ETF Trading Report: Emerging Bond, China Yuan ETFs In Focus - ETF News And Commentary

July 30 2012 - 1:25PM

Zacks

American markets weren’t able to keep up last week’s momentum as

stocks were unable to hold onto gains at the close. Thanks to this,

the Dow finished lower by three points, the S&P fell by a

single point, while the Nasdaq tumbled 12 points, or 0.4% on the

session.

In terms of sector performances, it was a pretty mixed day

across the board, although investors did see some strength in the

consumer goods, and independent oil and gas segments. Meanwhile, in

the red, investors saw big banks, health care, and some of the

large tech names lead the way on the downside (read Do ex-Financial

Funds Make Safer Dividend ETFs?).

Treasury bond investing saw decent inflows once again, as the

Ten Year trended down to the 1.50% mark, while investors also saw

yields decrease in much of Europe as well. For commodity trading,

it was largely mixed, although softs and precious metals did see

some modest increases while crude oil declined to the $90/bbl.

level.

ETF trading was moderate-to-light across many of the sectors, as

most of the big name products saw lower-than-average volume levels.

Investors did see, however, outsized interest in the U.S. sector

market, a few currency funds, and a couple of the style box ETFs as

well (read Mid Cap ETF Investing 101).

One ETF in particular that saw outsized volume interest was the

WisdomTree Dreyfus Chinese Yuan ETF (CYB) which

saw volumes nearly 20 times the daily average. Still, despite the

heavy volume, CYB finished the day in a narrow range, losing just

one cent on the day (read China Currency ETFs: Slow and Steady

Growth in 2012?).

Interestingly, more than half of the volume came in a block

trade just after 2PM at the low point of the fund during Monday’s

session. Also, it should be noted that the other China currency

ETFs saw strong trading while the most popular China equity ETFs

saw volume levels far below normal, suggesting a shift to the yuan

as the preferred way to play China, at least in the short term.

(Currently, CYB has a Zacks ETF Rank of 2 or ‘Buy’)

Another fund which saw outsized trading interest on the day was

the PowerShares Emerging Markets Sovereign Debt Fund

(PCY). This product usually does about three quarters of a

million shares during a normal day, but experienced a volume spike

to over 2.1 million during Monday trading (read Emerging Markets

Sovereign Bond ETFs: Safe with Attractive Yields).

Volume was pretty well spread out across the day, although a

large block trade of about 290,000 shares did hit the wires around

the mid day period. Investors also saw solid volume days in a

number of other products in the space, although none of these other

contenders really saw the level of volume or price increase that

was seen in PCY during the week’s opening session.

(see more in the Zacks ETF Center)

Author is long PCY.

WISDMTR-CH YUAN (CYB): ETF Research Reports

PWRSH-EM SVN DP (PCY): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

WisdomTree Chinese Yuan ... (AMEX:CYB)

Historical Stock Chart

From Mar 2024 to Apr 2024

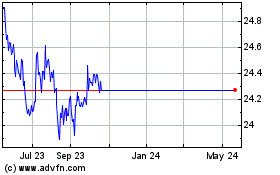

WisdomTree Chinese Yuan ... (AMEX:CYB)

Historical Stock Chart

From Apr 2023 to Apr 2024