Although the Chinese economy appears to be weakening as we head

into the final part of the year, one segment of their nation

appears to be holding up quite well, the yuan. This currency

strength comes in the face of sagging growth in the most populous

nation on earth and ongoing worries over inflation, credit bubbles,

and central bank decisions.

Nevertheless, the yuan recently rose to the 6.28 mark against

the dollar, the first time in nearly 20 years that the currency has

breached the level. Clearly, even despite the issues plaguing the

Chinese economy, investors remain at least somewhat bullish on the

currency, at least in the near term.

This could be especially true given the new level of uncertainty

surrounding the American presidential election. Romney has pledged

to be more aggressive with China and their currency policies, and

with his recent momentum, China could be looking to allow the yuan

to edge higher against the dollar in order to quell some U.S.

opposition over Chinese trade practices.

After all, a stronger yuan makes it more difficult to label the

nation as a currency manipulator, while the increase could help

American exports to the PROC as well. Still, some are predicting

that we could see a slight decline after the American election,

although the trend of the yuan has been definitely higher, a

situation that could also assist in rebalancing China’s economy

more evenly between exports and international consumption (see

China Currency ETFs: Slow and Steady Growth in 2012?).

Given this trend, investors may consider yuan investments a

lower risk choice at this time, especially if China continues to

allow the currency to appreciate modestly against the dollar.

However, it is worth noting that even with the increase in value of

the yuan against the dollar that the currency has only added about

0.3% so far this year, although it has appreciated roughly 32%

since mid-2005 (read If China Slumps, Avoid These Three Country

ETFs).

With this backdrop, investors seeking alternative currency

exposure—outside of the dollar—may be well-served by taking a

closer look at yuan-based investments. While Chinese stocks are

arguably too risky at this time, Chinese yuan ETFs could be a low

risk choice that seems poised to benefit in the near term—and over

the long term—as the country tried to rebalance its economy and

avoid a bigger trade scuffle with the U.S.

For these investors looking for some diversification into China

without much of the risk, any of the following China yuan ETFs

could be interesting picks. Just remember that they all have money

market like qualities so returns and volatility levels are likely

to be low for the group as a whole:

WisdomTree Dreyfus Chinese Yuan Fund (CYB)

The most popular Chinese Yuan fund is CYB from WisdomTree. The

product invests in short-term, investment grade instruments in

order to be reflective of both money market rates in China

available to foreign investors, and changes in the value of the

yuan against the dollar (read China ETF Investing 101).

The product charges investors 45 basis points a year but sees

solid volume on AUM of over $250 million. This suggests that bid

ask spreads will be quite tight and that total costs will not be

much more than the stated expense ratio.

The fund currently has a Zacks ETF Rank of 2 or ‘Buy’.

Market Vectors Chinese Renminbi/USD ETN

(CNY)

For investors seeking an ETN way to target the Chinese currency,

look no further than CNY. This product tracks the S&P Chinese

Renminbi Total Return Index which looks to track the performance of

the Chinese currency against the U.S. dollar, by using rolling

three-month non-deliverable currency forward contracts (see Three

China ETFs Still Going Strong).

As an ETN, the product does carry the credit risk of Morgan

Stanley, although tracking error is not a problem with CNY, since

it is a note. However, investors should realize that the fee is a

bit higher at 55 basis points a year while volume comes in below

15,000 shares a day, suggesting modest bid ask spreads.

The ETN currently has a Zacks ETF Rank of 3 or ‘Hold’.

CurrencyShares Chinese Renminbi Trust

(FXCH)

The newest choice on this comes to us from CurrencyShares and

their FXCH. The product debuted in 2011 and, like others on the

list, looks to track the price of the Chinese Renminbi net of Trust

expenses (read The Guide to China Bond ETFs).

Due in part to the newness of the fund, the ETF hasn’t

accumulated a great deal of assets and sees weak volumes,

suggesting a wide bid ask spread. Still, the ETF has the lowest

expense ratio at just 40 basis points a year, implying that it

could be the low cost choice for buy and hold investors seeking

exposure to the Chinese yuan.

This product currently has a Zacks ETF Rank of 3 or ‘Hold’.

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30

Days. Click to get this free report >>

Follow @Eric Dutram on Twitter

MKT VEC-RENMINB (CNY): ETF Research Reports

WISDMTR-CH YUAN (CYB): ETF Research Reports

CURR-CHIN RENMN (FXCH): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

WisdomTree Chinese Yuan ... (AMEX:CYB)

Historical Stock Chart

From Mar 2024 to Apr 2024

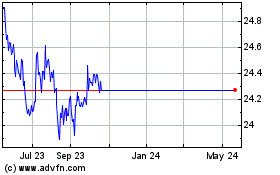

WisdomTree Chinese Yuan ... (AMEX:CYB)

Historical Stock Chart

From Apr 2023 to Apr 2024