LONDON MARKETS: FTSE 100 Drops As Pound Climbs After Strong Retail-sales Data

May 24 2018 - 11:01AM

Dow Jones News

By Sara Sjolin, MarketWatch

Pound rebounds from 2018 low

U.K. stocks traded lower on Thursday as the pound rallied on the

back of better-than-expected retail sales data that brought a Bank

of England interest-rate rise in August back in to play.

The benchmark index extended losses in the afternoon after U.S.

President Donald Trump called off a meeting with North Korea

planned for next month.

What are markets doing?

The FTSE 100 index was trading 0.7% lower to 7,734.26, adding to

a 1.1% loss from Wednesday.

The pound climbed to $1.3388 from $1.3348 late Wednesday in New

York. Sterling fell to a fresh 2018 low on Wednesday, after

official figures showed U.K. inflation unexpectedly declined in

April, seen as dampening expectations for a summer rate hike by the

BOE.

What is driving the market?

However on Thursday, the retail sales report painted a more

upbeat picture of the U.K. economy and suggested the economy may be

able to stomach a rate hike this summer. Retail sales rose 1.6%

month-on-month in April

(http://www.marketwatch.com/story/uk-retail-sales-rebound-from-bad-weather-2018-05-24),

beating forecasts of a 0.2% rise, recovering after a spell of cold

weather.

Investors in the U.K. are watching data closely, after BOE Gov.

Mark Carney emphasized that the central bank's next policy move

depends on an improvement in British economic health.

Stocks across Europe took a leg lower in the afternoon after

Trump called off a planned summit meeting with leader Kim Jong Un

of North Korea that was due to take place on June 12 in Singapore.

Trump said it was inappropriate to go ahead with the meeting based

on the "tremendous anger and open hostility" displayed Kim's most

recent statements.

"The World, and North Korea in particular, has lost a great

opportunity for lasting peace and great prosperity and wealth. This

missed opportunity is truly a moment in history", Trump said in a

letter to the North Korean leader

(https://twitter.com/capitolreport/status/999648470301540353).

Staying in the U.S., Trump rekindled concerns of a global trade

war, announcing an investigation that could lead to import tariffs

on cars

(http://www.marketwatch.com/story/trump-administration-mulls-tariffs-of-up-to-25-on-imported-autos-2018-05-23).

Traders were also still digesting the minutes from the U.S.

Federal Reserve's May 1-2 meeting, which were released late

Wednesday. The account of the gathering suggest

(http://www.marketwatch.com/story/fed-minutes-show-support-for-june-hike-and-calm-about-inflation-outlook-2018-05-23)

that the Fed is on track to raise interest rates in June and is

keeping calm about the inflation outlook.

Check out:How stock-market investors could be surprised by a

peak in interest rates

(http://www.marketwatch.com/story/heres-how-stock-market-investors-could-be-surprised-by-a-peak-in-rates-2018-05-23)

What are strategists saying?

"The pound was buoyed this morning as retails sales beat

expectations across the board. This is a small reprieve for Mark

Carney at the Bank of England, who has insisted that the dip in Q1

GDP was temporary, and that the fundamentals for the U.K. economy

could bounce back and move the central bank closer to an

interest-rate increase. This morning's retail figures indicate this

could happen," said Hamish Muress, currency analyst at OFX, in a

note.

"This bounce for sterling contrasts with yesterday's decline and

shows how the currency is currently trading on the release of every

piece of economic data as it tries to judge how the economy is

performing," he added.

Stock movers

Shares of Tate & Lyle PLC (TATE.LN) rose 8.6% after the food

ingredients maker said adjusted profit rose 13%

(http://www.marketwatch.com/story/tate-lyle-profit-rises-plans-100-mln-cost-cuts-2018-05-24)

in the last fiscal year.

Kingfisher PLC (KGF.LN) rose 1.5% even after the do-it-yourself

retailer

(http://www.marketwatch.com/story/kingfisher-sales-drop-as-cold-hits-footfall-2018-05-24)

said first-quarter sales fell due to bad weather.

Shares of Daily Mail & General Trust PLC (DMGT.LN) lost 9.7%

after the newspaper publisher reported a drop in revenue in the

first half of fiscal 2018

(http://www.marketwatch.com/story/daily-mail-general-trust-pretax-profit-jumps-2018-05-24).

Mediclinic International PLC (MDC.LN) lost 8.7% after the health

care group said it swung to a full-year pretax loss

(http://www.marketwatch.com/story/mediclinic-swings-to-loss-on-swiss-related-charges-2018-05-24)

due to one-time charges related to its Switzerland business and

intangible assets.

United Utilities Group PLC (UU.LN) gave up 1.2% after reporting

a 2.4% fall in fiscal 2018 pretax profit

(http://www.marketwatch.com/story/united-utilities-pretax-profit-slips-in-2018-2018-05-24).

(END) Dow Jones Newswires

May 24, 2018 10:46 ET (14:46 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

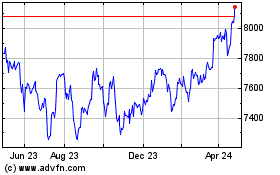

FTSE 100

Index Chart

From Mar 2024 to Apr 2024

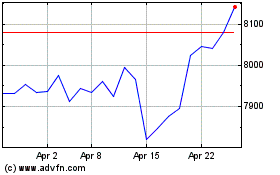

FTSE 100

Index Chart

From Apr 2023 to Apr 2024