Cisco Extends Growth Streak on Strong Software Sales

August 15 2018 - 8:22PM

Dow Jones News

By Jay Greene

Cisco Systems Inc. on Wednesday reported its third-consecutive

quarter of revenue growth, evidence the networking-gear maker's

move to build up its software business is paying off.

Shares of Cisco jumped 6.3% in after-hours trading after

finishing the regular day at $43.86.

Cisco's streak -- the company generated $12.84 billion in total

revenue in its fiscal fourth quarter, up 6% from a year earlier --

comes after two years of declines during which it faced increasing

pressure from competitors while it relied heavily on slower-growth

hardware sales.

And the company expects the run to continue, providing guidance

that calls for revenue growth of between 5% and 7% in the current

quarter.

Cisco has seen its financial fortunes improve, as it focused on

software sales, particularly in the security arena. Revenue in its

security segment revenue jumped 12% to $627 million.

Net income surged 57% to $3.8 billion, or 81 cents a share.

Adjusted earnings came to 70 cents a share, beating analysts'

expectations by a penny, according to a survey by S&P Global

Market Intelligence. Analysts had expected revenue of $12.76

billion.

"I'm pragmatic enough to know that it's a combination of both"

the company's performance and the macroeconomic environment, Cisco

Chief Executive Chuck Robbins told analysts.

One area of concern for Mr. Robbins is the growing trade dispute

between the U.S. and China. Last month, the White House said it was

considering expanding the trade fight with China by assessing

tariffs on $200 billion in Chinese goods, in addition to duties

levied and proposed on $50 billion of Chinese imports earlier this

summer.

The proposed tariffs target, among other items, switches and

routers -- some of which Cisco makes in China and imports to the

U.S.

"We're in deep discussions in Washington with the administration

on trying to get to a favorable outcome," Mr. Robbins told

analysts. He didn't detail the potential impact the proposed

tariffs might have on the company's results.

In Cisco's largest segment, infrastructure platforms, revenue

grew 7% to $7.44 billion, while revenue in its applications

business climbed 10% to $1.34 billion.

Cisco said it returned $7.5 billion to shareholders in its

fiscal fourth quarter. Its total cash is at $46.5 billion, 34%

lower than it was a year ago. The increasing shareholder returns

come after Cisco repatriated $67 billion of its foreign cash

holdings earlier this year, the result of the new U.S. tax law. Six

months ago, the company said it would spend about $44 billion on

share buybacks and dividends over two years.

"I don't think anyone believes we need the level of cash we have

now," Mr. Robbins said in an interview.

Write to Jay Greene at Jay.Greene@wsj.com

(END) Dow Jones Newswires

August 15, 2018 20:07 ET (00:07 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

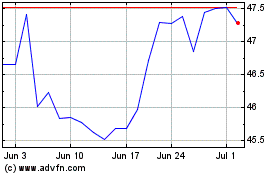

Cisco Systems (NASDAQ:CSCO)

Historical Stock Chart

From Mar 2024 to Apr 2024

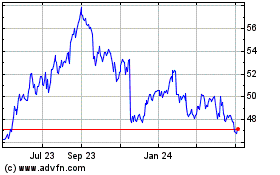

Cisco Systems (NASDAQ:CSCO)

Historical Stock Chart

From Apr 2023 to Apr 2024