Filing of Certain Prospectuses and Communications in Connection With Business Combination Transactions (425)

July 26 2022 - 5:20PM

Edgar (US Regulatory)

Filed

by Flexible Solutions International Inc.

Pursuant

to Rule 425 under the Securities Act of 1933, as amended,

And

deemed filed pursuant to Rule 14a-12

Under

the Securities Exchange Act of 1934, as amended

Subject

Company: Flexible Solutions International Inc.

Commission

File No.: 001-31540

Date:

July 26, 2022

The

following posts were made available by Lygos, Inc. (“Lygos”) on July 25, 2022 on LinkedIn and Twitter.

The

following posts were made available by Eric Steen on July 25, 2022 on LinkedIn and Twitter.

*

* * * *

Additional

Information about the Proposed Merger and Where to Find It

This

communication relates to the proposed business combination between Flexible Solutions International Inc. (“FSI”) and Lygos.

FSI has filed a registration statement on Form S-4 with the U.S. Securities and Exchange Commission (the “SEC”) on July 25,

2022 (SEC File No. 333-266314) in connection with its proposed merger with Lygos (the “Registration Statement”), which includes

both a preliminary prospectus with respect to the combined company’s securities to be issued in connection with the business combination

and a proxy statement to be distributed to FSI’s stockholders in connection with FSI’s solicitation of proxies for the vote

by its stockholders in connection with the business combination and other matters as described in the Registration Statement. FSI urges

its investors, stockholders and other interested persons to read the preliminary proxy statement/prospectus and, when available, any

amendments thereto and the definitive proxy statement/prospectus, as well as other documents filed by FSI with the SEC, because these

documents will contain important information about FSI, Lygos and the business combination. After the Registration Statement is declared

effective, FSI will mail the definitive proxy statement/prospectus to its stockholders as of a record date to be established for voting

on the proposed business combination. Stockholders will also be able to obtain a copy of the Registration Statement, including the preliminary

proxy statement/prospectus and, once available, the definitive proxy statement/prospectus, as well as other documents filed with the

SEC regarding the business combination and other documents filed by FSI with the SEC, without charge, at the SEC’s website located

at www.sec.gov.

No

Offer or Solicitation

This

communication is for informational purposes only and is not intended to and does not constitute an offer to subscribe for, buy or sell,

the solicitation of an offer to subscribe for, buy or sell or an invitation to subscribe for, buy or sell any securities or the solicitation

of any vote or approval in any jurisdiction pursuant to or in connection with the proposed business combination or otherwise, nor shall

there be any sale, issuance or transfer of securities in any jurisdiction in contravention of applicable law. No offer of securities

shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended, and otherwise

in accordance with applicable law.

Participants

in the Solicitation

FSI,

Lygos and certain of their respective directors, executive officers and members of management and employees may be deemed to be participants

in the solicitation of written consents in respect of the proposed transaction. Information regarding FSI’s directors and executive

officers is set forth in FSI’s Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, and Current Reports on Form 8-K. Information

regarding Lygos’ directors and executive officers and more detailed information regarding the identity of all potential participants,

and their direct and indirect interests, by security holdings or otherwise, is set forth in the preliminary proxy statement/prospectus

and other relevant materials filed with the SEC. Free copies of these documents may be obtained from the sources indicated above.

Forward-Looking

Statements

This

communication contains forward-looking statements based upon FSI’s and Lygos’ current expectations. The forward-looking statements

are intended to be subject to the safe harbor provided by Section 27A of the Securities Act of 1933, Section 21E of the Securities Exchange

Act of 1934, and the Private Securities Litigation Reform Act of 1995. Forward-looking statements involve risks and uncertainties, and

include, but are not limited to, statements about the structure, timing and completion of the proposed merger; the combined company’s

listing on the NYSE American after closing of the proposed merger; expectations regarding the ownership structure of the combined company;

the expected executive officers and directors of the combined company; the combined company’s expected cash position at the closing

of the proposed merger; the future operations and success of the combined company; the nature, strategy and focus of the combined company;

the success, cost and timing of the combined company’s product development activities, studies and clinical trials, the success

of competing products that are or become available, the combined company’s ability to obtain approval for and commercialize its

product candidates; the executive and board structure of the combined company; the location of the combined company’s corporate

headquarters; the expected charges and related cash expenditures that FSI expects to incur; and other statements that are not historical

fact. Actual results and the timing of events could differ materially from those anticipated in such forward-looking statements as a

result of these risks and uncertainties, which include, without limitation: (i) the risk that the conditions to the closing of the proposed

merger are not satisfied, including the failure to timely obtain stockholder and shareholder approval for the transaction, if at all;

(ii) uncertainties as to the timing of the consummation of the proposed merger and the ability of each of FSI and Lygos to consummate

the proposed merger; (iii) risks related to FSI’s ability to manage its operating expenses and its expenses associated with the

proposed merger pending closing; (iv) risks related to the failure or delay in obtaining required approvals from any governmental or

quasi-governmental entity necessary to consummate the proposed merger; (v) the risk that as a result of adjustments to the exchange ratio,

FSI shareholders and Lygos stockholders could own more or less of the combined company than is currently anticipated; (vi) risks related

to the market price of FSI common shares relative to the exchange ratio; (vii) unexpected costs, charges or expenses resulting from the

transaction; (viii) potential adverse reactions or changes to business relationships resulting from the announcement or completion of

the proposed merger; and (ix) risks associated with the possible failure to realize certain anticipated benefits of the proposed merger,

including with respect to future financial and operating results. Actual results and the timing of events could differ materially from

those anticipated in such forward-looking statements as a result of these risks and uncertainties. These and other risks and uncertainties

are more fully described in periodic filings with the SEC, including the factors described in the section entitled “Risk Factors”

in FSI’s Annual Report on Form 10-K for the year ended December 31, 2021, which is on file with the SEC, and in other filings that

FSI makes and will make with the SEC in connection with the proposed merger, including the proxy statement/prospectus/information statement

described above under “Additional Information.” You should not place undue reliance on these forward-looking statements,

which are made only as of the date hereof or as of the dates indicated in the forward-looking statements. FSI expressly disclaims any

obligation or undertaking to release publicly any updates or revisions to any forward-looking statements contained herein to reflect

any change in its expectations with regard thereto or any change in events, conditions or circumstances on which any such statements

are based.

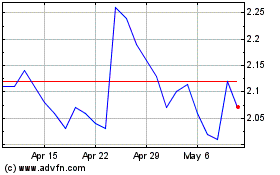

Flexible Solutions (AMEX:FSI)

Historical Stock Chart

From Aug 2024 to Sep 2024

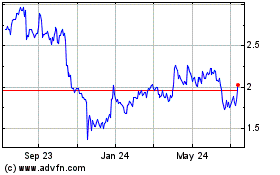

Flexible Solutions (AMEX:FSI)

Historical Stock Chart

From Sep 2023 to Sep 2024