Direxion Launches 2 Leveraged Bear ETFs - ETF News And Commentary

May 01 2013 - 8:37AM

Zacks

Direxion is a key player in the leveraged and inverse leveraged

ETF market, possessing a decent chunk of total funds and assets in

the space. Most of the funds in the company’s lineup though, focus

in on U.S. sectors or market cap levels, giving the firm a domestic

tilt.

Yet, with the rise of international markets and investors’

increased desire for global exposure, this is slowly beginning to

change. In fact, Direxion has recently expanded its lineup in the

levered emerging market space, zeroing in on Brazil and Korea in

particular.

The first play on these markets from Direxion came to us in the

form of long products, BRZU and KORU, respectively targeting Brazil

and Korea with 300% daily resetting exposure. The company is now

looking at the short side of these markets, as it has just launched

complimentary bear ETFs for these two increasingly important

nations (see Direxion Launches 2 Emerging Market Leveraged

ETFs).

These new funds could open up new trading opportunities for

those seeking to make a short-term play on either of these key

markets. So for investors seeking a different way to target Brazil

or Korea, or for those seeking to hedge their current exposure to

these two nations, we have highlighted some of the key details

about both below:

Direxion Daily Brazil Bear 3x Shares (BRZS)

This new ETF looks to focus on triple the inverse performance of

the MSCI Brazil 25/50 Index on a daily basis. The approach results

in a focus on mid and large cap Brazilian companies, charging

investors 95 basis points a year in fees.

Investors should also note that financials take up the top spot

in the index, accounting for over one-fourth of the total assets.

This is followed by materials (17.8%), staples (15%), and energy

(13.7%) to round out the top four (see Will Brazil ETFs Rebound in

2013?).

The fund also represents the bear counterpart to the just

launched Daily Brazil Bull 3x Shares (BRZU) from

Direxion. And both of these can be thought of as daily leveraged

versions of the ultra-popular MSCI Brazil Capped ETF

(EWZ), a fund which has lost about 3.2% so far in

2013.

Direxion Daily South Korea Bear 3x Shares

(KORZ)

This fund seeks to track triple the inverse performance of the

MSCI Korea 25/50 Index on a daily basis. The result is a fund that

zeroes in on large and mid cap Korean firms, charging investors 95

basis points for this exposure.

In terms of holdings, technology takes the top spot, comprising

nearly 31% of the total. Beyond that, four more sectors have double

digit allocations including consumer discretionary, financials,

industrials, and materials (see Is the Korea ETF About to

Breakout?).

KORZ is also the bear version of the recently launched

Daily South Korea Bull 3x Shares (KORU) from

Direxion. This duo can also be thought of as the daily leveraged

versions of the well-known MSCI South Korea Capped ETF

(EWY), a fund that has lost about 10.1% so far in

2013.

Bottom Line

Both BRZS and KORZ could be quite volatile and see big swings in

a short time period. The use of triple leverage and emerging

markets is a potent combination, and thus these funds should be

exclusively used by short term traders (see Time to Buy Emerging

Market ETFs?).

This is especially true when considering the -3x exposure

profile of the ETFs and the daily rebalancing which can result in

these moving differently than what some investors might expect over

long time periods. Nevertheless, for short-term traders, these two

funds could make for compelling options, particularly if weakness

continues to abound in these two markets.

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30

Days. Click to get this free report >>

DIR-D BRZL BL3X (BRZU): ETF Research Reports

ISHARS-S KOREA (EWY): ETF Research Reports

ISHARS-BRAZIL (EWZ): ETF Research Reports

DIR-D S KR BL3X (KORU): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

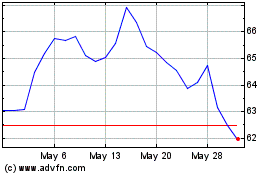

iShares MSCI South Korea... (AMEX:EWY)

Historical Stock Chart

From Apr 2024 to May 2024

iShares MSCI South Korea... (AMEX:EWY)

Historical Stock Chart

From May 2023 to May 2024