South Korean Won Falls Against Dollar And Yen

October 13 2009 - 12:07AM

RTTF2

During early Asian deals on Tuesday, the South Korean won edged

down against its U.S. and Japanese counterparts as a fall in

regional stock prices reduced demand for the currency.

The South Korean stock market is trading weak today with

investors pressing some heavy sales in front line stocks following

reports North Korea launched five short-range missiles and is

likely to fire more.

Bank, oil, steel and shipbuilding stocks have declined sharply,

while automobile and technology stocks are exhibiting a mixed

trend.

The benchmark KOSPI index, which fell to 1,614.4, is currently

trading at 1,632, down 7.12 points, or 0.43%, from its previous

close.

Against the US dollar, the South Korean won edged down during

early Asian deals on Tuesday. At 11:05 pm ET, the won touched a low

of 1169.95 against the dollar, compared to 1168.00 hit late New

York Monday. The next downside target level for the South Korean

currency is seen around 1183.6.

The South Korean currency lost ground after hitting a high of

12.9740 against the Japanese yen during Tuesday's early Asian

deals. At 11:05 pm ET, the won slipped to 13.0310 against the yen

with 13.34 seen as the next support level. The yen-won pair closed

Monday's North American session at 12.9980.

According to data released by Bank of Japan, the benchmark

measure of money supply, M2, rose 3% year on year to a daily

average of 757.8 trillion yen in September. M3 was up 2.2% in the

same period.

The Bank of Japan began its two-day monetary policy meeting

today and will announce its decision on interest rates at its

conclusion tomorrow. Analysts expect the bank to keep rates on hold

at the record low 0.10 percent, although investors will be looking

for clues as to how soon the bank may raise rates - especially

after Australia hiked rates in a surprise move last week.

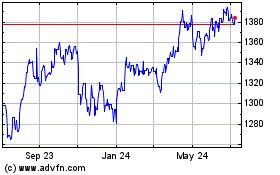

US Dollar vs KRW (FX:USDKRW)

Forex Chart

From Mar 2024 to Apr 2024

US Dollar vs KRW (FX:USDKRW)

Forex Chart

From Apr 2023 to Apr 2024