Euro Extends Slide Against Most Majors

May 02 2012 - 5:29AM

RTTF2

The euro has been extending its decline against most major

currencies in European deals on Wednesday as investors sold the

single currency following weaker-than-expected manufacturing PMI

reports from Europe and a rise in Eurozone unemployment rate.

The Eurozone manufacturing sector contracted more than initially

estimated for April, Markit Economics said. According to the

survey, the Purchasing Managers' Index for manufacturing fell to a

near three-year low of 45.9, from 47.7 in March and below the

earlier flash estimate of 46.0. The headline index signaled

contraction in each of the past nine months.

Meanwhile, data from Eurostat revealed that the unemployment

rate in euro area increased to new record high in March. The

seasonally adjusted jobless rate rose to 10.9 percent in March from

10.8 percent in February. The outcome was in line expectations. In

March 2011, the rate was 9.4 percent.

The euro that closed Tuesday's deals at 1.3238 against the US

dollar and 1.3050 against the Canadian dollar is now trading at a

5-day low of 1.3160 and a 2-day low of 1.2981, respectivey. The

next downside target level for the euro is seen at 1.310 against

the greenback and 1.295 against the loonie.

Against the pound, the euro is trading at a fresh 22-month low

of 0.8117, compared to yesterday's close of 0.8163. On the

downside, 0.807 is seen as the next target level for the euro.

The euro that rose to a 5-day high of 106.57 against the yen at

3:05 am ET declined thereafter. At present, the euro-yen pair is

worth 105.70 and if the euro weakens further, it may likely target

the 105.5 level. The pair ended yesterday's trading at 106.05.

The euro is currently worth 1.2737 against the Australian dollar

and 1.6189 against the New Zealand dollar, down from yesterday's

close of 1.2817 and 1.6243, respectively. If the euro falls

further, it may target 1.270 against the aussie and 1.605 against

the kiwi.

But the euro traded in a tight range of 1.2017 and 1.2019

against the franc though the pair surged up to a 1-week high of

1.2023 at 3:30 am ET.

Investors now focus on the New York session, in which the U.S.

ADP National employment report for April and the factory goods

orders for March are slated for release.

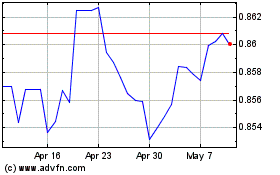

Euro vs Sterling (FX:EURGBP)

Forex Chart

From Mar 2024 to Apr 2024

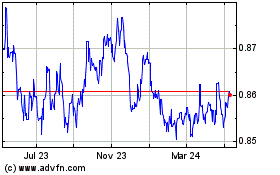

Euro vs Sterling (FX:EURGBP)

Forex Chart

From Apr 2023 to Apr 2024