Although WisdomTree is a relatively small ETF issuer, the

company is beginning to make a name for itself in the industry.

While it is gaining prominence for its innovative hedged ETFs, like

in the case of Japan and DXJ, its real claim to

fame is its dividend weighting.

The firm has a complete lineup of dividend weighted ETFs that

are unlike many others on the market. That is because these

securities do not base security weights on the size of a company,

but rather on cash dividends paid (see Three Impressive Small Cap

Dividend ETFs).

This novel approach could be better for those who believe in the

power of dividends and the signal that they send to the market.

After all, a cash payment is very hard to fake, so many believe

that these dividend payers are safer than their non-paying

counterparts.

A dividend-focused strategy has certainly paid off for

WisdomTree, as several of its most popular ETFs come to us in this

space including DLN and DGS.

These funds both have more than one billion in total AUM, and were

probably part of the inspiration for the firm’s latest two filings

in the dividend space.

These brand new documents, which were released to the SEC for

approval, follow in the footsteps of several of its top products,

zeroing in on stocks that are paying dividends and giving more

weight to those that offer up bigger cash payments. However, there

is a twist with these two proposed products, as they both look to

put a premium on dividend growth (read 4 Excellent Dividend ETFs

for Income and Stability).

Proposed Dividend ETFs in Focus

The in-registration funds, the WisdomTree U.S. Dividend

Growth Fund and the WisdomTree U.S. Small Cap Dividend Growth Fund,

look to center on their respective cap levels with a focus on

payouts. Both appear to be based off of established WisdomTree

indexes, but seek to apply more restrictive filters, which could

make these funds relatively unique in the ETF world.

First, the more large cap-focused U.S. Dividend Growth Fund will

be tracking the WisdomTree Dividend Index, holding 300 stocks that

have the best fundamental factors and a high likelihood of dividend

increases. Specifically, long-term earnings growth expectations,

ROE, and ROA, will be a big focus of the fund beyond the projected

growth of the payout.

The ETF looks to focus on stocks that have paid a dividend in

the past 12 months and have a market cap of at least $2 billion.

The product will be weighted by dividends on an annual basis, and

stocks will be capped at 5% of the total (read Have You Overlooked

These Dividend ETFs?)

The small cap-centric product will take a similar approach,

tracking the WisdomTree Small Cap Dividend Index. Of these

securities, once again 300 stocks that have the best fundamental

factors and prospects for dividend increases will be included.

The main difference between the two ETFs looks to be the market

cap level that is targeted. The first ETF will focus on large caps

with a two billion market cap minimum while this small cap ETF only

requires a market cap of just $100 million.

Additionally, the small cap fund will only allow any one stock

to obtain 2% of the ETF’s total capital. This suggests that it will

be far more spread out among its 300 stock portfolio, although it

will still look at ROA, ROE, and earnings growth, in addition to

projected dividend increases, for its exposure.

Portfolio Fit

These two ETFs could be interesting for those who like

WisdomTree’s approach to dividends, but value dividend growth more

than anything. The extra fundamental factors could also help to

drill down the portfolio, so you might get a better selection of

stocks in these ETFs (read Can You Beat These High Dividend

ETFs?).

However, this exposure is probably going to cost a bit

more—thanks to the addition of these factors—so it might not be a

low cost choice. This already somewhat true for WisdomTree’s other

products, as they are rarely the cheapest but instead hang their

hat on having unique exposure.

ETF Competitors

The funds will not be short of competitors though, as the

dividend ETF world is rife with choices. Chief among these is the

SPDR S&P Dividend ETF (SDY).

This extremely popular product does about one million shares in

volume a day and has a market cap over $10.5 billion. This is all

with focusing on higher yielding stocks that have a proven history

of consistently increasing dividends for at least the past 25

years.

Given the success of this product and countless others in the

space, it is reasonable to assume that there is a great deal of

interest in the dividend growth ETF world. However, it will be

interesting to see if WisdomTree’s new filings can hit the market,

and if the focus on dividend weighting is enough to differentiate

itself and attract new assets in this extremely competitive—but

lucrative—space.

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30

Days. Click to get this free report >>

Follow @Eric Dutram on Twitter

WISDMTR-E SC DV (DGS): ETF Research Reports

WISDMTR-LC DIV (DLN): ETF Research Reports

WISDMTR-J HEF (DXJ): ETF Research Reports

SPDR-SP DIV ETF (SDY): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

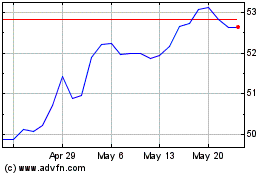

WisdomTree Emerging Mark... (AMEX:DGS)

Historical Stock Chart

From Mar 2024 to Apr 2024

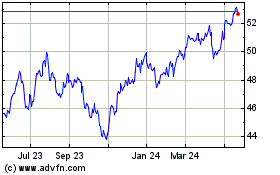

WisdomTree Emerging Mark... (AMEX:DGS)

Historical Stock Chart

From Apr 2023 to Apr 2024