue $ 889,575 $ 547,412 $ 342,163 63 % $ 2,444,104 $

1,558,866 $ 885,238 57 % Cost of revenue 226,176

203,972 22,204 11 % 728,279

505,280 222,999 44 % Gross margin $ 663,399 $ 343,440

$ 319,959 93 % $ 1,715,825 $ 1,053,586 $ 662,239 63 %

Gross margin% 75 % 63 % 12 %

70 % 68 % 2 %

Revenue in the fourth quarter 2018 was $890,000, an increase of

63%, versus the comparable period of 2017. Revenue for the twelve

months ended December 31, 2018 was $2,440,000, an increase of 57%,

versus the comparable period of 2017. Results for the three and

twelve months ended December 31, 2018, reflects a higher average

selling price due to a favorable product and sales channel mix.

Gross margin was 75% and 63% for the quarter ended December 31,

2018 and 2017, respectively. Gross margin was 70% and 68% for the

twelve months ended December 31, 2018 and 2017, respectively. The

increase in gross margins is primarily due to the aforementioned

improvement in average selling price.

Operating expenses were $3,398,000, an increase of $1,239,000,

or 57%, during the three months ended December 31, 2018, versus the

comparable period of 2017. Operating expenses were $12,244,000, an

increase of $4,643,000, or 61%, during the twelve months ended

December 31, 2018, as compared to the twelve months ended December

31, 2017. These increases in operating expenses primarily reflect

the addition of personnel in support of the Company’s expansion of

its sales, marketing and administrative functions.

The Company’s net loss for the quarter ended December 31, 2018

amounted to $2,692,000, or ($0.22) per share, compared with a net

loss of $1,900,000, or ($0.25 per share) for the corresponding

period of 2017. Net loss for the year ended December 31, 2018 was

$10,317,000, or ($0.84) per share compared with a loss of

$12,097,000, or ($2.93) per share for the year ago period. Net loss

for the twelve months ended December 31, 2017 included a $5,172,000

charge for debt discount on convertible notes. Net loss per share

in 2017 included adjustments for accreted dividends on preferred

stock to present loss per share available to common

stockholders.

Adjusted EBITDA1 for the quarter ended December 31, 2018 was a

loss of $2,542,000, compared with a loss of $1,770,000 for the

corresponding period in 2017. Adjusted EBITDA for the year ended

December 31, 2018 was a loss of $9,644,000, compared with a loss of

$6,257,000 for the year ended December 31, 2017. A reconciliation

of GAAP net loss to this non-GAAP financial measure has been

provided in the financial statement tables included in this press

release. An explanation of this measure is also included below

under the heading “Non-GAAP Financial Measures.”

Liquidity

Cash on hand at December 31, 2018 was $6,541,000, compared to

$12,959,000 at December 31, 2017. On February 12, 2019, the

Company successfully completed a follow-on public offering of its

common stock, generating net proceeds of approximately $5,600,000,

which is expected to provide sufficient liquidity to fund its

operations through 2019.

Conference Call and Webcast Information

Myomo will hold a conference call today, Thursday, March 7, 2019

at 4:30 p.m. EST. To access the conference call, please dial

1-877-270-2148 from the U.S. or 1-412-902-6510 internationally. Our

webcast and accompanying slides can also be accessed through

Myomo’s Investor Relations page.

Please allow extra time prior to the call to visit the site and

download any necessary software to listen to the live

broadcast.

A replay of the conference call will be available approximately

one hour after completion of the live conference call at the

Investor Relations page. A dial-in

replay of the call will be available until March 21, 2019; please

dial 1-877-344-7529 from the U.S. or 1-412-317-0088 internationally

and provide the passcode of 10129136.

About Myomo

Myomo, Inc. is a wearable medical robotics company that offers

expanded mobility for those suffering from neurological disorders

and upper limb paralysis. Myomo develops and markets the MyoPro

product line. MyoPro is a powered upper limb orthosis designed to

support the arm and restore function to the weakened or paralyzed

arms of patients suffering from CVA stroke, brachial plexus injury,

traumatic brain or spinal cord injury, ALS or other neuromuscular

disease or injury. It is currently the only marketed device that,

sensing a patient’s own EMG signals through non-invasive sensors on

the arm, can restore an individual’s ability to perform activities

of daily living, including feeding themselves, carrying objects and

doing household tasks. Many are able to return to work, live

independently and reduce their cost of care. Myomo is headquartered

in Cambridge, Massachusetts, with sales and clinical professionals

across the U.S. For more information, please visit

www.myomo.com.

1 Adjusted EBITDA is earnings before interest, taxes,

depreciation and amortization adjusted for the impact of the

write-off of unamortized debt discount associated with conversion

of convertible notes into common stock and warrants, stock

based-compensation, the impact of the fair value revaluation of our

derivative liabilities and the loss on early extinguishment of

debt.

Forward Looking Statements

This press release contains forward-looking statements regarding

the Company’s future business expectations, including the receipt

of revenues from units being processed for insurance reimbursement,

the scale-up and expansion of commercial operations, our

expectations for revenues and our results of operations, and the

potential benefits to users of our products, our financial position

and cash runway, which are subject to the safe harbor provisions of

the Private Securities Litigation Reform Act of 1995. These

forward-looking statements are only predictions and may differ

materially from actual results due to a variety of factors.

These factors include, among other things:

- our sales and commercialization

efforts;

- our ability to achieve reimbursement

from third-party payers for our products;

- our dependence upon external sources

for the financing of our operations;

- our ability to effectively execute our

business plan; and

- our expectations as to our clinical

research program and clinical results.

More information about these and other factors that potentially

could affect our financial results is included in Myomo’s filings

with the Securities and Exchange Commission, including those

contained in the risk factors section of the Company’s annual

report on Form 10-K, quarterly reports on Form 10-Q and other

filings with the Commission. The Company cautions readers not to

place undue reliance on any such forward-looking statements, which

speak only as of the date made. Although the forward-looking

statements in this release of financial information are based on

our beliefs, assumptions and expectations, taking into account all

information currently available to us, we cannot guarantee future

transactions, results, performance, achievements or outcomes. No

assurance can be made to any investor by anyone that the

expectations reflected in our forward-looking statements will be

attained, or that deviations from them will not be material and

adverse. The Company disclaims any obligation subsequently to

revise any forward-looking statements to reflect events or

circumstances after the date of such statements or to reflect the

occurrence of anticipated or unanticipated events.

Non-GAAP Financial Measures

Myomo has provided in this release of financial information that

has not been prepared in accordance with generally accepted

accounting principles in the United States, or GAAP. This

information includes Adjusted EBITDA. This non-GAAP financial

measure is not in accordance with, or an alternative for, GAAP and

may be different from similar non-GAAP financial measures used by

other companies. Myomo believes that the use of this non-GAAP

financial measures provides supplementary information for investors

to use in evaluating operating performance and in comparing its

financial measures with other companies in Myomo’s industry, many

of which present similar non-GAAP financial measures. Adjusted

EBITDA is EBITDA adjusted for the impact of the write-off of

unamortized debt discount associated with conversion of convertible

notes into common stock and warrants, stock based-compensation, the

impact of the fair value revaluation of our derivative liabilities

and the loss on early extinguishment of debt. Non-GAAP financial

measures that Myomo uses may differ from measures that other

companies may use. This non-GAAP financial measure disclosed by

Myomo is not meant to be considered superior to or a substitute for

results of operations prepared in accordance with GAAP, and should

be viewed in conjunction with, GAAP financial measures. Investors

are encouraged to review the reconciliation of this non-GAAP

measure to its most directly comparable GAAP financial measure. A

reconciliation of GAAP to the non-GAAP financial measures has been

provided in the tables included as part of this press release.

MYOMO, INC. CONDENSED STATEMENTS OF OPERATIONS

(unaudited) Three Months

Ended Twelve Months Ended December

31, December 31, 2018 2017

2018 2017 Revenue $ 889,575 $ 547,412 $

2,444,104 $ 1,558,866

Cost of revenue 226,176

203,972 728,279 505,280

Gross margin

663,399 343,440 1,715,825 1,053,586

Operating expenses: Research and development 529,619 356,867

1,838,633 1,751,731 Selling, general and administrative

2,868,807 1,802,584 10,405,609 5,849,969

3,398,426 2,159,451 12,244,242

7,601,700

Loss from operations (2,735,027 )

(1,816,011 ) (10,528,417 ) (6,548,114 )

Other expense

(income) Loss on extinguishment of debt — 135,244 — 135,244

Change in fair value of derivative liabilities (4,991 ) (52,429 )

(36,269 ) (116,795 ) Debt discount on convertible notes — — —

5,172,000 Interest (income) and other expense, net (38,082 )

1,450 (175,409 ) 358,916

(43,073 ) 84,265 (211,678 ) 5,549,365

Net loss (2,691,954 ) (1,900,276 ) (10,316,739

) (12,097,479 ) Deemed dividend – accreted preferred stock — — —

(274,011 ) Cumulative dividend to Series B-1 preferred stockholders

— — — (287,779 )

Net loss available

to common stockholders $ (2,691,954 ) $ (1,900,276 ) $

(10,316,739 ) $ (12,659,269 )

Weighted average number of common

shares outstanding: Basic and diluted 12,435,807

7,559,309 12,292,402 4,317,864

Net loss per share

available to common stockholders: Basic and diluted $ (0.22 ) $

(0.25 ) $ (0.84 ) $ (2.93 )

MYOMO, INC.

CONDENSED BALANCE SHEETS

December

31,

2018 2017

(Unaudited) ASSETS Current Assets: Cash and

cash equivalents $ 6,540,794 $ 12,959,373 Accounts receivable, net

382,258 297,039 Inventories, net 256,149 201,155 Prepaid expenses

and other 695,276 388,275

Total Current Assets

7,874,477 13,845,842

Restricted cash 75,000 52,000

Deferred offering costs 144,582 —

Equipment, net

187,513 77,150

Total Assets $ 8,281,572 $

13,974,992

LIABILITIES AND STOCKHOLDERS’ EQUITY Current

Liabilities: Accounts payable and other accrued expenses $

1,743,427 $ 1,277,236 Derivative liabilities 3,661 39,930 Deferred

revenue 1,990 61,288 Customer advance payments 106,609

106,718

Total Current Liabilities 1,855,687 1,485,172

Deferred revenue, net of current portion —

44,042

Total Liabilities 1,855,687 1,529,214

Stockholders’ Equity: Common stock 1,245 1,114

Undesignated preferred stock — — Additional paid-in capital

51,720,630 47,423,915 Accumulated deficit (45,289,526 ) (34,972,787

) Treasury stock (6,464 ) (6,464 )

Total

Stockholders’ Equity 6,425,885 12,445,778

Total Liabilities and Stockholders’ Equity $ 8,281,572 $

13,974,992

MYOMO, INC. CONDENSED STATEMENTS

OF CASH FLOWS (unaudited)

For the years

ended December 31,

2018 2017 CASH FLOWS

FROM OPERATING ACTIVITIES Net loss $ (10,316,739 ) $

(12,097,479 ) Adjustments to reconcile net loss to net cash used in

operations: Depreciation 69,682 11,415 Stock-based compensation

814,666 279,508 Bad debt expense 16,275 — Amortization of debt

discount — 17,765 Debt discount on convertible notes — 5,172,000

Inventory reserve 32,645 42,355 Common stock issued for services

and software license — 31,845 Change in fair value of derivative

liabilities (36,269 ) (116,795 ) Changes in operating assets and

liabilities: Accounts receivable (101,494 ) (182,533 ) Inventories

(140,817 ) (161,075 ) Prepaid expenses and other (307,001 )

(235,938 ) Accounts payable and other accrued expenses 466,191

563,225 Accrued interest — 377,503 Deferred revenue (103,340 )

38,067 Customer advance payments (109 ) 106,718 Net

cash used in operating activities (9,606,310 )

(6,153,419 )

NET CASH USED IN INVESTING

ACTIVITIES

(126,867 ) (67,002 )

NET CASH PROVIDED BY FINANCING

ACTIVITIES

3,337,598 18,382,620 Net increase (decrease)

in cash, cash equivalents, and restricted cash (6,395,579 )

12,162,199 Cash, cash equivalents, and restricted cash,

beginning of year 13,011,373 849,174

Cash, cash equivalents, and restricted cash, end of year $

6,615,794 $ 13,011,373

MYOMO, INC.

RECONCILIATION OF GAAP NET LOSS TO ADJUSTED EBITDA

(unaudited)

For the Three MonthsEnded

December 31,

For the Twelve MonthsEnded

December 31,

2018 2017 2018 2017 GAAP

net loss $ (2,691,954 ) $ (1,900,276 ) $ (10,316,739 ) $

(12,097,479 ) Adjustments to reconcile to Adjusted EBITDA: Loss on

early extinguishment of debt — 135,244 — 135,244 Interest expense —

27,037 — 357,122 Interest (income) expense and other expense, net

(38,082 ) (25,587 ) (175,409) 1,793 Depreciation expense 20,850

4,430 69,682 11,415 Stock-based compensation 171,705 41,286 814,666

279,508 Debt discount on convertible notes — — — 5,172,000 Change

in fair value of derivative liabilities (4,991 )

(52,429 ) (36,269 ) (116,795 )

Adjusted EBITDA $ (2,542,472 ) $

(1,770,295 ) $ (9,644,069 ) $ (6,257,192 )

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190307005752/en/

For Myomo:ir@myomo.com

Investor Relations:Vivian CervantesPCG

Advisory646-863-6274vivian@pcgadvisory.com

Public Relations:Sarah KarrMatter

Communications978-518-4817myomo@matternow.com

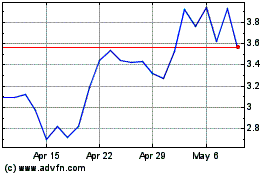

Myomo (AMEX:MYO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Myomo (AMEX:MYO)

Historical Stock Chart

From Apr 2023 to Apr 2024