Intercontinental Exchange Completes Acquisition of Bank of America Merrill Lynch’s Global Research Index Platform

October 22 2017 - 9:00AM

Business Wire

Intercontinental Exchange (NYSE:ICE), a leading operator of

global exchanges and clearing houses and provider of data and

listings services, announced it has completed its acquisition of

the Bank of America Merrill Lynch Global Research division’s fixed

income index platform, which will become part of ICE Data Services.

Terms of the agreement were not disclosed and the financial impact

of the transaction will be immaterial to ICE in 2017.

“We’re excited to expand the breadth and scale of our index

offering to give customers increased choice of third party

benchmark solutions,” said Lynn Martin, President and COO of ICE

Data Services. “With the addition of these indices, we are able to

offer a comprehensive portfolio that includes the addition of more

than 5,000 global fixed income, currency and commodity indices and

leverages our trusted pricing and reference data solutions to meet

the needs of our customers.”

The acquired indices will be renamed ICE BofAML Indices and will

become part of ICE Data Services’ suite of businesses, which

provides proprietary indices, and third-party index and ETF

calculation services, as well as proprietary market data, pricing

and analytics, desktops and connectivity solutions. ICE BofAML

Indices are the second largest fixed income indices by assets under

management (AUM) globally, and with the completion of this

acquisition, the AUM benchmarked against the combined fixed income

index business of ICE will be nearly $1 trillion.

ICE BofAML Indices will be offered alongside ICE’s existing

index offering, which includes the ICE U.S. Treasury indices, which

were introduced in 2015, and ICE’s index services, which serve as

the basis for ETFs and structured products across fixed income,

currencies, equities and commodities. The collective index families

are powered by ICE Data Services’ award-winning evaluated prices,

reference data and analytics, which provide high-quality

information on more than 10 million financial instruments across

all major asset classes, including futures, options, equities and

fixed income.

The full suite of ICE BofAML Indices are available on ICE’s

Global Index System (GIS), as well as a broad range of third-party

research platforms and execution venues. To register for an

extended complementary trial to GIS, please click here. For more

information about ICE Index Services, please visit

https://www.theice.com/indices.

About Intercontinental Exchange

Intercontinental Exchange (NYSE:ICE) is a Fortune 500 company

that operates a leading network of global futures, equity and

equity options exchanges, as well as global clearing and data

services across financial and commodity markets. The New York Stock

Exchange is the world leader in capital raising, listings and

equities trading.

Trademarks of ICE and/or its affiliates include Intercontinental

Exchange, ICE, ICE block design, NYSE and New York Stock Exchange.

Information regarding additional trademarks and intellectual

property rights of Intercontinental Exchange, Inc. and/or its

affiliates is located at

www.intercontinentalexchange.com/terms-of-use.

ICE Data Services is the marketing name used for ICE Data

Indices, LLC, Interactive Data Corporation and its subsidiaries

globally, including Interactive Data Pricing and Reference Data

LLC, Interactive Data (Europe) Ltd. and Interactive Data

(Australia) Pty Ltd. And CMA Ltd. ICE Data Services is also the

marketing name used for Super Derivatives (Israel) Ltd. and its

subsidiaries globally and certain other data products and services

offered by other affiliates of Intercontinental Exchange, Inc.

(NYSE:ICE).

ICE BofAML Indices, the NYSE Index Services, ICE U.S. Treasury

indices and third-party index and ETF calculation services are

provided through ICE Data Indices LLC.

Evaluated pricing (including fixed income evaluations),

Continuous Evaluated Pricing, end‐of‐day evaluations, evaluated

pricing for listed and unlisted ADRs, and Fair Value Information

Services and any other investment advisory services with respect to

securities are provided in the US through Interactive Data Pricing

and Reference Data LLC and internationally through Interactive Data

(Europe) Ltd. and Interactive Data (Australia) Pty Ltd. Interactive

Data Pricing and Reference Data LLC is a registered investment

adviser with the U.S. Securities and Exchange Commission.

Safe Harbor Statement under the Private Securities Litigation

Reform Act of 1995 -- Statements in this press release regarding

ICE's business that are not historical facts are "forward-looking

statements" that involve risks and uncertainties. For a discussion

of additional risks and uncertainties, which could cause actual

results to differ from those contained in the forward-looking

statements, see ICE's Securities and Exchange Commission (SEC)

filings, including, but not limited to, the risk factors in ICE's

Annual Report on Form 10-K for the year ended December 31, 2016, as

filed with the SEC on February 7, 2017.

SOURCE: Intercontinental Exchange

ICE- CORP

View source

version on businesswire.com: http://www.businesswire.com/news/home/20171022005052/en/

Media Contact:Damon

LeavellDamon.leavell@theice.com212-323-8587orInvestor

Contact:Warren

GardinerWarren.Gardiner@theice.com770-835-0114

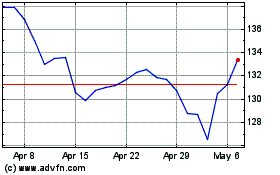

Intercontinental Exchange (NYSE:ICE)

Historical Stock Chart

From Mar 2024 to Apr 2024

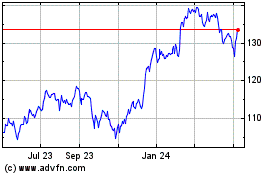

Intercontinental Exchange (NYSE:ICE)

Historical Stock Chart

From Apr 2023 to Apr 2024