Swiss Franc Declines On Risk Appetite, Falling Consumer Prices

August 05 2015 - 4:38AM

RTTF2

The Swiss franc lost ground against its major counterparts in

European morning deals on Wednesday, after the nation's consumer

prices slipped further in July and amid risk appetite due to strong

corporate earnings.

Figures from the Federal Statistical Office showed that the

consumer price index dropped 1.3 percent year-over-year in July,

faster than June's 1.0 percent decrease. Economists had expected

the index to fall 1.0 percent. Prices have been falling since

November last year.

On a monthly basis, consumer prices declined 0.6 percent in

July, in contrast to 0.1 percent rise in the preceding month. It

was first fall in three months.

Upbeat reading on China's services sector eased fears over the

health of the world's second-largest economy. The closely watched

Caixin Services Purchasing Managers' Index climbed to an 11-month

high of 53.8 in July, up from 51.8 in June, day showed early in the

day.

The currency showed mixed performance in the previous session.

While the franc held steady against the yen and the pound, it

advanced against the euro. Against the greenback, the franc

declined.

In European trading, the franc depreciated to 126.91 against the

yen for the first time since April 30. This marks a 0.1 percent

decrease from Tuesday's closing value of 127.07. The franc-yen pair

is likely to find support around the 126.00 zone.

The franc fell by 0.17 percent to hit 0.9798 against the

greenback, its lowest since April 13. At Tuesday's close, the pair

was valued at 0.9781. Continuation of the franc's downtrend may

take it to a support around the 0.985 level.

The franc fell to 1.5264 against the Sterling, a level not seen

this year. If the franc continues slide, it may challenge support

around the 1.54 mark.

The Swiss currency pared gains to 1.0645 against the euro, from

an early high of 1.0621. On the downside, 1.075 is possibly seen as

the next support level for the franc.

Looking, U.K. services PMI for July and Eurozone retail sales

for June are due to be released shortly.

In the New York session, U.S. private sector jobs data for July,

trade balance for June, U.S. services PMI for July and Canada trade

data for June are slated for release.

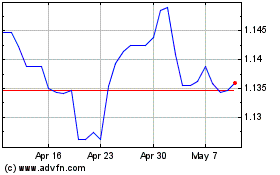

Sterling vs CHF (FX:GBPCHF)

Forex Chart

From Aug 2024 to Sep 2024

Sterling vs CHF (FX:GBPCHF)

Forex Chart

From Sep 2023 to Sep 2024