Altius Confirms Closing of $65 Million Offering of Common Shares

May 13 2014 - 8:27AM

Marketwired Canada

NOT FOR DISTRIBUTION TO THE U.S. NEWSWIRE SERVICES, OR FOR DISSEMINATION IN THE

UNITED STATES

Altius Minerals Corporation ("Altius" or the "Company") (TSX:ALS) is pleased to

announce it has closed its previously announced offering of 4,643,000 common

shares at a price of $14.00 per share for gross proceeds of $65,002,000 (the

"Offering"). There was no over-allotment option granted in connection with the

Offering. The Offering was undertaken by a syndicate of investment dealers

co-led by Scotia Capital Inc. and Haywood Securities Inc., and included BMO

Capital Markets, Sprott Private Wealth L.P., Raymond James Ltd. and Salman

Partners Inc. (collectively, the "Agents")

The Company intends to use the net proceeds of the Offering to (i) acquire OTPPB

SCP Inc.'s 50% interest in Carbon Development Partnership, which is expected to

close today, May 13, 2014, (ii) repay its $7.2 million unsecured loan, (iii)

repay $20 million of borrowings under its credit facility, and (iv) for general

corporate purposes.

The Common Shares were offered by way of a short form prospectus, which was

filed in all of the provinces and territories of Canada and in the United States

on a private placement basis pursuant to an exemption from the registration

requirements of the United States Securities Act of 1933, as amended, and

applicable state securities laws.

About Altius

Altius is focused on the mining and resources sector through prospect generation

and the creation and acquisition of royalties.

Altius holds royalty interests in 12 producing assets that include 5 coal mines

and 6 potash mines located in western Canada and a royalty on the producing

Voisey's Bay nickel-copper-cobalt mine in Labrador.

It has a 3% gross sales royalty on the development stage Kami iron ore project

of Alderon Iron Ore Corp. ("Alderon"), a 2% gross sales royalty for the advanced

exploration stage Central Mineral Belt uranium project of Paladin Energy

Limited, and several other resource stage project royalties. Its project

generation pipeline contains a diversified portfolio of exploration stage

projects and royalties, many of which are being advanced through various

partner-funding arrangements.

Altius has also built a portfolio of directly and indirectly held junior

resource investments, including a approx. 25% shareholding in Alderon (TSX:ADV),

an approx. 8% shareholding in Virginia Mines Inc. (TSX:VGQ), and a approx. 5.9%

shareholding in Callinan Royalties Corporation (TSX VENTURE:CAA).

Altius has 32,238,821 shares issued and outstanding that are listed on Canada's

Toronto Stock Exchange. It is a member of both the S&P/TSX Small Cap and S&P/TSX

Global Mining Indices.

Caution Regarding Forward-Looking Statements and Information

This news release contains forward-looking information about the Offering,

including, but not limited to, statements pertaining to the Company's proposed

use of the net proceeds of the Offering. The forward-looking statements in this

news release are subject to a number of risks and uncertainties that could cause

actual events or results to differ materially from current expectations,

including those related to the business generally, which are set out in

materials filed with the securities regulatory authorities in Canada from time

to time, including the risk section of the Company's annual Management's

Discussion and Analysis report, Annual Information Form and the short form final

prospectus.

The Company does not undertake to update any forward-looking statements that may

be made from time to time by or on behalf of the Company other than as required

by applicable securities laws.

FOR FURTHER INFORMATION PLEASE CONTACT:

Altius Minerals Corporation

Chad Wells

Toll Free: 1-877-576-2209

709-576-3441 (FAX)

info@altiusminerals.com

www.altiusminerals.com

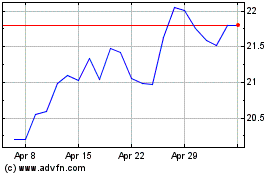

Altius Minerals (TSX:ALS)

Historical Stock Chart

From Mar 2024 to Apr 2024

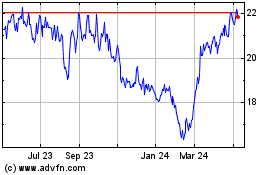

Altius Minerals (TSX:ALS)

Historical Stock Chart

From Apr 2023 to Apr 2024