Kelso Technologies Inc. (“Kelso” or the “Company”), (TSX:

KLS), (NYSE American: KIQ) reports that it has released its

unaudited consolidated interim financial statements and Management

Discussion and Analysis for the three months ended March 31,

2020.

The unaudited consolidated interim financial

statements were prepared in accordance with International Financial

Reporting Standards (“IFRS”) as issued by the International

Accounting Standards Board (“IASB”). All amounts herein are

expressed in United States dollars (the Company’s functional

currency) unless otherwise indicated.

SUMMARY OF FINANCIAL

PERFORMANCE

|

|

Three months ended March 31 |

|

2020 |

|

|

2019 |

|

|

|

|

Revenues |

$ |

5,643,428 |

|

$ |

5,674,288 |

|

|

|

|

Gross profit |

$ |

2,602,326 |

|

$ |

2,744,935 |

|

|

|

|

Gross profit margin |

|

46% |

|

|

48% |

|

|

|

|

EBITDA |

$ |

1,404,488 |

|

$ |

1,537,704 |

|

|

|

|

EBITDA margin |

|

25% |

|

|

27% |

|

|

|

|

Non-cash expenses |

$ |

121,193 |

|

$ |

44,746 |

|

|

|

|

Taxes |

$ |

- |

|

$ |

402,054 |

|

|

|

|

Net income |

$ |

1,283,295 |

|

$ |

1,090,904 |

|

|

|

|

Basic earnings per share |

$ |

0.03 |

|

$ |

0.02 |

|

|

LIQUIDITY AND CAPITAL

RESOURCES

At March 31, 2020 the Company had cash on

deposit in the amount of $4,576,643, accounts receivable of

$2,901,000, prepaid expenses of $178,081 and inventory of

$4,289,112 compared to cash on deposit in the amount of $4,418,236,

accounts receivable of $1,824,563, prepaid expenses of $96,627 and

inventory of $3,394,192 at December 31, 2019.

The working capital position of the Company at

March 31, 2020 was $9,038,198 compared to $7,937,873 at December

31, 2019. The majority of accounts receivable are collected

within 30 days from invoicing shipments giving Kelso $2,901,000 of

additional cash flow plus $4,576,643 of available cash to discharge

accounts payable and accrued liabilities of $2,906,638 on a timely

basis subsequent to March 31, 2020. Income taxes payable in

the amount of $71,341 are due mid 2020.

Net assets of the Company improved to

$13,158,570 at March 31, 2020 compared to $11,845,275 at December

31, 2019. The Company had no interest-bearing long-term

liabilities or debt at March 31, 2020.

OUTLOOK

The results for the first quarter of 2020

demonstrated good sales results and earnings consistent with the

prior year. Business results in the first quarter occurred

before the COVID-19 pandemic became an unforeseen crisis to be

managed.

While certain government authorities in North

America have ordered the closure or minimization of all

non-essential business operations in regions where they operate,

Kelso falls within the exemptions for businesses that provide

essential products and workforces that carry out critical

manufacturing. Kelso therefore plans to continue operations

at its valve assembly facility in Bonham, Texas while being mindful

of the potential negative impacts of COVID-19 in terms of decreased

rail business activities and potential supply chain

interruptions.

The Company continues to be committed to the

health, welfare and safety of our employees, business partners and

communities where we operate. We are applying comprehensive

and rigorous hygiene policies and employee temperature monitoring

practices to ensure our personnel remain risk free. Travel is

restricted and our people that can work from home do so.

Management will maintain full adherence to all measures put in

place by applicable government authorities.

The Company’s working capital remained at a

healthy level of $9,038,198 at March 31, 2020. We have no

interest-bearing long term debt to service and we currently operate

without the need for new equity capital or credit facilities.

Our capital management allows us to finance operations and R&D

from our existing capital reserves and sales of our products.

With respect to our rail tank car product

development, long AAR approval processes continue to impede our

ability to improve sales with additional rail tank car

equipment. The Company has applications in process with the

AAR for our new ceramic ball bottom outlet valve, pressure car

pressure relief valve, ball valve, manway cover and angle valve

although final AAR approval processes take considerable time to

complete. These new products have been derived through

co-engineering support and testing support from our key customers

which may strengthen the probability of longer term adoption by the

rail industry.

Our non-rail product development initiatives

concentrate on a wider range of transportation technology products

that are designed to provide unique economic benefits and safe

operational advantages to commercial customers. Our goal is

to spread our business risk to diminish the severe negative impacts

of the historic down cycles in the rail industry.

The technology challenges regarding the safety

and access capabilities of emergency responders fighting wilderness

fires motivated Kelso to begin the development of a unique

wilderness vehicle suspension system. This innovative

equipment provides new rapid response “road-to-no-road and back”

capabilities regardless of weather, climate or the severity of the

terrain. Known as the KXI™ Suspension System (KXI) it is

based on thirty years of active wilderness research and

experience.

KXI is in the final design stages and moving

toward revenue generation. The Company is scheduled to

complete the conversion of two vehicles with the production

prototype KXI to prepare the final “blueprint” for the first

commercial offerings to the marketplace. The Company will

then move into “pilot” production operations where we will convert

and sell or lease 24 KXI equipped vehicles. We will then

scale our production capacity based on projected sales. These

potential markets for KXI are multi-million dollar revenue

opportunities for Kelso to pursue.

Our longer term business prospects remain good

but we are living in very challenging times. No one will be

unaffected by the uncertainties surrounding the COVID-19

economy. There will certainly be diminishment of our

financial performance during 2020 due to the pandemic although the

depth and length of the downturn remains uncertain. We have

evaluated the impact of several downside scenarios and feel that

our debt free financial position, capital reserves, manageable

costs and flexible business model will allow Kelso to maintain its

positive stature and exit the COVID-19 crisis with a strong

financial foundation.

About Kelso Technologies

Kelso is a diverse product development company

that specializes in the design, production and distribution of

proprietary service equipment used in transportation

applications. Our reputation has been earned as a designer

and reliable supplier of unique high quality rail tank car valve

equipment that provides for the safe handling and containment of

hazardous and non-hazardous commodities during transport. All

Kelso products are specifically designed to provide economic and

operational advantages to customers while reducing the potential

effects of human error and environmental harm.

For a more complete business and financial

profile of the Company, please view the Company's website at

www.kelsotech.com and public documents posted under the Company’s

profile on www.sedar.com in Canada and on EDGAR at www.sec.gov in

the United States.

On behalf of the Board of

Directors,

James R. Bond, CEO and President

Notice to Reader: References to

EBITDA refer to net earnings from continuing operations before

interest, taxes, amortization, unrealized foreign exchange and non

cash share-based expenses (Black Sholes option pricing model) and

write off of assets. EBITDA is not an earnings measure

recognized by IFRS and does not have a standardized meaning

prescribed by IFRS. Management believes that EBITDA is an

alternative measure in evaluating the Company's business

performance. Readers are cautioned that EBITDA should not be

construed as an alternative to net income as determined under IFRS;

nor as an indicator of financial performance as determined by IFRS;

nor a calculation of cash flow from operating activities as

determined under IFRS; nor as a measure of liquidity and cash flow

under IFRS. The Company's method of calculating EBITDA may

differ from methods used by other issuers and, accordingly, the

Company's EBITDA may not be comparable to similar measures used by

any other issuer.

Legal Notice Regarding Forward-Looking

Statements: This news release contains “forward-looking

statements” within the meaning of applicable securities

legislation. Forward-looking statements are indicated

expectations or intentions. Forward-looking statements in this news

release include that the COVID-19 pandemic has become an unforeseen

crisis to be managed; that Kelso plans to continue operations at

its valve assembly facility in Bonham, Texas; that our capital

management allows us to finance operations and R&D from

existing capital reserves and sales of our products without the

need for new equity capital or credit facilities; that new rail

products have been derived through co-engineering support and

testing support from our key customers which may strengthen the

probability of longer term adoption by the rail industry; that

these potential markets for new products are multi-million dollar

revenue opportunities for Kelso to pursue; that we will move into

“pilot” production operations where we will convert and sell or

lease 24 KXI equipped vehicles; that we will scale our

production; that potential markets for KXI are multi-million dollar

revenue opportunities; and that there will certainly be

diminishment of our financial performance during 2020 due to

COVID-19 but with our current debt free financial position, capital

reserves and manageable costs Kelso can maintain its positive

stature and exit the COVID-19 crisis with a strong financial

foundation. Although Kelso believes its anticipated future

results, performance or achievements expressed or implied by the

forward-looking statements and information are based upon

reasonable assumptions and expectations, they can give no assurance

that such expectations will prove to be correct. The reader

should not place undue reliance on forward-looking statements and

information as such statements and information involve known and

unknown risks, uncertainties and other factors which may cause the

actual results, performance or achievements of Kelso to differ

materially from anticipated future results, performance or

achievement expressed or implied by such forward-looking statements

and information, including without limitation that the market for

KXI may not materialize as expected and we may not sell or lease 24

vehicles and may not need to scale production; that the risk that

regulatory deadlines for compliance may be delayed or cancelled;

the Company’s products may not provide the intended economic or

operational advantages; or reduce the potential effects of human

error and environmental harm during the transport of hazardous

materials; or grow and sustain anticipated revenue streams; our new

products may not receive AAR certification; orders may be cancelled

and competitors may enter the market with new product offerings

which could capture some of our market share; and our new equipment

offerings may not capture market share as well as expected.

Except as required by law, the Company does not intend to update

the forward-looking information and forward-looking statements

contained in this news release.

For further information, please

contact:

|

James R. Bond, CEO and President |

Richard Lee, Chief Financial Officer |

Corporate Address: |

|

Email: bond@kelsotech.com |

Email: lee@kelsotech.com |

13966 - 18B AvenueSouth Surrey, BC V4A

8J1www.kelsotech.com |

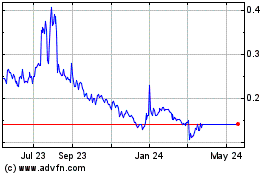

Kelso Technologies (AMEX:KIQ)

Historical Stock Chart

From Mar 2024 to Apr 2024

Kelso Technologies (AMEX:KIQ)

Historical Stock Chart

From Apr 2023 to Apr 2024