UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14C

SCHEDULE 14C INFORMATION

Information Statement Pursuant to Section 14(c)

of the Securities Exchange Act of 1934 (Amendment No.

)

|

Check the appropriate box:

|

|

x

|

Preliminary Information Statement

|

|

o

|

Confidential, for Use of the Commission Only (as permitted by Rule 14c-5(d)(2))

|

|

o

|

Definitive Information Statement

|

|

|

CPI CARD GROUP INC.

|

|

|

(Name of Registrant As Specified In Its Charter)

|

|

Payment of Filing Fee (Check the appropriate box):

|

|

x

|

No fee required

|

|

o

|

Fee computed on table below per Exchange Act Rules 14c-5(g) and 0-11

|

|

(1)

|

Title of each class of securities to which transaction applies:

|

|

|

|

|

(2)

|

Aggregate number of securities to which transaction applies:

|

|

|

|

|

(3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

|

|

(4)

|

Proposed maximum aggregate value of transaction:

|

|

|

|

|

(5)

|

Total fee paid:

|

|

|

|

|

o

|

Fee paid previously with preliminary materials.

|

|

o

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

(1)

|

Amount Previously Paid:

|

|

|

|

|

(2)

|

Form, Schedule or Registration Statement No.:

|

|

|

|

|

(3)

|

Filing Party:

|

|

|

|

|

(4)

|

Date Filed:

|

|

|

|

CPI CARD GROUP INC.

10026 WEST SAN JUAN WAY

LITTLETON, CO 80127

NOTICE OF ACTION BY

WRITTEN CONSENT OF MAJORITY STOCKHOLDERS

WE ARE NOT ASKING YOU FOR A PROXY

AND YOU ARE REQUESTED NOT TO SEND US A PROXY

Dear Stockholders:

The accompanying Information Statement is being furnished to the holders (“

Stockholders

”) of shares of the common stock, par value $0.001 per share (the “

Common Stock

”), of CPI Card Group Inc., a Delaware corporation (the “

Company

”). The Board of Directors of the Company (the “

Board

”) is not soliciting your proxy and you are requested not to send us a proxy. The purpose of this Information Statement is to notify you that the Company has received the written consent, dated July 25, 2018 (the “

Written Consent

”), from holders of shares of voting securities representing approximately

59

% of the total issued and outstanding shares of voting stock of the Company approving the action described in the enclosed Information Statement.

We are furnishing this notice and the accompanying Information Statement solely for the purpose of informing our Stockholders of the action taken by the Written Consent before such action becomes effective in satisfaction the notice requirements of Section 14C of the Securities Exchange Act of 1934, as amended and the rules promulgated by the U.S. Securities and Exchange Commission thereunder, and Section 228 of the Delaware General Corporation Law.

This is not a notice of a special meeting of Stockholders and no Stockholder meeting will be held to consider the matter described herein.

This notice and the Accompanying Information Statement are first being sent to Stockholders on our about August

[

·

]

, 2018.

|

|

By Order of the Board of Directors,

|

|

|

|

|

August [

·

], 2018

|

|

|

|

/s/ Sarah Kilgore

|

|

|

Sarah Kilgore

|

|

|

Chief Legal and Compliance Officer and Corporate Secretary

|

CPI CARD GROUP INC.

10026 WEST SAN JUAN WAY

LITTLETON, CO 80127

INFORMATION STATEMENT

AUGUST [

·

]

, 2018

WE ARE NOT ASKING YOU FOR A

PROXY AND YOU ARE REQUESTED NOT TO SEND US A PROXY

GENERAL INFORMATION

In this Information Statement we refer to CPI Card Group Inc., a Delaware corporation, as the “Company,” “we,” “us,” or “our.”

This Information Statement is being furnished by the Board of Directors of the Company (the “

Board

”), to inform the holders (“

Stockholders

”) of our common stock, par value $0.001 per share (the “

Common Stock

”), as of

July 25

, 2018, of an action (the “

Action

”) approved by the Board and by the written consent (the “

Written Consent

”) of holders (the “

Consent Holders

”) of shares of Common Stock representing approximately 59% of the total issued and outstanding shares of voting stock of the Company.

This Information Statement contains a brief summary of the material aspects of the Action approved by the Board and the Consent Holders.

Action by Written Consent

Section 228 of the Delaware General Corporation Law (the “

DGCL

”) provides that, unless the Company’s Certificate of Incorporation provides otherwise, the Company’s Stockholders may approve an action by written consent signed by the holders of outstanding shares of voting capital stock having not less than the minimum number of votes that would be necessary to authorize or take such action at a meeting at which all shares entitled to vote thereon were present and voted. Our Certificate of Incorporation provides that so long as Tricor Pacific Capital Partners (Fund IV), Limited Partnership and Tricor Pacific Capital Partners (Fund IV) US, Limited Partnership, and their respective affiliates, collectively continue to beneficially own a majority of the voting power of the outstanding shares of our capital stock, any action required or permitted to be taken by the Stockholders may be taken without a meeting, without prior notice and without a vote if a consent or consents in writing, setting forth the action so taken, is signed by holders of outstanding shares of voting stock having the minimum number of votes necessary to authorize or take such action at a meeting at which all shares of the Company’s outstanding voting Stock entitled to vote thereon were present and voted.

On May 31, 2018, the Board adopted a resolution approving and declaring the advisability of filing of a Certificate of Amendment of the Third Amended and Restated Certificate of Incorporation of CPI Card Group Inc. (the “

Certificate of Amendment

”) to eliminate certain contingent provisions relating to the removal of directors of the Company (collectively, the “

Amendment

”) that would, if they were to go into effect, require a supermajority vote for the removal of directors of the Company and permit such removal only for cause. As a result, if the Certificate of Amendment is filed with the Secretary of State of the State of Delaware, and Amendment becomes effective, subject to the rights of any class of then outstanding preferred stock, the Stockholders will be entitled at all times to remove directors of the

Company with or without cause by a simple majority vote. Pursuant to the Written Consent, the Consent Holders have approved the Amendment and the filing of the Certificate of Amendment.

What is the Purpose of this Information Statement?

This Information Statement and the accompanying notice are being furnished to our Stockholders solely for the purpose of informing our Stockholders of the action taken by the Written Consent of the Consent Holders in accordance with:

·

Section 14C of the Securities Exchange Act of 1934, as amended (the “

Exchange Act

”), and the rules promulgated by the U.S. Securities and Exchange Commission (“

SEC

”) thereunder, and

·

Section 228 of the DGCL and the Company’s Certificate of Incorporation and bylaws.

Section 14C of the Exchange Act and Regulation 14C promulgated by the

SEC

thereunder, require the Company to furnish to our Stockholders an information statement describing any action taken by written consent in lieu of a meeting of stockholders before such action becomes effective. In connection with an action by written consent, Section 228 of the DGCL requires prompt notice of the taking of such action to be given to the Stockholders of record who have not consented in writing to such action and who, if the action had been taken at a meeting, would have been entitled to notice of the meeting if the record date for such meeting had been the date that written consents signed by a sufficient number of holders to take the action were delivered to a company.

Who is Entitled to Notice?

Each outstanding share of Common Stock as of record on the Record Date is entitled to notice of the Action to be taken pursuant to the Written Consent. The close of business on

July 25

, 2018, is the record date (the “

Record Date

”) for the determination of Stockholders who are entitled to receive this Information Statement. This Information Statement will be mailed on or about August [

·

], 2018 to Stockholders of record as of the Record Date.

What Vote is Required to Approve the Action?

Each share of Common Stock entitles the holder to one vote. On the Record Date, there were

11,159,714

shares of Common Stock issued and outstanding. Pursuant to Section 228 of the DGCL, at least a majority of the voting stock of the Company, or at least 5,579,857 votes, are required to approve the Action by written consent.

The Consent Holders are Tricor Pacific Capital Partners (Fund IV), Limited Partnership and Tricor Pacific Capital Partners (Fund IV) US, Limited Partnership. As of the Record Date, the Consent Holders held 6,558,825 shares of Common Stock, or approximately 58.8% of the total voting power of all outstanding voting stock. Pursuant to the Written Consent, the Consent Stockholders have approved the Action. Therefore, no other Stockholder consents will be obtained in connection with this Information Statement.

Do I have appraisal rights?

Neither the DGCL nor our Certificate of Incorporation or bylaws provide our Stockholders with appraisal rights in connection with the Action discussed in this Information Statement.

ACTION TO BE TAKEN

Set forth below is a brief summary of the material aspects of the Action approved by the Board and the Consent Holders.

ACTION I

THE AMENDMENT OF THE THIRD AMENDED AND RESTATED CERTIFICATE OF INCORPORATION OF CPI CARD GROUP INC.

Purpose and Effect of the Amendment

Currently, Paragraph D of Article Fifth of our Certificate of Incorporation provides that, subject to the rights of holders of any shares of our preferred stock then outstanding, prior to the date (the “

Trigger Date

”) on which the Majority Stockholders collectively cease to beneficially own at least a majority of the voting power of the then outstanding shares of our capital stock then entitled to vote generally in the election of directors of the Company (the “

Voting Stock

”), the directors of the Company may be removed with or without cause upon the affirmative vote of the Stockholders representing at least a majority of the voting power of the then outstanding shares of our Voting Stock. On and after the Trigger Date, Paragraph D of Article Fifth of our Certificate of Incorporation provides that, subject to the rights of holders of any shares of our preferred stock then outstanding, directors may be removed only for cause (the “

only for cause requirement

”) and only upon the affirmative vote of stockholders representing at least 75% of the voting power of the then outstanding shares of Voting Stock at a meeting of the Stockholders called for that purpose (the “

supermajority vote requirement

”). T

he Trigger Date has not occurred because the Majority Stockholders continue to own a majority of the outstanding Voting Stock, and therefore neither the only for cause requirement nor the supermajority vote requirement is, or has at any time been, in effect,

Our Board and the Nominating and Governance Committee of the Board review our corporate governance practices on a continuing basis and, for the reasons described below, our Board has determined that it is advisable and in the best interests of the Company and its Stockholders to amend our Certificate of Incorporation to eliminate the only for cause requirement and the supermajority vote requirement for the removal of directors.

In recent court proceedings not involving the Company, the Delaware Court of Chancery has held that, in the absence of a classified board or cumulative voting, an “only for cause” director removal provision conflicts with Section 141(k) of the DGCL and is therefore invalid. In light of this guidance, the Board determined an amendment to our Certificate of Incorporation is necessary to remove the only for cause requirement and permit a director to be removed for cause or without cause. In connection with that determination, the Board also concluded that it is in the best interests of the Company and the Stockholders to amend our Certificate of Incorporation to allow for removal of a director by a simple majority as opposed to the 75% supermajority that would be required after the Trigger Date under the

current provisions of

paragraph D of Article FIFTH of our Certificate of Incorporation

. The simple majority voting requirement will give stockholders enhanced flexibility to make changes on the Board.

On

May 31, 2018, the Board adopted a resolution approving and declaring the advisability of the proposed Amendment, and directing that the Amendment be submitted to the Stockholders for approval. The Consent Holders signed and delivered the Written Consent, dated July 25, 2018, to the Company in accordance with Section 228 of the DGCL and our Certificate of Incorporation.

The Amendment

Upon filing of the Certificate of Amendment with the Secretary of State of the State of Delaware, Paragraph D of Article Fifth of the Certificate of Incorporation will be amended to eliminate the only for cause requirement and supermajority voting requirement to remove directors on or after the Trigger Date. The Amendment will amend Paragraph D of Article Fifth of the Certificate of Incorporation as follows

(with the deletions stricken through and additions underlined):

D. Removal of Directors. Subject to the rights of the holders of any series of Preferred Stock then outstanding and notwithstanding any other provision of this Certificate of Incorporation,

(i) prior to the first date (the “Trigger Date”) on which Tricor Pacific Capital Partners (Fund IV), Limited Partnership, Tricor Pacific Capital Partners (Fund IV) US, Limited Partnership and their respective affiliates collectively cease to beneficially own (directly or indirectly) at least a majority of the voting power of the then outstanding shares of capital stock of the Corporation then entitled to vote generally in the election of directors (“

Voting Stock

”),

directors may be removed with or without cause upon the affirmative vote of stockholders representing at least a majority of the voting power of the then outstanding shares of

capital stock of the Corporation then entitled to vote generally in the election of directors

Voting Stock, voting together as a single class and (ii) on and after the Trigger Date, directors may only be removed for cause and only upon the affirmative vote of stockholders representing at least 75% of the voting power of the then outstanding shares of Voting Stock, at a meeting of the Corporation’s stockholders called for that purpose

. Any director may resign at any time upon written notice to the Corporation.

Although stockholders have approved the Amendment, we may abandon or delay the Amendment if our

Board of Directors determines that it is no longer in the best interests of our corporation or our stockholders.

Vote Required to Approve the Amendment

The affirmative vote of the holders of a majority of the voting power of all outstanding shares of Voting Stock, voting together as a single class, is required to approve the Amendment. Under the DGCL, our Certificate of Incorporation and our bylaws, any action required or permitted to be taken by the Stockholders may be taken without a meeting, without prior notice and without a vote if a consent or consents in writing, setting forth the action so taken, is signed by holders of outstanding stock having the minimum number of votes necessary to authorize or take such action at a meeting at which all shares of the Company’s Common Stock entitled to vote thereon were present and voted.

The Consent Holders, who together hold approximately 58.8% of the Voting Stock, approved the Amendment by written consent dated July 25, 2018.

No Voting of Stockholders Required

Since the Consent Holders have already approved the Action by the Written Consent, we are not soliciting any votes with regard to the Action.

Manner of Effecting the Amendment

The Amendment will become effective upon the filing of a Certificate of Amendment with the Secretary of State of the State of Delaware. Pursuant to Rule 14c-2 under the Exchange Act, the earliest date that the Action can become effective is 20 days after this Information Statement is first sent to the Stockholders. As a result, the Certificate of Amendment will be filed at least 20 days after the date of the mailing of this Information Statement to our Stockholders.

INTEREST OF CERTAIN PERSONS IN OR OPPOSITION TO MATTERS TO BE ACTED UPON

We do not believe that any of our current directors or officers, or any associates of the foregoing, have any substantial interest in the Action that are different from the interests of the Stockholders generally.

OUTSTANDING VOTING SECURITIES

Record Date and Voting Securities

The close of business on July 25, 2018, is the record date (the “

Record Date

”) for the determination of Stockholders who are entitled to receive this Information Statement. As of the Record Date, the Company had 11,159,714 shares of Common Stock issued and outstanding. Each share of outstanding Common Stock is entitled to one vote on matters submitted for Stockholder approval.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information known to us regarding beneficial ownership of shares of our Common Stock as of June 30, 2018 by:

·

each of our directors;

·

each of our named executive officers;

·

all of our executive officers and directors as a group; and

·

each person (including any “group”) known to us to be the beneficial owner of more than 5% of our issued and outstanding shares of Common Stock.

Beneficial ownership is determined in accordance with the rules and regulations of the SEC and includes voting and investment power with respect to the securities. In computing the number of shares beneficially owned by a person and the percentage ownership of that person, shares of Common Stock subject to options, warrants or stock-based awards held by that person that are currently exercisable or have vested, as applicable, or are exercisable or will vest, as applicable, within 60 days of June 30, 2018 are deemed outstanding. Such shares, however, are not deemed outstanding for purposes of computing the percentage ownership of any other person. To our knowledge, except as indicated in the footnotes to this table and subject to community property laws where applicable, the persons and entities named in the table have sole voting and investment power with respect to all shares of our Common Stock shown as beneficially owned by them. The percentage of beneficial ownership is computed on the basis of 11,159,714 shares of our Common Stock outstanding as of June 30, 2018. Unless otherwise noted below, the address of the persons and entities listed in the table is c/o CPI Card Group Inc., 10026 West San Juan Way, Littleton, CO 80127.

The beneficial owners of all issued shares have voting rights over such shares, whether or not such owners have dispositive powers with respect to the shares, and such shares are included in each person’s beneficial ownership amount. For the avoidance of doubt, if a beneficial owner does not have dispositive powers with respect to certain shares, each such person maintains voting control over these shares, and such shares are included in the determination the person’s beneficial ownership amount.

|

Name and Address of Beneficial Owner

|

|

Number of

Shares

Beneficially

Owned

|

|

Percentage of

Shares

Beneficially

Owned

|

|

|

Five Percent Stockholders:

|

|

|

|

|

|

|

Tricor Pacific Capital Partners (Fund IV), Limited Partnership(1)

|

|

4,124,368

|

|

37.0

|

%

|

|

Tricor Pacific Capital Partners (Fund IV) US, Limited Partnership(1)

|

|

2,434,457

|

|

21.8

|

%

|

|

|

|

|

|

|

|

|

Named Executive Officers and Directors:

|

|

|

|

|

|

|

Steven Montross (2)

|

|

349,636

|

|

3.1

|

%

|

|

Robert Pearce

|

|

86,392

|

|

*

|

%

|

|

Lillian Etzkorn (3)

|

|

16,092

|

|

*

|

%

|

|

Silvio Tavares

|

|

11,241

|

|

*

|

%

|

|

Lane Dubin (4)

|

|

10,230

|

|

*

|

%

|

|

Douglas Pearce

|

|

9,394

|

|

*

|

%

|

|

Scott Scheirman

|

|

6,241

|

|

*

|

%

|

|

Nicholas Peters

|

|

—

|

|

—

|

%

|

|

Bradley Seaman

|

|

—

|

|

—

|

%

|

|

Valerie Soranno Keating

|

|

—

|

|

—

|

%

|

|

Executive Officers and Directors as a group (16 individuals)(5)

|

|

606,430

|

|

5.4

|

%

|

*Less than 1%

(1)

Based on a Schedule 13G filed jointly by Tricor Pacific Capital Partners (Fund IV), Limited Partnership, Tricor Pacific Capital Partners (Fund IV) US, Limited Partnership (collectively, the “

Tricor Funds

”) and Parallel49 Equity, ULC on February 12, 2016. Each of the Tricor Funds is managed by Parallel49 Equity, ULC, as the general partner. Mr. Bradley Seaman, Mr. J. Trevor Johnstone and Mr. Roderick Senft are the sole members of an investment committee of the Tricor Funds that has the power to vote or dispose of the shares held by the Tricor Funds. Each of Messrs. Seaman and Peters is an officer or member of Parallel49 Equity, ULC and has an indirect pecuniary interest in the shares of common stock held by the Tricor Funds through their respective interests in the Tricor Funds. Each of Messrs. Seaman and Peters expressly disclaims any beneficial ownership of any shares of Common Stock held by the Tricor Funds. The address of the Tricor Funds is c/o Parallel49 Equity, One Westminster Place, Suite 100, Lake Forest, IL 60045.

(2)

Includes vested options to purchase 35,682 shares of common stock. Mr. Montross retired from the position of President and Chief Executive Officer with the Company as of October 4, 2017. The information regarding Mr. Montross’ beneficial ownership is based solely on his Section 16 filings through his Form 4 filed on March 6, 2017.

(3)

Includes vested options to purchase 16,092 shares of common stock. Ms. Etzkorn resigned from the position of Chief Financial Officer with the Company as of July 19, 2018. The information regarding Ms. Etzkorn’s beneficial ownership is based solely on her Section 16 filings through her Form 4 filed on September 27, 2017

(4)

Includes vested options to purchase 9,595 shares of common stock.

(5)

Includes an aggregate of 87,173 vested options to purchase common stock.

INFORMATION STATEMENT COSTS

The cost of delivering this Information Statement, including the preparation, assembly and mailing of the Information Statement, as well as the cost of forwarding this material to the beneficial owners of our Common Stock will be borne by us. We may reimburse brokerage firms and others for expenses in forwarding Information Statement materials to the beneficial owners of our Common Stock.

ADDITIONAL INFORMATION

The Company is subject to the information and reporting requirements of the Exchange Act and in accordance with the Exchange Act, the Company files periodic reports, documents and other information with the SEC relating to its business, financial statements and other matters.

These reports and other information filed with the SEC by the Company may be inspected and are available for copying at the public reference facilities maintained at the Securities and Exchange Commission at 100 F Street NW, Washington, D.C. 20549.

The Company’s filings with the SEC are also available to the public from the SEC’s website, http://www.sec.gov. Our Annual Report on Form 10-K containing the disclosure for the year ended December 31, 2017, and other reports filed under the Exchange Act, are also available to any Stockholder at no cost upon request to: CPI Card Group at 10026 West San Juan Way, Littleton, Colorado 80127, Attention: Investor Relations or by email to InvRelations@cpicardgroup.com; Telephone: (877) 369-9016.

HOUSEHOLDING OF INFORMATION STATEMENT

Some banks, brokers and other nominee record holders may be participating in the practice of “householding” information statements. This means that only one copy of the Information Statement may be sent to multiple Stockholders who share an address. We will promptly deliver a separate copy of the Information Statement to any Stockholder at a shares address to which a single copy of the Information Statement was is delivered upon written or oral request to CPI Card Group Inc., 10026 West San Juan Way, Littleton, CO 80127, Attention: Chief Legal and Compliance Officer and Corporate Secretary. Any Stockholder who wants to receive separate copies of our Information Statement in the future, or any Stockholder who is receiving multiple copies and would like to receive only one copy per household, should contact the Stockholder’s bank, broker, or other nominee record holder, or the Stockholder may contact us at the above address or calling Investor Relations at (877) 369-9016.

|

|

By Order of the Board of Directors,

|

|

|

|

|

August [

·

], 2018

|

/s/ Sarah Kilgore

|

|

|

Sarah Kilgore

|

|

|

Chief

Legal and Compliance Officer and

|

|

|

Corporate Secretary

|

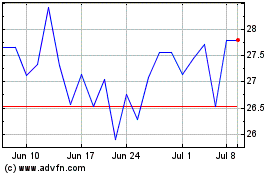

CPI Card (NASDAQ:PMTS)

Historical Stock Chart

From Mar 2024 to Apr 2024

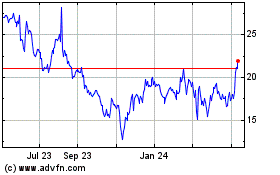

CPI Card (NASDAQ:PMTS)

Historical Stock Chart

From Apr 2023 to Apr 2024