- Amended Statement of Ownership: Solicitation (SC 14D9/A)

September 29 2009 - 1:45PM

Edgar (US Regulatory)

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14D-9

(Rule 14d-101)

Solicitation/Recommendation Statement

Under Section 14(d)(4) of the

Securities Exchange Act of 1934

(Amendment No. 5)

CHARLOTTE RUSSE HOLDING, INC.

(Name of Subject

Company)

CHARLOTTE RUSSE HOLDING, INC.

(Name of Person Filing Statement)

Common Stock,

$0.01 par value per share

(Title of Class of Securities)

161048103

(CUSIP Number of Class of Securities)

John D. Goodman

Chief Executive Officer

4645 Morena Boulevard

San Diego, California 92117

(858) 587-1500

(Name, Address and Telephone Number of Person Authorized to Receive Notices and

Communications on Behalf of Person Filing Statement)

Copies to:

|

|

|

|

|

Frederick T. Muto, Esq.

Jason L. Kent, Esq.

Cooley Godward Kronish LLP

4401 Eastgate Mall

San Diego, CA 92121

(858) 550-6000

|

|

Leonard Chazen, Esq.

Stephen A. Infante, Esq.

Covington & Burling LLP

The New York Times Building

620 Eighth Avenue

New York, New York 10018

(212) 841-1000

|

|

¨

|

Check the box if the filing relates solely to preliminary communications made before the commencement of a tender offer.

|

This Amendment No. 5 (the “

Amendment

”) amends and supplements the

Solicitation/Recommendation Statement on Schedule 14D-9 initially filed on August 31, 2009, by Charlotte Russe Holding, Inc., a Delaware corporation (“

Charlotte Russe

” or the “

Company

”) (as amended and

supplemented, the “

Schedule 14D-9

”). The Schedule 14D-9 relates to the tender offer by Advent CR Holdings, Inc., a Delaware corporation (“

Parent

”), and Advent CR, Inc., a Delaware corporation and wholly-owned

subsidiary of Parent (“

Purchaser

”), pursuant to which Purchaser has offered to purchase all of the outstanding shares of common stock, par value $0.01 per share, of the Company, together with the associated rights to purchase Series

A Junior Participating Preferred Stock of the Company issued pursuant to the Rights Agreement, dated as of August 13, 2008 between the Company and Mellon Investor Services, LLC as Rights Agent, at a price of $17.50 per Share, net to the selling

stockholder in cash, without interest and less any required withholding taxes, upon the terms and conditions set forth in the Offer to Purchase dated August 31, 2009 and the related Letter of Transmittal, and described in a Tender Offer

Statement on Schedule TO filed by Parent and Purchaser with the Securities and Exchange Commission on August 31, 2009, as amended.

Except as otherwise set forth below, the information set forth in the Schedule 14D-9 remains unchanged and is incorporated herein by reference as relevant to the items in this Amendment. Capitalized terms used but not otherwise defined

herein have the meanings ascribed to such terms in the Schedule 14D-9.

Item 8. Additional Information.

Item 8, “Additional Information” is hereby amended and supplemented by adding the following:

“

Expiration of Offer

At 12:00 A.M. midnight, New York City time, at the end of the day on Monday, September 28, 2009, the initial offering period expired. Based on preliminary information from Mellon Investor Services

LLC, the depository for the Offer (the “

Depositary

”), stockholders of Charlotte Russe had tendered and not validly withdrawn approximately 18,001,964 shares of Charlotte Russe’s Common Stock, which represents approximately

79.255% of the outstanding shares of Charlotte Russe’s Common Stock on a fully diluted basis, and 85.477% of the currently outstanding shares (in addition to 800,253 shares tendered under guaranteed delivery procedures). Therefore, the Minimum

Tender Condition has been satisfied. The Purchaser has accepted for payment all validly tendered shares (not validly withdrawn) of Charlotte Russe’s Common Stock and will make payment to the Depositary for the accepted shares promptly.

Pursuant to the Merger Agreement and upon Purchaser’s acceptance for payment of all Shares validly tendered and not

properly withdrawn prior to the expiration of the Offer, Purchaser became entitled to designate a number of individuals to the Board. Such designees, together and following their appointment or election to the Board, would constitute a majority of

the Board.

On September 29, 2009 Parent and Purchaser issued a press release announcing the completion of the initial

offering period and the immediate commencement of a subsequent offering period, which will expire at 12:00 A.M. midnight, New York City time, at the end of the day on Tuesday, October 13, 2009. All shares of Charlotte Russe’s Common Stock

properly tendered during the subsequent offering period will be accepted, and tendering stockholders will receive the same price of $17.50 per share in cash. No shares of Charlotte Russe’s Common Stock tendered during the initial offering

period or the subsequent offering period may be withdrawn.”

2

SIGNATURE

After due inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete

and correct.

|

|

|

|

|

Charlotte Russe Holding, Inc.

|

|

|

|

|

By:

|

|

/s/ John D. Goodman

|

|

|

|

Name: John D. Goodman

Title: Chief Executive Officer

|

Dated: September 29, 2009

3

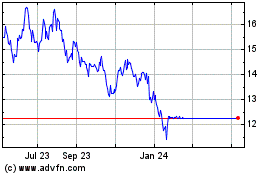

Global X Funds Global X ... (AMEX:CHIC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Global X Funds Global X ... (AMEX:CHIC)

Historical Stock Chart

From Apr 2023 to Apr 2024