Credit and Debit Cards May Be Adding a New Element: Fingerprints

June 19 2018 - 10:49PM

Dow Jones News

By AnnaMaria Andriotis

Everyone knows the future of payments is digital. Trouble is,

Americans just don't want to give up plastic.

Tech companies, banks and fintech startups have all tried to

wean consumers off physical cards. Attempts have included digital

wallets and various apps. So far, though, these efforts seem to be

solutions in search of a problem, as people still find plastic

cards incredibly easy to use.

So, card companies are now considering steps that would try to

bolster the security of plastic through the use of

fingerprint-enabled cards. Visa Inc. and Mastercard Inc. are in the

early stages of adding fingerprint sensors to cards, a move they

believe will help lower fraudulent purchases in stores.

Prints match

Here's how it works. When consumers activate their cards, they

place a finger on a fingerprint sensor on the card. A template of

the print is then stored on the card's chip, which is usually

located above the card number. When cardholders use the card to pay

at a store's checkout terminal, technology in the card's chip

checks the print to make sure it matches the print stored on the

card.

The move is the latest in a string of security features that

card networks have rolled out to lessen fraud. Proponents of the

technology say that if swindlers steal or replicate the fingerprint

card, the purchases they try to make in store won't be approved

because their fingerprint won't match the template. They say the

cards can also improve consumer convenience, including lessening

the chances of consumers' legitimate in-store card transactions

being flagged as fraudulent and getting rejected.

Card analysts say that banks' appetite for these cards is

limited, however, in large part because of the hefty costs they

incurred reissuing U.S. consumers' debit and credit cards with

security chips over the past few years. Those costs exceeded $1

billion, according to bank executives, and required consumers to

get used to a new method of inserting rather than swiping their

cards.

Benefits eyed

Banks are resistant to replacing cards again when the benefits

to consumers aren't significant, says Kevin Morrison, senior

payments analyst at research firm Aite Group.

Still, it is possible that the fingerprints could catch on after

a few years when many cards reach their expiration dates and need

to be reissued. Mastercard says it is looking for banks to issue

fingerprint cards in the U.S. The company ran two pilots in South

Africa last year and another one in Bulgaria. Other pilots are

under way in Europe and in Kuwait. A Mastercard spokesman declined

to disclose how many of these cards were issued. He also declined

to say in what country the current European pilot is taking

place.

Several U.S. banks have expressed interest in issuing the cards

for corporate use and for affluent consumers with high credit

limits who travel abroad often, says Bob Reany, Mastercard's

executive vice president of identity solutions.

But the efforts aren't yet resonating with many consumers. First

off, there is the privacy question of whether they want to add

their fingerprint to card transactions. Then, there are practical

limitations: The safety feature doesn't help with online shopping,

an increasingly popular way to purchase goods and services.

Also, U.S. consumers have little financial need for the cards.

When credit cards are fraudulently used, cardholders usually don't

pay a dime. Technically, credit-card users can be on the hook for

$50 of fraudulent purchases, but most issuers waive that

charge.

Similar protections are in place with debit cards if consumers

report unauthorized use quickly. Card executives say these

protections create little incentive for consumers to get accustomed

to new types of security features.

Visa's fingerprint pilot in the U.S. ran earlier this year and

involved a debit card issued by Mountain America Credit Union. Just

130 people signed up for it.

Asking 'Why?'

"Consumers are asking, 'Why am I doing this?' " says Mark

Nelsen, Visa's senior vice president of identity and risk products.

"They're not totally sure what the value proposition is."

Card executives are also mixed on whether consumers'

fingerprints with these cards will become vulnerable to hacks. Some

say such hacking isn't possible because the fingerprints don't

leave the card during the purchase process and aren't stored in a

centralized database.

Others say that is a rosy outlook. "Anytime you introduce a new

security feature...it's just a matter of time until the bad guys

figure out a way to compromise that," says Aite's Mr. Morrison.

Ms. Andriotis is a reporter for The Wall Street Journal in New

York. She can be reached at annamaria.andriotis@wsj.com.

(END) Dow Jones Newswires

June 19, 2018 22:34 ET (02:34 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

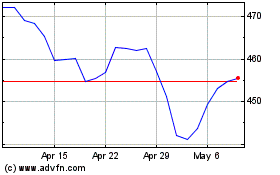

MasterCard (NYSE:MA)

Historical Stock Chart

From Mar 2024 to Apr 2024

MasterCard (NYSE:MA)

Historical Stock Chart

From Apr 2023 to Apr 2024