Disappointing 4Q for Amedisys - Analyst Blog

February 29 2012 - 8:01AM

Zacks

Home health care provider Amedisys (AMED)

reported EPS of 25 cents in the fourth quarter of 2011, compared

with 86 cents in the year-ago quarter. The company recorded

goodwill impairment charge of $5.8 million during the quarter due

to decline in market capitalization and disappointing performance

over the past few quarters.

After taking into account this charge and other one-time

expenses, the adjusted EPS in the reported quarter stood at 49

cents compared with $1.03 in the fourth quarter of 2010. The Zacks

Consensus Estimate for the quarter was pegged at 29 cents. In

fiscal 2011, the adjusted EPS from continuing operation came in at

$2.27, down 50.8% year over year.

Amedisys primarily derives revenue from its home health and

hospice agencies by providing a variety of services at homes. Net

service revenue stood at $370.7 million in the reported quarter,

almost in line with the Zacks Consensus Estimate but down 4.6% year

over year.

The decline in net service revenue during the quarter was mainly

due to a 14.3% drop in same-store Episodic-based sales. Net service

revenue in fiscal 2011 was $1.5 billion, down 8.2% from $1.6

billion in the previous year.

Gross margin decreased 463 basis points (bps) to 45.19% in the

fourth quarter of 2011. Adjusted operating margin (excluding the

effect of depreciation and amortization, provision for doubtful

accounts as well as goodwill and other intangibles impairment

charge) witnessed a massive 530 bps year-over-year decline to

9.24%.

Amedisys exited the reported fiscal with cash and cash

equivalents of $48.0 million, compared with $120.3 million at the

end of December 2010.

Guidance

Amedisys provided its guidance for fiscal 2012. The company

expects EPS in the range of 95 cents–$1.10. The current Zacks

Consensus Estimate of 95 cents falls at the lower end of the guided

range. The company’s revenue guidance for 2012 is expected to

remain within $1.475–$1.525 billion.

We believe the highly uncertain home nursing reimbursement

environment (an expected reduction in Medicare reimbursements to

hit the home health-care sector in another year) will further

weaken the company’s persisting volatile position.

Presently, the stock retains a short-term Zacks #4 Rank (Sell).

Over the long term, we have an Underperform recommendation on the

company.

AMEDISYS INC (AMED): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

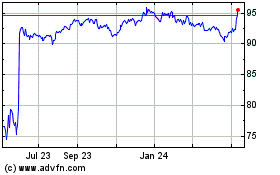

Amedisys (NASDAQ:AMED)

Historical Stock Chart

From Mar 2024 to Apr 2024

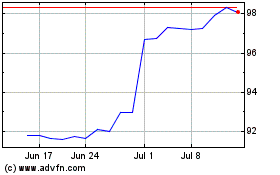

Amedisys (NASDAQ:AMED)

Historical Stock Chart

From Apr 2023 to Apr 2024