GE Whittles Down Lighting Assets -- WSJ

November 07 2018 - 3:02AM

Dow Jones News

By Thomas Gryta and Dana Mattioli

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (November 7, 2018).

General Electric Co. said it agreed to sell its Current lighting

division to private-equity firm American Industrial Partners for an

undisclosed amount, as the conglomerate continues to separate from

a business that is central to its historical roots.

The Current business, which sells LED lighting for commercial

use, had about $1 billion in sales in 2017.

GE is still trying to sell the rest of its consumer-lighting

business, which includes light bulbs, according to people familiar

with the matter. The company sold its overseas lighting business

earlier this year.

American Industrial Partners is a middle-market private-equity

firm. Its current investments include bulk-freight shipping company

Rand Logistics, aviation-services provider Vertex Aerospace and

Gerber Technology, which makes equipment for apparel

manufacturers.

Under the Current deal, which is expected to close in early

2019, the Boston-based business would continue using the GE brand

under a licensing agreement, GE said.

"[AIP's] deep expertise in operations and engineering, combined

with its highly successful track record of industrial business

investments, would help us accelerate Current's growth," Maryrose

Sylvester, president and chief executive of Current, said in a

statement.

GE's sale attracted a number of private-equity firms as well as

foreign buyers, according to people familiar with the matter.

The struggling conglomerate has been trying to sell its lighting

business for years, beginning under former CEO Jeff Immelt. While

the lighting business is iconic for GE -- which was co-founded by

Thomas Edison -- the products have become commoditized and profit

margins are thin.

GE has been evaluating sales and spinoffs as the company looks

to shore up its cash balance. Last week, the company cut its

dividend for the second time in a year. It also revealed that

federal prosecutors had opened a criminal investigation into its

accounting.

In recent years, GE has been selling the last of its consumer

businesses. In 2016, it agreed to sell its appliances business to

China's Haier Group for $5.4 billion. GE gave the Chinese buyer the

right to continue using its brand on stoves, refrigerators and

other appliances for several decades. Thousands of workers and a

sprawling factory complex in Louisville, Ky., were transferred in

the deal.

Write to Thomas Gryta at thomas.gryta@wsj.com and Dana Mattioli

at dana.mattioli@wsj.com

(END) Dow Jones Newswires

November 07, 2018 02:47 ET (07:47 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

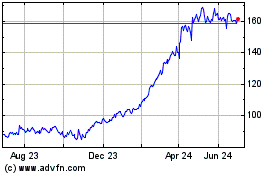

GE Aerospace (NYSE:GE)

Historical Stock Chart

From Mar 2024 to Apr 2024

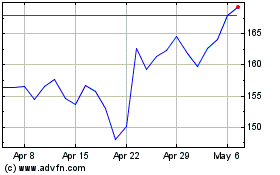

GE Aerospace (NYSE:GE)

Historical Stock Chart

From Apr 2023 to Apr 2024